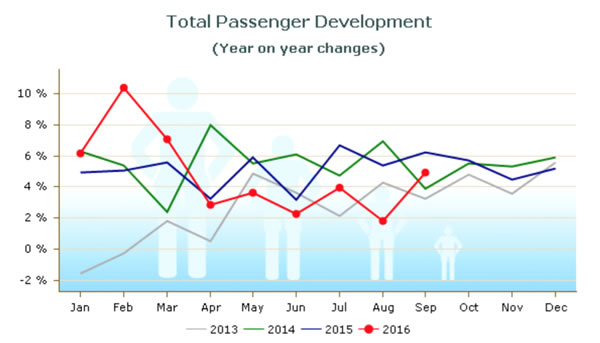

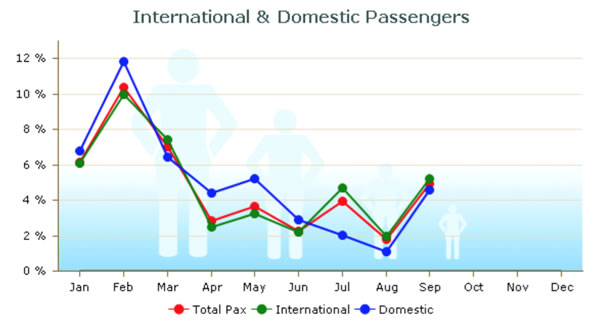

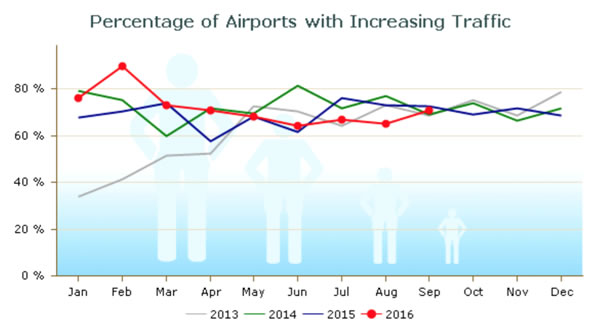

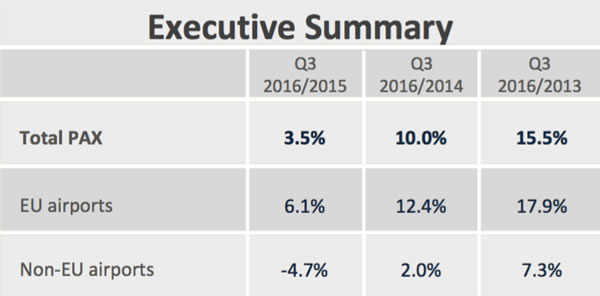

EUROPE. European passenger traffic grew by an average of +3.5% during the third quarter of 2016, according to ACI Europe statistics.

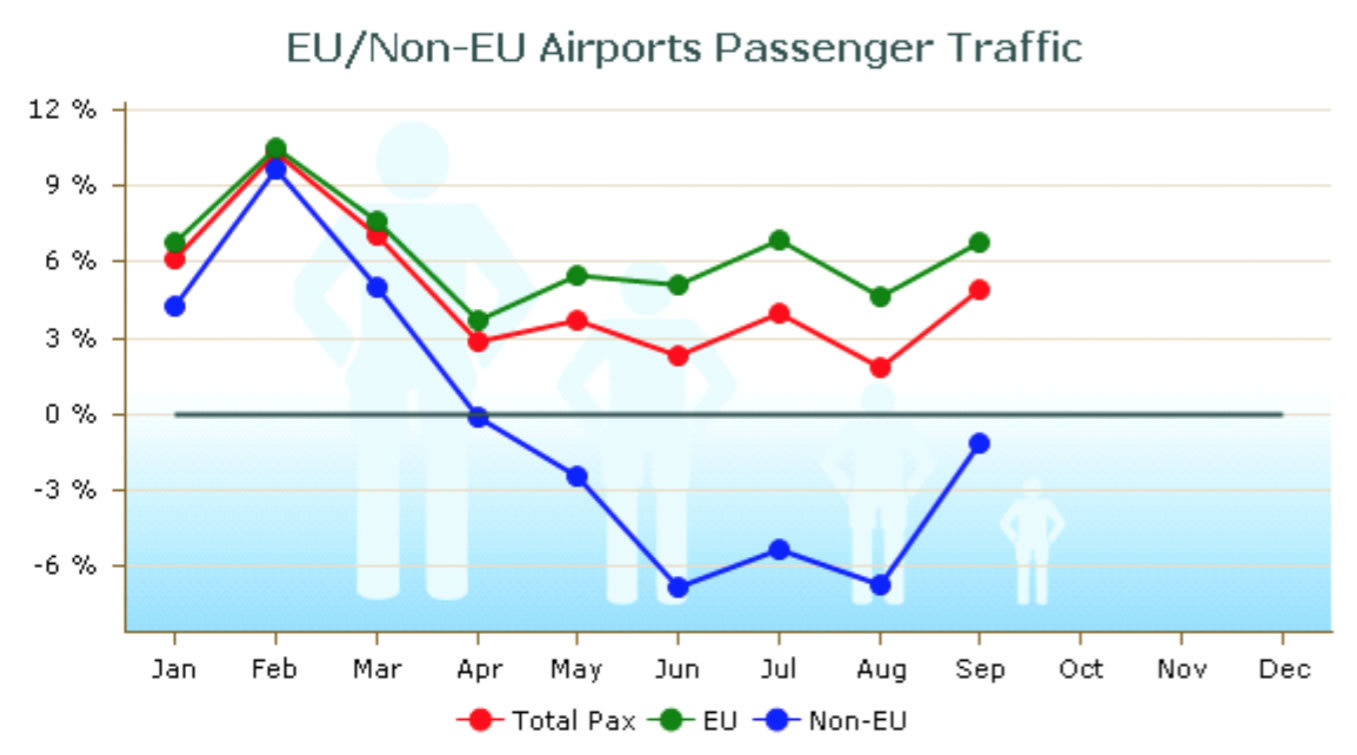

The increase was entirely attributable to the EU market, with passenger traffic increasing +6.1% during the peak summer months, the association noted.

EU passenger traffic growth was mainly driven by Southern and Eastern Europe, with Bulgaria (+20.4%), Romania (+21.8%), Cyprus (+16.1%), Croatia (+14.5%), Lithuania (+11.7%), Poland (+11.0%) and Greece (+8.7%), strongly outperforming the EU average.

Meanwhile, the non-EU market saw passenger traffic fall -4.7% during the quarter, with Turkey (-13.5%) and Russia (-10.9%) declining sharply. Ukraine (+20.6%) saw a notable improvement, and smaller markets including Iceland (+37.8%), Bosnia Herzegovina (+14.5%) and Montenegro (+14.2%) were also very dynamic throughout the summer, ACI Europe said.

Source (all charts): ACI Europe

Europe’s five biggest airports – London Heathrow, Paris Charles de Gaulle, Istanbul-Atatürk, Frankfurt and Amsterdam Schiphol – collectively reported a +0.1% increase in passenger traffic in the period.

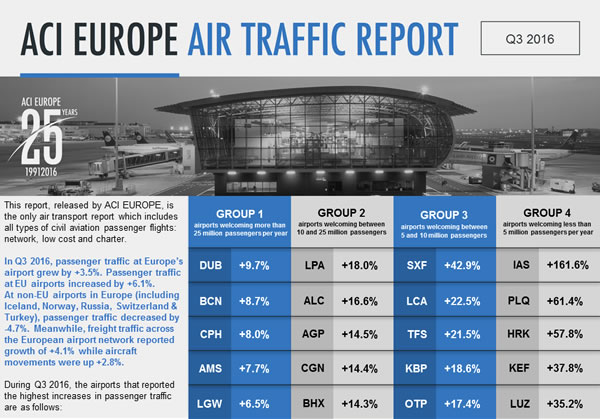

Airports welcoming more than 25 million passengers per year (Group 1); airports welcoming between 10 and 25 million passengers (Group 2); airports welcoming between 5 and 10 million passengers (Group 3); and airports welcoming less than 5 million passengers per year (Group 4) reported average adjustments of +0.0%, +6.2%, +9.9% and +3.3% respectively.

The airports which reported the highest increases in passenger traffic during Q3 2016 (compared with Q3 2015) are as follows:

Group 1: Dublin (+9.7%), Barcelona (+8.7%), Copenhagen (+8.0%), Amsterdam (+7.7%) and London Gatwick (+6.5%)

Group 2: Gran Canaria (+18.0%), Alicante (+16.6%), Malaga (+14.5%), Cologne-Bonn (+14.4%) and Birmingham (+14.3%)

Group 3: Berlin Schönefeld (+42.9%), Larnaca (+22.5%), Tenerife Sur (+21.5%), Kiev (+18.6%) and Bucharest (+17.4%)

Group 4: Iasi (+161.6%), Palanga (+61.4%), Kharkiv (+57.8%) Keflavik (+37.8%) and Lublin (+35.2%)

“This has been a rather contrasted summer with geopolitical events and terrorism in particular shaping traffic performance at Europe’s airports,” said ACI Europe Director General Olivier Jankovec. “The shift in passenger demand towards leisure markets perceived as being safer has been significant. However, September has revealed some improvement for Turkish airports – while traffic prospects for Russian airports also seem to be getting better.”

“This has been a rather contrasted summer with geopolitical events and terrorism in particular shaping traffic performance at Europe’s airports,” said ACI Europe Director General Olivier Jankovec. “The shift in passenger demand towards leisure markets perceived as being safer has been significant. However, September has revealed some improvement for Turkish airports – while traffic prospects for Russian airports also seem to be getting better.”

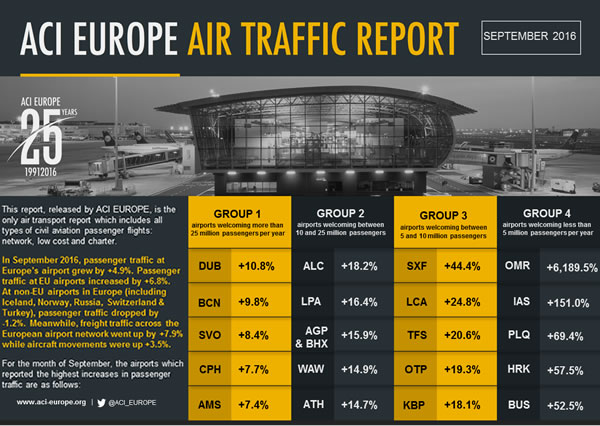

During September, European passenger traffic grew +4.9%, with EU airports seeing a healthy increase of +6.8%. Non-EU airports registered a decline in passenger traffic at -1.2%.

From January-September, total passenger traffic increased +4.4% year-on-year, with EU airports again faring better with +6.2% growth. Non-EU airports saw a decline in passenger traffic of -1.9%.

During September, airports welcoming more than 25 million passengers per year (Group 1); airports welcoming between 10 and 25 million passengers (Group 2); airports welcoming between 5 and 10 million passengers (Group 3); and airports welcoming less than 5 million passengers per year (Group 4); reported average adjustments of +1.4%, +7.1%, +10.8% and +5.9% respectively.

The airports which reported the highest increases in passenger traffic during September 2016 (compared with September 2015) are as follows:

Group 1: Dublin (+10.8%), Barcelona (+9.8%), Moscow Sheremetyevo Aiport (+8.4%), Copenhagen (+7.7%) and Amsterdam (+7.4%)

Group 2: Alicante (+18.2%), Gran Canaria (+16.4%), Malaga and Birmingham (+15.9%), Warsaw Chopin (+14.9%) and Athens (+14.7%)

Group 3: Berlin Schönefeld (+44.4%), Larnaca (+24.8%), Tenerife Sur (+20.6%), Bucharest Henri Coandă (+19.3%) and Kiev (+18.1%)

Group 4: Oradea (+6,189.5%), Iasi (+151.0%), Palanga (+69.4%), Kharkiv (+57.5%) and Batumi (+52.5%)

“Aside from the external factors, low-cost airlines have been the primary driver of passenger traffic in the EU – on the back of their continued capacity expansion and move upmarket in search of higher yields,” noted Jankovec. “As a result, most of the growth over the peak summer months has taken place at airports welcoming between 5 and 25 million passengers per annum. Small regional airports grew at a much slower pace – and even more revealing, collectively the passenger volumes remained flat at Europe’s five biggest hubs.

“Aside from the external factors, low-cost airlines have been the primary driver of passenger traffic in the EU – on the back of their continued capacity expansion and move upmarket in search of higher yields,” noted Jankovec. “As a result, most of the growth over the peak summer months has taken place at airports welcoming between 5 and 25 million passengers per annum. Small regional airports grew at a much slower pace – and even more revealing, collectively the passenger volumes remained flat at Europe’s five biggest hubs.

“Last week’s announcement of Ryanair setting up a base at Frankfurt airport undoubtedly marks a turning point for European air travel. Along with long haul low cost, these disruptive forces are pointing towards increasing airport competition and a more hybrid airport market. The traditional segmentation between mega hubs, secondary hubs, medium-sized airports and smaller regional airports is blurring.”