INTERNATIONAL. The Estée Lauder Companies has recorded double-digit growth for its travel retail business in fiscal Q3.

INTERNATIONAL. The Estée Lauder Companies has recorded double-digit growth for its travel retail business in fiscal Q3.

The rise was led by strong growth from Tom Ford, Jo Malone, La Mer, MAC and Estée Lauder. An increase in global airline passenger traffic growth, new launch initiatives and targeted expanded consumer reach also contributed sharply to sales gains, said the company.

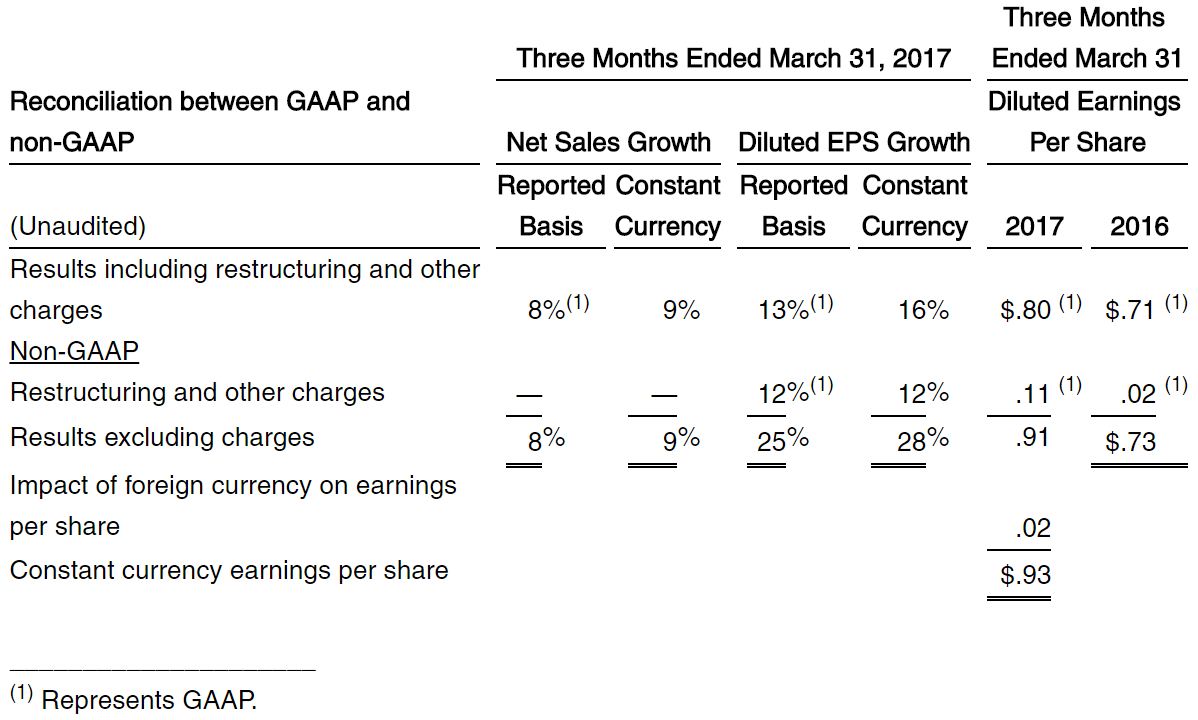

The company overall posted net sales of US$2.86 billion for its third quarter, up +8% compared to the prior-year quarter. Incremental sales from the company’s recent acquisitions of Too Faced and BECCA contributed approximately half the reported sales growth.

Net earnings increased +12% to US$298 million, compared with US$265 million last year.

Net sales and operating income in the company’s major product categories were ‘unfavourably’ impacted by the strength of the US Dollar in relation to most currencies. Total operating income in constant currency, before charges, increased +25%.

The Estée Lauder Companies President and Chief Executive Officer Fabrizio Freda said: “We delivered an excellent third quarter performance. Sales accelerated across every geographic region and in our three largest product categories, reflecting the range and strength of our brand portfolio and product offerings. Our business in global travel retail and in China was exceptionally strong, driven by strong sales gains in virtually every brand. Our mid-sized and luxury brands, as well as online and specialty-multi retail channels, also led growth. Additionally, our recent acquisitions of Too Faced and BECCA performed above expectations. These elements contributed to stronger-than-expected constant currency sales growth that, combined with disciplined expense management, resulted in sharply higher earnings per share.

“By further penetrating the specialty-multi channel globally and selectively opening freestanding stores in some key international markets, our brands made great progress reaching new consumers. Our strategy and financial performance continue to be powered by our ability to deploy our diverse brand portfolio into fast-growing channels and consumer segments.

“We will continue to seize opportunities in the most promising areas of prestige beauty and expect our sales growth to continue to accelerate in our fourth quarter, capping another strong fiscal year. In our fiscal fourth quarter, we plan to increase targeted investment spending behind the greatest opportunities to further our momentum into fiscal 2018. We are confident in our ability to achieve our previously stated fiscal 2017 sales growth goal of 6% to 7% in constant currency, which includes approximately 2% of incremental sales from our recent acquisitions. We are also reiterating our constant currency earnings per share growth expectation of 8% to 9%, before charges, which reflects US$.07 of dilution related to acquisitions.”

Category performance

Skincare

• Net sales increased, with sharp double-digit gains from La Mer, driven by the success of new and existing products, as well as targeted expanded consumer reach.

• The Estée Lauder brand delivered solid sales growth primarily in travel retail and China, due, in part, to gains in the Advanced Night Repair and Revitalizing Supreme lines of products. GlamGlow recorded strong double-digit sales growth.

• Increases were partially offset by lower skin care sales from Clinique. The lower sales reflected sales gains in the Americas being more than offset by lower sales in the other regions.

• Operating income increased sharply, primarily from Estée Lauder and La Mer. Estée Lauder also benefitted from a favourable comparison to higher spending behind launches in the prior-year period.

Make-up

• Make-up sales increased, primarily driven by incremental sales from the company’s fiscal 2017 second quarter acquisitions of Too Faced and BECCA, strong double-digit increases from Tom Ford in every region, double-digit gains from Smashbox and La Mer, and solid growth from Estée Lauder.

• The increased sales in Tom Ford were driven primarily by its lip colour franchises. La Mer’s sales increase reflected the continued success of the Skin Color Collection. At Estée Lauder, higher sales were fuelled by the Double Wear and Pure Color Envy product lines.

• The overall increase in make-up sales also resulted from MAC growth internationally, as well as new product offerings, and a selectively increasing presence in high-growth channels like travel retail.

• Lower Clinique and MAC sales partially offset the increases, due to slow foot traffic in US brick-and-mortar stores

• Make-up operating income was flat. Tom Ford, Estée Lauder and Bobbi Brown posted increased operating income, primarily due to higher sales. These increases were offset by declines from MAC and Clinique

Fragrance

• Strong double-digit gains from luxury brands Jo Malone London, Tom Ford and Le Labo contributed to a net sales increase, plus incremental sales from the recent acquisition of By Kilian.

• Jo Malone delivered ‘outstanding’ double-digit sales increases in every region.

• Growth of existing Tom Ford fragrances and new launches contributed to a rise in sales

• Le Labo benefitted from new and existing launches and targeted expanded consumer reach.

• The recent launches of Tory Burch Love Relentlessly and Michael Kors Wonderlust also contributed to fragrance sales growth.

• Fragrance operating income increased sharply, primarily due to higher sales from our luxury brands noted above, as well as higher sales of certain designer fragrances.

Haircare

• Haircare sales decreased slightly, primarily due to a difficult comparison with several product launches in the prior year.

• Haircare operating income increased, reflecting effective expense management.

Regional performance

The Americas

• Sales in North America benefitted from incremental sales from the recent acquisitions of Too Faced and BECCA.

• Tom Ford, Jo Malone, Smashbox and La Mer recorded double-digit gains

• Sales in the company’s online and specialty-multi channels grew strong double-digits.

• The growth in these areas was partially offset by sales decreases primarily attributable to the decline in retail traffic in US brick-and-mortar stores, principally for MAC, Estée Lauder and Clinique. A decrease in tourist spending also adversely affected sales in certain US MAC stores.

• Sales in Canada were flat for the quarter, and in Latin America increased mid-single digits.

• Operating income in the Americas decreased, primarily reflecting lower sales at MAC, partially offset by disciplined expense management.

Europe, the Middle East & Africa

• Most markets recorded sales growth, with many posting double-digit increases, led by Russia, Israel, South Africa, the Balkans and India.

• Foreign currency translation reduced reported sales by -3%, with the largest impact from the deterioration of the Pound Sterling.

• In constant currency, sales in the region grew strong double-digits, with most countries generating sales gains. Double-digit growth was posted in several markets, including the Balkans, Central Europe, Israel, Russia and Nordic, as well as strong growth in the UK and Italy.

• As reported, in travel retail, exceptionally strong double-digit sales growth was generated across brands, led by Tom Ford, Jo Malone, La Mer, MAC and Estée Lauder.

• In constant currency, lower sales were posted in the Middle East, driven by retailer inventory rebalancing, reflecting the impact of the macro-environment on consumer purchases. Operating income increased, led by strong double-digit operating results in travel retail and the UK.

Asia Pacific

• On a reported basis and in constant currency, sales increased, led by strong double-digit growth in China. The higher sales in China reflected strong double-digit gains in most brands and in the online, freestanding store and department store channels.

• Reported sales in Taiwan also grew double-digits, while in constant currency, Malaysia generated strong sales gains. The company’s business in Hong Kong continues to stabilise.

• Tom Ford, Jo Malone, La Mer and MAC each grew strong double-digits.

• These increases were partially offset by slightly lower sales in Indonesia and the Philippines.

• In Asia Pacific, operating income increased, primarily due to higher results in China and Singapore.