SOUTH KOREA. Frenzied purchasing by Chinese overseas personal shoppers (called daigou) in South Korea could be about to gear down and enter a more manageable phase according to the biggest beauty players in the global travel retail channel.

SOUTH KOREA. Frenzied purchasing by Chinese overseas personal shoppers (called daigou) in South Korea could be about to gear down and enter a more manageable phase according to the biggest beauty players in the global travel retail channel.

The thriving daigou or ‘shuttle trader’ business – which is heavily focused on cosmetics – had kept the South Korean duty free and travel retail market on a strong footing in 2017 despite the dearth of Chinese travellers. Chinese arrivals slumped -48.3% to 4,1699,353 last year according to Korea Tourism Organization.

However, as revealed by The Moodie Davitt Report, the Korean duty free market surged by +20.7% in 2017 to a record US$12.8 billion. That growth was driven by the daigou dynamic. While an ostensibly outstanding performance, the cost of the daigou business seriously eroded retailer profitability.

But the recent thawing in Chinese-South Korean relations over last year’s THAAD missile crisis has seen Chinese numbers beginning to recover.

L’Oréal Travel Retail Asia Pacific Managing Director Emmanuel Goulin told The Moodie Davitt Report: “The business will continue, but it has reached a peak in Korea. When the regular Chinese tourists start coming back, the level of promotion will reduce and the business will be less dependent on daigou shoppers.”

“It’s a matter of balance. Daigou trade is acceptable per se as long as it doesn’t become the majority of the business. We believe it is not sustainable – it is a bubble which could blow up in our faces. So as a group we are extremely cautious.” – L’Oréal Travel Retail Asia Pacific Managing Director Emmanuel Goulin

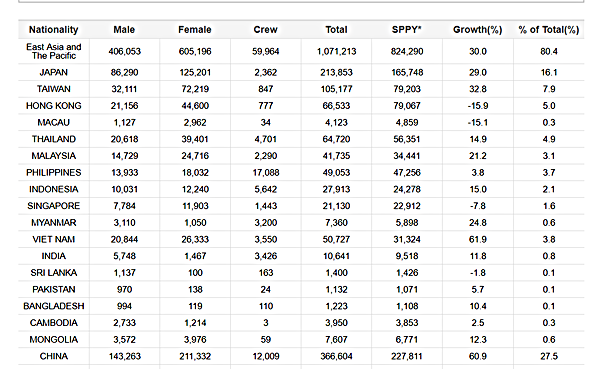

That Chinese travel trend has already started. While year-on-year Chinese tourist numbers to South Korea remained depressed in the first quarter of 2018 at -30%, April saw a dramatic flip of +60.9% year-on-year (the first fully like-for-like monthly comparison of Chinese arrivals since the group tour ban of mid-March, 2017).

“Based on what is happening politically between China and Korea we have reasons to believe that the normal Chinese tourists will be back,” said Goulin. “Korea is a key strategic market in the region with a lot of influence. It remains the biggest beauty market in duty free by far.”

Actively attracting daigou

Due to the THAAD-driven collapse of Chinese travel, Korean duty free retailers came under severe pressures and were forced to compensate for these lost sales opportunities. Selling to daigou – in a “structured way” that could also include commissions – was one of the few options open to them.

With Korean brands an increasingly difficult proposition to sell in China’s anti-Korean climate, a greater focus on international brands emerged among daigou resellers. This led to retailers increasingly using price as a lever to attract daigou shoppers. “This is not sustainable for anyone because the retailers will not be able to hold this level of promotion,” Goulin pointed out.

He continued: “As a group there are two ways of looking at it. Either you are opportunistic and make the most out of it in the short term or, if you want to build your brand equity in the long term, then you consider it a bubble. The latter is our approach and that’s why we are reluctant to push this phenomenon to a higher level.”

Enforcing quotas for long-term goals

Instead of waiting for the bubble to subside on its own, L’Oréal has been more proactive. “We have been enforcing quotas to limit this phenomenon. As a group we were probably one of the first to take strict action to reduce dependency on diagou shoppers as much as possible. We’ve been quite bold,” Goulin said.

“At some of our counters you can’t buy more than three of the same products lines. So, for example, if you want to buy a YSL lipstick you can buy up to three pieces. Sometimes we go even lower than that to one piece. This way we avoid mass buying.”

The risk from the brand standpoint is that once stocks are bought up by daigou, regular consumers can’t be served. “That creates a lot of disappointment,” said Goulin. “So, yes, we have quotas so that we can grow the business sustainably.”

L’Oréal imposed quotas as early as April last year and the move has been followed by other players who also don’t see daigou sales as healthy for future development.

“It’s a matter of balance. Daigou come to Korea because it’s nearby and cheap. It’s acceptable per se as long as it doesn’t become the majority of the business. We believe it is not sustainable – it is a bubble which could blow up in our faces. So as a group we are extremely cautious,” said Goulin frankly.

A booming personal shopper market

Daigou means ‘buying on behalf of’ and these shoppers have grown so fast in numbers that this has become a fully-fledged channel of commerce with sales across all product sectors estimated at US$15 billion annually. According to a report in The Business of Fashion, the value of the daigou business in luxury goods increased from CNY55 billion to CNY75 billion (US$8.9 billion to US$12.3 billion) in 2014.

Goulin said: “It’s not my job to make the most of this phenomenon in the next few months. We don’t want to have a short-sighted view when developing our brands over the long term. My job is to create the conditions for healthy growth over the coming years. This is the discussion we are having with the retailers now: how we grow the business in the long term.”

[Look out for more comment from Emmanuel Goulin on the wider trends and prospects in the Asia Pacific market soon. The Moodie Davitt Report invites reader comments via the Disqus platform below.]