CHINA (HONG KONG & MACAU). DFS yesterday suspended operations at two stores in Hong Kong to add to the seven shops temporarily shut down in Macau on Thursday.

The measures have been taken in the wake of a tourism collapse in both locations and to protect staff and customers.

DFS has shut down T Galleria by DFS, Hong Kong in Tsim Sha Tsui East; and Hong Kong T Galleria Beauty by DFS, Moko from 8 to 29 February.

Earlier, the retailer suspended operations in Macau from 6 to 19 February inclusive, with a planned reopening on 20 February. DFS said the action was taken in line with the direction of the Macau SAR Government.

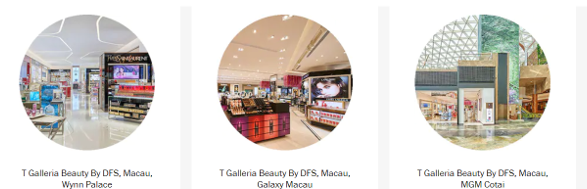

The Macau stores are: T Galleria Beauty by DFS, Macau, Wynn Palace

T Galleria Beauty by DFS, Macau World Galaxy Macau

T Galleria Beauty by DFS, Macau

T Galleria Beauty by DFS, Macau, MGM Macau

T Galleria By DFS, City of Dreams, Macau

T Galleria by DFS, Macau, Four Seasons

Studio City Macau at T Galleria by DFS

Key travel retail store temporary closures due to the coronavirus crisis

Source: Moodie Davitt Business Intelligence Unit |

Contacted by The Moodie Davitt Report, DFS said in a statement: “In our continued efforts to protect our employees and customers in the current health environment, and to curb the spread of the coronavirus, we have made the decision to temporarily close two of our stores in Hong Kong – namely, T Galleria by DFS, Tsimshatsui East and T Galleria Beauty by DFS Moko – until the end of February.

“This is a purely preventative step which will allow us to focus our resources and efforts on a reduced store footprint while balancing the need to continue to serve our customers. To date, there have been no cases of the coronavirus in any of our store locations and we will continue to take all necessary precautions to ensure our stores remain hygienic and safe environments for all.

“We look forward to serving customers at our T Galleria by DFS, Canton Road or T Galleria Beauty by DFS, Causeway Bay stores, which remain open as usual, or through our Click and Collect service on dfs.com.

“We apologise for any inconvenience to our loyal customers during the temporary closure of two of our stores. We will continue to closely monitor the situation and we look forward to reopening as soon as possible.”

Commenting on the earlier closure of the Macau stores, DFS said: “Also, to align with the direction of the Macau SAR Chief Executive to prevent further contagion of the coronavirus, all DFS stores in Macau will be closed until February 19 inclusive. Casino operations and entertainment venues have also been requested to close during this period. We will resume normal operations in Macau on February 20.”

Reduced hours at other stores

DFS has also adjusted its trading hours at numerous stores worldwide to reflect reduced trading.

From 28 January to 29 February its T Gallerias in Canton Road and Causeway Bay are trading from 11:00 to 20:00 only.

Similar hours are in place at T Gallerias in Bali and Cambodia. In Sydney, the T Galleria is open from 11.00 to 19:00; while in Singapore the downtown store is trading from 12:00 to 20:00. T Galleria by DFS in Auckland is open from 11:00 to 20:00.

Safety first approach

DFS has put in place strict hygiene controls at its stores to ensure staff and customer safety. Daily disinfection and cleaning is being carried out daily; while all T Galleria by DFS counters in Hong Kong are equipped with disinfection solutions for use at any time of the day.

Every T Galleria by DFS in Hong Kong employee has to take their temperature before starting their shift and wear a mask while serving customers.

As the largest beauty hall in Hong Kong, DFS’s Hong Kong T Galleria Canton Road store has temporarily suspended product testing services. Beauty consultants disinfect their hands with alcohol before and after receiving customers.

| A mounting crisis for travel retail News of the closure of two more DFS stores is an unwelcome reminder of just how severe the impact of the coronavirus outbreak on the travel retail community has become, writes Martin Moodie. Some of the world’s biggest duty free doors are now shut for business. Seven in Macao, two in Hong Kong and of course the cdf Mall in Haitang Bay, Sanya, the epicentre of China’s offshore duty free business. One can add to that list the temporary closure of Lotte Duty Free stores (including its flagship Myeong-dong complex) and those of rival The Shilla Duty Free for various periods over recent days. There has also been an alarming slump in business at many other airport and downtown locations around Asia Pacific and the US West Coast. As reported, King Power International Group has seen its key group tour traffic (up to 10,000 store visitors a day) wiped out, despite being fully open for trading and applying strict health measures. And business at Chinese airport stores, starved of passenger traffic, is in freefall. Travel retailers such as China Duty Free Group, DFS, Lotte Duty Free and The Shilla Duty Free have acted with commendable speed in putting the safety of staff and customers first, whatever the drastic commercial toll. They and many of their retailer and brand peers in the travel retail community are being hit hard. As we have said before, the big difference from a travel retail perspective between this health crisis and SARS in 2003 is the huge growth in Chinese travel and overseas shopping in the intervening years. Remember, offshore duty free on Hainan Island was not introduced until 2011. Considering these sobering statistics from ACI Asia-Pacific: In 2003 the total number of passengers moving through Chinese airports amounted to about 187 million vs 1.26 billion in 2018. The volume of international passengers increased from 50 million to 114 million over the same period (representing annual average growth by +9.6%). Chinese shoppers have become not just a locomotive of the travel retail industry, but a bullet train. Markets such as South Korea (the world’s biggest duty free channel) have become overwhelmingly dependent on the nationality and others have relied increasingly on the Chinese for growth. Consider the words of Singapore’s Transport Minister Khaw Boon Wan on Thursday, when comparing the coronavirus outbreak’s impact on the aviation sector with SARS. Chinese travellers accounted for just 5% of Changi’s passenger numbers in 2003. “Now, they account for 11%, so it is double in terms of percentage and even more by absolute numbers,” Khaw said. “But the purchasing power has increased even more… they account for one-third of retail sales in Changi, and the one-third has evaporated.” Evaporated is a very strong word, especially from a usually understated individual such as Khaw. But it tells its own story. The luxury and travel retail sectors, inextricably related, are going to take a powerful hit over coming weeks. How big a hit depends very much on one’s geographic, customer and product profile. For suppliers, premium skincare, Cognac, baiju and tobacco brands, for example, are being hit much harder than others due to their popularity with Chinese travellers (sales of those liquor categories at Changi, for example, are off by around -70% over the past couple of weeks, compared to Scotch whisky off by 30-40% and spirits such as rum and gin, not particularly favoured by Chinese consumers, down by around 5-15% depending on the category). For retailers it’s all about how key the Chinese traveller and spend is within their geographic footprint. The question every business executive is asking themselves is ‘How long will it last?’ And that, alas, is a question that no-one, not even in the medical world, can yet answer. |