Having already recovered most sales that were lost during COVID-19, sparkling wine powerhouse Henkell Freixenet has set its sights on growing market share and expanding its reach to new territories – with travel retail a vital channel for its ambitions.

That’s according to CEO Dr. Andreas Brokemper, speaking to The Moodie Davitt Report as 2021 – a year of solid recovery despite the continuing impact of the pandemic – draws to a close.

Even against the backdrop of the pandemic, the company posted a relatively modest -7.4% fall in total turnover in 2020 compared to 2019, reaching €1,195 million.

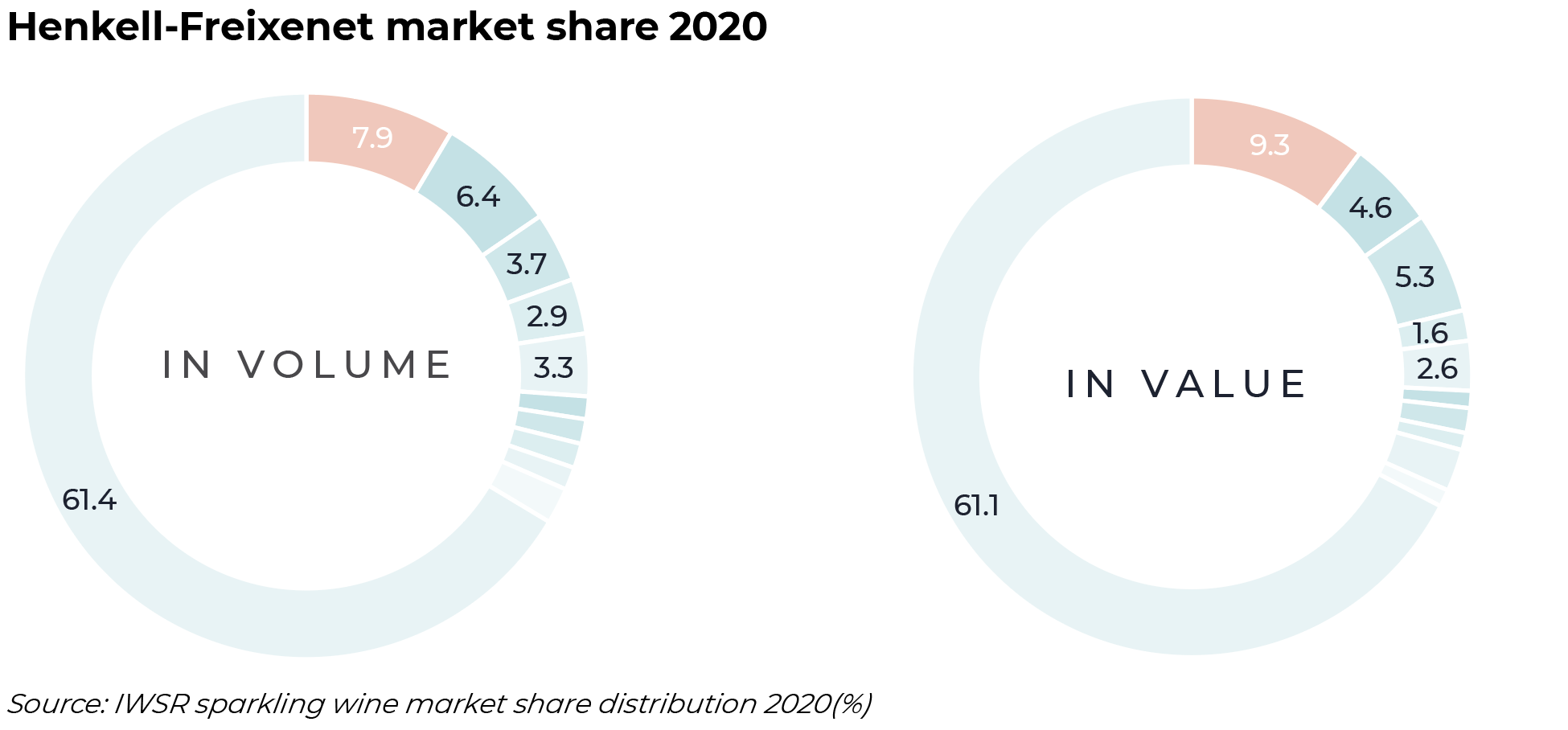

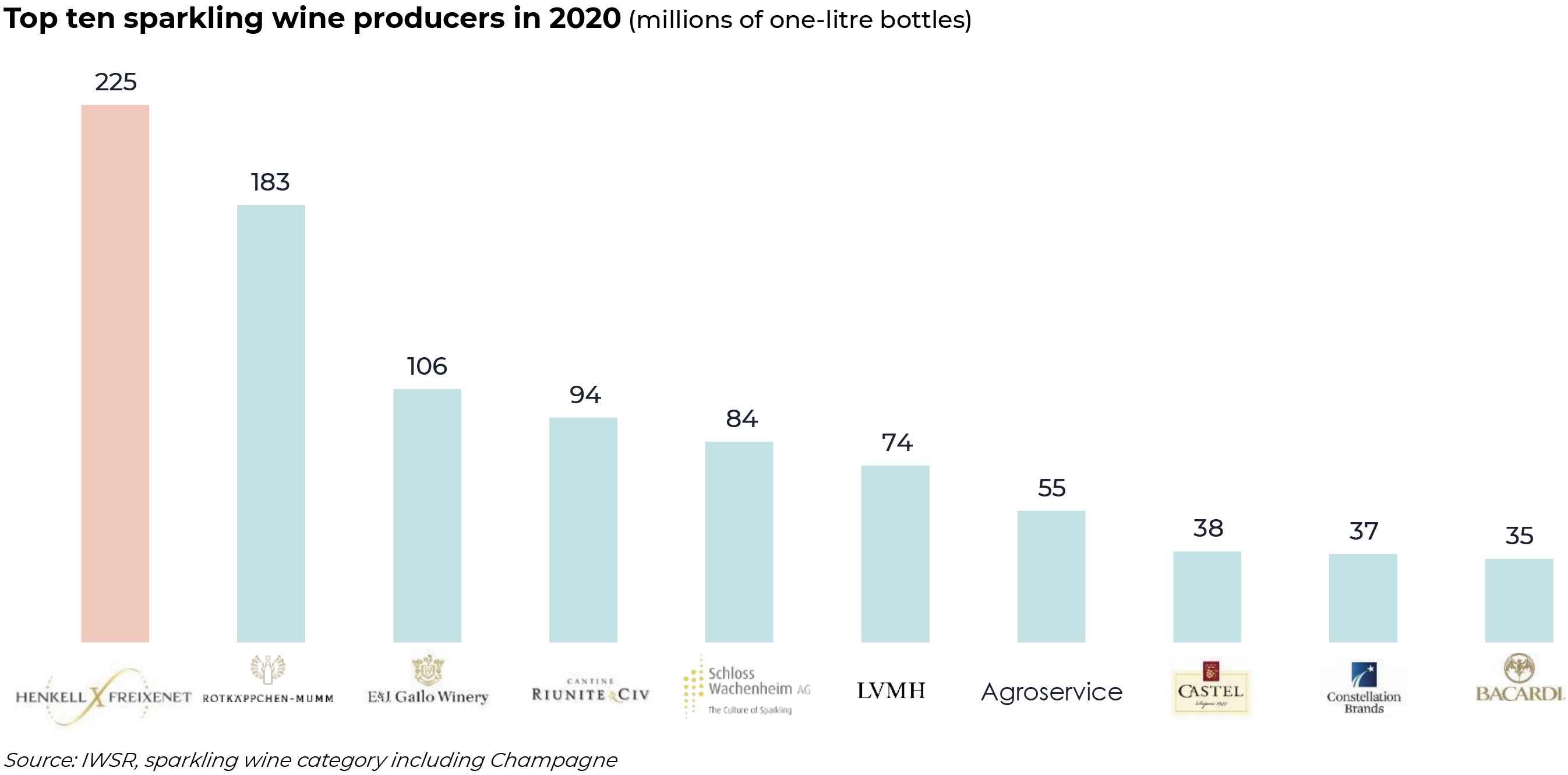

“In 2021, we will most likely exceed the volumes that we had in 2019 – let’s see,” says Dr. Brokemper. Of the wider vision for the business, he adds: “In volume we account for every 11 to 12th glass of sparkling wine consumed globally (IWSR) and represent nearly 10% of the sparkling wine market by value. Our vision is to have every tenth glass consumed or distributed by Henkell Freixenet.”

In looking to the future, Wiesbaden-based Henkell Freixenet is building on a proud and pioneering past: Adam Henkell began producing sparkling wine in Germany as early as 1856; JJ Söhnlein separately established the Rheingauer Schaumweinfabrik in 1864. While these brands were exporting product from the 1870s, it was not until the 1990s that the group began a true internationalisation drive that has continued at pace to this day.

The Henkell Freixenet line-up (and its strategy for travel retail) is now led by what the company calls its ‘Global Icons’, namely Henkell alongside Mionetto (acquired in 2008) and Freixenet (2018), the latter two respectively market leaders in prosecco and cava. The group reported this week that Freixenet alone will reach a new record with the sale of 100 million bottles worldwide in 2021.

Dr. Brokemper says: “[After the Henkell-Söhnlein merger in 1987] Mionetto was really the second very important milestone of the history of our group, because we invested in prosecco, when it was not a denomination. In that moment, we already felt that prosecco would be the next big thing. Prosecco in Italy is not a celebration, it is more an everyday consumption, less formal, more about enjoyment.

“The addition of the Mionetto brand to our portfolio gave us great opportunities for international growth. And we agreed that the next big thing would be a strong Spanish producer of sparkling wine to create a global company. We worked some years on merging Henkell and Freixenet together. Why? First of all, we didn’t have a cava. But most of all cava is still the second biggest category in non-Champagne sparkling wine.

“So we could combine those companies and all of the different markets to gain a stronger position, but also open new opportunities.”

“I am optimistic that we can get to single-digit growth in 2022 compared to 2021. And that will for sure be better than in 2019. So the recovery should be there.”

These hero brands sit alongside a prestige range which includes Alfred Gratien Champagne, Gratien & Meyer Crémant and Saumur, Segura Viudas cava, Gloria Ferrer sparkling wine and Schloss Johannisberg Riesling. The portfolio also features numerous local icons such as leading German sparkling wine Fürst von Metternich, Törley (Hungary) Bohemia (Czech Republic), Hubert de Luxe (Slovakia) and Wodka Gorbatshow, the market-leading vodka in Germany – plus other local and regional brands.

Today the group is present in 30 countries with its own distribution and it serves every country in which there is sparkling wine consumption, which number over 150.

In amplifying the voice of each of the core brands – and other local heroes in relevant markets – travel retail has a big role to play, says Dr. Brokemper, both as a marketing vehicle and as a sales and profit driver.

“The growth of the duty free business in our group shows its importance. If you look back 20 or 30 years duty free was a promotional hotspot. And today, it is the global boutique for showcasing the quality and the superiority of the product.

“The idea that we have, and that we share, is that we want to show the consumers the diversity in sparkling wines, and that many more interesting categories besides Champagne exist. Global travel retail can be a place where we showcase a wonderful Crémant or great German Riesling and try out new categories.”

The coming together of Henkell and Freixenet in 2018 [Brokemper and Pedro Ferrer of Freixenet are joint CEOs of the Freixenet Group] also helped the company gain share in this channel.

“We both shared the same idea that the duty free business for us is extremely important. We merged our organisations to give our customers in the duty free markets better support. We are now the clear market leader for the non-Champagne sparkling wine business globally in duty free. [According to IWSR 2020 data, Henkell Freixenet has a 31.3% market share in the non-Champagne sparkling business in travel retail -Ed].

“We have our three very important global brands, Freixenet, Mionetto and Henkell, alongside further specialities. Duty free is very often a combination of international and local brands. In the duty free shops we have our very strong local heroes as we call them. We also have specialities like prosecco, like cava, and always these specialities at different prices, for example, our super-premium cava Segura Viudas, or the latest Freixenet Prosecco DOCG.

With Freixenet integrated and a consolidated portfolio in place by 2019, the business was well prepared for a new phase of growth including in duty free, through Henkell Freixenet Global Export Head of Brand & Business Development Vanessa Lehmann and colleagues – before coronavirus struck.

Resilient performance & role of travel retail

As noted above, the COVID-19 impact on the global business was not as sharp as on other companies, though duty free turnover fell by around -50% in 2020. Dr. Brokemper maintains that in business terms, this crisis will represent more of an interruption than a fundamental change.

“What is most important is that we strongly believe in the channel. In 2020 really what changed was that there was no opportunity to buy in duty free, but the general demand was still there. We had the feeling that once travel returned, so would consumers.

“We had a sharp drop from 2019, with turnover falling by around -50%, though this was less than we had imagined it might be. Customers simply shifted from one channel to another, led by online.

“We kept investing in our brands and we believed always that travel and travel shopping would return. We invested in the markets where they could buy at that time, from online to trade monopolies. And what we see are the benefits right now that the business is coming back.”

That faith in the channel is reinforced by a recent ‘Celebrate Life’ study conducted by the group. It investigated how people in Germany, Spain, France and the UK have rediscovered enjoyment in their daily lives during the pandemic and offered insights into how consumers are planning to celebrate the holiday season.

Importantly for travel retail, key nationalities expect to travel more across the Christmas period in 2021 than last year (23% among French respondents, versus 8% in 2020; and 24% among those surveyed in Spain, against 15% a year ago).

Besides airport duty free stores, the airline retail and pouring business is also hugely important for Henkell Freixenet.

Dr. Brokemper explains: “In Germany in particular, there is still the tradition that you start your vacation with a glass of sparkling wine in the plane, as this is exactly the moment when you are now on vacation. Therefore a big part of our business is the serve and pouring onboard.

“And there we have built some further distribution for our brands, with mini bottles of Mionetto. With this, even if passenger numbers are not at the level of 2019, the brand is developing strongly due to strong awareness. For the moment, we see a strong recovery. We are also optimistic that this recovery will be sustained and we will put a very strong focus on what we call our house of brands.”

Alongside its ‘global icons’, one additional brand that is growing well in duty free today is the i-Heart wine brand. This represents good wines from popular varieties – part of a company mission to “make wine available to everyone”.

The concept, says Dr. Brokemper, “is so simple and it is a brand that has the DNA on the label. We want to make wine consumption simple and we want to serve the consumers the product that they love without knowing too much about the grape. It’s about understanding when they expect a prosecco, when they expect a pinot grigio. We are seeing strong growth in most of the international markets.”

“In the past Champagne was mainly the benchmark. And Champagne is a great wine absolutely, but it takes you towards a certain taste profile.”

Travel retail exclusives also play a role in differentiating the offer, with selected ranges chosen for their appeal to travellers.

Dr. Brokemper says: “The last big innovation at Freixenet was the introduction of the Italian portfolio, where we served the DOCG and the pinot noir rosé only in duty free. At Mionetto we have the luxury collection in duty free, which otherwise is never sold beyond Italian on-premise. So that brings added value to what we offer in duty free. For Henkell, years ago we developed years ago the Henkell Five-Pack, which combines five units of Piccolo. It is a great item for the channel.”

Henkell Freixenet’s vision to engage the curiosity of consumers about this diverse category is not always easy to execute, especially in travel retail – but the company continues to introduce new ideas that will appeal to travellers and retail partners alike.

“Trial and education are really important here,” he says. “Some years ago we created a concept called the Pearls of Europe for duty free and for some speciality retailers.

“We arranged tastings and found that consumers, especially younger consumers with high expectations of wine quality, loved to compare a prosecco with a Champagne, with a cava, with a crémant. So one point is to create an offer that interests the consumer.

“We also made a small dégorgement line where you can degorge the traditional sparkling wine directly in front of the consumer. We did this at Prowein, at KaDeWe, the leading retail store in Berlin, and it’s a great attraction for people to see. We wanted to do this in duty free but it’s not easy. Despite some bureaucratic challenges, we would still like to do this but what we must do in any case is remain innovative, present new ideas like the Pearls of Europe, to convince the consumer and make them aware about sparkling wines and their diversity.”

Diverse appeal

What is clear is that interest in sparkling wines is growing. A global market worth €17 billion in 2009 was worth €26.9 billion a decade later, slipping to €25.4 billion in 2020 (IWSR). Today, consumers are tempted by new taste profiles and styles more than ever.

Dr. Brokemper says: “In the past Champagne was mainly the benchmark. And Champagne is a great wine absolutely, but it takes you towards a certain taste profile.

“Nowadays, the education of consumers about sparkling wine is changing. And the main driver of this change was prosecco. People often say prosecco is similar to Champagne but I always say that prosecco is the opposite. Why? Well, you always have two different taste profiles in the product. You have primary aromas coming from the grapes and you have secondary aromas coming from the yeast. And finally, the Champagne is a perfect example of oxidation in the yeast, together with ageing.

“Prosecco is the opposite and you need to drink it when it is fresh and then you have all these primary aromas in the product. And this is something that really changed and that the consumers started to understand. Prosecco is not like a Champagne. It’s totally different.

“Consumers now understand that sparkling wine is more than just Champagne. It is prosecco, it’s cava, crémant, it’s English sparkling, so there is a diversity of sparkling wine that is really worth trying, and you should also find your own priorities, for a certain event or moment. Maybe in Summer or Christmas, you want to try something different.”

That increasing diversity of appeal also extends to geography. Henkell Freixenet’s core consumer base remains a European one, built around the cornerstone markets of Germany/Austria/Switzerland, alongside others in both Western and Eastern Europe. But as sparkling wine extends its reach, other regions are opening up.

“It’s really interesting to see how things are changing, from a place where sparkling wine was dominated almost entirely by Europe,” says Dr. Brokemper. “Over the past 20 years North America has become the fastest growing market, with good growth also in South America.

“Asia remains small and is led by Japan, but that is because the proportion of Champagne consumption is very high. Freixenet is the strongest brand but the knowledge about prosecco or cava is not at the level we would like yet. But it will come. We see some promising signs there, just as we do in China.

“It’s a question of the globalisation of the consumption. When consumers in one part of the world see the trends in Europe or elsewhere, and see how sparkling is drunk, on its own or in a cocktail, then I believe consumption will follow and grow in these other markets as well.

“It’s a question mark now which of the markets will grow first, Asia or Africa? Some African markets really do well, such as South Africa and Nigeria, and we see big potential for growth here too.”

In extending that reach, Henkell Freixenet will continue to eye opportunity – after all, strategic acquisition has helped it become the world’s number one producer by volume in sparkling wine today (IWSR).

Dr. Brokemper notes: “When you do the sparkling wine business in a really good way, and you grow your brands, then very often these businesses are dynastically handed over from one generation to the next. So we always say that the first thing we do for our strategic development is to look after our house of brands.

“And if then there is an opportunity, like we took for Mionetto or Freixenet, then we are open to that. There are always some denominations of sparkling wine, which are interesting, because they add something new or they have something that other sparkling wines do not have.”

Sustainability & supply chain

As well as consumer desire for diversity, sparkling wine providers – like brand owners in every other sector – must satisfy consumer demand that they are doing enough to protect the planet and its people. In this regard, Henkell Freixenet places sustainability at the top of its corporate agenda.

Dr. Brokemper says: “When you go deeper into sustainability you learn that you can do so much more. If you just take a top-line view you can say, we produce our wines from 40,000 hectares of vineyards, and those are sustainable because they create O2 and so on, but when you then go deeper, you find out that there are many, many areas in your supply chain and in your footprint where you can do better.

“And that is something that we are working on. This starts with vineyards, because the biggest part of this is in the production of the wines. And we have our target for being CO2 neutral in the future.”

None of this is made easier by the supply chain challenges facing the world today. For a business bent on further internationalisation, it adds further complexity and cost.

Says Dr. Brokemper: “Supply chain is an extremely important topic right now. I would say that how expensive a container shipment from Germany or Europe to Asia is not really the question; it is whether you can get one at all.

“Are you able to ship the products to satisfy the demand from the different places? I have never seen a situation like this. A year ago, everybody was cautious. Everybody expected a very long crisis, and nobody knew when the business would recover. And then boom, the whole supply chain was disrupted, not only on containers but in many areas. And it will take time until this comes again into a balanced situation of supply and demand.”

That is one of the biggest challenges facing the business currently, but it’s not the only one.

“The next [challenge] is on the way. We have had a bad harvest in 2021 in different countries, especially in France due to frost. White wines were lower in yield so that will be an issue for prosecco into next year. So one challenge rolls into the next.

“On coronavirus, it’s my impression that beyond the second or third wave we will have a fourth wave, a fifth wave, a sixth wave, a seventh wave, but maybe each one will be less amplified and gradually we will manage each one better than the last.

“Normal life will come back, in 2022 or latest 2023, unless we see some surprises, which is also possible.”

Geared up for growth

Notwithstanding the continuing fallout from the pandemic, supply chain and other issues, Henkell Freixenet is a business that continues to gear up for growth, and its CEO is upbeat about the prospects for next year and beyond.

“The most important two months of our overall business are November and December. And for sure we will recover back beyond 2020 levels. We did not have the sharp drop that some houses experienced last year. The question is whether we hit 2019 levels yet. There are some good signals but we have this important period ahead of us still.

“For 2022 there will be growth in consumption, if nothing really bad happens on a global scale. I hope that we find a way to handle inflation, the problems in the supply chain, and any further problems that that we need to face. But all in all, I am optimistic that we can get to single-digit growth in 2022 compared to 2021. And that will for sure be better than in 2019. So the recovery then should be there.

“I remember the first projection exactly one and a half years ago was that we would lose -15% in year one and then that we would grow +5%, meaning that the markets will be back at the 2019 level in 2024 or 2025. It looks right now that we can be more optimistic.”

And a final message to the travel retail industry?

Dr. Brokemper says: “First of all, I wish that there will be no further lockdowns. I think that is the most important thing, that the world can reopen. I hope governments start opening up so that we have the same opportunities to travel as in the past.

“If the consumers can travel again, I am more than sure that they will also spend money on premium consumption. In the crisis that was something we didn’t experience in duty free but we did experience it in many markets. They learned more about quality products, they premiumised, so when they consumed they consumed on a higher quality level.

“I hope that this gives a tailwind to duty free in all markets. What we see and what we know is that everybody is really keen to travel again, to see the world. After this sabbatical in normal life people again realise the value of travelling, meeting people, and experiencing new things.”