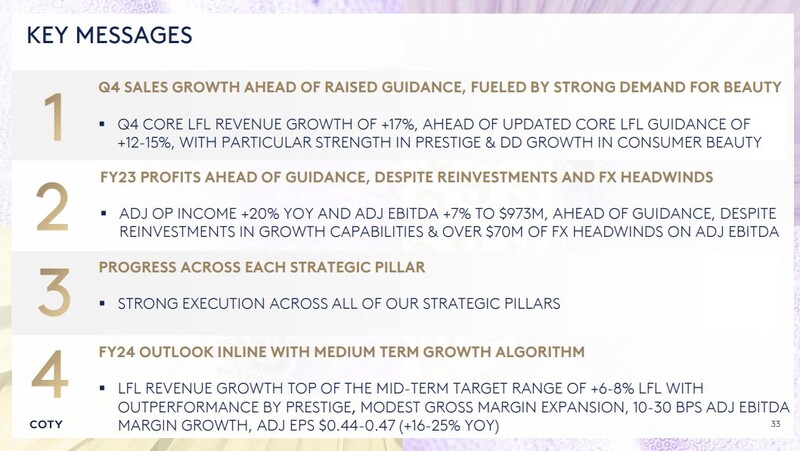

Travel retail played a starring role as French-American beauty house Coty posted a +16% year-on-year rise in reported sales (+17% like-for-like) in its fourth quarter ended 30 June.

Coty said this was the twelfth consecutive quarter its results have been in-line to ahead of expectations.

Q4 concluded what the company described as “a very strong year” with full-year sales up +5% (+12% like-for-like), which includes approximately 2% of negative impact from the company’s exit from its Russia business.

CEO Sue Y. Nabi said on an earnings call: “We are continuing to see incredible momentum in our travel retail sales. Both in the quarter and fiscal ’23, our travel retail sales grew over +30% like-for-like. As a result, our travel retail sales are approximately 8% of our overall business.

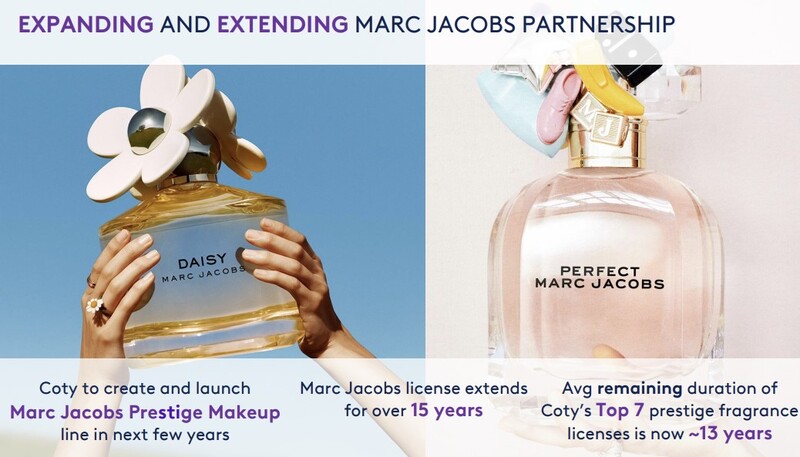

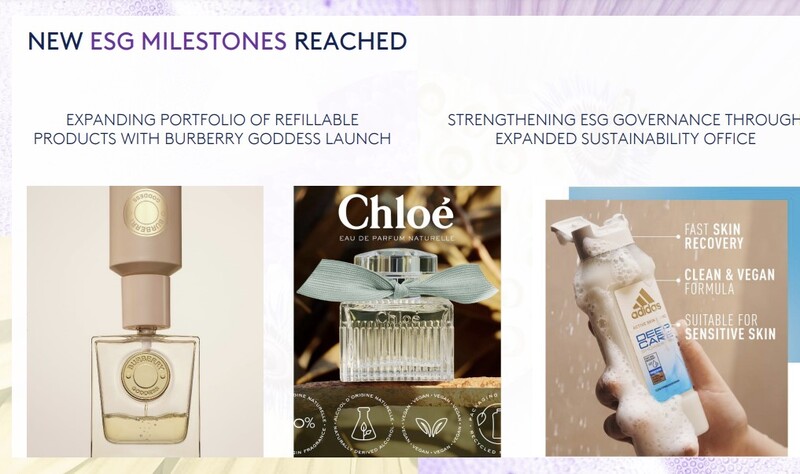

On the record with Sue Y. Nabi (speaking on last week’s earnings call)On the expansion and extension of the Marc Jacobs partnership: “We’ve been married together since 20 years. And the outcome of this collaboration is, I have to say, fantastic. During fiscal ’23, the second fastest-growing brand of Prestige at Coty was indeed Marc Jacobs – high double-digit growth. And this is… the result of this long-standing collaboration.” On prolonged success: This is also the 12th consecutive quarter of the company reporting results inline to ahead of expectations. These accomplishments are the result of the focus and agility across the full Coty organisation as we continue to amplify our strengths, adjust to evolving market conditions, and capture new opportunities. On clean beauty: Clean and sustainable beauty is the only category – in all the studies that are published by us, but also by any company studying consumers’ mood etc – where people are ready to spend more money. And that’s very important, because they believe they are making the right choice for the planet, for them and for their skin health. On growth in the fragrance sector: As we enter fiscal ’24, we see no signs of slowing in fragrance demand. And while we are already a leader in prestige fragrances, we still have ample white space opportunities in this category, even within our stronghold geographies. On Prestige makeup performance: In Q4, our Prestige makeup revenues grew over +25% like-for-like. Trends have been improving sequentially with the reopening of the China economy and the strong launch activations behind Burberry and behind Gucci. On skincare’s development: In the last few months, we have ignited our comprehensive strategy as planned, with exciting initiatives across each of our key skincare brands Lancaster, Orveda and Philosophy, and many more to come in the coming quarters and years. On Lancaster Ligne Princiere: Since the launch of Ligne Princiere in China, store sales are growing +20% to +30% month over month. The conversion rate at new counters in China, especially in Hainan, is exceeding leading beauty peers, with Lancaster Ligne Princiere driving the majority of sales. On Orveda: We are opening today the sales of what we believe in skincare is probably one of the most potent serums of all time, behind the Orveda skincare line. This serum is called Omnipotent Concentrate.

|

“This is consistent with our travel retail penetration in 2019, even though international travel is still below pre-COVID levels. We have continued to gain share in the high-growth and highly profitable travel retail channel, particularly in EMEA and in the Americas, fuelled by distribution expansion, travel retail exclusivities, successful innovations and our growing multi-category presence.

“And with no sign of slowing in global consumers’ appetite for travel, coupled with the return of Chinese travellers in the coming quarters, we remain highly optimistic about the growth potential of this channel for Coty.”

Travel retail played a key role in Coty’s Prestige business growing +21% like-for-like in Q4 (+13% for the full year). “The strong sales growth acceleration in Q4 reflected double-digit growth across Americas, EMEA and the travel retail channel, and a couple of points of benefit from the China low comparison last year,” Nabi said {report continues underneath the panel below}.

Among best in classCoty’s profits grew strongly in both Q4 and FY23. Q4 reported operating income reached US$129.0 million, with +61% growth in the adjusted operating income to US$105.1 million and +25% growth in adjusted EBITDA to US$165.4 million. For FY23, reported operating income more than doubled to US$543.7 million, adjusted operating income grew +20% to US$738.8 million, and adjusted EBITDA rose +7% to US$972.8 million. Coty said its strong FY23 core like-for-like growth exceeded its recent target of +9-10%. The performance was well ahead of the underlying beauty market, putting Coty among the best in its competitive set, the company said. Sales were driven by consistent momentum in both divisions, supported by strong global beauty demand across categories, geographies and channels. Importantly, core like-for-like growth for both Q4 and FY23 included low single-digit volume growth and approximately +10% benefit from price and mix. The Prestige segment led the way during Q4, with both reported and like-for-like sales growth of +21% versus the prior year. For FY23, the Prestige segment grew +5% as reported while core like-for-like revenues rose a robust +13%. Earlier momentum in the fragrance category remained to full effect, with the prestige fragrance market growing over +10% in both Q4 and for the full year. Coty’s prestige fragrance revenues outperformed the market, increasing by more than +20% in Q4 and a low teens percentage in FY23 on a core like-for-like basis.

Outlook promising Entering FY24, the beauty market remains a strong and outperforming category, with ongoing premiumisation trends, Coty noted. The company said it is continuing to benefit from these positive trends, with momentum across its core categories, a strong innovation pipeline, and early wins in key white spaces. The combination of these factors is fuelling the company’s FY expectations for the core business to grow at the top of Coty’s medium-term target range of +6-8% like-for-like. |

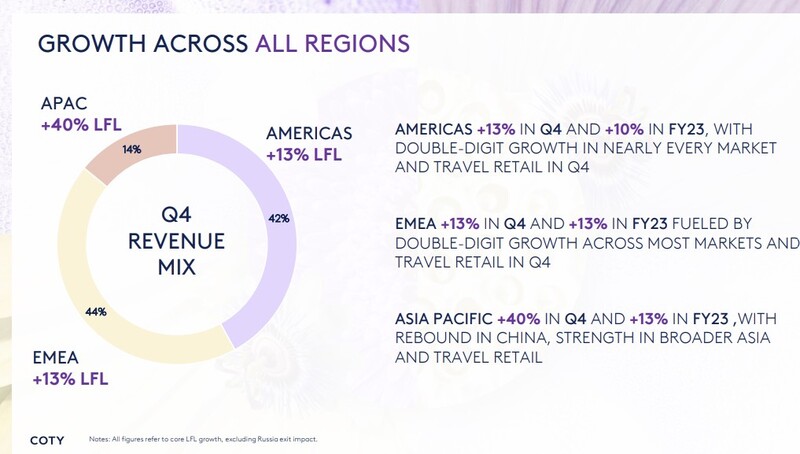

Travel retail contributed strongly to each geographical region. In the Americas and EMEA it generated (reported) double-digit gains. A +40% group-wide growth in like-for-like sales in Asia Pacific (+13% in fiscal ’23) was notable for a “robust rebound” in China generally and Hainan specifically. Strong momentum was also noted in travel retail elsewhere in Asia Pacific.

Summing up the group’s performance, Nabi said: “The beauty market remains a strong and outperforming category, with ongoing premiumisation trends. In this attractive backdrop, we are successfully executing on the strategy we laid out three years ago, with momentum across our core categories, and early wins in the white space opportunities we are pursuing – including female fragrances and ultra-premium fragrances, skincare, prestige cosmetics, China and travel retail.

“And we are delivering a best-in-class medium-term growth algorithm, including a mid-20%-s EPS CAGR, active deleveraging, and capital returns, as we propel our growth story and strengthen our position as a beauty powerhouse.”

Nabi singled out the recent introduction of Burberry Goddess, which as reported was pre-launched exclusively into global travel retail on 1 July before its domestic launch this month. “This is the best of Coty know-how in terms of creating and winning users,” she said.

“It takes time to put in place these kinds of methodologies to craft a five-star launch at this level. To execute it, we started to do this in travel retail in July. And now we are expanding globally. What we are seeing… is giving a direction or a flavour of what could be the upcoming innovations from Coty in this area – and therefore for our partners when it comes to fashion houses.”

Step by step in Hainan

Asked if the current inventory pressures in Hainan – well-documented by peers such as The Estée Lauder Companies, L’Oréal and Shiseido – had affected Coty’s ability to secure space for the Lancaster launch or if Gucci and Burberry had been impacted, Nabi replied: “Our shelf space for Lancaster has not at all been affected by all the pressures we are seeing.

“We are just doing the job step-by-step. We don’t want to open a massive number of doors while at the same time creating a business model of success for this brand. So we are doing this very carefully in terms of investment, be it capital investment, media investment etc.

“And therefore in Hainan and also in Mainland China we are making the productivity of the doors that we have opened as high as possible before starting to expand the number of doors and the expansion of shelf space.”

Gucci and Burberry have suffered no impact from the Hainan issues, she said. Both were growing very fast in makeup pre-pandemic and are benefitting from the resurgence of that category since the lockdowns ended.

Referencing the crackdown on daigou activity in Hainan, Nabi again said the company was unaffected. “We are not exposed to this kind of phenomenon given our small size, but also given how much we are willing to pay very strong attention to preserving the brand equity of the brands we have in Coty.”

Closing the call, Nabi said: “The immediate white space opportunities for this company are female fragrances, ultra-premium fragrances, prestige cosmetics, travel retail and Brazil. And then there are the mid-term opportunities, which are skincare and China.” ✈