EUROPE. Airports Council International (ACI) Europe has further revised downwards its projections for traffic and revenue at European airports for 2020 in light of the COVID-19 pandemic.

The association now forecasts a loss of 873 million passengers for Europe’s airports in the year, representing a decrease of -35% in a year that was predicted to see +2.3% passenger growth in a business-as-usual scenario.

In financial terms, this translates into a loss of €23 billion in revenues, a fall of -41% compared to the business-as-usual scenario.

The revision was driven by downgraded expectations about the duration of lockdowns and restrictions to air travel – including advice from the European Commission to prolong current restrictions upon non-essential travel until 15 May.

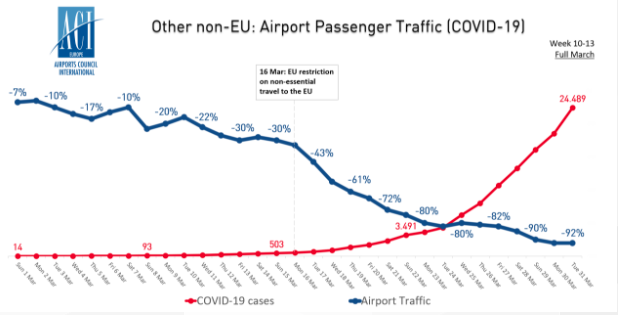

Figures for March show that passenger traffic fell by -59.5% year-on-year, pulling Q1 numbers down by -21%. While Europe’s airports still handled 5,120,000 passengers on 1 March (down by -11.7% compared to the same day in 2019), that number had reduced to just 174,000 by 31 March, a fall of -97.1% compared to the same day in 2019.

Director General Olivier Jankovec said: “This is like nothing we have seen before. In the global financial crisis, it took Europe’s airports 12 months in 2009 to lose 100 million passengers. With COVID-19, it just took 31 days – the month of March – for that same passenger volume and more to vanish.”

He added: “With repatriation flights bringing back Europeans to their home countries coming to an end, what now remains is essentially limited to cargo traffic as well as sanitary and other emergency air services. While 93 airports have closed their doors – mostly secondary and smaller regional airports, more than 80% of Europe’s airports remain open to commercial air traffic.”

ACI Europe also renewed its call for European Aviation Relief Plan that looks at supporting all actors in the air transport eco-system, with no measures benefiting one sector at the expense of another (a call initially made with other associations, including the ETRC).

The trade association also insisted on the need for support to address current business continuity risks for airports and their business partners (ground handlers, caterers and travel retailers) as well as to safeguard their capabilities to restart operations and carry on strategic long-term investments.

Jankovec said: “Airports are local jobs machines. They very often are the largest employment site in their communities, regions or even at national level. That reflects the value and role air connectivity plays for economic growth – with every +10% increase in direct connectivity yielding a +0.5% increase in GDP. This means restoring air connectivity must be at the forefront of the EU’s exit and recovery strategy. Such a strategy will need to guarantee an orderly transition from today’s patchwork of restrictions to travel – and be based on effective coordination both within the EU and internationally.”

To support the EU and governments in that exercise, ACI Europe is today launching a dedicated ‘Off the Ground’ project. This aims to map out the issues airports and their business partners face in restarting full operations and restoring air connectivity. The objective is to identify best practices, provide airports with a common set of guidelines and governments and policy makers with advice and essential requirements, said ACI Europe.