[An earlier version of this article first appeared in The Moodie Davitt Report Magazine]

Hainan’s burgeoning offshore duty free sector has once again narrowed the gap with the world’s largest duty free market, South Korea.

As reported, the Chinese island province’s offshore duty free stores generated sales of CNY60.17 billion (US$9.47 billion) in 2021, an +84% increase year-on-year. The results include duty free sales of CNY50.49 billion (US$7.94 billion), up +83% year-on-year, with the balance being accounted for by tax paid sales.

While the South Korean market rose +15% year-on-year in 2021 to KRW17.83 trillion (US$14.74 billion), that result came from a low base in 2020 when sales plummeted -38% over pre-pandemic 2019 to US$13.2 billion – just ahead of 2017 levels.

The pandemic-ravaged Korean duty free channel was once again driven in 2021 by sales to foreign customers who generated 95.4% of total revenue (up from 94% in 2020). Almost all of that activity was through reseller activity to China.

The Hainan Provincial People’s Congress recently set an ambitious Hainan CNY100 billion (US$15.8 billion) sales target for its duty free stores in 2022, a +66.2% increase on 2021.

Whether that figure can be met will depend on two key factors. The first is control of the COVID-19 pandemic on the Mainland and Hainan itself (there were three imported cases in late February/early March though none since), a key determinant in visitor numbers.

On 10 March the National Health Commission of the People’s Republic of China reported 397 indigenous cases across the Mainland, not a big number by global standards but worrying nonetheless.

The second factor is when China eases its currently stringent outbound travel restrictions, a big influence in Hainan’s surge as a tourism destination during the COVID era.

Business in Hainan has got off to a strong start in 2022 with sales surging by +151% year-on-year during the recent Spring Festival holidays to CNY2.13 billion (US$333) million, according to the Hainan Provincial Department of Commerce.

For the holiday period 31 January to 6 February, duty free sales alone grew by +156% to CNY1.94 billion (US$305 million), with the balance being generated by tax/duty paid sales.

For the troubled South Korean market, the outlook is much less certain. While the current government (the conservative People Power Party candidate Yoon Suk-yeol was elected as President this week) has declared a ‘Live with COVID’ policy that should see a gradual reopening of outbound and international travel, Omicron’s rapid spread is likely to delay any significant change.

The country’s daily case numbers fell below 300,000 today (11 March) after spiking to a record high two days earlier, according to the Korea Disease Control and Prevention Agency (KDCA).

That means Korean travel retail’s overwhelming dependence on the daigou sector is certain to prevail for some time, a worrying vulnerability given the Chinese authorities’ ability to crackdown on the unofficial trade. But 95.4% of US$14.74 billion is a lot of money and seasoned observers see little rear near-term structural change in the market.

“The future of Korean duty free is hard to imagine at this moment,” said one senior source. “I cannot imagine how they rebuild without letting go of the daigou which we know they will never do. I think it is a pity, as it could perhaps be a US$4-5 billion, very profitable and qualitative business post-COVID and will not reach its potential due to this daigou dependence.”

Any normalisation of the Korean business will also be affected by the recent or impending exits of several luxury brands, including Louis Vuitton, Chanel and Rolex, from all or selected downtown duty free locations.

And with Incheon International Airport failing to attract interest in its once highly desirable Terminal 1 contracts, the immediate future for a business that was the industry’s number one airport for duty free sales — hitting an all-time high of US$2.43 billion in 2019 before plummeting through the pandemic to an estimated 5% of former levels — also looks problematic.

Incheon served a mere 3.2 million passengers in 2021 — just 4% of pre-pandemic 2019 levels. 2022 will be slightly better but passenger numbers are still expected to be no more than 10-15% of 2019.

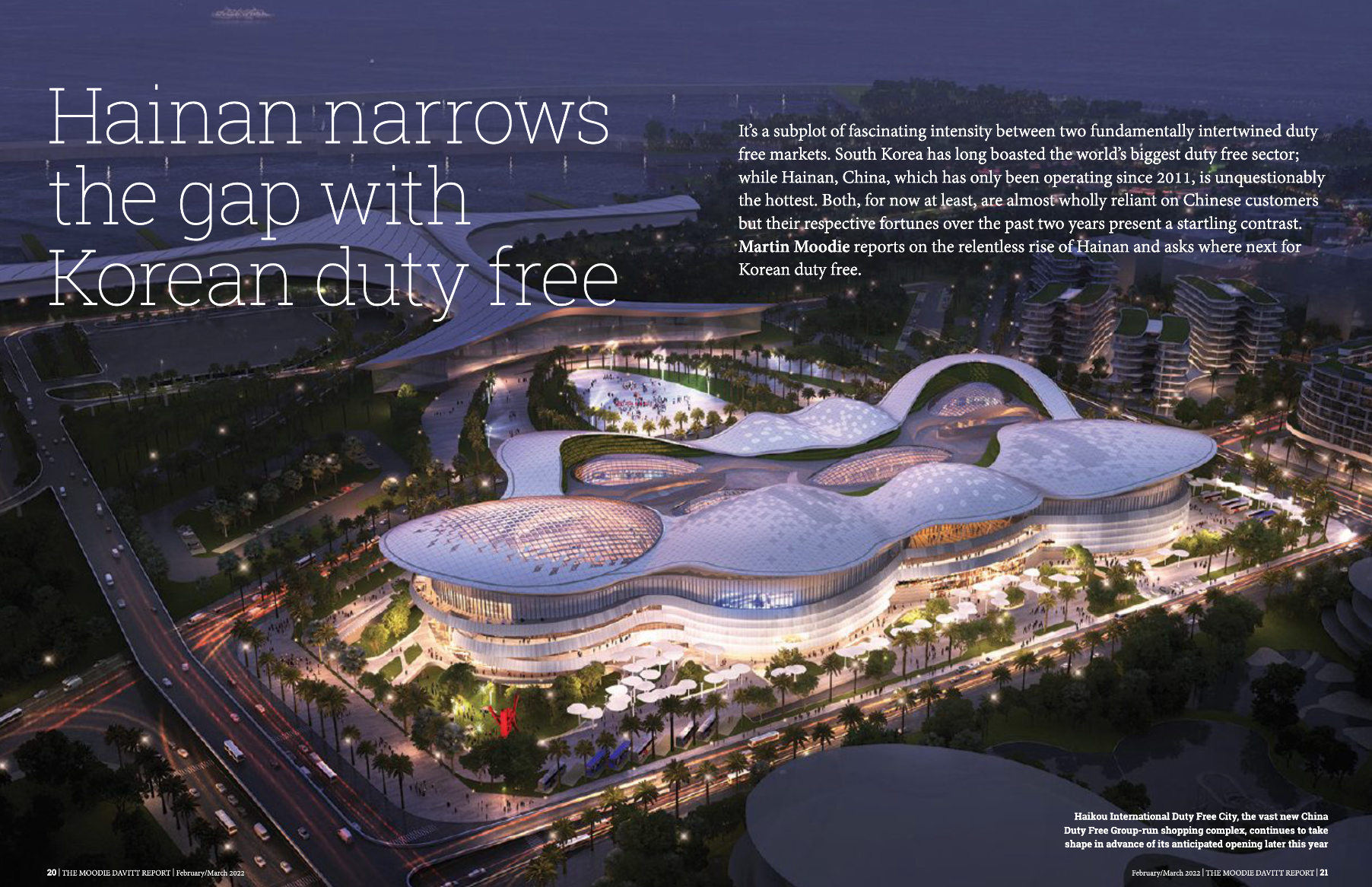

For Hainan, there are no such problems. Supported by highly supportive national and regional government policies; growing retail professionalism among the sector newcomers; and with China Duty Free Group’s extraordinary new Haikou International Duty Free Shopping City set to open in September, Hainan seems set to close the gap significantly with Korean duty free in 2022.

Just how significantly will depend on events in both countries. Whether that heady US$15.8 billion target will be reached in Hainan or not, it is certain that 2022 will see a strong uplift in sales. There is nothing certain in Korean duty free, however. An almost total reliance on a single customer base – no matter how lucrative – is always dangerous, a reality that has come back to haunt Korean duty free retailers.

A strong and well-led (by Lotte Duty Free CEO Kap Lee) Korea Duty Free Association has pushed hard for more supportive government policies with some success.

In January, Korean Customs Service announced that it will permit online sales of Korean domestic duty free products to overseas residents without them having to even visit South Korea. And a few weeks earlier the government abolished the US$5,000 (KRW5.97 million) upper value ceiling for purchases at Korean duty free stores by outbound nationals (effective 1 March 2022).

However, critically, the inbound value allowance remains fixed at US$600, meaning that Korean travellers must still pay duty on goods valued at over that amount on their return to Korea. While the government described the move as an attempt to convert overseas spending into domestic consumption, logic suggests the prime beneficiary will be Korean daigou traders.

Asia travel retail’s most fascinating sub-plot – the content between the world’s biggest duty free market and the world’s hottest — looks set for plenty of twists and turns yet.

Coming soonThe Moodie Davitt Report is delighted to announce the launch of 穆迪达维特中国旅游零售报告 – The Moodie Davitt China Travel Retail Report, a digital magazine dedicated to our industry’s hottest market. The new digital title, to be launched in April, will be published in Mandarin and English four times a year across multiple platforms.  This exciting new digital magazine from the world’s leading travel retail publisher will focus on all aspects of China’s travel-related ecosystem, including:

To subscribe, please email Kristyn Branisel at Kristyn@MoodieDavittReport.com For advertising and sponsorship enquiries please contact Irene@MoodieDavittReport.com or Sarah@MoodieDavittReport.com. For all editorial enquiries please contact Martin Moodie at Martin@MoodieDavittReport.com |

Note: Every fortnight The Moodie Davitt Report publishes Hainan Curated, in association with Foreo, a selection of all recent stories from the offshore duty free sector in Hainan province.

Click here to view all back issues. Please email Kristyn@MoodieDavittReport.com to subscribe.