SWITZERLAND/INTERNATIONAL. Dufry, the world’s leading travel retailer by sales, today posted first-quarter turnover of CHF1,706.8 million (US$1,714.6 million), up +4.7%. That represents accelerated organic growth of +7.2% (compared to +5.6% in Q4 2016).

Supported by synergies from the World Duty Free (WDF) acquisition, gross profit margin improved further to 59.6%. EBITDA increased to CHF154.7 million (US$155.4 million), while EBITDA margin expanded by ten basis points to 9.1%.

The step-up in organic growth reflected steady growth in markets such as the USA, the UK and Spain as well as significant improvements in several key Dufry locations, specifically South America, Eastern Europe and Turkey.

Because of the WDF synergies, gross margin increased by 100 basis points, to 59.6% from 58.6% in Q1 2016. EBITDA in absolute amounts reached CHF154.7 million from CHF146.5 million in Q1 2016, while the EBITDA margin also increased to 9.1%.

From an operational perspective Dufry continued to focus on accelerating business development. In the year to March, the company refurbished 7,200sq m with plans for a further 19,500sq m in upgraded space this calendar year.

The retailer has added 5,600sq m of gross retail space and has already signed contracts to open a further 23,000sq m in 2017/18.

Dufry noted that it has launched a new business operating model deployment at country level in the first quarter. The model aims at implementing best practices and common processes and procedures across the group, generating additional efficiencies.

The roll-out will be executed throughout 2017 and 2018 in all countries. It is expected to be completed by the end of 2018 and to start generating additional profitability towards the end of 2017, Dufry commented.

Dufry Group CEO Julían Díaz commented: “I am very confident with the good start we had in 2017.

“The efforts we have put and the measures we have implemented to recover organic growth are finally showing a significant impact in the sales performance, together with better economic and political conditions in several markets. After turning positive in the third quarter of 2016 with a +1.3% organic growth, we posted +5.6% organic growth in Q4, and now report a good start into 2017 with organic growth accelerating to 7.2%.

“Dufry’s performance has considerably improved compared to last year, due to the ongoing good performance in important markets such as Spain, the UK and the US. The improvements seen in the last two 2016 quarters in distinct locations such as South America, Russia and Turkey also continued positively in Q1 2017, as well as in the first weeks of the second quarter.

“Having successfully completed the WDF integration ahead of plan, we are expecting to see the WDF synergies fully reflected in the P&L by the end of 2017. Our focus for 2017 and 2018 will be on implementing the business operating model, which will generate additional efficiencies by the end of 2018. Cash generation and deleveraging remain the most important targets in 2017. With respect to organic growth we will continue to both drive expansion of retail space as well as implement further initiatives to increase spend per passenger.

“Dufry’s fundamentals are strong, and our strategy of diversification by geographies and channels puts Dufry in the right position to strongly benefit from the normalized business environment. At Dufry we are all committed and working towards a successful year.”

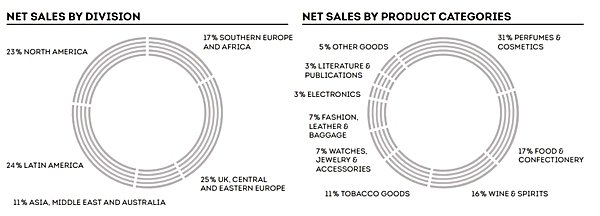

Performance by region

Southern Europe and Africa – Russian tourists return

Turnover reached CHF288.8 million (US$290.13 million) in the first quarter. Organic growth reached +2.8%. Spain and Portugal had positive single-digit performance, while Greece remained basically stable, Dufry said. Italy turned in a “solid” performance and Turkey also posted good growth, despite being low season, due to the return of the Russian tourists.

The closure of some shops limited organic growth but along the year, this effect is going to be compensated with new retail space becoming operational, the company said.

UK, Central and Eastern Europe – Russia, East Europe rebound

Turnover grew to CHF 415.5 million (US$417.42 million) in the first quarter, underpinned by +8.8% organic growth. The UK operations continued to perform strongly, Dufry said, while performance in Russia and other Eastern European locations rebounded strongly and most operations grew double digits.

Asia, Middle East and Australia – Middle East strong, Macau picks up

Turnover reached CHF188.5 million (US$189.37 million) in the first quarter, with a slight fall (-0.4%) in organic terms. In the Middle East, Jordan and Sharjah performed well. In Asia, most operations also performed well, Dufry said. These included businesses in South Korea, Indonesia, Cambodia and China. Macau saw a pick-up of sales volumes, while Hong Kong and Singapore also improved, but remained in negative territory.

The performance in Melbourne, Australia, was impacted by a temporary closure related to the comprehensive refurbishment of the retail space at Melbourne Airport.

Latin America – strong all-round performance

Turnover reached CHF400.2 million (US$402.5 million) in the first quarter, anchored by strong (+12.7%) organic growth. In Central America, all main operations performed “very well”, including Mexico, Puerto Rico, Dominican Republic and the cruise business. In South America, all operations prospered, with Brazil, Uruguay, Peru and Chile growing by double digits, while Argentina and Ecuador both posted single-digit gains.

North America – “solid” duty free and duty paid showings

Turnover reached CHF392.1 million (US$393.91 million) with organic growth reaching +4.8%, as a result of “solid” performances in the USA and Canada, in both the duty free and duty paid sectors.

Seasonality reflected in results

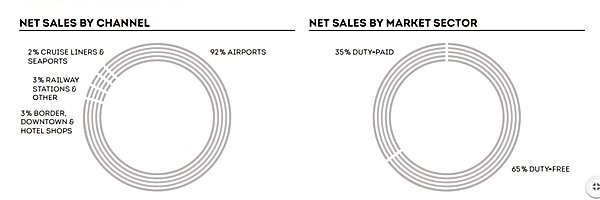

The recent acquisitions [of World Duty Free Group and The Nuance Group] have further accentuated the inherent seasonality of the Dufry business, the company noted. As most of its businesses are in the Northern hemisphere, the summer months represent an important part of the passenger flows.

“Consequently, the first quarter is the least important period of the year for turnover, profitability and cash generation, which are more concentrated in the second and third quarters,” it pointed out.

“Moreover, the first quarter 2017 was impacted as compared to Q1 2016 by one less sales day in February and the shift of Easter into the second quarter.”