| Omnichannel opportunity beckons What Hahn & Company will do with the inflight duty free business if the transaction is completed is as fascinating as the sale itself, writes Martin Moodie. While Korean Air’s duty free business has been in steady decline over recent years, it still offers a high-class assortment (dominated by high-end skincare and liquor) and has a well-established pre-order and ecommerce business. Free of airport concession fees and with a desirable passenger profile largely based on Korean and Chinese customers, the airline has a big opportunity to develop a full-fledged omnichannel business that could thrive as the market recovers. Hahn & Company will realise that and will have no shortage of suitors if it follows the well-worn private equity path of reshaping and then divesting its acquisition. |

SOUTH KOREA. Korean Air confirmed today that it has entered into exclusive discussions with private equity giant Hahn & Company to sell the airline’s inflight retail and meal service units.

The announcement was made in a disclosure (see below) to the stock market following a board meeting.

Hahn & Company has the exclusive negotiation rights for the purchase of the combined inflight business. Korean Air said it will negotiate with the private equity group and provide updates when available.

The news confirms a report earlier this week by reputable financial title The Korea Economic Daily, which put a combined price tag of almost KRW1 trillion (US$840 million) on the business.

Hahn & Company is South Korea’s second-largest private equity firm.

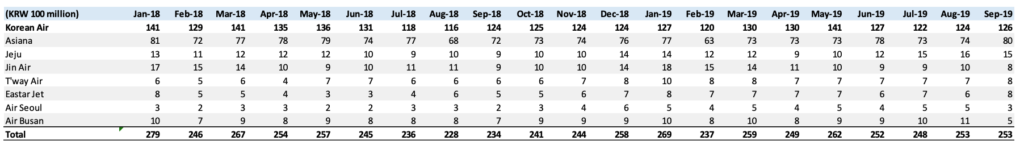

Korean Air, hit hard by the COVID-19 crisis, has long run the world’s most successful inflight retail business (see historical sales below).

Last year sales hit US$134-135 million, down by -5.6% year-on-year, though the depreciation of the Korean Won against the US Dollar implied that duty free sales were actually flat in a difficult year. This year’s performance will be ruined by COVID-19 but given Korean Air’s high-spending passenger profile and strong Chinese route network, the business is likely to bounce back as the crisis eases.

On 2 July, the cash-strapped flagship carrier received a KRW1 trillion (US$837 million) government commitment for further aid, added to the promised KRW1.2 trillion (US$1 billiion) bailout package from Korea Development Bank and the Export-Import Bank of Korea in April.