INTERNATIONAL. The International Air Transport Association (IATA) has downgraded its traffic forecast for 2020 to reflect a “weaker than expected” recovery from the effects of the COVID-19 pandemic. The organisation said it now expects full-year 2020 traffic to decline -66% compared to 2019, replacing its previous estimate of -63%.

It reported that August passenger demand – measured by revenue passenger kilometres (RPKs) – slumped by -75.3% year-on-year, representing only a minor improvement compared to the -79.5% traffic contraction in July.

IATA observed that domestic markets continued to outperform international markets in terms of recovery, although most remained significantly down on a year ago. August capacity – measured by available seat kilometres (ASKs) – was down -63.8% compared to a year ago, and load factor plunged 27.2 points to an all-time low for August of -58.5%.

Based on its flight data, IATA said the recovery in air passenger services was brought to a halt in mid-August by a return of government restrictions in the face of new COVID-19 outbreaks in a number of key markets.

Forward bookings for air travel in the fourth quarter of 2020 show that the recovery since the April low point “will continue to falter”, IATA said. It added that the decline in year-on-year growth of global RPKs was expected to have moderated to -55% by December and a much slower improvement is now expected, with the month of December forecast to be down -68% on a year ago.

IATA Director General and CEO Alexandre de Juniac said: “August’s disastrous traffic performance puts a cap on the industry’s worst-ever summer season. International demand recovery is virtually non-existent and domestic markets in Australia and Japan actually regressed in the face of new outbreaks and travel restrictions.”

He added: “A few months ago, we thought that a full-year fall in demand of -63% compared to 2019 was as bad as it could get. With the dismal peak summer travel period behind us, we have revised our expectations downward to -66%.”

International passenger markets

IATA revealed that August international passenger demand collapsed by -88.3% compared to August 2019, slightly improved on the -91.8% decline recorded in July. Meanwhile, capacity sagged -79.5%, and load factor fell 37.0 percentage points to 48.7%.

Asia Pacific airlines took the biggest hit across the regions, with traffic contracting -95.9% compared to the year-ago period, only marginally improving on the -96.2% fall in July. Capacity slumped -90.4% and load factor shrank 48.0 percentage points to 34.8%.

Latin American airlines took the next most severe hit, with a -93.4% demand drop in August compared to the same month last year; the fall in July had been -94.9%. Capacity fell by -90.1% and load factor dropped 27.8 percentage points to 56.1%.

North American carriers’ traffic was down by -92.4% in August, compared to -94.4% decline in July. Capacity fell 82.6%, and load factor plunged 49.9 percentage points to 38.5%.

Similar numbers were recorded by Middle East airlines, with a -92.3% fall in demand for August, compared with a -93.3% decline in July. Capacity plummeted by -81.9%, and load factor sank 47.1 percentage points to 35.3%.

African airlines fared little better, with traffic sinking -90.1% in August, slightly improved over a -94.6% decline in July. Capacity contracted -78.4%, and load factor fell 41.0 percentage points to 34.6%, which was the lowest number among regions.

The drop was less severe in Europe, where the continent’s carriers saw August demand down -79.9% compared to the same month last year, a notable improvement on the -87.0% drop in July, as travel restrictions were lifted in the Schengen Area. However, IATA noted that more recent flight data suggests this trend has reversed amid a return to lockdown and quarantine in some markets. Capacity fell -68.7% and load factor dropped by 32.1 percentage points to 57.1%, which was the highest figure across the regions.

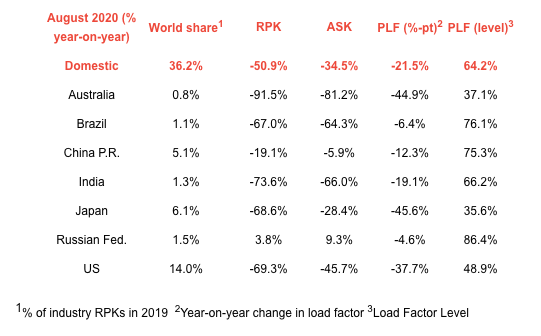

Domestic passenger markets

Turning to the domestic picture, IATA revealed that air traffic in home markets fell -50.9% in August. This was, however, an improvement compared to a -56.9% decline in July. Domestic capacity fell -34.5% and load factor dropped 21.5 percentage points to 64.2%.

US carriers’ August traffic was down -69.3% compared to August 2019, only a slight improvement compared to July, when traffic fell -71.5%. Meanwhile, Russian airlines saw their domestic traffic grow +3.8% compared to August 2019, the first market to see an annual increase since the onset of the pandemic, IATA noted. This was attributed to falling fares along with a boom in domestic tourism.

Giving his view on the outlook for air traffic in the months ahead, de Juniac said: “Traditionally, cash generated during the busy summer season in the Northern Hemisphere provides airlines with a cushion during the lean autumn and winter seasons. This year, airlines have no such protection. In the absence of additional government relief measures and a reopening of borders, hundreds of thousands of airline jobs will disappear.

“But it is not just airlines and airline jobs at risk. Globally tens of millions of jobs depend on aviation. If borders don’t reopen, the livelihoods of these people will be at grave risk. We need an internationally agreed regime of pre-departure COVID-19 testing to give governments the confidence to reopen borders, and give passengers the confidence to travel by air again.”