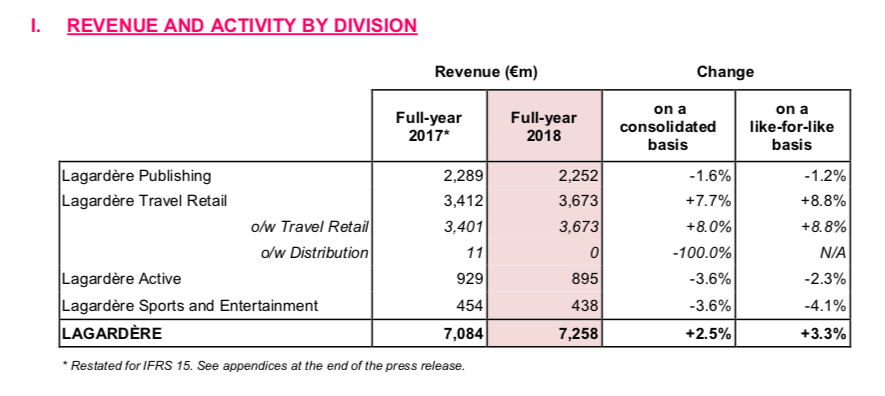

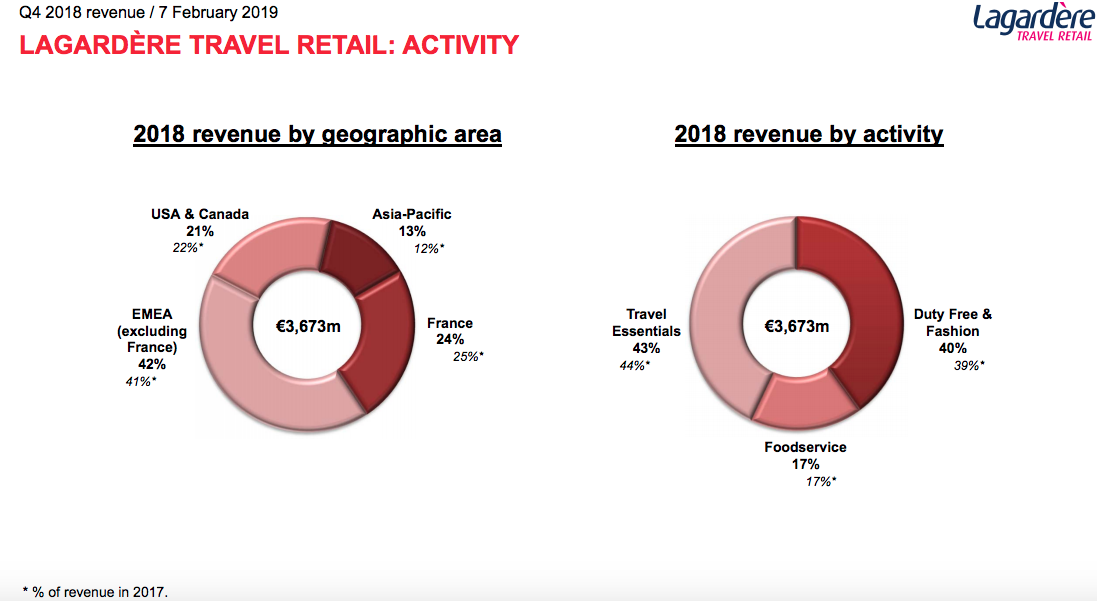

FRANCE/INTERNATIONAL. Lagardère Travel Retail revenue reached €3,673 million in 2018, a rise of 7.7% on a consolidated basis and 8.8% like-for-like.

Chairman & CEO Dag Rasmussen said: “Our organic growth has been strong in 2018 at 8.8% versus 2017, pushed by sustained traffic growth, the success of our new concepts, innovative and dynamic commercial initiatives, and the development of the network. We also had a very successful year in terms of acquisitions, in particular HBF in North America, that we were able to integrate in December.”

The difference between consolidated and like-for-like data is attributable to a €62 million negative foreign exchange effect resulting mainly from the depreciation of the US Dollar, and to a €25 million positive scope effect.

This comprised:

- a €40 million positive impact from acquisitions, relating mainly to HBF and to a lesser extent duty free operations in Poland and of travel essentials activities in the Czech Republic;

- a €15 million negative impact from deconsolidations, mainly resulting from the divestment of Press Distribution activities in Hungary.

In duty free and fashion, the group reached €2 billion in managed sales for the first time, thanks to steady like- for-like growth and the integration of several major contracts won in 2017 – in Geneva, Senegal, Saudi Arabia and Hong Kong.

The company also launched the Beauty New Age concept in Paris airports – the new approach to beauty in travel retail, which includes a new “phygital” experience for travellers. It struck new contracts for duty free in Gabon (Libreville Airport), and for fashion in Vienna and Beijing Daxing (China).

F&B activities developed strongly in 2018, it added. In North America this featured the acquisition of HBF and openings in Austin, San Francisco, and Los Angeles; in EMEA there were numerous openings in Italy, France (Toulouse Airport) plus Dubai Airport (The Daily DXB, a new food hall format). A new contract in the Netherlands with Smullers built the group’s presence in the Dutch railways network, and a global franchise agreement with Dean & DeLuca was initiated with the opening of two restaurants in Hong Kong.

F&B activities developed strongly in 2018, it added. In North America this featured the acquisition of HBF and openings in Austin, San Francisco, and Los Angeles; in EMEA there were numerous openings in Italy, France (Toulouse Airport) plus Dubai Airport (The Daily DXB, a new food hall format). A new contract in the Netherlands with Smullers built the group’s presence in the Dutch railways network, and a global franchise agreement with Dean & DeLuca was initiated with the opening of two restaurants in Hong Kong.

In travel essentials, the company claimed strong results thanks to the roll-out of the new Relay concept and product offer adjustments across the network. New brands and concepts opened, including an Official All Blacks store in Auckland New Zealand and Trip Advisor stores in the USA and in Hong Kong.

The Innovation pipeline was also very strong, said the company, in particular thanks to a partnership with Lafayette Plug & Play, which won a Corporate Engagement Award.

Rasmussen added: “We are fortunate that the travel retail sector continues to benefit from strong fundamentals. Within this favourable environment, we have shown superior growth which proves not only that our three-business line strategy (travel essentials, duty free & fashion and food service) is paying off, but also that our investments on concepts, innovation, staff training and development, and customer services – are meeting passenger and landlord expectations.”

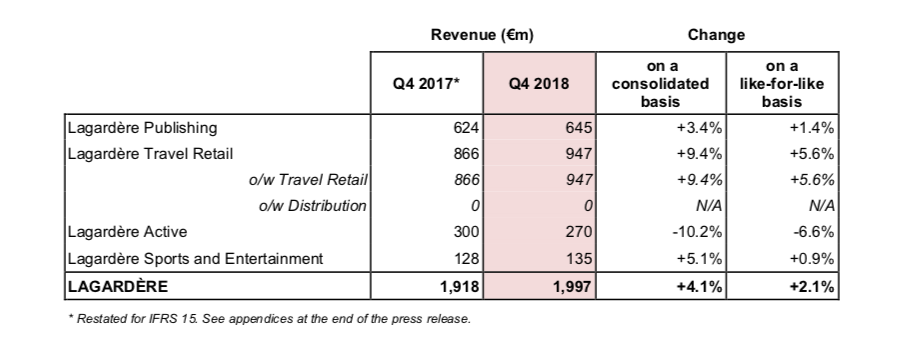

Q4 performance

Lagardère Travel Retail reported fourth-quarter revenue of €947 million, a rise of 5.6% like-for-like and of 9.4% on a consolidated basis versus 2017, with the difference between the two figures mainly reflecting a €29 million positive scope impact, essentially attributable to the HBF acquisition.

France delivered a solid 6.5% like-for-like increase in revenue, buoyed notably by continued growth in regional duty free stores (particularly at Nice Airport), the expansion of Aelia Duty Free and Relay concepts, and network growth in food service.

The EMEA region (excluding France) delivered 4.5% growth, buoyed chiefly by good sales performances and a positive network effect in Eastern Europe (Romania, Bulgaria, Czech Republic) and by growth in Italy. The concessions opened in Geneva and Dakar in fourth-quarter 2017 are now fully comparable, explaining the slowdown in growth this quarter.

North America reported 5.6% growth attributable to network expansion in food service, and to “a combination of successful sales initiatives and a continued robust passenger traffic”.

The Asia Pacific region posted a revenue rise of 7.6% with good growth in China (Beijing, Shanghai, Wuhan), which offset “contrasting performances” in the Pacific region. The fourth quarter marks one year since the launch of the liquor & tobacco concession at Hong Kong Airport in partnership with China Duty Free Group (click here for our special report on the Duty Zero by cdf opening).