CHINA/SOUTH KOREA. In a dramatic escalation of the THAAD anti-missile system dispute, China has ordered travel agencies to stop selling group tours to South Korea, according to widespread media reports in both countries. The China National Tourism Administration has also today issued a warning to Chinese citizens about the risks of visiting popular South Korean holiday destination Jeju Island.

The ban, if confirmed, is set to have a profound report on the Korean economy and particularly its interrelated tourism and travel retail sectors. The Moodie Davitt Report will bring you further reaction soon as retailers and markets digest the impact of today’s news (UPDATE: see reaction from The Shilla Duty Free and other retailers below).

“It is a really terrible and worrying situation here” – Leading Korean duty free retailer

As reported, the Chinese authorities are outraged by South Korea’s decision to deploy the US defence system later this year. While the South Korean government says the move is a necessary protection against attacks from North Korea, the Chinese government insists the move destabilises the region and poses a threat to China’s own security.

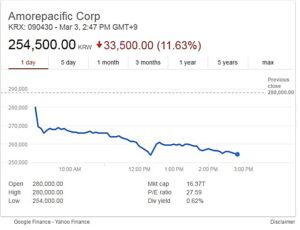

From a travel retail perspective, the news is made worse by the fact that THAAD will be sited on land owned by Lotte Group, parent company of South Korea’s most powerful duty free retailer, Lotte Duty Free.

On Monday the Lotte board ratified the decision to allow a land-swap with the Korean military to go ahead, a move that prompted an outpouring of retaliatory rhetoric in the Chinese state media. The backlash culminated in an attack on various Lotte Duty Free websites yesterday, causing extended outage and the loss of “hundreds of billions of Won”.

Now the situation is set to deteriorate even more – and quickly. Quoting unnamed industry sources, South Korea’s Yonhap News led the reports today claiming that China has instructed travel agencies in the country to stop selling trips to South Korea.

Yonhap said that the China National Tourism Administration (CNTA) called travel agencies in Beijing to a meeting on Thursday and issued verbal instructions to suspend sales of all travel packages, both online and offline, to South Korea. The agency concluded: “It means that any package tours or free trips sold by travel agencies will not be available to Chinese wishing to visit Korea.

“While ordering to immediately put a halt on all trip sales, the agency told them to exhaust those that have already been sold by mid-March,” the report continued, quoting the same sources. “Such a measure will likely be imposed on the travel agencies based in other cities nationwide following regional meetings that will be held soon, they added.”

Retailers express their concern

The crackdown is certain to have a drastic impact on South Korean travel retail. Last year almost one in two visitors to the country were Chinese, with the share of duty free spending much higher again, sometimes higher than 70%. Group tourists were by far the dominant sector compared with free independent travellers (FITs).

Mirae Asset Daewoo Research Center Equity Analyst (Cosmetics, Hotel & Leisure, Fashion) Regina Hahm estimated that for the overall Korean duty free market, Chinese shoppers account for around 60% of the non-Korean spend (with Koreans responsible for 30-40% of total sales. “The total exposure will be much less than 50%,” she estimated.

Ms Hahm also noted that since China’s crackdown on unregulated low cost package tours last year to Korea, the average spend per passenger has risen. That slight silver lining, she said, might mean the actual exposure from the CNTA edict is less than -40%. “Yet still not ignorable,” she concluded with some understatement.

A spokesman for The Shilla Duty Free told The Moodie Davitt Report that the ban is focused on group tourists and excludes FITs. He said the company was currently gathering information to clarify the situation. Chinese group tourists generate around 45% of sales at The Shilla Duty Free Seoul flagship store.

Another leading Korean duty free retailer highlighted the CNTA advisory notice and added simply: “It is a really terrible and worrying situation here.”

A veteran travel retail executive in another key Asian market commented: “The sad part of the situation is that given the lack of government institutions empowered to legislate at the moment in Korea, this impasse may last longer than desirable.”

One leading brand executive told The Moodie Davitt Report that the ban is “just the proverbial shot over the bow”. In short, it could get much worse if the situation is not resolved. That will not be easy given South Korea’s current Presidential crisis and subsequent political impasse, he noted. But without a resolution, the economy could be forced into a deep recession, he warned.

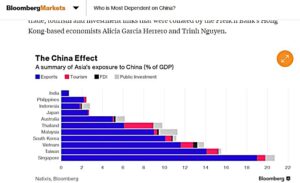

The South Korean economy in general is heavily dependent on China (see Bloomberg chart below) but no sector is more reliant than travel retail, for whom the Chinese spend has become lifeblood.

If this week’s developments are anything to go by, it could be a long, cold summer for Korean duty free retailers.