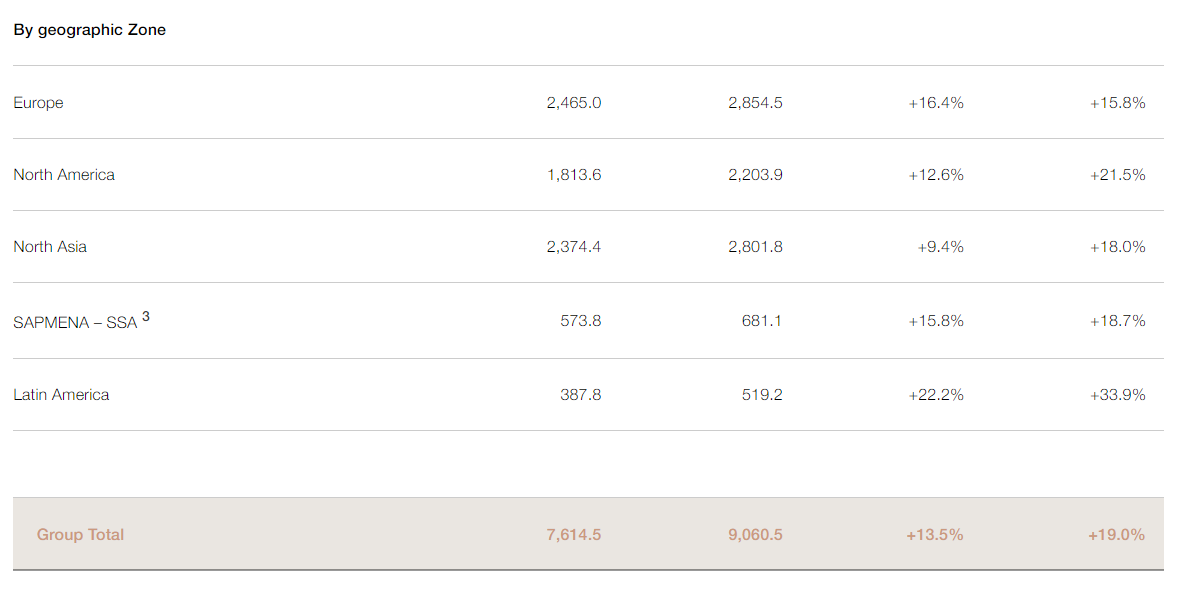

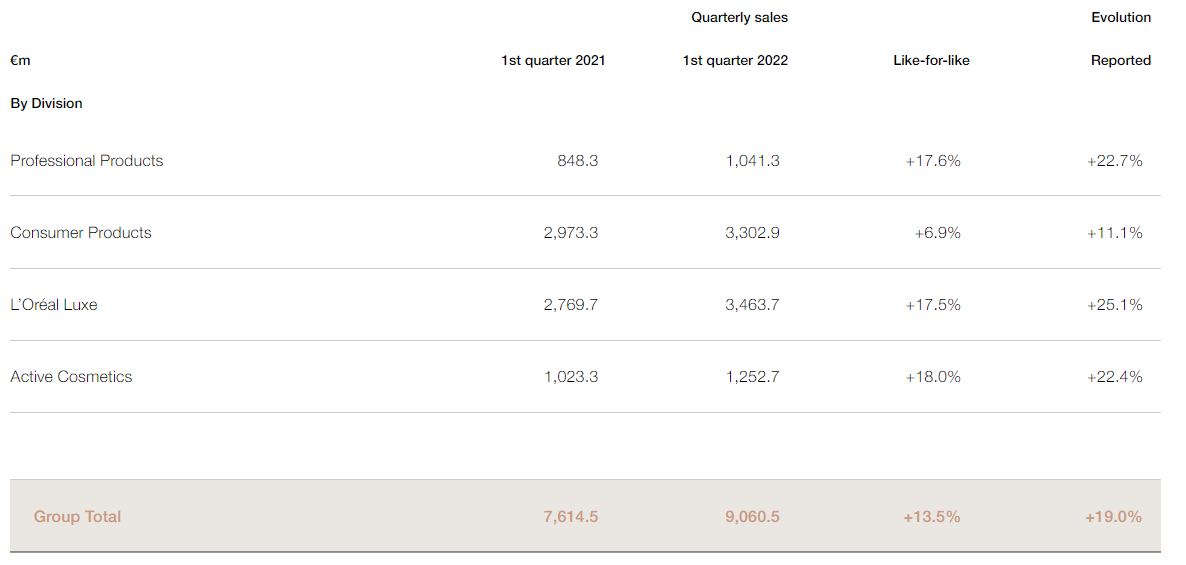

French beauty products group L’Oréal has posted “very strong” year-on-year reported sales growth of +19.0% in the first quarter to €9.06 billion. Like-for-like growth and constant exchange rate growth were +13.5% and +13.9% respectively.

L’Oréal said that it had outperformed the key Hainan travel retail market, which remained “very dynamic” [see sidebar below for more on Hainan and the wider travel retail channel].

L’Oréal CEO Nicolas Hieronimus said: “Against the backdrop of the invasion of Ukraine and strengthened sanitary measures in China, L’Oréal had a strong first quarter… the growth trend continued in the global beauty market, with consumer purchasing behaviour unaffected by inflation.

“L’Oréal pursued its premiumisation and innovation strategy and continued to outpace the beauty market across all zones and divisions, recording strong growth by volume and value. L’Oréal Luxe, Professional Products and Active Cosmetics all achieved double-digit growth, and our Consumer Products Division again outperformed the market despite supply-chain challenges.”

Hieronimus said that the group had made the most of its omnichannel strategy, with a “clear revival” in offline sales and sustained growth in ecommerce, which now represents 25.8% of sales.

Growth was balanced across all geographic Zones, with continued “outstanding momentum” in North America, double-digit growth in Mainland China, and an acceleration in emerging markets and Europe, where growth was muted by a number of lockdowns a year earlier. [Main commentary continues below the following China/travel retail panel]

Rapid China bounceback predicted; travel retail recoveringAsked about the China market during a post-results call, Hieronimus said: “When we look at the total Chinese ecosystem, which includes Mainland China, Hong Kong and Hainan – which is the only other destination where Chinese [travelling] shoppers can shop – and we take the quarter, we estimate the market to be around mid-single digit [growth], which is the growth we had estimated. “We very, very significantly outpaced that growth; we estimate that our performance… is in the mid-teens. So it’s a pretty decent overperformance. January and February started very strong. We had a great Chinese New Year, a pretty good International Women’s Day, and we had lots of traffic in Hainan in February. “March clearly showed a different atmosphere. We’ll have to see looking ahead how long these very strict lockdowns imposed by the zero COVID policy will last.”  Despite the current constraints in Shanghai and elsewhere, Hieronimus said that he remained confident that the China market would quickly bounce back as it has in the past. “If we look mid-term, the Chinese market is going to continue to grow until it becomes the number one beauty market in the world. There are 370 million people that will enter the middle classes by 2030… wo we will do everything to continue to grow that market.” “In terms of Hainan versus the domestic market, Hainan is clearly the strongest for the [beauty] market and for L’Oréal because it’s really a destination that is being encouraged by the Chinese government. “Whats important is that the local market in China remains dynamic, positive. We’ve had a very good start and we are over-performing it. We are playing our cards in the region strategic strategically to make sure that we capture consumers wherever they shop and that we loyalise them if they are recruited through travel retail. “That’s what our teams are doing and managing in a very close cooperation between our travel retail team and our domestic China team.” West to east improvement for travel retailCommenting on the wider travel retail channel, Hieronimus said, “Q1 was a very strong quarter for travel retail overall, with high double-digit growth. What was probably the event of the quarter – even though we remain far from 2019 numbers – was the very strong rebound of international traffic in the western world, in particular, even in the context of the Ukrainian invasion. “In March, we have seen the traffic and the business bounce back strongly in Western Europe, and in Europe in general.” Returning to Hainan, Hieronimus said that L’Oréal had generated strong growth in Q1, particularly around the Chinese New Year, when great animations drove strong market share gains. “I wish you could see the pictures of Lancôme, YSL or Armani and we are now number one in Haitang Bay, which is the number one mall in Hainan,” he said.  Hieronimus also expressed his excitement about the new Haikou International Duty Free City being constructed by China Duty Free Group and its parent China Tourism Group in Haikou. This “gigantic” project which is due to open in late 2022 will have 29,000sq m of beauty space, two to two-and-a-half times the size of Haitang Bay, he said. [Click on the YouTube icon to view New Hainan’s aerial footage shot earlier this month, which shows the completion of Haikou International Duty Free City’s vast roof. New Hainan is owned by Hainan Hinews Media Co, The Moodie Davitt Report’s strategic partner in Hainan province.] Summing up travel retail prospects, Hieronimus added, “Considering the volatile context we live in, we see the continuous rebound of traffic and consumption in the Western world, with Hainan and Korean duty free stores remaining a destination for North Asian shoppers.” |

Commenting on the war in Ukraine, Hieronimus said, “In these challenging times following the invasion of Ukraine, I would like to express our support for all our Ukrainian employees, whose protection remains our absolute priority.”

Looking forward, he concluded, “While mindful of volatility and uncertainty, we remain optimistic about the outlook for the beauty market and confident in our ability to outperform the market in 2022 and achieve another year of growth in sales and profits.”