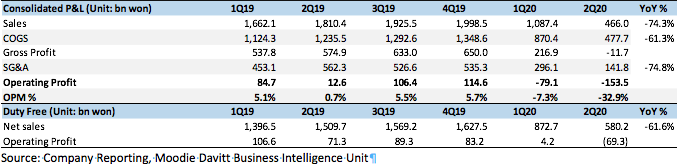

SOUTH KOREA. Lotte Duty Free sales declined by -62% year-on-year in Q2 2020 to KRW580.2 billion (US$490 million) and operating profit plunged to a loss of KRW69.3 billion (US$58.5 million), writes Min Yong Jung*.

This is the first loss for the duty free division since Q2 2018 when heavy competition among domestic players and the threat of China’s new ecommerce law proved a drag on sales and earnings.

The Korean duty free market is heavily dominated by daigou operators, which are providing some respite to the market in the absence of travellers. However Lotte Duty Free did not receive the same boost as other players, with its performance lagging behind an overall -51% market decline.

Lotte Duty Free told The Moodie Davitt Report that the company is less engaged in third party exports compared to competitors. As reported, in May Korea Customs Service permitted international shipping and sales of unsold imported foreign goods overseas. It meant that duty free retailers could sell direct overseas (including to daigou) without collecting flight/personal information. Lotte Duty Free expressed a view that this is a temporary reprieve that simply heightens competition and adds little to the bottom line.

The performance in the second quarter was mostly because of the company’s airport operations, which accumulated as much as KRW100 billion in expenses. This heavy burden should improve as the Incheon International Airport Terminal 1 concession switches from a MAG-based deal to a percentage of sales from September.

*Note: Korean national Min Yong Jung, formerly based in London and now in Seoul, is Senior Retail and Commercial Analyst at The Moodie Davitt Report. His appointment in June 2019 was the first of its kind in travel retail media. It marked the creation of the Moodie Davitt Business Intelligence Unit, a new division designed to provide a previously unseen level of research and analysis for the travel retail channel.

*Note: Korean national Min Yong Jung, formerly based in London and now in Seoul, is Senior Retail and Commercial Analyst at The Moodie Davitt Report. His appointment in June 2019 was the first of its kind in travel retail media. It marked the creation of the Moodie Davitt Business Intelligence Unit, a new division designed to provide a previously unseen level of research and analysis for the travel retail channel.

Do you have research needs related to the Korean and Asia Pacific travel retail and luxury markets? Min Yong Jung can be contacted at minyong@moodiedavittreport.com