SCOTLAND. Edinburgh Airport emphasised its recent retail investments on Friday with a catwalk show featuring some of its newest brands.

The retail department used the fashion category – which the Global Infrastructure Partners-owned airport has expanded in recent months – to underline the status of the UK’s sixth-busiest airport (12.4 million passengers in 2016) as a capital-city gateway, to change perceptions that it is simply a regional airport.

“Edinburgh had a reputation as a domestic, regional airport but it’s actually a capital city airport with international customers. So we wanted to change that image and fashion can be a big driver of that,” Edinburgh Airport Retail and Property Director, Richard Townsend, who joined from Gatwick Airport in September 2013, told The Moodie Davitt Report.

He has spearheaded the airside retail transformation – now almost complete – which features 19 new or refurbished shops across watches, beauty, fashion and F&B, with 13 new brands.

Four months ago Norway’s Airport Retail Group opened a multi-branded Traveller fashion store, while a Yo! Sushi opened a week ago. Additionally, a new Hugo Boss unit will be unveiled in March. Some 300 jobs have been created due to the retail expansion alone.

New and recognisable brands

Friday’s fashion show featured a mix of the High Street and international labels, as well as Scottish heritage brands. They included Michael Kors, MaxMara Weekend (both operated by ARG), Kurt Geiger (shoes), Traveller, Accessorize, JD (sports), Rolling Luggage and Scotland’s Brora (cashmere) and Scottish Fine Gifts – almost all of which are newcomers to the airport within the past year. The Brora store is a world first at an airport.

“We did our market research and matched our age profile, gender and socioeconomic groups to develop the existing retail offer,” said Townsend. “We engaged over 100 brands initially before filtering down to finally introduce 13 new fashion brands – but over 100 if you include all those in the multi-brand stores.” As well as Traveller, the much-enlarged 1,240sq m walk-through World Duty Free (Dufry) store, JD, Scottish Fine Gifts and Rolling Luggage all feature multiple brands.

Over 70% of Edinburgh Airport’s customers tend to use the catering outlets, so the airport has made these the anchors of the commercial zone. The stores have been zoned by type and category into four areas: the main WDF duty free store; an essentials area featuring newsagents, currency exchange and a pharmacy; high street labels adjacent to which are a Costa (coffee bar) and JD Wetherspoon (pub) for example; and higher-end brands adjacent to which is a Champagne bar.

This plan, based generally on hierarchical needs, has led to a big shift in retail performance. “We are seeing double-digit growth, obviously, because we have so much more retail – but we are also seeing strong growth on like-for-like sales in some cases up to +30-40%,” said Townsend.

New expansion

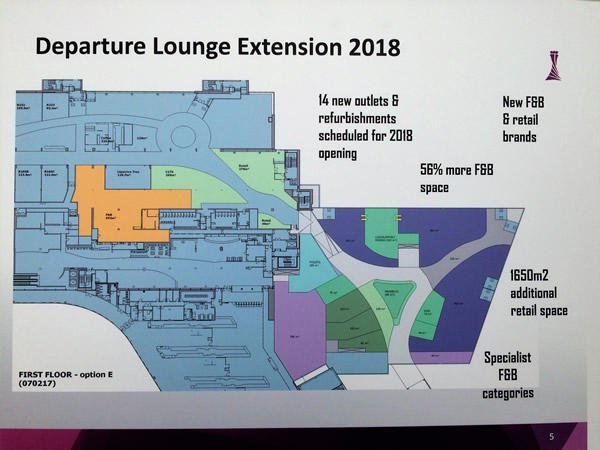

These results should stand Edinburgh Airport in good stead for its next phase of expansion, which is in the pipeline now. It consists of a new £19 million (US$23.7 million) Southeast pier extension, planned to open in 2018, which is set to deliver another bundle of shop and F&B units with more opportunities for retailers and brands.

All of this comes on the back of a very strong traffic uplift of +11% in 2016. The airport company said it will continue to outgrow competitor airports the same size and larger this year and into 2018. Speaking exclusively to The Moodie Davitt Report, Chief Executive Gordon Dewar said: “Over the past four years, European airports have growth by +5.5% and we’ve grown by +11%.”

He added: “We’ve invested heavily in the route development team… and we’ve become much better in selling the value of the city and the country. We give the airlines board-ready propositions based on high-quality business analysis.” A key beneficiary has been long-haul which has gone from one route in 2012 (to New York) to eight last year, with the Middle East and Asia seen as a “huge opportunity” for the coming years.

On EDI’s retail outlook for the rest of 2017 into 2018, Townsend commented: “In January and February (so far) we’ve seen significant increases on last year and, more importantly, we are trading above growth in passenger numbers (+11% in 2016), and that is our benchmark.”

Tender time on retail and F&B Exclusive by Kevin Rozario Edinburgh Airport is currently tendering six new F&B outlets, with up to nine retail stores to follow by mid-year. These opportunities form an integral component of a new retail and catering area in a £19 million (US$23.7 million) pier extension. F&B alone will grow by +56% thanks to this extra space. The bids come in the wake of a successful overhaul of the retail offer at Scotland’s busiest airport, the culmination of which was Friday’s fashion show (see main story) to highlight new brand arrivals. The extension – ready by mid-2018 – will add 1,650sq m of retail space. While F&B is the big focus, because it is under-served in the existing departures lounge, the new area is likely to see more luxury brands entering the fray, as EDI also sees this as a segment for further development. Brora and Weekend MaxMara are currently the top-end fashion brands at the airport but “we believe there is demand for more luxury, and another level that we can go to – and now we have the opportunity to do that with standalone stores in the extension,” says Retail and Property Director Richard Townsend. “Every space will be competitively bid.” ‘Second-hit’ essentials stores, such as newsagents, will also be present. Pod success On the extra catering units, Townsend added: “We’ve had high double-digit growth in our existing F&B outlets with one of them up by +60% year-on-year. Eating out has become a much more significant part of our everyday lives and airports now represent that trend.” Key existing F&B partners are bar and restaurant operator JD Wetherspoon and leading international concessionaire Delaware North. On luxury and fashion, the airport will be looking closely at the performance of brands in current multi-brand units to determine if any of these houses might want to bid for individual outlets. One of the success stories has been introducing a ‘pod’ for pop-up stores (let on three-month cycles). “The reason was to test particular markets and categories, but also leverage events such as the Ryder Cup, the Edinburgh Fringe etc. It also allows brands to see the value of being at an airport,” said Townsend. Pop-ups that became long-staying tenants include Krispy Kreme (doughnuts) and a souvenir store selling cashmere. “We will be introducing more pop-up spaces in future,” noted Townsend. |