Moodie Davitt snapshot: Estée Lauder third quarter results – Net sales up +18% to US$3.37 billion – Net earnings +25% to US$372 million – Double-digit sales increases in travel retail for almost all brands Source: The Moodie Davitt Report |

Double-digit sales growth in travel retail helped The Estée Lauder Companies to deliver a strong third-quarter performance (to 31 March), the company reported today.

The group posted a +18% year-on-year net sales increase to US$3.37 billion. Net earnings rose +25% to US$372 million.

Within this, travel retail continued its recent strong momentum, generating double-digit sales rises in virtually every brand, led by Estée Lauder, La Mer, MAC, Clinique and Tom Ford. Brands benefited from growth in global air passenger traffic, new launches and expanded consumer reach, said Estée Lauder.

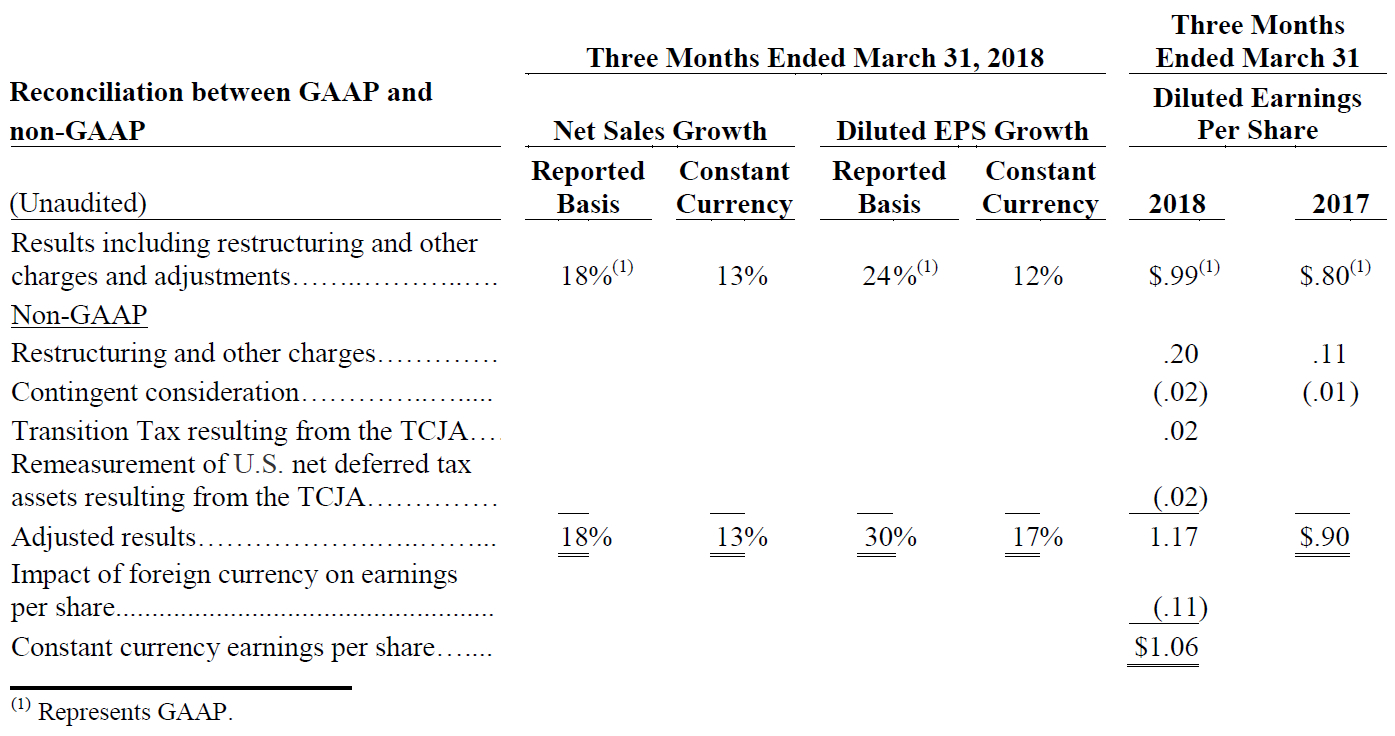

The Estée Lauder Companies President and Chief Executive Officer Fabrizio Freda said: “Our company delivered another excellent quarter in what we expect to be an outstanding fiscal year. Many areas of our business that contributed to our strong first-half results continued to thrive in our third quarter, as we generated +13% sales growth and +17% adjusted earnings per share growth, each in constant currency.

“Among our multiple engines of growth, travel retail, online and Asia again were standouts, and we experienced strong momentum in other high-growth channels and markets. Our performance this quarter reflected robust global demand across our portfolio, with virtually all our brands posting sales growth. Each of our three biggest brands grew globally, with exceptional growth in Estée Lauder. These results reflect our strong array of hero products, as well as product and service innovations that resonated well with today’s diverse global consumers.”

Freda added: “We continue to position our company for sustainable, profitable growth and long-term shareholder value creation, with strategic actions and targeted investments to build our brands and strengthen our assets. Our ability to anticipate prestige beauty trends enables us to quickly deploy our resources to capture potential growth opportunities.

“Amplifying our digital initiative to drive brand engagement, trial and loyalty is a priority. We are raising our full-year constant currency sales growth forecast to between +11% and +12% and increasing our constant currency earnings per share growth estimate to +20% to +21%, before restructuring charges and the impact of the provisional tax act charges.”

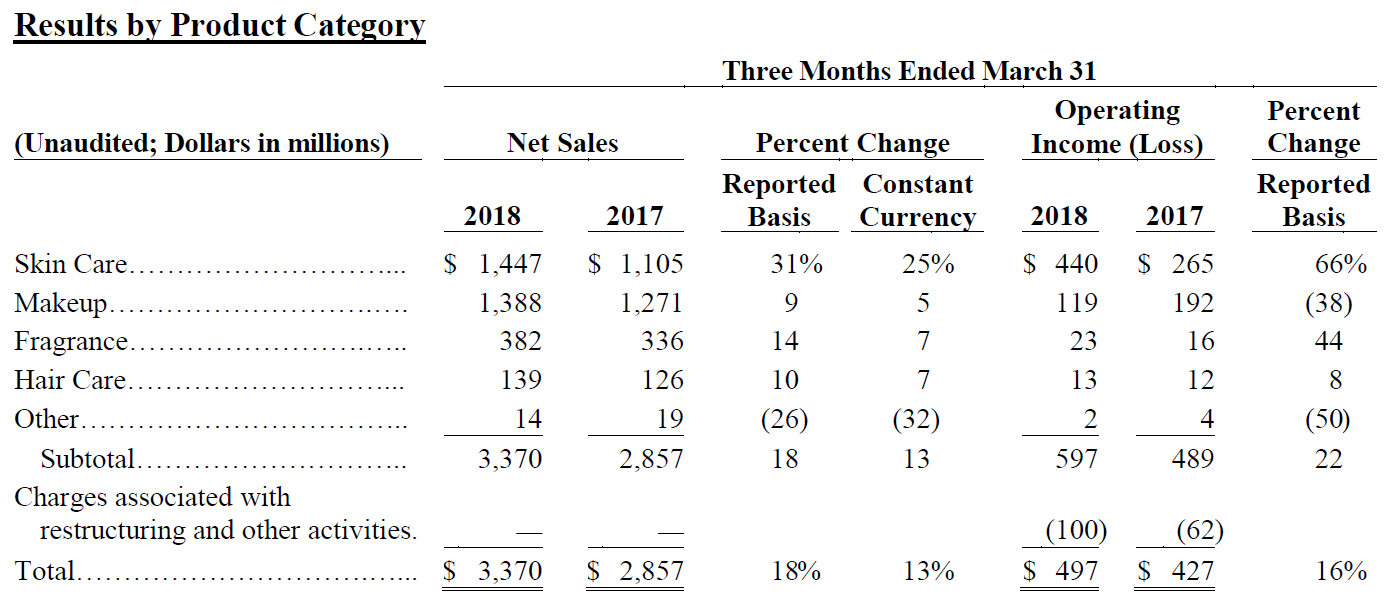

Category performance

Net sales and operating income in the company’s product categories were favourably impacted by a weaker US Dollar in relation to most currencies. Total operating income in constant currency, before charges, increased +11%.

Skincare

• Net sales growth benefited from increases in Asia, where skincare represents about two-thirds of the region’s product category mix. Growth also reflects strong innovations, gains from ‘hero’ products and the increasing demand from younger consumers, noted Estée Lauder.

• Net sales increased sharply, with strong double-digit gains in most regions from La Mer, Estée Lauder, Origins and GLAMGLOW; Clinique achieved solid double-digit growth globally.

• La Mer’s growth was driven by the success of new products, including the launch of The Moisturizing Cool Gel Creme, gains from existing products, and targeted, expanded consumer reach. The Estée Lauder brand’s growth was particularly strong in China and travel retail.

• Higher sales at Origins were generated in large part from the continued success of several product lines in the facial mask and moisturiser sub-categories. GLAMGLOW’s sales gains reflected strength from its core facial mask products and targeted expanded consumer reach. Clinique’s sales gains reflected increases in the brand’s Moisture Surge product line.

• Operating income increased sharply, primarily from the company’s heritage brands and La Mer, reflecting higher sales.

Make-up

• Sales growth in make-up was primarily driven by strong double-digit increases from Estée Lauder and Tom Ford and solid gains from MAC and Clinique.

• Sales from Estée Lauder were fuelled by the Double Wear foundation and Pure Color product lines. At Tom Ford, higher sales were driven primarily by strength in the eyeshadow sub-category.

• The higher sales from MAC were due to strong growth in the Asia Pacific region, particularly China and Hong Kong, and in travel retail, as well as success in the speciality-multi channel in the USA. Clinique’s sales growth stemmed primarily from emerging markets within Europe.

• These increases were partially offset by lower make-up sales in the USA, reflecting slow foot traffic in some US brick-and-mortar stores.

• Make-up operating income declined. Growth from heritage brands was more than offset by lower operating results from make-up artist brands, reflecting increased digital and social media spending to engage new consumers. Too Faced had lower results reflecting additional investments behind targeted expanded consumer reach internationally, as well as new and existing products.

Fragrance

• Net sales increased, primarily due to strong double-digit gains from luxury brands.

• Jo Malone London delivered outstanding double-digit growth in every region and in travel retail. The launch of the English Fields fragrance collection contributed to the higher sales.

• Increased sales from Tom Ford reflect, in part, the continued success of the Private Blend line of fragrances.

• Le Labo, By Kilian and Editions de Parfums Frédéric Malle each benefited from growth in existing products and targeted expanded consumer reach.

• Partially offsetting these increases were lower sales of certain Estée Lauder fragrances.

• Fragrance operating income increased sharply, reflecting higher sales as well as disciplined expense management.

Haircare

• In haircare, Aveda grew, driven by solid performances in the online and travel retail channels, along with contributions from the launches of Invati Advanced and Full Spectrum Demi+. Growth from Bumble and bumble was driven by the success of the brand in Ulta Beauty.

• Partially offsetting the sales growth was softness in the salon channel in North America, which impacted both brands.

• Haircare operating income increased, reflecting higher sales.

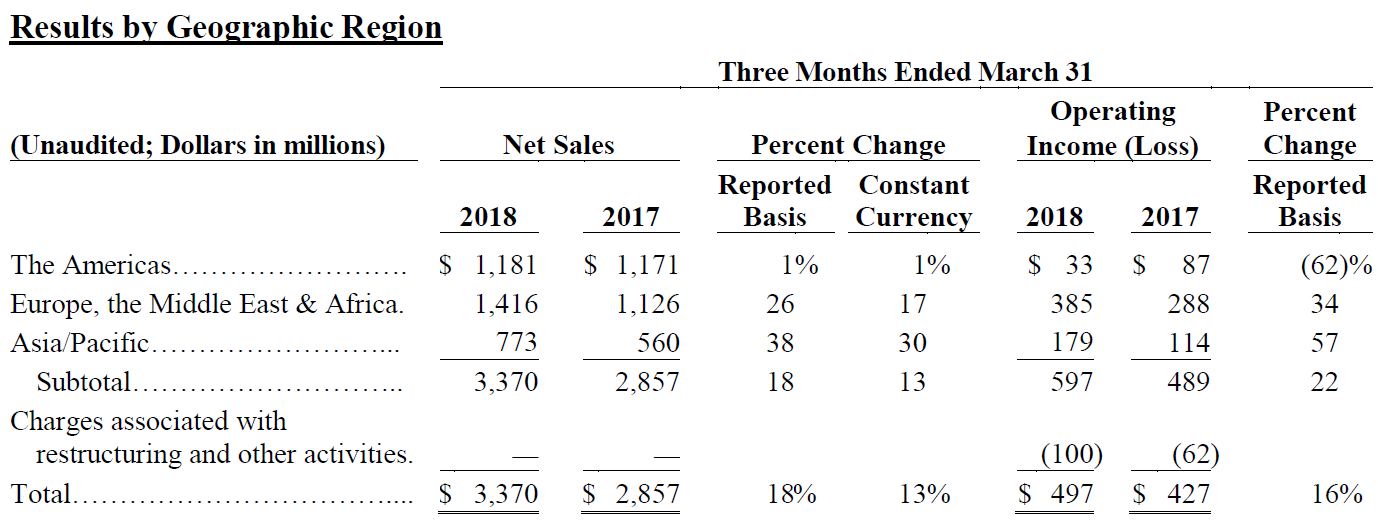

Regional breakdown

Net sales and operating income outside the USA were favourably impacted by a weaker US Dollar in relation to most currencies.

The Americas

• Sales in North America were relatively flat, with growth in La Mer, Estée Lauder and certain luxury brands offset by lower sales from make-up artist brands.

• La Mer generated strong double-digit sales gains in skincare, and Estée Lauder posted strong double-digit sales growth in skincare and make-up. Most of the company’s luxury and artisanal fragrance brands also experienced double-digit growth.

• Sales decreases were recorded in several brands, primarily attributable to the decline in retail traffic in some US brick-and-mortar stores.

• Sales in the company’s online and specialty-multi channels grew strong double-digits.

• On a reported basis, sales in Canada and Latin America increased double-digits. In constant currency, sales in Canada rose high-single digits and Latin America increased double-digits.

• Operating income in the Americas decreased, as higher operating results from certain heritage brands were more than offset by lower results, primarily from make-up artist brands and Too Faced. The decrease reflects higher digital and social media investments and additional support spending behind new and existing products. Higher stock-based compensation expense also contributed to the operating income decline.

Europe, the Middle East & Africa

• As reported, travel retail continued its momentum, generating double-digit sales growth in virtually every brand, led by Estée Lauder, La Mer, MAC, Clinique and Tom Ford.

• The company generated strong sales growth in most markets in the region both on a reported basis and in constant currency. In constant currency, double-digit sales gains came in travel retail and Italy, as well as several emerging markets, including India, Russia, Central Europe and Turkey.

• Lower sales were posted in the Middle East, driven by distributor inventory rebalancing, reflecting the impact of the macro-environment on consumer purchases.

• Operating income increased, primarily due to strong double-digit operating results in travel retail. Certain developed and emerging markets such as Italy and South Africa also contributed to the higher profits. The gains were partially offset by lower results in the UK and the Middle East.

Asia Pacific

• On a reported basis and in constant currency, sales increased sharply, led by strong double-digit growth in China, Hong Kong, the Philippines and Taiwan. In constant currency, Japan, Australia and Thailand each had solid sales increases.

• The higher sales in China reflected strong double-digit gains in every brand except Clinique, which increased high-single digits. Estée Lauder, MAC, La Mer, Tom Ford and Jo Malone London led the sales growth. The company generated double-digit sales growth in every major channel, particularly in department stores, online and specialty-multi.

• The sales increase in Hong Kong reflected higher domestic consumption and a rise in tourism.

• Sales in the region benefitted, in part, from continued demand for make-up products, acceleration in skin care and targeted expanded consumer reach.

• In Asia Pacific, operating income increased significantly, primarily due to improved results in China and Hong Kong driven by higher sales.

For the nine months ended March 31 2018, the company reported net sales of US$10.39 billion, a +16% year-on-year increase. Net earnings were US$922 million.

Outlook for fiscal 2018 full year

Looking to the fiscal 2018 full year, Estée Lauder said: “Global prestige beauty is performing exceptionally well and is estimated to grow +6% to +7% during the fiscal year. The company expects to grow about double the industry for fiscal 2018, benefiting from loyalty to its high-quality products, strong innovation, outreach to new target consumers and growth from recent acquisitions.

“The continued emphasis on a digital-first approach and on fast-growing markets and channels are also expected to contribute to growth.”