CHINA. The Moodie Davitt Report is pleased to publish the Jessica’s Secret Index for November 2020 covering wines & spirits, fragrances, makeup, skincare and confectionery.

The Jessica’s Secret Index, in association with The Moodie Davitt Report, provides an indicator of what’s hot with the app’s predominantly younger Chinese traveller user base. The results do not represent sales rankings (especially during the current crisis) but offer a useful insight into Chinese consumer interest on a monthly basis.

At a glance

- November 2020 shows month-on-month position movements from the October Index for spirits and wines.

- Note: These rankings only reflect search demand, not sales. A SKU’s movement upwards or downwards can be influenced by many factors.

- Hover over individual SKUs to show month-on-month movement.

1. Moutai Feitian 53%

2. Hibiki Suntory Japanese Harmony Master’s Select

3. Hennessy XO giftpack

4. Kweichow Moutai Special Edition Year of the Dog

5. Hibiki Harmony Master’s Select Limited Edition

6. Wuliangye Crystal 52%

7. Chivas Regal 12 Year Old Brothers’ Blend

8. Kweichow Moutai Flying Fairy 53%

9. Kweichow Moutai Flying Fairy 38%

10. Suntory Yamazaki 25 Year Old Limited Edition

11. Jägermeister

12. Martell XO

13. Hibiki 30 Year Old Limited Edition

14. Rémy Martin X0 Excellence 40% Giftpack

15. Hennessy VSOP

16. Rémy Martin Louis XIII Le Jeroboam

17. Kweichow Moutai Li Bai giftpack

18. Suntory Hakushu 25 Year Old Limited Edition

19. The Macallan Enigma

20. Baileys Strawberry & Cream

—————————-

At a glance: Makeup

- November 2020 shows month-on-month position movements from the October Index for makeup.

- Note: These rankings only reflect search demand, not sales. A SKU’s movement upwards or downwards can be influenced by many factors.

- Hover over individual SKUs to show month-on-month movement.

The Jessica’s Secret Index – Top Makeup Brand Searches November 2020

1. Giorgio Armani Lip Maestro Lip Stain #405

2. Giorgio Armani Designer Lift Foundation #3

3. Giorgio Armani My Armani to Go Essence-in-Foundation Cushion Foundation #2

4. Lancôme Absolue Rouge Matte Lipstick #196

5. Tom Ford Lip Colour #80

6. Lancôme Absolue Fluid Foundation #100

7. Tom Ford Eye Color Quad Eyeshadow Palette #04

8. YSL Rouge Pur Couture The Slim Matte Lipstick Rouge Paradoxe #21

9. Givenchy Prisme Libre Loose Powder Couture Edition #1

10. YSL Rouge Volupté Shine #46

11. Nars Light Reflecting Setting Powder

12. Estée Lauder Futurist Aqua Brilliance #1C1

13. Estée Lauder Double Wear Stay-in-Place Makeup Duo #17

14. Estée Lauder Double Wear Stay-in-Place Makeup

15. Chantecaille Just Skin Tinted Moisturizer

16. Dior Rouge Dior Couture Lip Color #80

17. Suqqu Extra Rich Glow Foundation #101

18. YSL Fusion Ink Cushion Foundation #B20

19. Givenchy Le Rouge #304

20. YSL Touche Éclat Le Teint Crème

——————–

At a glance

- November 2020 shows month-on-month position movements from the October Index for skincare lines.

- Note: These rankings only reflect search demand, not sales. A SKU’s movement upwards or downwards can be influenced by many factors.

- Hover over individual SKUs to show month-on-month movement.

The Jessica’s Secret Index – Top Skincare Brand Searches November 2020

The Jessica’s Secret Index – Top Skincare Brand Searches November 2020

1. La Mer The Treatment Lotion 150ml

2. Clarins Double Serum Complete Age Control Concentrate Duo 50ml

3. Estée Lauder Advanced Night Repair Multi Recovery Complex II 100ml

4. Estée Lauder Advanced Night Repair Synchronized Multi Recovery Complex II Duo 2 x 100ml

5. Lancôme Advanced Génifique Youth Activating Duo 2x100ml

6. La Mer Crème de la Mer 60ml

7. SK-II Facial Treatment Essence Duo Set 2x230ml

8. Sisley Ecological Compound 125ml

9. Clé de Peau Beauté Correcting Cream Veil 36ml

10. Lancôme Tonique Confort 400ml

11. Guerlain Abeille Royale Youth Watery Oil 50ml

12. Helena Rubinstein Re-Plasty Age Recovery Skin Regeneration Accelerating Night Care 50 ml

13. Lancôme Absolue Regenerating Brightening Soft Cream 60ml

14. Chanel La Mousse Anti-Pollution Cleansing Cream-to-Foam 150ml

15. SK-II R.N.A. Power Radical New Age Cream 80ml

16. Estée Lauder Advanced Night Repair Synchronized Recovery Complex II 100 ml

17. SK-II Facial Treatment Essence 330ml

18. Clarins Double Serum Complete Age Control Concentrate Duo 2x50ml

19. Shiseido Ultimune Power Infusing Concentrate Serum 50ml

20. SK-II GenOptics Aura Essence 50 ml

——————–

At a glance

- November 2020 shows month-on-month position movements from the October Index for fragrances.

- Note: These rankings only reflect search demand, not sales. A SKU’s movement upwards or downwards can be influenced by many factors.

- Hover over individual SKUs to show month-on-month movement.

The Jessica’s Secret Index – Top Fragrances Brand Searches November 2020

1. Byredo Rose of No Man’s Land edp

2. Chanel Bleu de Chanel edt

3. YSL Black Opium edp

4. Tom Ford Oud Wood edp

5. Jo Malone London Wild Bluebell edc

6. Chanel Chance Eau Tendre edt

7. Chanel Coco Mademoiselle edp

8. Chanel Bleu de Chanel Homme Spray edp

9. Chanel Gabrielle edp

10. Serge Lutens La fille de Berlin edp

11. Diptyque Philosykos edt

12. Bvlgari Pour Homme edt

13. Giorgio Armani Sì Passione Limited Edition

14. Serge Lutens L’Orpheline edp

15. Acqua Di Parma Mirto di Panarea edt

16. Acqua Di Parma Fico di Amalfi edt

17. Jo Malone London English Pear & Freesia edc

18. Tom Ford Rose Prick edp

19. Chanel N°5 L’eau edt

20. Hermès Terre d’Hermès edt

——————–

At a glance

- November 2020 shows month-on-month position movements from the October Index for confectionery lines.

- Note: These rankings only reflect search demand, not sales. A SKU’s movement upwards or downwards can be influenced by many factors.

- Hover over individual SKUs to show month-on-month movement.

The Jessica’s Secret Index – Top Confectionery Brand Searches November 2020

- Ferrero Rocher Box 375g

- Ferrero Rocher Collection 24pcs

- Godiva Coeur Iconique 14pc 150g

- Godiva Truffles 16pc 230g

- Lindt Tube Assorted 400g

- Godiva Gold Ballotin Box 290g

- Ferrero Rocher 48pc pack 600g

- Lindt Excellence Dark 70% Chocolate Cocoa Bar 100g

- Lindt Dark Swiss Masterpieces Ballotin 250g

- Ferrero Rocher T48 Destination Pack Dubai

- Godiva Carrés 72% Dark Chocolates 180g

- Godiva Tower Napolitains Medium 450g

- Milka Strawberry Cheese Tablet 300g

- Godiva Dark Pretzels 71g

- Lindt Swiss Classic 100g

- Godiva Luxury Gift Box 59pc

- Lindt Assorted Napolitains 500g

- Lindt Gold Bunny Milk 200g

- Godiva Tablet Dark Chocolate 85% 100 g

- Toblerone Tiny Mono Bag Gold 272g

——————–

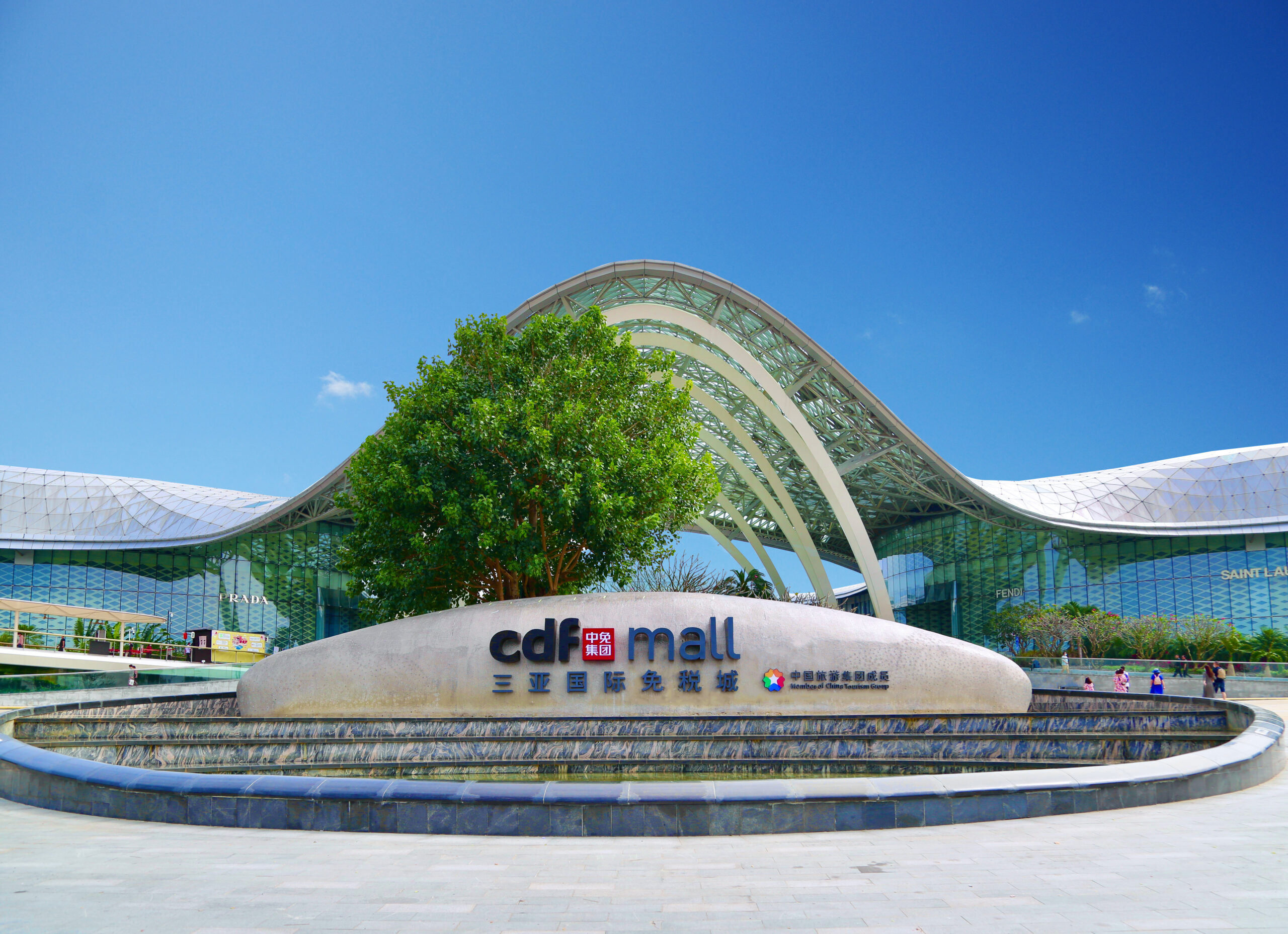

Hainan Island: Travel retail’s global hotspot The Moodie Davitt Report will publish a Hainan Island Special Report with the China edition of The Magazine in February 2021. Written by Martin Moodie and Dermot Davitt, it will explore how the offshore duty free business in China has become critical to the world’s leading brands across many categories. 海南:旅游零售业的全球焦点 穆迪戴维特报告(Moodie Davitt Report)将于2021年2月随The Magazine的中文版发表《海南特别报道》。该篇由马丁·穆迪(Martin Moodie)和德莫特·戴维特(Dermot Davitt)撰写,将探讨中国的离岸免税业务是如何变得对跨类别的各大全球领先品牌至关重要。 报告将覆盖以下内容:

The report will feature:

Contact Irene@MoodieDavittReport.com to partner with The Moodie Davitt Report for this special edition. |