Introduction: 2019 has been a transformative year for Coty. Almost three years after its merger with P&G, the company is writing a new chapter in its corporate story and recently announced a series of leadership appointments to reposition the business for growth.

One of the key moves was to appoint Txema Marquiegui as Senior Vice President Travel Retail to succeed the well-regarded Philippe Margueritte.

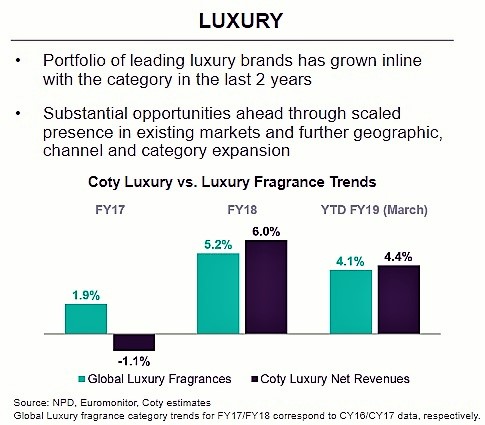

Marquiegui has been tasked with building on the fundamentals put in place over the past year and accelerate Coty’s growth in travel retail, which continues to be a key driver for the company, even amid a tough recent trading period (Coty Luxury reported in Q3 FY19 net revenues of US$729.2 million; a 2.8% increase on a like-for-like basis).

With Marquiegui taking the lead, Coty plans to strengthen its position in travel retail, with a clear growth strategy that capitalises on its broad brand portfolio. This includes strengthening its fragrance business, while exploring new opportunities in skincare and cosmetics. The first half of 2019 has shown this strategy in operation, with major activations and launches from Coty’s powerhouse brands including Hugo Boss, Davidoff, Miu Miu, Lacoste and Marc Jacobs.

The Moodie Davitt Report’s Hannah Tan-Gillies sat down with Marquiegui to discuss what the future holds for Coty. He spoke about the Coty business, the realities of living an omnichannel world, and the challenges of increasing conversion in a highly competitive travel retail landscape.

How would you describe the Coty travel retail strategy today? What are the key pillars on which it is built?

Our vision is to keep growing fragrances and expand into makeup and skincare. Niche fragrances in the Asia Pacific region are very important, so that’s something we want to continue focusing on.

We have achieved great success with a key brand in our portfolio, Gucci, thanks to the launches of both the Gucci Bloom and ultra-premium The Alchemist’s Garden fragrances. Meanwhile the recently launched Gucci Makeup collection is performing extremely well and offers significant potential for the future, especially in Asia.

“Passenger numbers are always increasing, but the issue is that only 16% of them are buying. We want to help our retailers grow conversion. To do this, we have to keep working on disruptive merchandising.”

For most businesses, the key challenge is to get people to walk into their stores. In this business, we already have a lot of people walking through our airport stores. Passenger numbers are always increasing, but the issue is that only 16% of them are buying. We want to help our retailers grow conversion. To do this, we have to keep working on disruptive merchandising.

These are the things that really make the consumer stop. For example, an average consumer will spend three minutes buying with us, but spend 14 minutes when they get into a selective fragrance store [downtown]. They go there to buy, but they go to the airport to take a plane.

We have to create experiences that will add value to their trip. We are blessed to have a large portfolio of contemporary brands, that cover all tiers, trends and consumer needs. We have to drive people to purchase at the airport, and we can leverage our travel exclusives even more. All of our digital efforts, KOLs and activations are there to make sure that people spend more time in airport shops, enjoy the brand experiences we can offer and ultimately convert to purchase.

“In our business, size matters, and this merger really enriched the company portfolio. We have a proposition for every single consumer, no matter the positioning, personality, tone of fragrance.”

The company’s efforts at turnaround have been well publicised. How has travel retail performed relative to the rest of the group this year to date, and what have been the key drivers and influences?

The first thing that has driven travel retail is our launches. They are a big part of the answer. Travel retail has done very well. Coty Luxury had a great year, and we’ve done that through notably our launches. We have achieved great successes from Tiffany & Co., Chloé and Marc Jacobs, among many others.

We will continue to innovate and bring some major new propositions to the markets in the coming months, so our portfolio richness is and remains a key asset to our success roadmap. Another big priority is makeup. We are consolidating Burberry Makeup in Asia this year, which we expect will perform very well in Asia Pacific.

What are the big geographical priorities within travel retail, and where does Asia sit today? What are the big opportunities here?

Each region has its own assets. Here in Asia, we can see an incredible appetite from partners and consumers for beauty and cosmetics.

With the merger with P&G behind you, has the full impact bedded in? Has this altered the approach to travel retail and shifted brand focus?

We were two different companies, and joined forces end October 2016 to turn into one of the key global beauty players and the leader in fragrance. The merger has given us a breadth of portfolio. We created a new culture, and inherited two very complementary portfolios. In our business, size matters, and this merger really enriched the company portfolio. We have a proposition for every single consumer, no matter the positioning, personality, tone of fragrance.

How are you changing the ways you engage with the travelling beauty consumer today? What are the priorities in terms of lifting conversion rates and how do you ensure the environment, activations, and impact of your people on the front line are maximised?

We have to accompany the consumer at every point of their journey. The travel retail purchase begins the moment a consumer decides that they are going to travel. This is the first moment in which we try to engage with the consumer digitally.

“I’m also interested in the 84% of those consumers who are not buying. I want to make sure that those people improve their equity perception of our brand just after having walked through the airport.”

The second moment is when they go to the airport, where we try to place our advertisements to remind them where we are. After that, we have disruptive merchandising. Once they are in front of the shelf, we have experienced beauty consultants who are trained day in and day out. Our beauty consultants need to make the buying experience unique, because they need to tell you the story of the fragrance. They need to make the jump from selling a product to selling a dream. I often tell the beauty consultants that we don’t sell fragrances, we sell dreams in a bottle.

Is the travel retail channel today more about a sales and profit line or about being a showcase?

It’s both. Of course we have sales targets for travel retail, but at the same time we also have an equity target for travel retail. Consumers are already seeing our brands, but I’m more interested in growing our 16% conversion rate to 17% and then to 20%.

I’m also interested in the 84% of those consumers who are not buying. I want to make sure that those people improve their equity perception of our brand just after having walked through the airport. So, even if a customer does not buy, at least they see our brands, remember us, and hopefully buy later.

“I think that digital is a friend, it’s here to stay, and we have to embrace it”

How do you see the state of relationships between the key Trinity partners: brands, retailers and airports? How would you like to see these partnerships evolve?

During my stay in Singapore, I’ve had the joy of sitting with most of our partners, and I think the status of the partnerships is tremendously healthy. We have very good partners here, who we share a common vision with.

How does the company’s digital strategy feed into travel retail? And how big a threat is competition from the big online retailers?

Online retailers are a complementary channel, not a threat. When people want to buy anything today, they can basically get it anytime and anywhere. Big online retailers are a reality that exists, but I do not see them as a threat. Quite the opposite actually, because I see digital communication and ecommerce as an opportunity to enhance travel retail. Click and collect is a nice way to do this. Now we have the chance to engage with our consumers outside of the time they spend in the airport. I think that digital is a friend, it’s here to stay, and we have to embrace it.

How can you merge digital and ecommerce in your stores? How are you developing an omnichannel approach?

We live in an omnichannel world. We know consumers cannot smell online, but they also cannot taste food online, which doesn’t stop them from buying food digitally. Online is here to stay, so we are supporting all of our retailers with click and collect. Today, the consumer journey starts at home. You check-in online, but you can also explore what you can buy at the airport. Consumers can also be influenced in a geo-localised way through digital platforms like WeChat or Instagram. This is why we have to accompany them through the entire journey.