SOUTH KOREA. In an extraordinary development, Incheon International Airport Corporation (IIAC) today launched the Request for Proposals (RFP) for its Terminal 2 duty free contracts, after failing to resolve a dispute with Korea Customs Service (KCS) over who should assess the contract bids.

“Today we finally issued the tender,” an IIAC source confirmed to The Moodie Davitt Report. “The KCS office did not agree to our bid but IIAC has no choice. T2 will be open in October so we had reached our deadline at the end of January.

“It’s a very, very unusual thing and a very difficult situation,” he said. “We really wanted an agreement.”

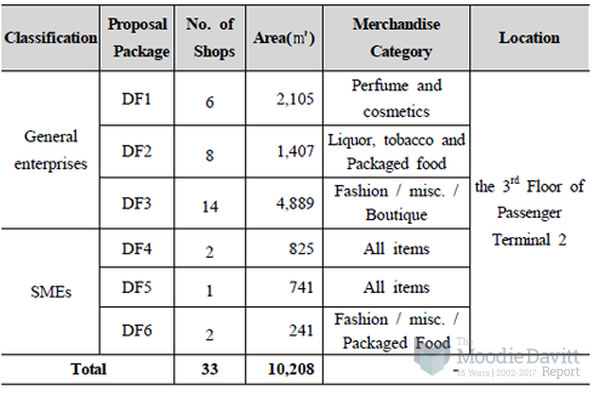

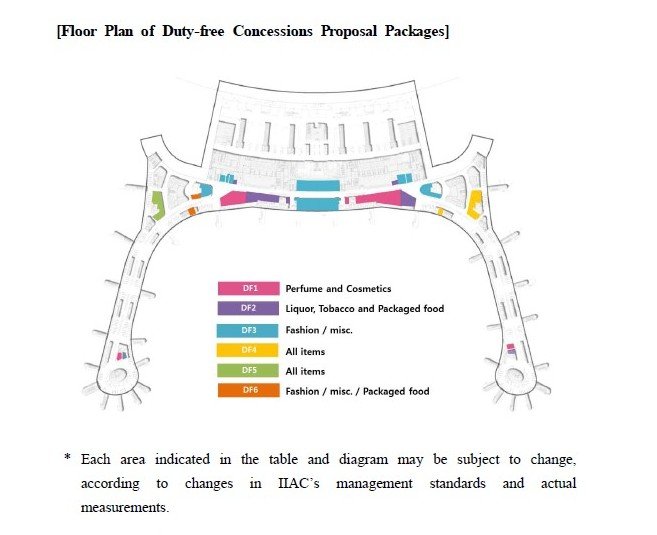

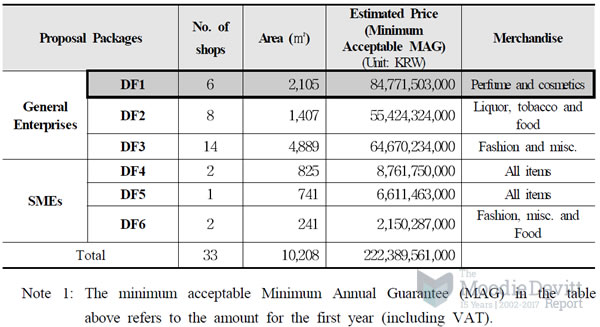

The IIAC source said bids are due to close on 31 March with awards due by the end of April. Six retailers will be appointed on five-year contracts – three major companies and three small & medium enterprises (SMEs). That structure is seen as an effort to appease KCS’s insistence on having more SMEs involved. International retailers are able to bid but no joint ventures are permitted.

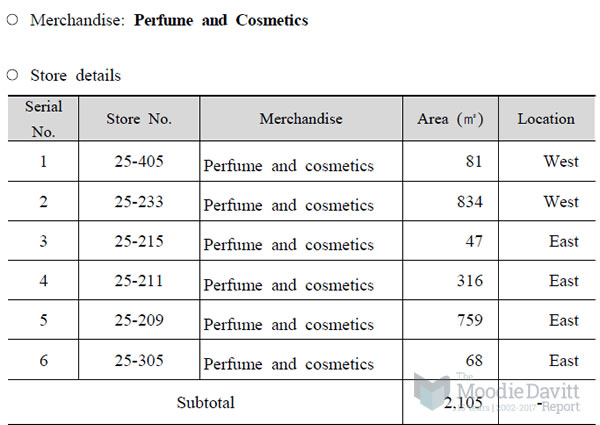

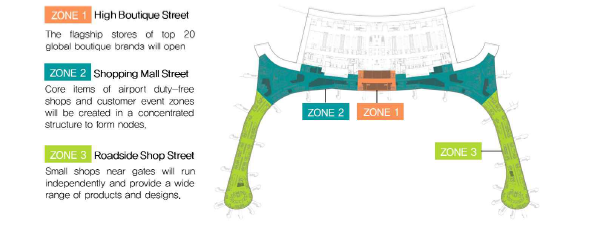

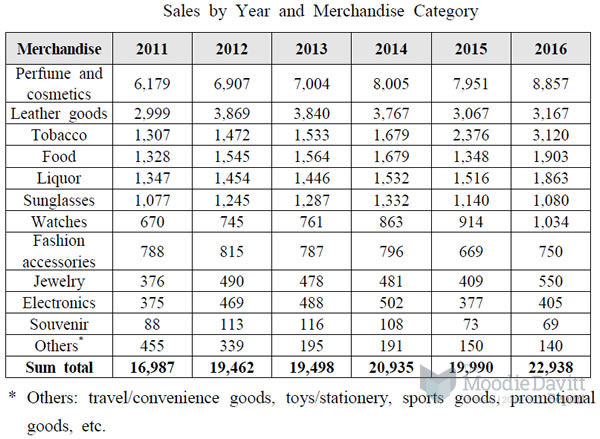

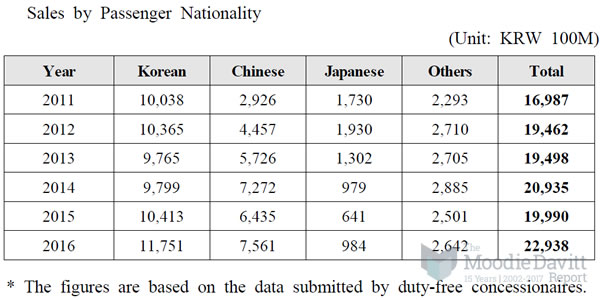

As reported, multiple concessions for the key categories of perfumes & cosmetics (around 40% of current sales), liquor & tobacco (almost 35%) and fashion & other products (circa 25%) are being offered. A single retailer will not win multiple categories due to monopoly sensitivities. IIAC had originally hoped to appoint a combination of three major retailers and one SME. Bids will be assessed on a weighting of 60% for the technical offer and 40% for the financial proposal.

IIAC plans a tender presentation on 9 February at 09:30 for prospective bidders.

However, the row is hardly likely to be over. The KCS has just issued a statement in local media expressing its formal protest at the latest development. “The KCS has condemned the IIAC for the tender announcement without its consent and declared it invalid,” a senior Korean duty free retailer told The Moodie Davitt Report.

According to the source, KCS has said it will not endow the winners with the necessary licenses to trade. The government agency commented via Korean media, “We will continuously try to find a reasonable solution about who has the right to choose the concessionaires.”

In an ominous sounding message to industry giants Lotte and Shilla, KCS said, “And even before the effect of newly amended regulations regarding qualification limitations on monopoly and oligopoly bidders, KCS will apply new rules to regulate their participation in the process.”

As revealed by The Moodie Davitt Report, IIAC and KCS have been locked in disagreement over the tender. In an unprecedented intervention, the government agency insisted it, not the airport company, should have the final say as to which companies should be awarded the T2 concessions.

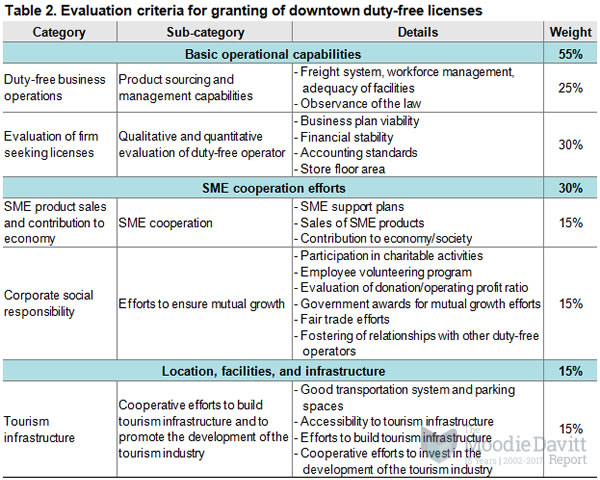

The KCS wants to create a licensing committee to evaluate the T2 bids and judge the offers according to a much wider set of criteria (see table below) than those used by IIAC and with less emphasis on the financial offer. The committee would work on a similar basis to those that assess rival candidates for downtown duty free shops

Note: As a currency guideline, KW222,389,561,000 = US$192.3 million; KW84,771,503,000 = US$73.3 million; KW55,424,324,000 = US$47.9 million; and KW64,670,234,000 = US$55.9 million

BACKGROUND TO THE DISPUTE

The KCS intervention had led to an impasse with the IIAC, which has been forced to delay the tender, slated initially for November or December last year. Bidding for the five-year contracts was originally due to close by mid-February 2017 with awards expected to be announced by the end of the same month. The tight timeline recognises that the first phase of the ambitious T2 development will open in October, with ultimate project completion in 2023.

NOTE TO AIRPORT OPERATORS: The Moodie Davitt Report is the industry’s most popular channel for launching commercial proposals and for publishing the results. If you wish to promote an Expression of Interest, Request for Proposals or full tender process for any sector of airport revenues, simply e-mail Martin Moodie at Martin@MoodieDavittReport.com.

We have a variety of options that will ensure you reach the widest, most high-quality concessionaire/retailer/operator base in the industry – globally and immediately.

Similarly The Moodie Davitt Report is the only international business intelligence service and industry media to cover all airport consumer services, revenue generating and otherwise. We embrace all airport non-aeronautical revenues, including property, passenger lounges, car parking, hotels, hospital and other medical facilities, the Internet, advertising and related revenue streams.

Please send relevant material, including images, to Martin Moodie at Martin@MoodieDavittReport.com for instant, quality global coverage.

All such stories are consolidated in our popular Tender News section (see home page dropdown menu) that has been running since 2003.