SOUTH KOREA. A hard-hitting online and print article in the country’s most influential media, Chosun Daily, has likened the Korean duty free market’s current reliance on Chinese tourists to the Japanese boom turned bust of the late 1980s and early 1990s.

The article, which includes comments by The Moodie Davitt Report Chairman Martin Moodie, was sparked by a dramatic recent slowdown in the growth of Chinese visitor numbers to South Korea.

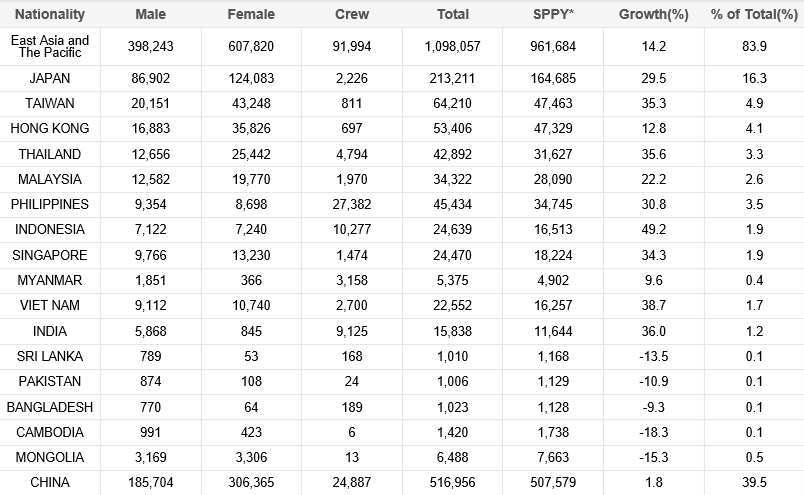

As reported, Chinese arrivals increased just +1.8% year-on-year in November, continuing a sharp easing that began in October (+4.7%). Sources in Korea believe the slowdown is related to the government’s decision to deploy the US missile system THAAD from later this year, a move that has deeply angered the Beijing authorities.

The numbers make deeply concerning reading given the South Korean duty free industry’s overwhelming reliance on Chinese business and the fast-proliferating retail competition. For the first 11 months of 2016, Chinese visitors accounted for 47.4% of all arrivals. Chinese visitor numbers for that period reached 7,532,186, up +36.5% on the MERS-ravaged 2015 and +32% on the first 11 months of 2014.

The Chosun Daily drew a parallel between current market conditions and the then-booming but Japanese-dominated Korean duty free market of 1984-1988. In that period Japanese arrivals rose by +94% to 1,112,000, earning the duty free industry the unwelcome sobriquet of ‘the goose that lays the golden eggs’ – 황금 알을 낳는 거위.

In 1986, five new downtown stores opened in the year, after then-President Chun Doo-hwan ordered the “activation of foreign tourist shopping”. A proliferation of successful licence applications led to a total of 29 stores being open, far in excess of the necessary capacity, especially in the event of a downturn. That duly arrived as the Japanese bubble economy burst in 1990 and many stores were forced to close as tourist arrivals and spending slumped.

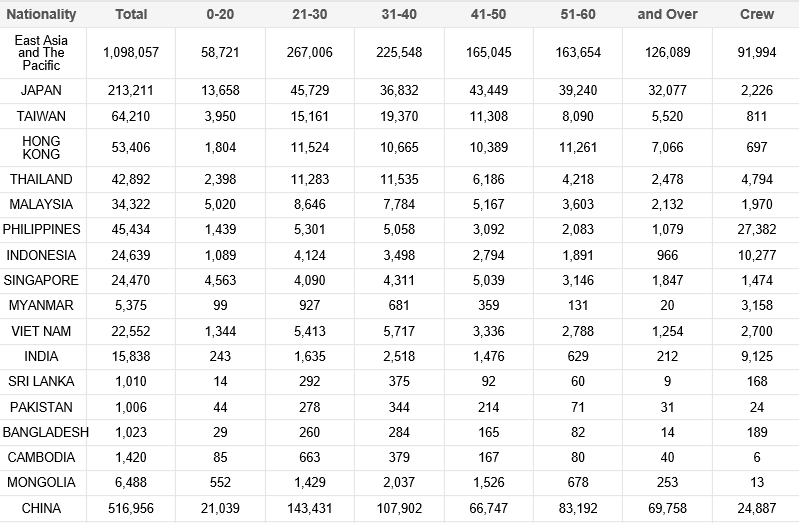

“The current situation does not look much different from the time of the collapse of the Japanese bubble,” the report said. Thanks to the Hallyu (Korean wave) and K-Beauty trends, the number of annual Chinese visitors is close to exceeding 8 million. Many of those are younger 20-30 year-olds who are only buying cheaper items, it noted.

The number of downtown duty free shops in Seoul has increased from six at the beginning of 2015 to 13 (once the recently granted licences are in operation), the report pointed out, warning, “Signs of overheating are already being detected everywhere.”

“If there ever was such an egg, it cracked long ago”

“Many of the companies that have not acquired luxury brands are paying commissions of up to 40% of their sales to the travel agencies in order to attract customers,” it claimed [certainly The Moodie Davitt Report understands from our recent visit to Seoul that commissions have soared from a former base of around 7-11% to consistently in the high 20s and sometimes beyond].

The Chosun Daily pointed the finger at the government and the National Assembly, saying they have weakened the international competitiveness of the industry through their policies, notably with the decision to stick to the controversial five-year licence term after earlier signalling a move to ten years.

That decision has caused the investment community to cool its view of travel retail as well as causing job insecurity among workers. An unnamed senior official at a leading duty free shop said: “In China, Japan and Thailand, the government supports the large-scale integration of duty free shops and gives them wings. In Korea that is not the case.”

Asked if the contemporary Korean duty free industry was indeed a goose that lays golden eggs, Martin Moodie is quoted as saying, “If there ever was such an egg, it cracked long ago.”

In an extended interview set to appear at a later date, he continued: “Duty free is a hugely complex and expensive business, constantly affected and undermined by external factors, including currency fluctuations, political issues, ever-changing regulations and the sheer cost of doing business.

“The proliferation of duty free licences in Korea was based to some extent on the perception that it was an industry full of easy and rich pickings. The reality is that excessive competition in the market has simply driven up the cost of business (especially with tour agency commissions) and left too many players fighting over a pot that is frighteningly vulnerable to a downturn in Chinese tourism.”