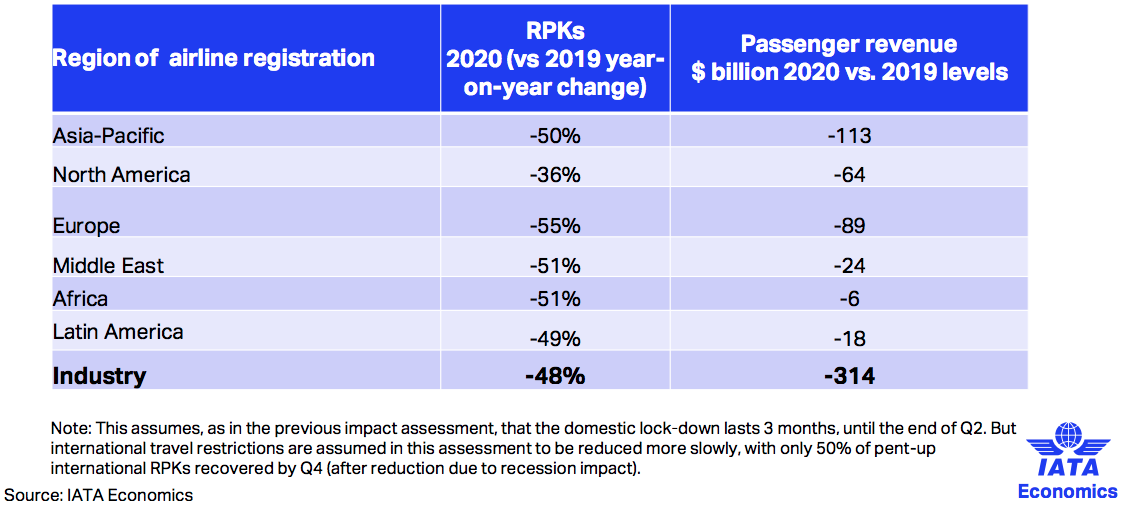

INTERNATIONAL. The International Air Transport Association (IATA) has said that airline industry passenger revenues could fall by -55% or US$314 billion in 2020, down on previous estimates provided just three weeks ago. Then IATA said that revenues could fall by -44% (US$252 billion) below 2019 due to the impact of travel restrictions and the expected global recession brought on by the COVID-19 crisis.

The updated figures reflect a significant deepening of the crisis since then, and reflect the following assumptions:

- Severe domestic restrictions lasting three months

- Some restrictions on international travel extending beyond the initial three months

- Worldwide severe impact, including Africa and Latin America (which had a small presence of the disease and were expected to be less impacted in the March analysis).

Full-year passenger demand (domestic and international) is expected to be down 48% compared to 2019.The two main elements driving this are:

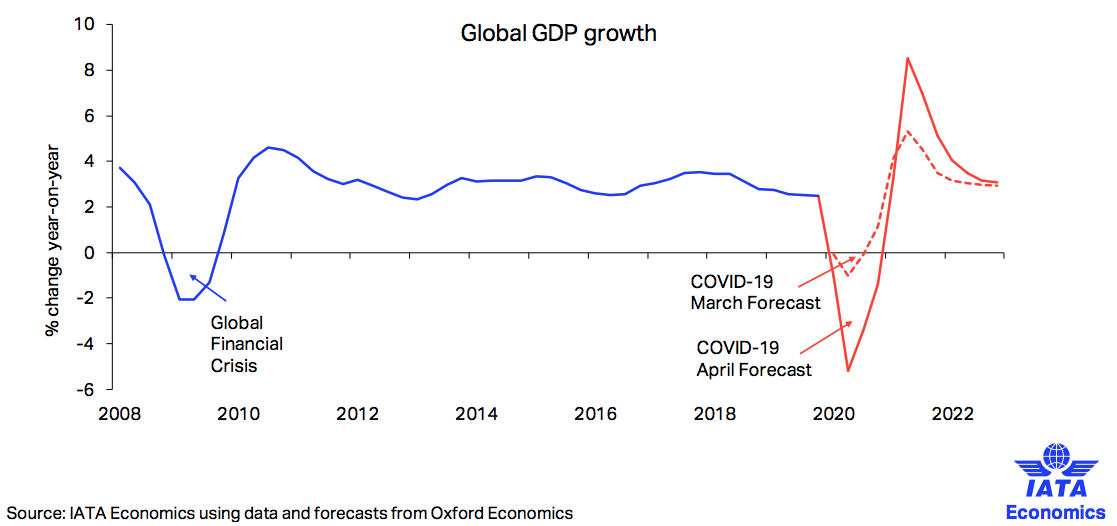

- Economic developments notably a global recession. The economic shock of the COVID-19 crisis is expected to be at its most severe in Q2 when GDP is expected to shrink by -6% (by comparison, GDP shrank by -2% at the height of the Global Financial Crisis). Passenger demand closely follows GDP progression, noted IATA. The impact of reduced economic activity in Q2 alone would result in an -8% fall in passenger demand in the third quarter.

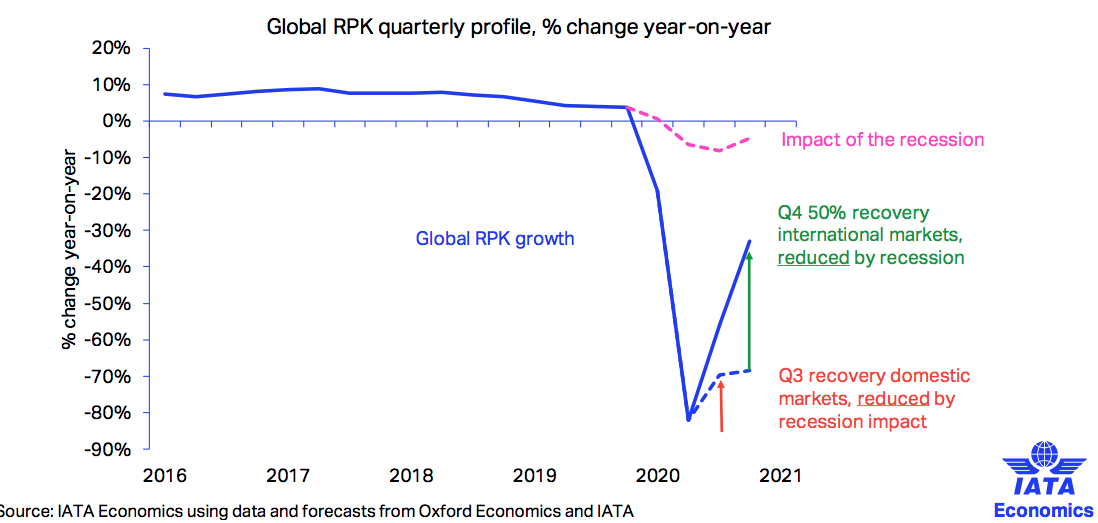

- Travel restrictions: These will deepen the impact of recession on demand for travel. The most severe impact is expected to be in Q2, said IATA. As of early April, the number of flights globally was down -80% compared to 2019 in large part owing to severe travel restrictions imposed by governments. IATA said: “Domestic markets could still see the start of an upturn in demand beginning in the third quarter in a first stage of lifting travel restrictions. International markets, however, will be slower to resume as it appears likely that governments will retain these travel restrictions longer.”

IATA Director General and CEO Alexandre de Juniac said: “The industry’s outlook grows darker by the day. The scale of the crisis makes a sharp V-shaped recovery unlikely. Realistically, it will be a U-shaped recovery with domestic travel coming back faster than the international market. We could see more than half of passenger revenues disappear. That would be a US$314 billion hit.

“Several governments have stepped up with new or expanded financial relief measures but the situation remains critical. Airlines could burn through US$61 billion of cash reserves in the second quarter alone. That puts at risk 25 million jobs dependent on aviation. And without urgent relief, many airlines will not survive to lead the economic recovery.”

IATA has proposed a number of relief options for governments to consider, including direct financial support, loans and guarantees, and tax relief.

Noting that airlines are at the core of a value chain that supports some 65.5 million jobs worldwide, de Juniac added: “Financial relief for airlines today should be a critical policy measure for governments. Supporting airlines will keep vital supply chains working through the crisis. Every airline job saved will keep 24 more people employed. And it will give airlines a fighting chance of being viable businesses that are ready to lead the recovery by connecting economies when the pandemic is contained. If airlines are not ready, the economic pain of COVID-19 will be unnecessarily prolonged.”