FRANCE. Groupe ADP has updated its traffic forecast for 2020, saying that passenger volumes at the major Paris airports will fall by between -65% and -70% year-on-year. The impact on consolidated revenue in 2020 would be between €2.3 and €2.6 billion with this level of traffic decline.

Amid much uncertainty about the recovery, the company said it expects to reach 2019 traffic volumes at Paris Charles de Gaulle and Orly airports “between 2024 and 2027”.

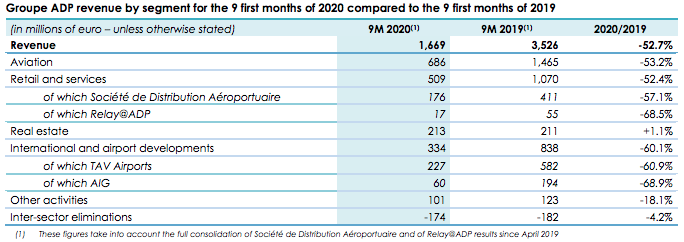

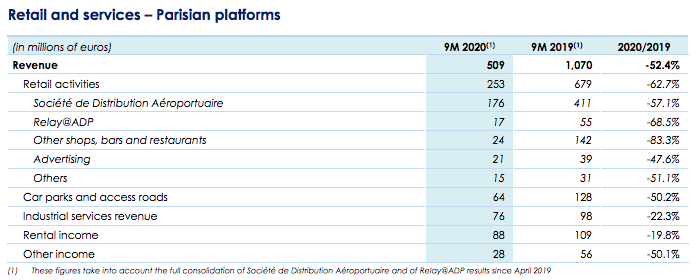

The latest forecasts came as the group reported nine-month results to 30 September. Revenue from the Retail and Services division (Paris airports only) fell by -52.4% to €509 million compared to a year earlier. This includes rents received from airside and landside shops, bars and restaurants, banking and foreign exchange activities, and car rental companies, as well as revenue from advertising. Within this, retail revenue fell by -62.7% to €253 million.

Revenue from the Société de Distribution Aéroportuaire joint venture with Lagardère Travel Retail reached €176 million, down by -57.1%, with the Relay@ADP JV down by -68.5% to €17 million.

Sales per passenger from airside shops reached €18.60 in the period, down by just -2% compared to the same period in 2019.

Paris Aéroport passenger traffic fell by -66.3% to 27.8 million in the nine-month period.

Total group traffic over the first nine months was down by -61.8% to 72.3 million passengers compared to the same period in 2019 (this excludes comparison with Istanbul Atatürk and GMR Airports)

The company has already recorded impairments related to its international airport assets, with an impact of €177 million in profits attributable to the group as of 30 June 2020. But it said that further depreciation could be recorded for the full year to 31 December due to the continuing crisis, with talks over the “financial and operational sustainability” of certain assets.

ADP noted: “In particular, Groupe ADP, as a shareholder of AIG, concessionaire of Amman Airport in Jordan, could have to support the company in the form of a shareholder loan for an amount of around €20 million before a restructuring which is the subject of discussion between the stakeholders. Regarding TAV Tunisia, a consensual solution is being developed.”

AIG revenue fell by -68.9% year-on-year to €60 million, mainly due to the decline in passenger fees caused by falling traffic in Amman (-75.3%) and the decline in revenues from airside shops (-€22 million).

TAV Airports reported a revenue fall of -60.9% to €227 million, partly due to the decrease in revenue of F&B subsidiary BTA (-€71 million) and lounge management business TAV OS (-€46 million). There were also sharp falls in ground handling business Havas (-€62 million) and at subsidiary TAV Georgia (-€57 million) with traffic at Tbilisi and Batumi airports down by -83% year-on-year.