The Estée Lauder Companies (ELC) today reported double-digit (unspecified) growth in global travel retail net sales for its third quarter ended 31 March amid a strong groupwide global performance.

The travel retail result reflected continued growth in Asia Pacific, though additional travel restrictions late in the third quarter led to reduced travel, particularly to the duty free hotspot of Hainan, China. Travel retail net sales also grew in Europe, the Middle East & Africa and the Americas.

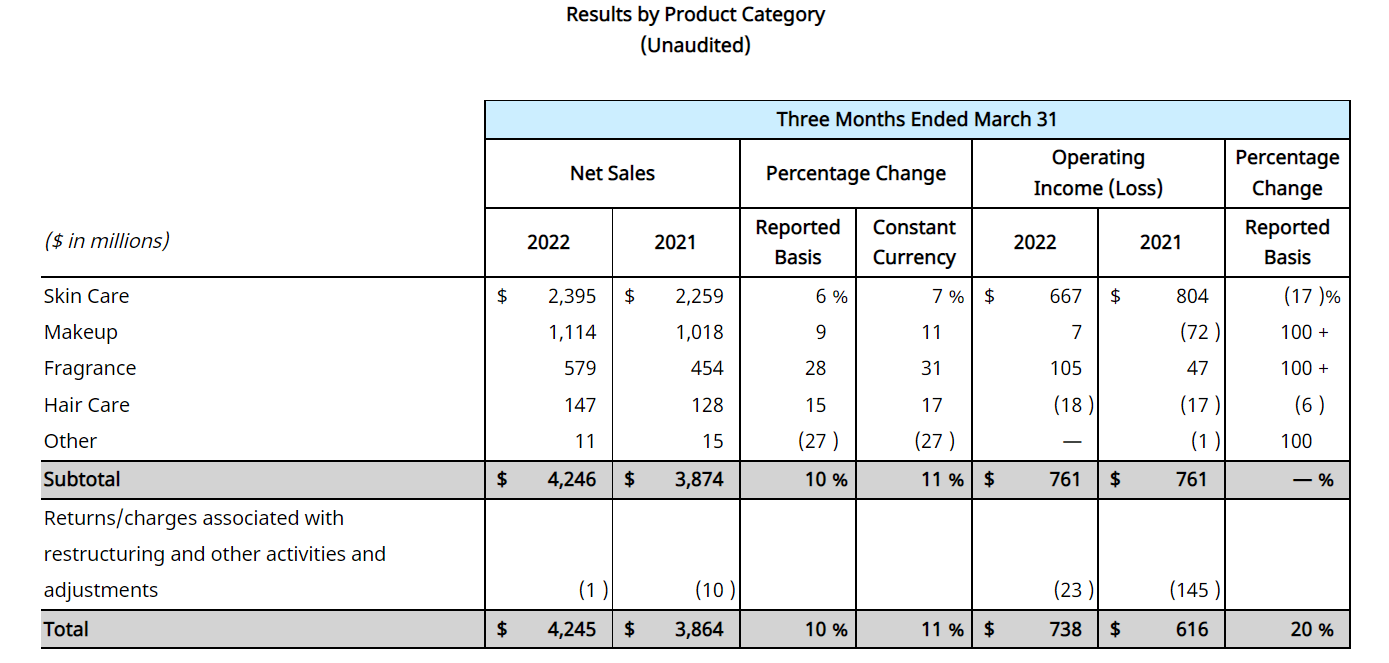

Groupwide net sales from all channels reached US$4.25 billion for Q3, an increase of +10% year-on-year (organic +9%).

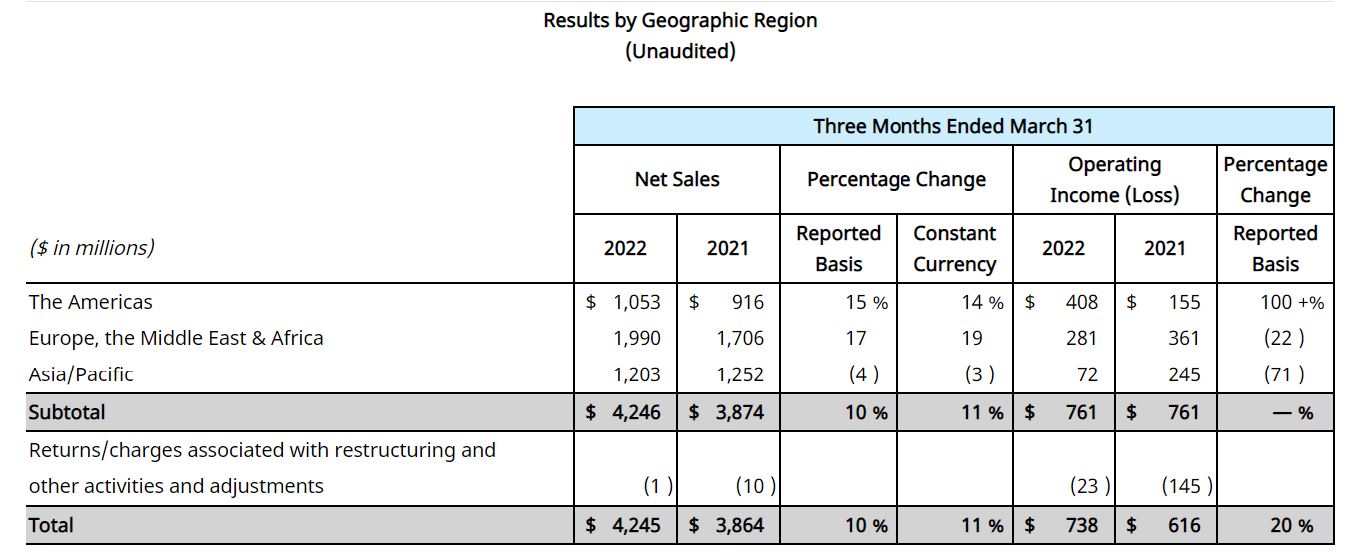

Net sales grew in every product category, largely reflecting continued recovery in brick-and-mortar retail stores, driven by double-digit growth in the Americas and Europe, the Middle East & Africa (EMEA) regions, as well as growth in global online.

The company delivered strong sales growth in the context of increased COVID-related restrictions in China beginning mid-March. These temporary restrictions reduced consumer traffic and travel and limited the company’s capacity to ship orders from its distribution facilities.

Net earnings reached US$0.56 billion, compared with US$0.46 billion a year earlier. Diluted net earnings per common share were US$1.53 compared with US$1.24 reported in the prior-year period.

For the nine months ended 31 March, the company reported net sales of US$14.18 billion, up +15% year-on-year (+13% organic). Net earnings reached US$2.34 billion (US$1.85 billion in the prior year) and diluted earnings per share stood at US$6.39 (US$5.03).

President and Chief Executive Officer Fabrizio Freda said, “We delivered strong sales growth and better-than-expected profitability in the third quarter of fiscal 2022 in the face of accelerated headwinds as the quarter evolved, including COVID restrictions in the Asia Pacific region.

“Every category grew organically, led by fragrance’s outstanding performance globally and the makeup renaissance in western markets. Eleven brands contributed double-digit organic sales growth and further demonstrated our diversification, empowered by our multiple engines of growth strategy. Consumer demand remained robust even in this more inflationary environment.

“The Americas and EMEA regions outperformed our overall sales growth. We capitalised on reopening to deliver double-digit organic sales growth, leveraging our high-touch services, breakthrough innovation, and desirable hero franchises. In the Asia Pacific region, several markets prospered, led by Japan while our China results were pressured by COVID restrictions.”

Freda concluded, “Given our outstanding performance year-to-date, we expect to deliver a record year in fiscal 2022 despite temporary COVID-driven headwinds that reduced our fourth quarter outlook. We are confident that our business in China will rebound when COVID abates and accelerate our momentum.”

The COVID-19 pandemic continued to disrupt the company’s operating environment globally, primarily impacting retail traffic, travel, supply chain, inventory levels and other logistics during the fiscal 2022 third quarter. The resurgence of COVID-19 cases in many Chinese provinces led to restrictions late in the fiscal 2022 third quarter to prevent further spread of the virus.

Consequently, retail traffic, travel, and distribution capabilities were temporarily curtailed. The company’s distribution facilities in Shanghai operated with limited capacity to fulfil brick-and-mortar and online orders beginning in mid-March.

Mixed bag for Q4

The company is revising its full fiscal year outlook, reflecting both outstanding performance year-to-date and additional headwinds that are impacting Q4. The latter include COVID-related restrictions in China which are also affecting the travel retail business, and the impact of Russia’s invasion of Ukraine.

Reported net sales for the full year are forecasted to increase between +7% and +9% versus the prior-year period.