SWITZERLAND/ITALY. Dufry CEO Xavier Rossinyol said today that the new combined travel retail to F&B group of Dufry and Autogrill would drive business development, diversification and differentiation in the travel services market.

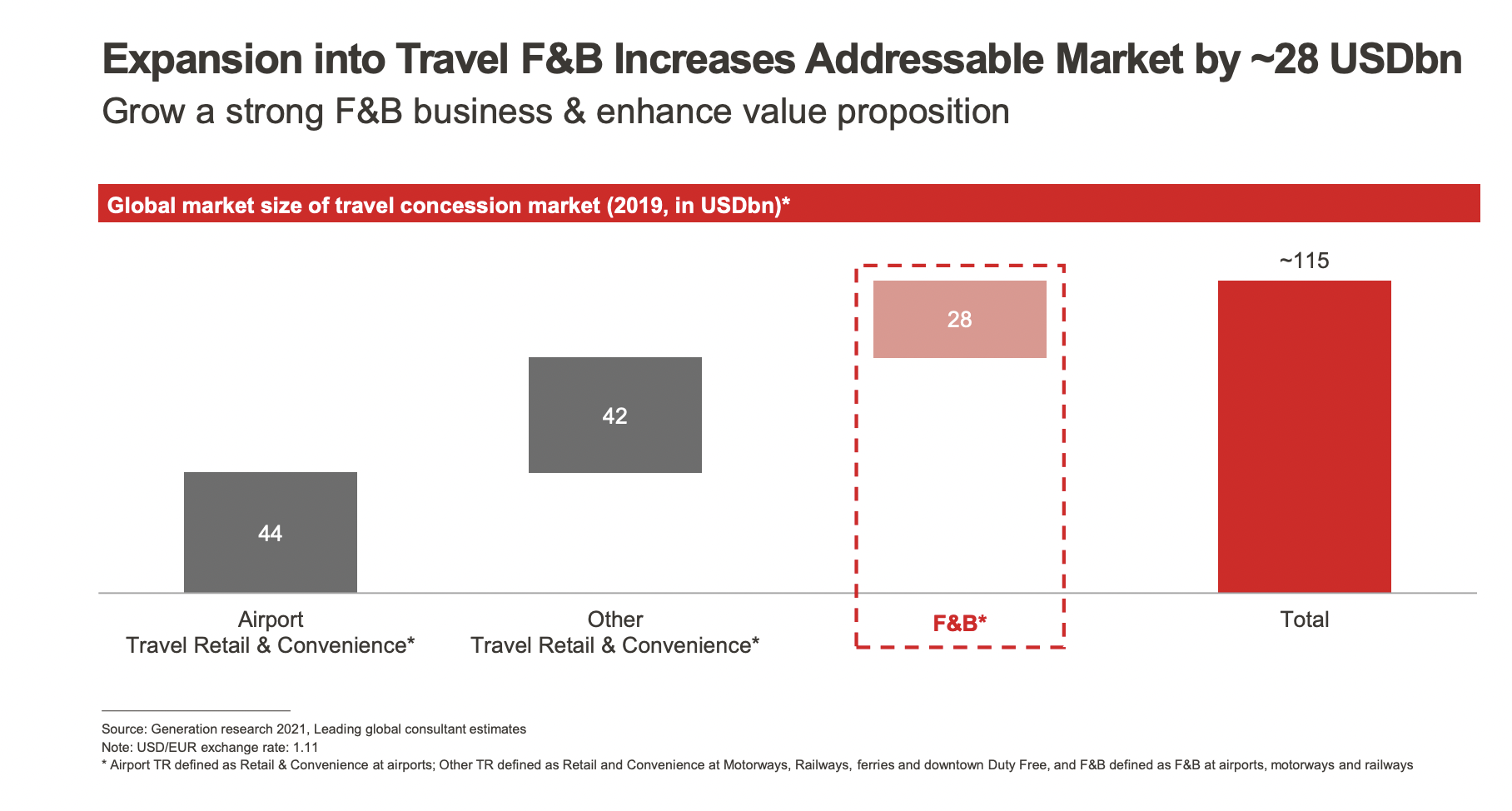

He said that the “addressable market” in which the combined force will now operate is valued at US$115 billion a year, based on the combination of duty free, other airport retail and F&B sales (2019 figures). The size of the travel F&B channel Dufry puts at US$28 billion a year (2019).

Rossinyol said: “We are not just putting together two great companies, we are creating something new, which is more than the sum of the parts. This is a combination of two leaders in their respective spaces, travel retail and travel F&B.”

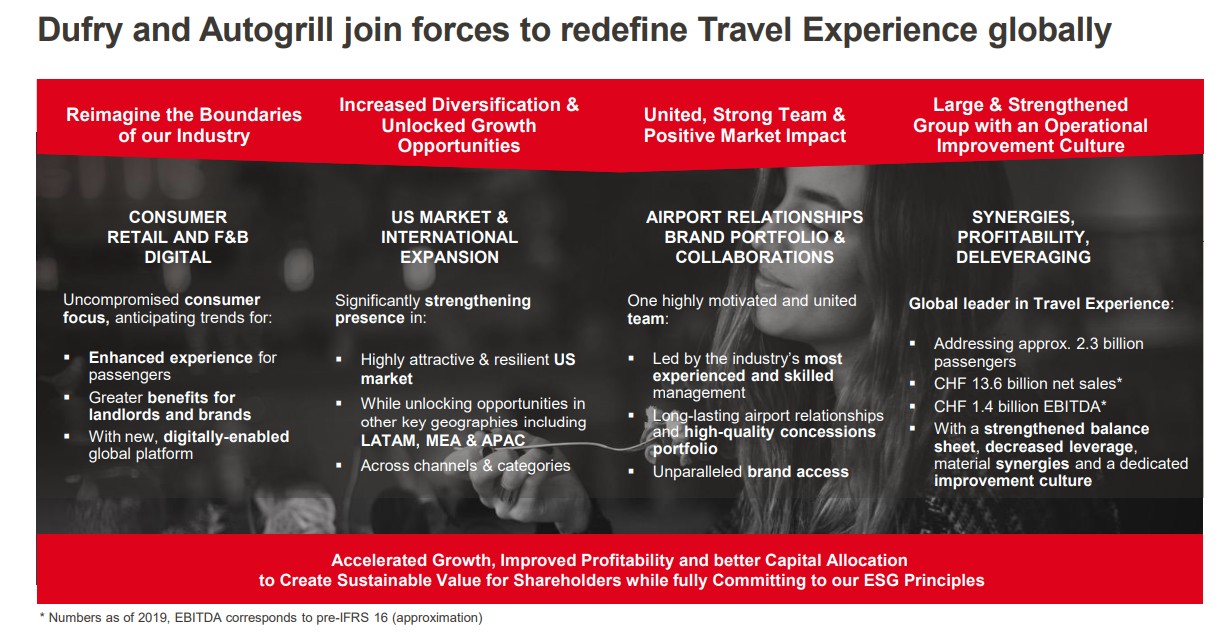

He said the new supergroup is coming together with Dufry having identified opportunities in four key areas.

“First, we are redefining the traditional boundaries of our industry,” said Rossinyol. “We already see in many parts of the world a convergence between the different formats and we want to lead that process. We are putting the focus on the consumer in an uncompromising way. We are expanding our offer from retail to retail and F&B, and also giving a big push to the digital platform.

“Number two, this deal allows us to diversify. We will be able to increase our presence in the highly attractive and very resilient market of the US while increasing business development opportunities in the rest of the world.”

Third, he said, the combined group will “differentiate ourselves from the competition” with its “two strong management teams, high-quality concession portfolio and the relationship with brands”.

Fourth, added Rossinyol, is that the group will be larger – CHF13.6 billion in revenues and CHF1.4 billion in EBITDA based on 2019 pro forma figures – and more diversified, will be less leveraged and generate synergies of CHF85 million per year.

“All together we will accelerate growth, increase profitability and cash flow generation while keeping our commitment to the principles of ESG, both for the planet and the communities where we are.”

An updated Dufry strategy

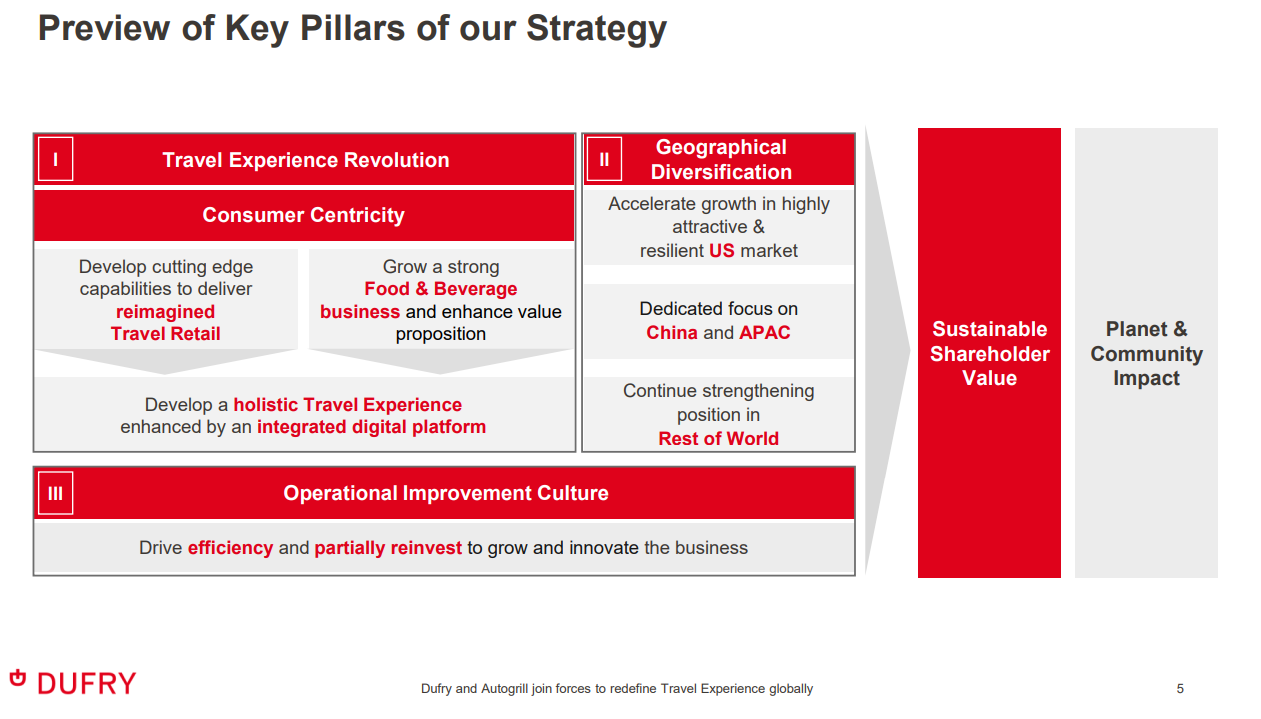

Dufry is to present its detailed, updated strategy to markets in September. In advance, in line with today’s announcement, Rossinyol presented a snapshot of that strategy.

“Number one is a revolution in the travel experience based on our current strengths, but with no fear to change what needs to be changed. Consumer-centricity will be a key guiding principle of what we do. We will reimagine travel retail and add F&B on top. We want to offer a holistic experience to all the travellers while massively enhancing our digital platform, because we are not where we should be.”

The second pillar is redefining the Dufry diversification strategy. There will be a big push to accelerate growth in the US market while designing a dedicated strategy for Asia Pacific, China and the Chinese traveller.

The third element is what Rossinyol called the ‘Operational Improvement Culture’. “This is not focusing only on one-off cost-cutting, but more on a constant circular continuous improvement of efficiency,” he said.

“The three pillars have the purpose to generate higher cash flow and therefore sustainable shareholder value while making very clear that the company has a wider purpose. We are committed to the effects of our business on the planet and communities.”

Convergence of channels

Rossinyol said that Dufry had undertaken extensive research to understand where travel retail as a channel is heading next.

“The first idea is that change has already happened. We have adapted from a duty free business to a convenience and specialist retail business over the past 20 years.

“But more change is coming. Passengers are evolving. Already 50% are Generation Y and Z and they want experiences. Also the pattern of consumption of Chinese travellers is changing.

“Airports and landlords want something different. The digitally-enabled relationship with passengers is fundamental. The good news is that technology is advancing very rapidly. There are advanced alternatives for intelligent stores to improve shopper insights and for autonomous check-out.

“Brands are also adapting. One of the key trends is the massive focus on premiumisation. Already 40% of beauty is premium and it is the fastest growing part of the business. So this is a big opportunity and need to redefine ourselves.

“We don’t see duty free, travel convenience and F&B as three separate businesses, we see them as one integrated offer. Why? It’s the same consumer, it’s the same journey in the same real estate, and actually, we all compete for their time. With the consumer in the centre we can create more commercial opportunity and better optimise the flow of the space. How are we going to do that? By improving the physical spaces, increasing brand partnerships, increasing digital engagement and creating more dynamic sales.”

Geographical diversity

Another pillar of the strategy is geographical diversification. “The US is very resilient and convenience and F&B are converging,” said Rossinyol. “More than 50% of what we sell through Hudson is already grab & go F&B.

“Asia is a large market and we must have a dedicated focus while recognising that the recovery may take longer. Also Chinese passengers may change the way they travel. We will strengthen the rest of the world in an organic way.”

He said later: “I see opportunities for each to use the presence of the other group to bring competencies to bear. I see us using the know-how of Autogrill to implement new F&B outlets in Latin America, Africa and Middle East. They also have a presence in Southeast Asia where we can do the same, and look for additional business development.”

On the improvement of efficiencies, Rossinyol said he wanted to create a “virtuous circle”. This will involve “adding zero-based budgeting across the group, improving supply chain, improving back office technology with parts of those efficiencies going to the bottom line and part of those efficiencies being reinvested to generate innovation.”

Another idea, he added is more active portfolio management of concessions “with a focus on cash flow and not on revenue”. Ultimately, Rossinyol said later, this could mean exiting less profitable concessions.

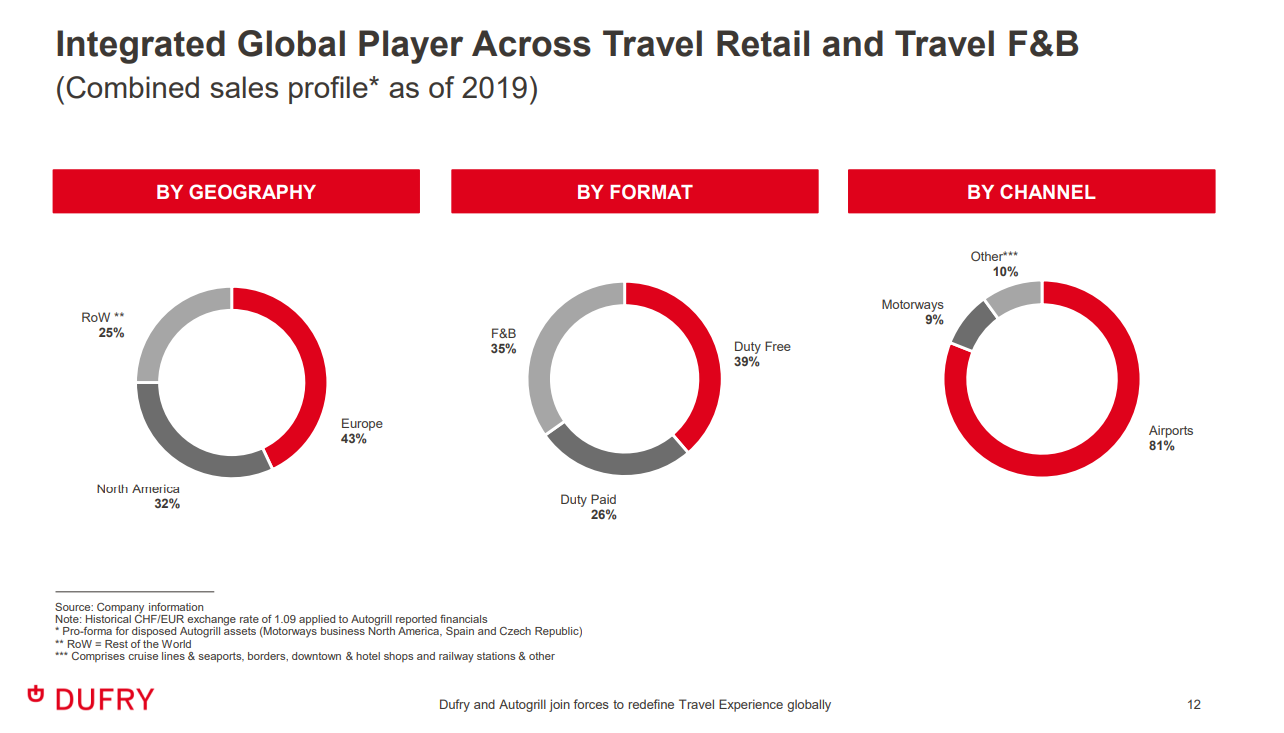

On the makeup of the new group, 81% of sales will come from airports. Geographically the sales portfolio will be 43% Europe, 32% North America and 25% from the rest of the world.

Taking leadership across channels

“A key point to make,” said Rossinyol, “is that we will be the leader in a new industry where some of our competitors are already present in these formats”.

He said that the size of the market “increases our business development opportunities and also allows us to be more selective on geography and on concession portfolio management”.

Crucially, he added, the combination offers the chance to create new commercial opportunities.

“Of course there will be dedicated duty free stores or branded stores and there will be food course but there is part of the business that will converge to hybrid forms.

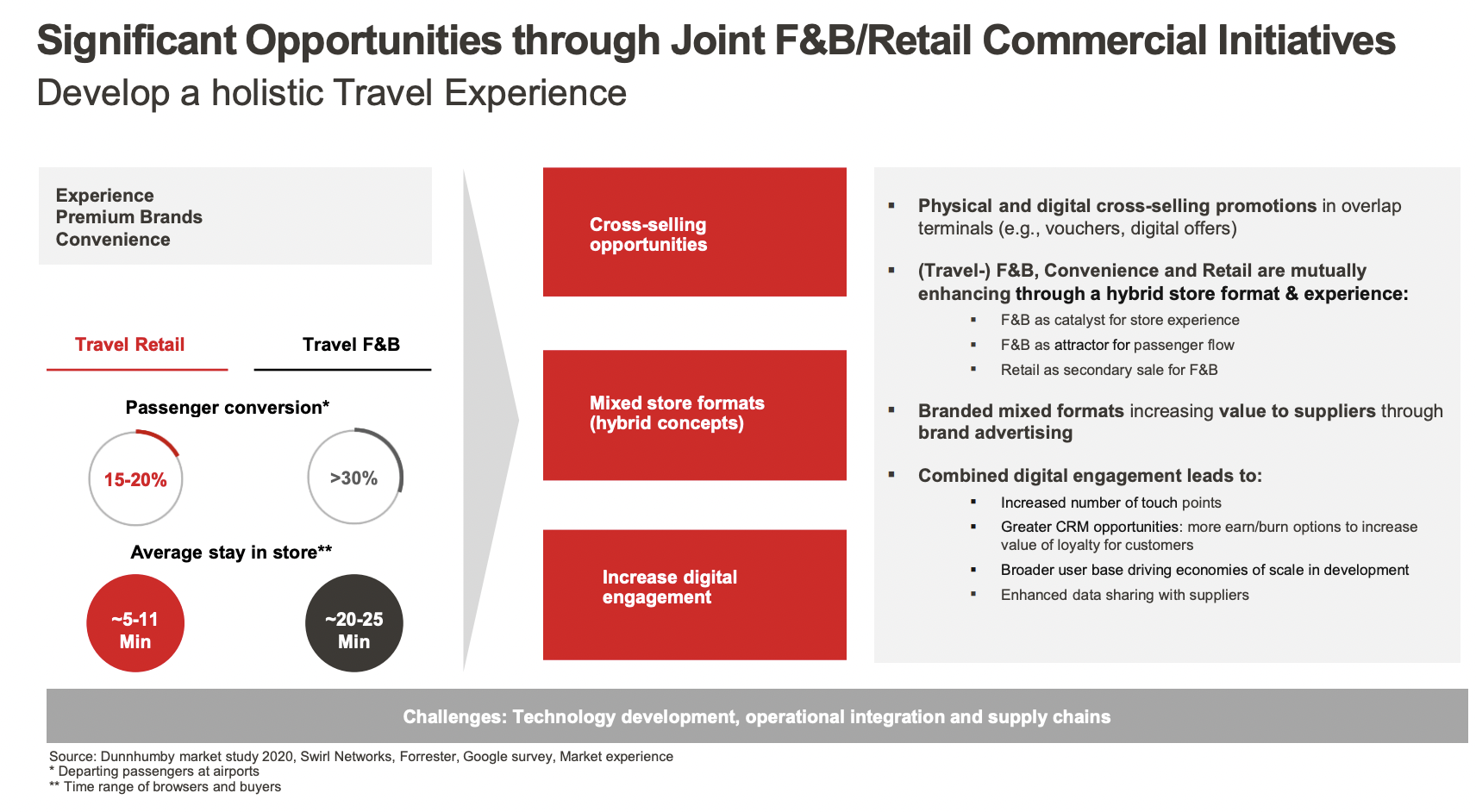

Boosting conversion

“Two important metrics here. Number one, the traditional conversion rate in travel retail is between 15 and 20% which means 80% to 85% of the passengers do not shop anything. In F&B conversion is much higher at an average of 30%. Also the average stay in the store in the case of travel retail is between five and ten minutes while in F&B it is 20 to 25.

“Taking this into consideration, we think we can create very good additional revenue through cross-selling, mixed store formats and increased digital engagement.

“Let me give you a few examples. We have already tried physical and digital cross-promotions. And it has worked very well, increasing the spend per head. We already have mixed store format for example Hudson with Starbucks. We see going forward the duty free store of wines & spirits combined with a bar where you can actually taste the item you are going to buy.

“A key trend is Sense of Place. Consumers when they travel want in their airport experience something that brings them a sense of the place where they are, and it is very difficult to find something with more Sense of Place than food. We already have airports demanding a combination of F&B and retail.

“We see F&B as a way to redirect the flow in our stores. We can change the usual hot and cold shop areas. Having more outlets and more businesses increases the number of touch points with the travellers. So we are more relevant and that allows us to do more digital engagement. With that we can increase our knowledge of customers and we can increase our loyalty programme.”

Transaction challenges

On challenges to the transaction, Rossinyol said that Dufry will need to “beef up” its back office technology but he said that investment here would help drive better understanding of consumer needs.

He added: “The integration of business is always complex and this will not be an exception. We will have a strong dedicated team to generate the integration and synergies we expect. Supply chain is different but sometimes we forget that today the supply chain between duty paid and duty free is already different and we manage that successfully.

“Also F&B has been moving over the last ten years more and more to ambient and frozen food. There is less production on site.

“There are challenges but we think they are smaller than the opportunities. We can increase the business development opportunities across the group and across the world. We can implement new formats in the geographies where each of the two companies is strong.

“All in all, to me it’s very clear that the combination of the two companies will bring much more than the sum of the parts.”

Rossinyol said that the group would benefit from an updated shareholders base. On top of existing major shareholders including Qatar Investment Authority, Alibaba and Richemont (5-10% each), Edizione (holding company of the Benetton group) joins with 20-25% of shares once the deal is completed.

“These shareholders are committing to this new strategy and the long-term value generation of the company,” said Rossinyol.

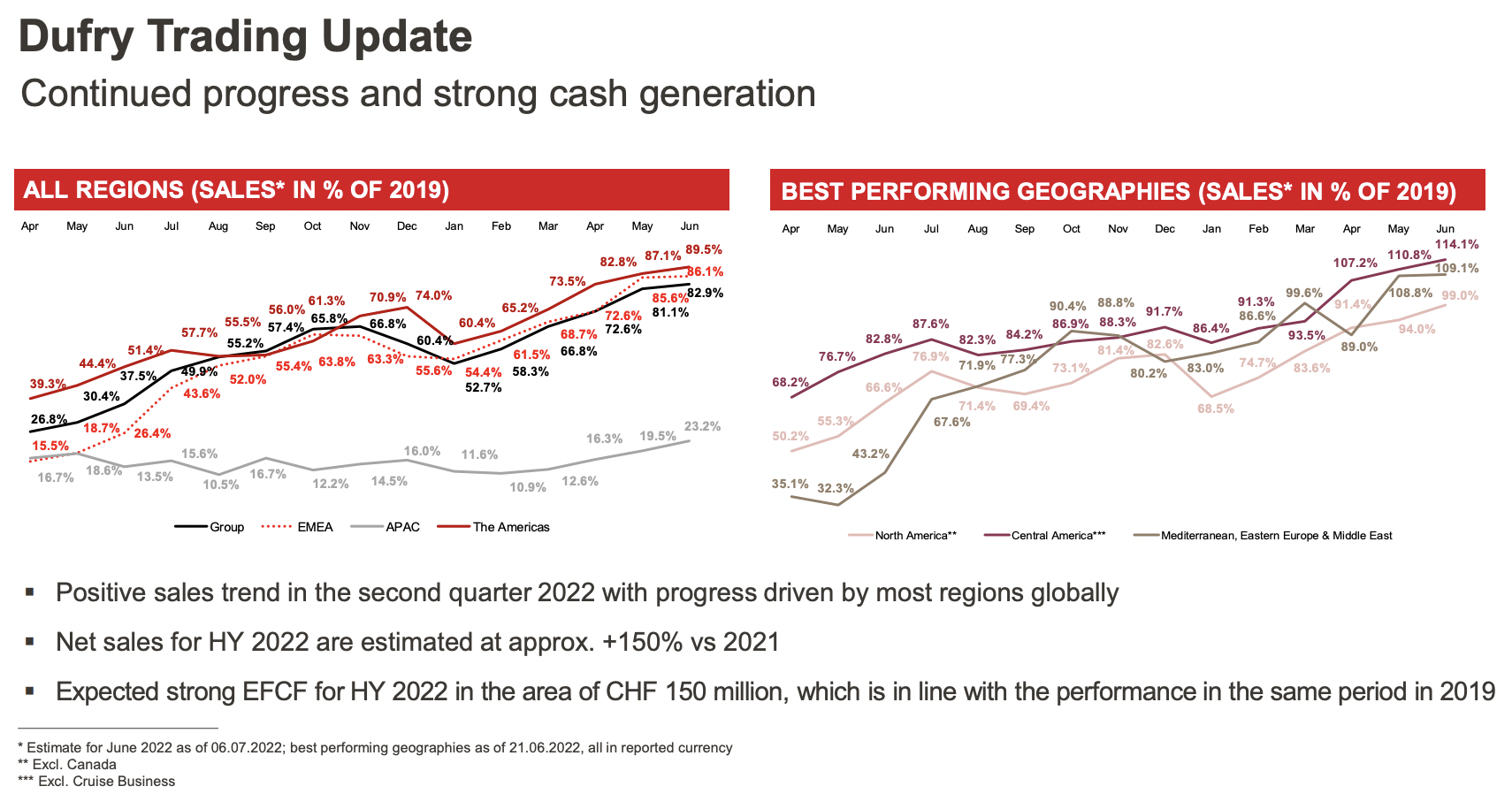

UPDATE

Speaking to the investment community later in the day, Rossinyol repeated that Dufry could exit unprofitable contracts but said this was part of a wider review, and did not give specifics.

Asked about the Spanish duty free business that Dufry operates and that will be tendered this year, Rossinyol said: “Our idea is to participate in the tender and do our best to retain the business. But we won’t do it at any cost. Relationships with airports must be a partnership.”

On current MAG relief in that business, he added: “Once we hit a certain level of pax, MAG relief disappears. We are far from that level now in the big airports though we are ahead in some leisure airports. If we get no more MAG relief because we are ahead on sales, it is not an issue.”

Asked how confident he was that the company could generate shareholder value with this complex deal, Rossinyol said: “Our commitment on return on equity through cashflow generation is absolute. We are not here to sell more, we are here to make more money while keeping the purpose of being a sustainable company.”

He underlined that there were opportunities for blended F&B and retail concessions, though not in all markets currently.

“Today mixed formats for these combined concepts are limited but the US is more developed with these one-stop-shop solutions for airports. The review we have done makes us believe that this trend will only increase and that today is the right moment to go there. We believe offering all formats gives us a competitive advantage. Not long ago we lost a tender when a competitor offered all three lines, and we offered duty free.

“At the same time I don’t think every airport is open to a hybrid offer. We don’t need all of the market to move but we see potential in the US, others in developing parts of Asia, but we have enough to build on for the next five years.”

For more on the new structure in our earlier story, click here. For an exclusive interview with Autogrill Group CEO Gianmario Tondato Da Ruos, click here.