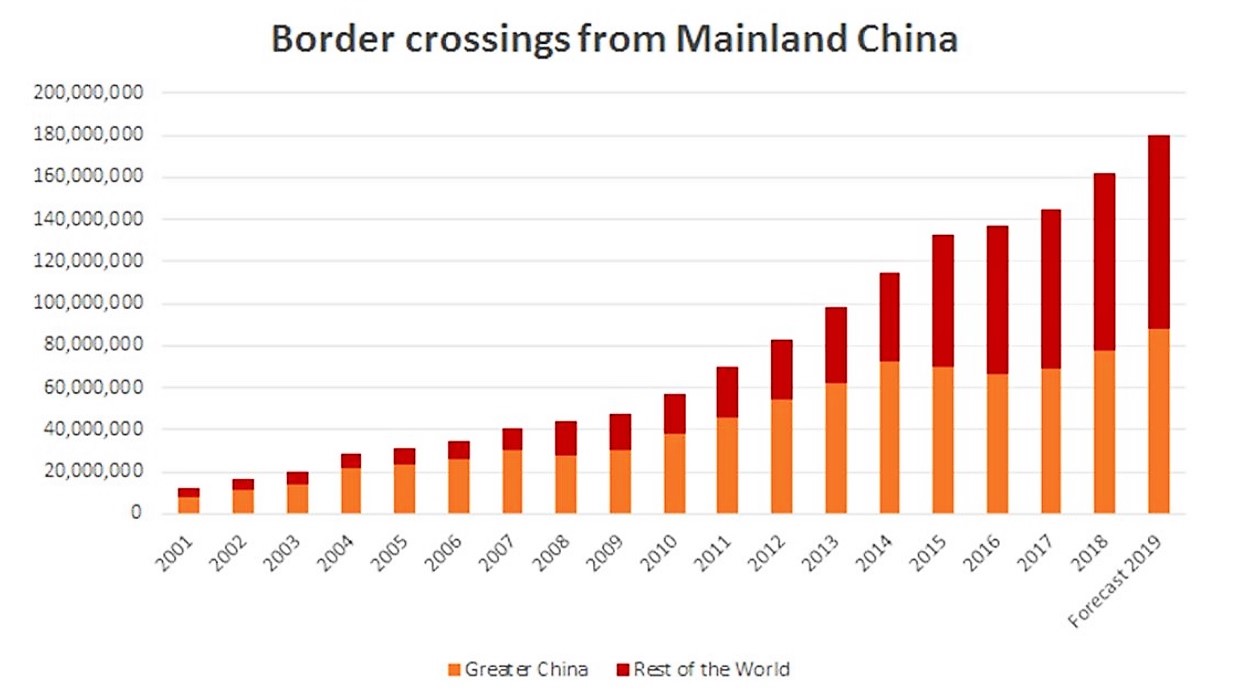

CHINA. The latest data from the Hamburg-based China Outbound Tourism Research Institute (COTRI) indicates that the number of border crossings from Mainland China increased by 7% in the last quarter of 2018 – but that this growth only benefited destinations in Greater China.

CHINA. The latest data from the Hamburg-based China Outbound Tourism Research Institute (COTRI) indicates that the number of border crossings from Mainland China increased by 7% in the last quarter of 2018 – but that this growth only benefited destinations in Greater China.

“The rest of the world welcomed – for the first time in a last quarter of the year – fewer Chinese visitors compared to the year before,” said the German consulting group.

COTRI’s fourth quarter 2018 statistics show that 56% or 22.5 million of the 40 million outbound trips from Mainland China ended in the Greater China locations of Hong Kong, Macau or Taiwan.

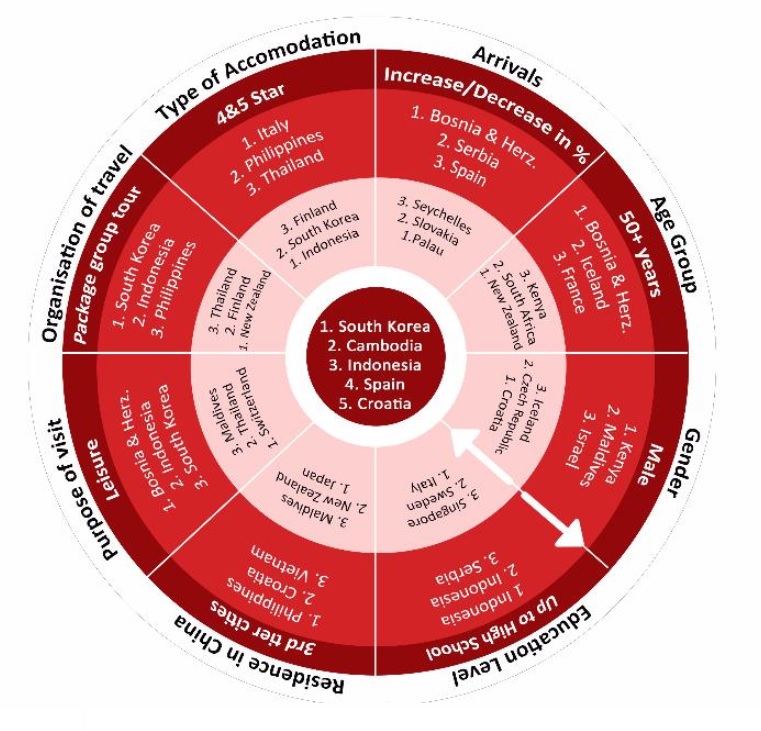

The remaining 44% or 17.5 million trips took Chinese travellers to destinations further afield, with South Korea, Cambodia, Indonesia, Spain and Croatia respectively seeing the highest increases in market share (see centre of the graphic).

The last quarter of 2018 included National Golden Week in October, one of the main travel seasons in China. Hong Kong and Macau managed to add five million arrivals from China in the final quarter over the past two years, whereas the rest of the world lost one million arrivals in the same period, according to COTRI.

The last quarter of 2018 included National Golden Week in October, one of the main travel seasons in China. Hong Kong and Macau managed to add five million arrivals from China in the final quarter over the past two years, whereas the rest of the world lost one million arrivals in the same period, according to COTRI.

The trend since 2000 has been for Chinese travellers to steadily increase their appetite for longer-haul trips. However, it looks like destinations closer to home are finding favour again. In 2017, the ratio between Greater China trips and visits to the rest of the world had been 50:50 and COTRI forecasts it will be roughly the same again this year (see bar chart below).

Infrastructure drives additional travel to Hong Kong and Macau

The 2019 forecast shows that almost half of all border crossings from the mainland will be to the Hong Kong and Macau Special Administrative Regions. These territories have staged a comeback after two weak years with a year-on-year growth rate of 13% in 2018. This was possibly helped by more cautious travel spending due to China’s slowing GDP trend.

COTRI said: “The new bridge connecting Hong Kong, Macau and Zhuhai, and the new high-speed train line are bringing Hong Kong and Guangzhou and the rest of China much closer together in terms of time and convenience of travel. The much-talked about ‘bay project’ is likely to create additional travel for the two SARs. Even with a conservative growth forecast of 13% year-on-year, that would add ten million trips to make a new total of 85 million in 2019.

A new tourism policy by the Chinese government to selectively support certain cities and counties in Taiwan should also revitalise Chinese arrivals to the island and bring them back to a level of more than three million this year. Therefore COTRI’s forecasts that Greater China will receive 88 million Mainland Chinese visitors, or 49% of the 180 million outbound trips expected in 2019.

Who is taking a hit and who is benefiting?

China is the world’s biggest international tourism source market. Different destinations have been hit in different ways by travel decisions to stay closer to home. COTRI said: “Many traditional markets like Australia, Germany or Thailand saw little growth or even decline. Others enjoyed growing arrival numbers and increasing market shares, especially Nepal, South Korea and Cambodia in Asia, plus smaller destinations like Serbia, Croatia and Spain in Europe as well as Canada.”

COTRI Director Professor Dr Wolfgang Georg Arlt said: “The Chinese are still travelling abroad in growing numbers, but the lower end of the market has become a bit more cautious, choosing destinations close by. Whereas the upper end of the market is looking for more authentic experiences in new destinations.

“Simplified visa regulations, increased numbers of direct air connections and the new road and rail links between Hong Kong, Macau and China support this new travel pattern. Long-distance destinations will have to increase their efforts to attract Chinese visitors.”