AUSTRALIA. In big breaking news, Dufry has extended its duty free contract at Melbourne Airport, held by The Nuance Group [see our comment at the foot of this story].

AUSTRALIA. In big breaking news, Dufry has extended its duty free contract at Melbourne Airport, held by The Nuance Group [see our comment at the foot of this story].

The partnership extends the existing contract held by Dufry-owned Nuance to 2022, representing what Melbourne Airport described as “a significant milestone” as it continues to expand its retail offerings for local and international travellers.

Under the terms of the agreement the airside duty free retail footprint will be increased by +30% as part of what the parties described as “a total retail transformation” of the Victorian gateway.

The new store will incorporate key elements of the ‘next generation stores’ being developed by Dufry.

With 2,743msq m of retail space in the new Departures store and 1,074sq m of retail space in the new Arrivals shop, the stores will serve nearly nine million annual Victorian and international visitors, “delivering a new duty free retail experience which promises to be world-class”, Dufry pledged.

The partnership is a first for Dufry in Australia. The retailer said this demonstrates a clear intent to grow its presence within the Australian market through the newly extended partnership .

This next phase of retail transformation at Melbourne Airport follows the successful opening of the new T4 domestic terminal and transport hub in late 2015. T4 is built on 20,000sq m over three levels and can accommodate up to 10 million passengers a year.

It incorporates the latest self-service

technology, designed to provide passengers with a quick and easy start to their journey. A central departure lounge with more than 30 specialty retail and food & beverage outlers provides passengers with diverse opportunities to shop, eat and relax.

Melbourne Airport Chief of Retail Andrew Gardiner said: “The growth of our international duty free retail offering underpins a critical component of Melbourne Airport’s retail transformation. When complete, local and international visitors to the airport will benefit from a duty free retail experience that is in keeping with Melbourne’s renowned reputation as the fashion and retail capital of Australia.

Melbourne Airport Chief of Retail Andrew Gardiner said: “The growth of our international duty free retail offering underpins a critical component of Melbourne Airport’s retail transformation. When complete, local and international visitors to the airport will benefit from a duty free retail experience that is in keeping with Melbourne’s renowned reputation as the fashion and retail capital of Australia.

especially Chinese travellers, where we have seen a +24% year-on-year increase in 2015. It is our ambition to make Victorians as proud of the airport as they are of our great city and to deliver a world-class experience to our international visitors.

“Over the past eight months, Dufry senior executives have demonstrated a refreshing engagement with Melbourne Airport and impressed with both their vision for the duty free retail precinct and commitment to deliver an exciting, modern, attractive and diverse offering to our visitors.”

Dufry CEO Julián Díaz said: “As its transformation journey continues, Melbourne Airport offers one of the most exciting expansion opportunities for Dufry’s duty free retail business in Asia – evolving well beyond our prior presence through our Nuance subsidiary.

“We thank Melbourne Airport for the renewal of this longstanding partnership and the trust put in our company and our local teams. In creating a new, world-class duty free retail concept for Melbourne Airport, we have drawn on our expertise, which spans 63 countries and services more than 1.5 billion potential international and domestic customers worldwide.

“As the only major airport in Australia that offers 24/7 operations and strong international passenger growth, Melbourne Airport’s approach has been one of partnership and we look forward to getting started on delivering our duty free retail vision and concept. Furthermore, this contract is an important step in our strategy to further expand our footprint across Asia.

Comment: This extension, widely touted within Australian travel retail circles for months, answers a key question about the market – and throws up a whole lot more, writes Martin Moodie.

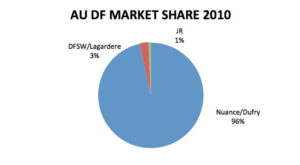

When Dufry acquired The Nuance Group in 2014 it inherited a distinctly fading Australian operation. Whereas in 2010 Nuance held a 96% share of the Australian on-airport duty free market (Source: The Mercurius Group), by 2016 that grip had eased to just 21%, based on a single operation – Melbourne Airport.

With the Melbourne contract set to expire in 2018, and a flurry of competitive activity in the Australasian marketplace (debuts by Gebr Heinemann in Sydney; Aer Rianta International in Auckland; Lagardère Travel Retail in Auckland and several Australian locations), it seemed a high possibility that Dufry might quit the market, perhaps even selling the remaining duration of its Melbourne contract on to a competitor seeking greater critical mass in the market. After all, there was no shortage.

But there was a difference between Melbourne and the rest of the former Nuance empire, particularly Sydney where the worst bleeding occurred. Thanks to a sharp improvement in Chinese visitors in particular, the Melbourne operation turned the corner. It was making money.

Just look at their State-wide spending. In the period ended March 2016, Chinese expenditure shot up by +40.0% to A$2.3 billion (exceeding the Government’s long term 2020 target of A$2.0 billion). Chinese visitor expenditure accounted for a whopping one-third (33.6%) of total international visitor spending in Victoria. All of that will have been reflected in Dufry’s results at Melbourne Airport. You need go no further to discover the rationale behind this deal.

Melbourne Airport also wins – it secures heavy investment in vital commercial infrastructure from the industry’s most solid and secure player, one eminently capable of delivering the retail vision the airport company has promised its stakeholders and consumers.

So what does this extension spell in terms of sector consolidation in Australia and New Zealand?

Certainly a target has just been removed. Does the potential hunted quarry now turn hunter? Might Dufry CEO Julián Díaz now seek consolidation himself, a phenomenon he and his company have proved so masterly at?

Certainly there is no shortage of potential plot lines here. Does Gebr Heinemann aspire to extend its single (though vast) operation at Sydney? What about Aer Rianta International across the Tasman Sea in Auckland, surely it covets greater volume and economies of scale? Lagardère Travel Retail has a steadily swelling portfolio of duty free, news & books, specialist retail and food & beverage operations around the two countries and is the probable front-runner for the Cairns Airport duty free contract (currently held by JR/Duty Free, which has chosen not to extend). Is that pace of development sufficient?

What, perhaps most crucially, of the widely admired JR/Duty Free, the family-held retailer that has twice shown its financial prudence in recent times through its bidding positions (walking away from the Auckland bid; choosing not to extend on what it perceived as unfavourable terms in Cairns)? Could the Evelyn Danos-owned company be the kingmaker in any consolidation? The company is profitable, has excellent regional infrastructure and management, and recently defended a key (though small) concession at Wellington Airport. Like all its rivals on an Antipodean duty free version of a Monopoly board, JR will be weighing up closely the consequences of today’s announcement.

There will be speculation aplenty but one thing now seems sure. Dufry is in Australia to stay.

NOTE TO AIRPORT OPERATORS: The Moodie Davitt Report is the industry’s most popular channel for launching commercial proposals and for publishing the results. If you wish to promote an Expression of Interest, Request for Proposals or full tender process for any sector of airport revenues, simply e-mail Martin Moodie at Martin@MoodieDavittReport.com.

We have a variety of options that will ensure you reach the widest, most high-quality concessionaire/retailer/operator base in the industry – globally and immediately.

Similarly The Moodie Davitt Report is the only international business intelligence service and industry media to cover all airport consumer services, revenue generating and otherwise. We embrace all airport non-aeronautical revenues, including property, passenger lounges, car parking, hotels, hospital and other medical facilities, the Internet, advertising and related revenue streams.

Please send relevant material, including images, to Martin Moodie atMartin@MoodieDavittReport.com for instant, quality global coverage.

All such stories are consolidated in our popular Tender News section (see home page dropdown menu) that has been running since 2003.