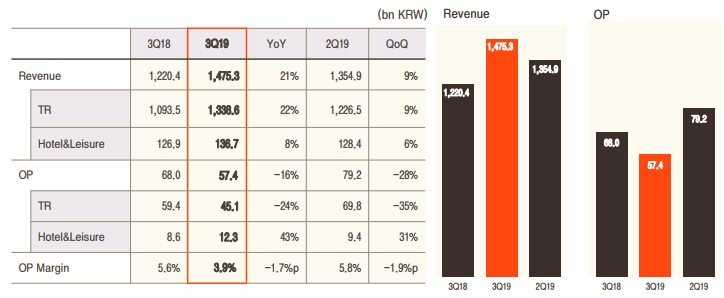

SOUTH KOREA. Hotel Shilla, parent company of The Shilla Duty Free, posted a +20.9% year-on-year increase in consolidated sales to KRW1,475.3 billion for the third quarter but operating profit fell -15.6% to KRW57.4 billion, writes The Moodie Davitt Report Senior Retail and Commercial Analyst Min Yong Jung.

Despite gaining market share in Korean duty free, costly commissions and promotions offered to Chinese resellers plus a decline in Korean customers acted as a major drag to reported profits for the quarter. The company’s overseas duty free business was badly hit by falling sales in protest-hit Hong Kong.

The quarterly results announcement coincided with a dramatic few days for Korean travel retail – and for Shilla. As reported, Shilla missed out on the Singapore Changi Airport liquor & tobacco concession to arch rival Lotte Duty Free’s blockbuster financial offer, while on Friday Hotel Shilla announced it was taking a 44% stake in US travel retailer 3Sixty Duty Free for a figure The Moodie Davitt reliably estimates at around US$140 million (the US$121 million price tag quoted in Korean media and other titles excludes key aspects of the deal).

In other big news for Hotel Shilla this week, the group finally received its long-awaited approval to build a Korean architecture ‘hanok’ themed hotel. Hotel Shilla had presented the first blueprint to Seoul City in 2011. That will mean a long-awaited increase in downtown duty free space (see below for details).

Despite concerns about the fall in Q3 operating profit, Hotel Shilla’s top-line performance suggests it could move up a place from third to second in The Moodie Davitt Report’s Top 25 Travel Retailers league for 2019 (from June 2020, current number two Lotte Duty Free will benefit from the Changi liquor & tobacco effect).

The new hotel will increase floor space for duty free retailing by as much as 2x – see below

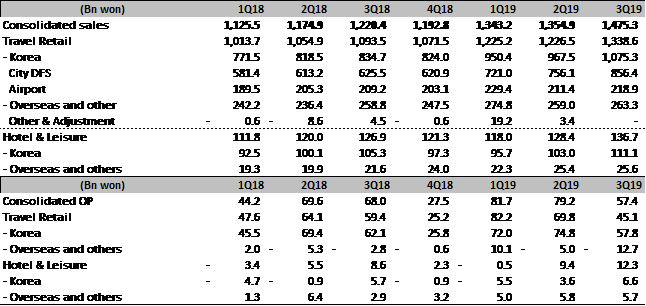

Q3 BUSINESS RESULTS: CONSOLIDATED

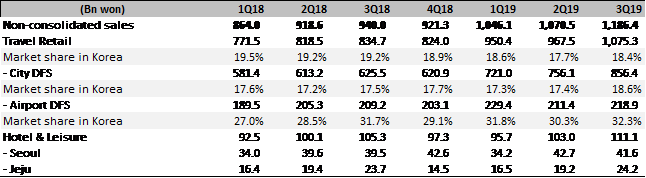

Hotel Shilla’s Korea duty free operations posted a new sales high, rising +28.8% year-on-year in Q3 to KRW1,075.3 billion. Downtown duty free sales increased +36.8% year-on-year to KRW856.4 billion but the airport performance remained sluggish.

The company is on course to post KRW5 trillion in revenue for the year

Airport duty free revenues grew just +4.6% year-on-year to KRW218.9 billion, buffeted by headwinds from lower Korean passenger traffic, higher promotions by inflight duty free retailers, the introduction of arrivals duty free at Incheon International Airport, and increasing cannibalisation from online duty free.

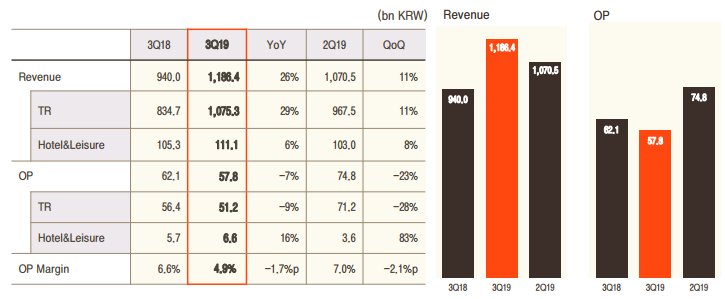

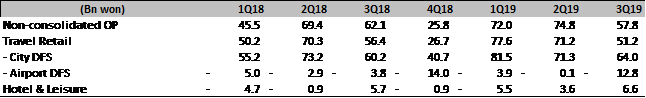

Q3 BUSINESS RESULTS: NON-CONSOLIDATED

Market share gains

In the intensely competitive Korean travel retail sector, market share is a key indicator for the major players. With Hotel Shilla clearly determined to aggressively defend its position this quarter against domestic rivals, its downtown duty free business gained ground to reach an 18.4% share, after falling in the second quarter to 17.7%.

Daigou traders drive sales, hit profits

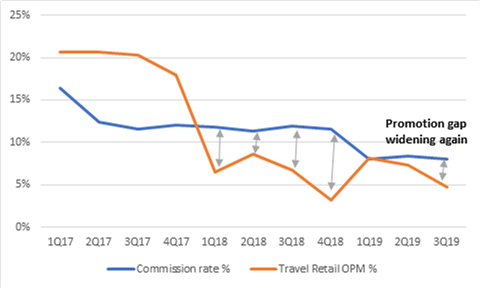

The most important factors that drive near-term sales growth in today’s Korean duty free are commissions and promotions provided to resellers.

Hotel Shilla reported that the downtown duty free commission rate was 8.1% in Q3 and that the commission rate decline that began from Q1 is continuing.

However, unlike Q1 and Q2 when a decline in commission rates also entailed an improvement in operating profit margin, the Q3 operating profit margin declined to 4.8%. The gap between the commission rate and travel retail OPM% in 2018 was a result of heightened competition and enhanced promotions for resellers not captured in Hotel Shilla’s commission rate.

All eyes are on whether competition for market share will intensify or if those responsible for the increase will scale back promotions in the interests of profit recovery. Hotel Shilla commented post earnings that heightened competition between operators has eased and the company is on course to post KRW5 trillion in revenue for the year.

Enhanced promotions and lacklustre sales to Korean nationals who account for a significant portion of the airport duty free business resulted in an operating loss of KRW12.8 billion. With Korean Air and Asiana Airlines continuing to offer more promotions to regain price competitiveness, and online competition fierce, losses from airport duty free are likely to continue.

Hotel Shilla remained tight-lipped in terms of how their concessions in protest-hit Hong Kong performed for the quarter.

However, The Moodie Davitt Business Intelligence Unit estimates that the sales decline in the quarter was likely below -10% as, based on the consolidated results, anything above that would have required the Changi beauty concession to have grown in excess of +20% for the quarter. Nonetheless, driven by the difficulties in Hong Kong, the overseas duty free business recorded a KRW12.7 billion operating loss for the quarter.

With no end in sight for the protests in Hong Kong, and tourism there in freefall, losses are expected to mount.

Hanok triumph brings big boost for duty free

The Seoul Metropolitan Government’s approval of Hotel Shilla’s plans to erect a traditional Korean house-themed (hanok) hotel also has duty free repercussions.

For Hotel Shilla CEO Boo-jin Lee, who outlined her plans for the hotel in 2010 when she became CEO, it is a particular triumph. The initial blueprints and a request to break ground to build the landmark hotel were submitted as early as 2011 but have been delayed by government red tape and political issues.

The Hanok hotel pictured above will be built on the ground of Hotel Shilla’s current duty free store and will comprise two storeys above ground and three below. A new duty free store and other auxiliary facilities and an underground parking lot will be constructed as part of the plan.

With the approval in place, Hotel Shilla will begin to break ground next year and complete the construction in 2025. The construction detail that the travel retail industry needs to take note of is that the floor space allocated for duty free retailing is likely to grow by as much as 2x. This will allow the company to cater for more daigou resellers and Chinese tourists. The current space is badly overcrowded at peak periods.

3Sixty deal

The acquisition of a 44% stake in the parent company of US travel retail 3Sixty Duty Free & More (formerly DFASS Group) is an important step in Shilla’s planned globalisation. The company now gains an important foothold in the Americas and can decrease its worrying dependence on Chinese resellers at home. The deal also entails a call option and a put option that could see Hotel Shilla own the company outright in time. As part of this deal, Hotel Shilla has a call option to purchase 23% additional shares during a ten-month period from January 2024. Should Hotel Shilla exercise this right to purchase additional shares, the existing shareholder has a put option to sell the remaining 33%.

Lotte’s Changi concession win and Hotel Shilla’s acquisition of 3Sixty both underline the strong determination by the Korean giants to expand their business internationally and lessen their reliance on their big but vulnerable home market.