INTERNATIONAL. Travel data analyst ForwardKeys has presented new data which highlights trends that should spell good news for travel retail, including a revival for business travel and longer airport dwell times.

In January 2022 business travel was tracking at -76% of 2019 levels, according to ForwardKeys air ticketing data. But looking at forward-booked air tickets from 6 February until the end of March, the gap has closed to -18%. The respective figures for leisure travel are -64% and -14%.

ForwardKeys said that this has positive implications for travel retail and food & beverage activities at airports, noting that business travellers spend, on average, more in airport stores and dining venues than leisure passengers.

The travel data analyst also noted a strong revival in business travel from Asia Pacific, giving the example of Japan, where the recovery of business travel is tracking ahead of leisure travel.

ForwardKeys noted that Istanbul Airport is in a strong position in this market, up by +13% in Q1 2023 compared to the same quarter in pre-pandemic 2019. More than 90% of the tickets booked from Japanese airports to Istanbul are for transfers to Italy, Germany, France and Spain.

“What is aiding this hot trend are two things. Seat capacity is above 74% of the 2019 levels and the lower cost of airfares when compared to flights from Japan to Germany or France,” said ForwardKeys VP of Insights Olivier Ponti.

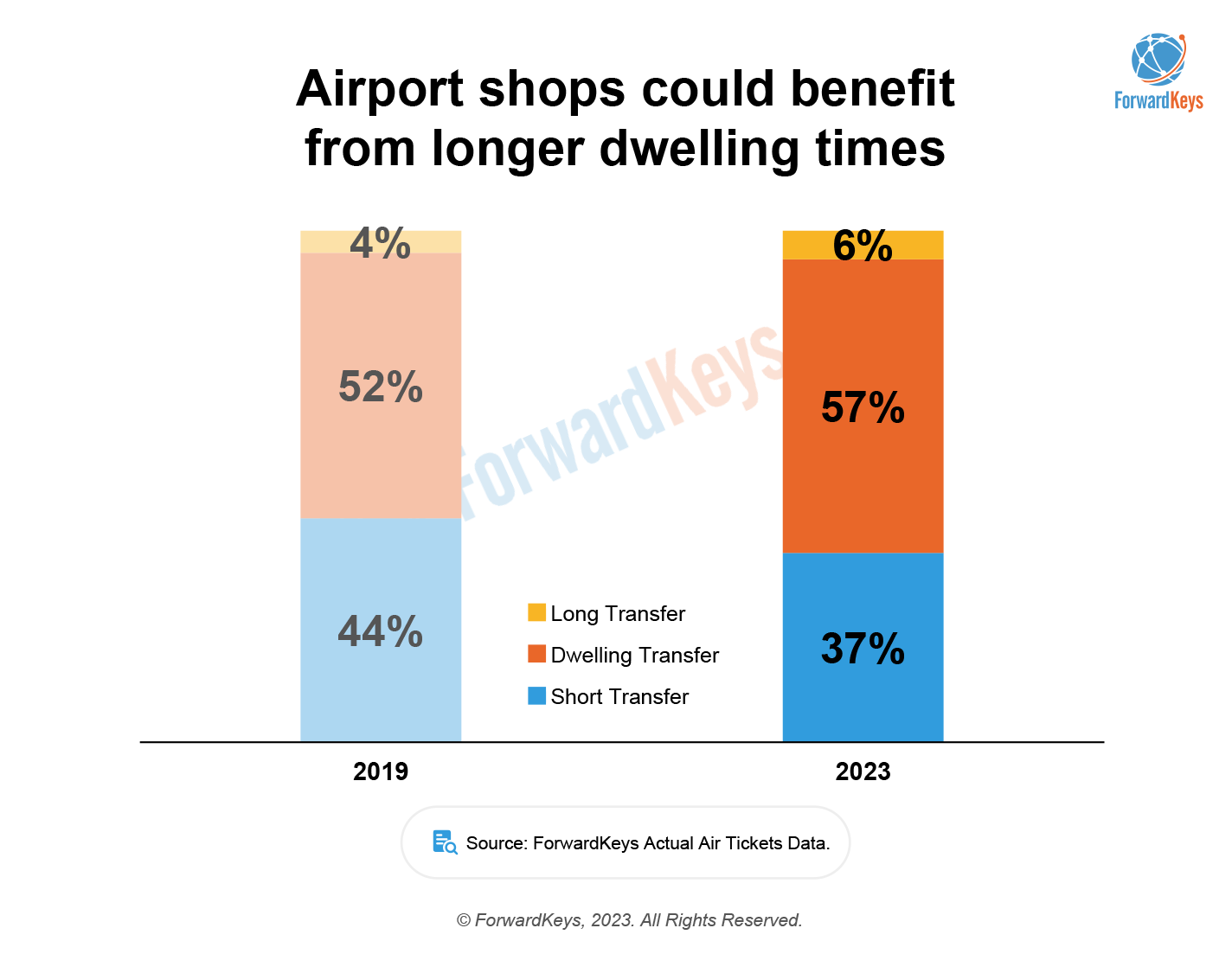

In highlighting a second positive trend for travel retail and F&B, ForwardKeys also offered data on airport dwell times for those passing through airports for transfers to a second airport. According to the analyst’s data, the share of ‘Short Transfers’ (up to two hours in the airport) has decreased from 44% in 2019 to 37% in 2023.

That means the remainder of passengers are classed as either ‘Dwelling Transfers’ (between two and seven hours in the airport) or ‘Long Transfers’ (seven hours or more) – i.e. passengers with significant time for potential spending. The percentage in each case is 57% and 6% respectively.

ForwardKeys also provided a Q1 update on US source markets, highlighting that travellers into Lisbon are up +106% vs 2019, Copenhagen +68% and Istanbul +62%.

The analyst noted that US travellers are tending to stay longer and are increasingly taking multi-destination holidays.

The top destination pairs from the US remain the UK and France, and France and Italy, but new pairs are emerging strongly such as Denmark and Sweden (+127% vs 2019), Portugal and Spain (+116%) and Turkey and Greece (+32%).