The Moodie Davitt Report Senior Retail and Commercial Analyst Min Yong Jung investigates the impact of the coronavirus outbreak on stock markets and key shares.

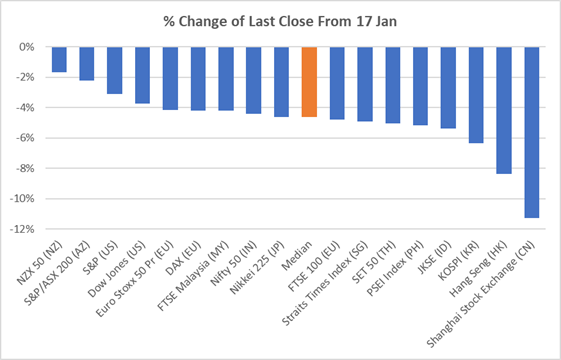

CHINA. The Shanghai Stock Exchange plunged -8.9% at the opening of trading after the Lunar New Year holiday today, as investors reacted to the coronavirus spread, but later gained ground to close down -7.7%.

Chinese authorities moved to shore up confidence in the market by announcing a 1.2 trillion yuan (US$174 billion) capital injection into the financial markets. This however was not enough to assure investors spooked by the widening spread of the coronavirus.

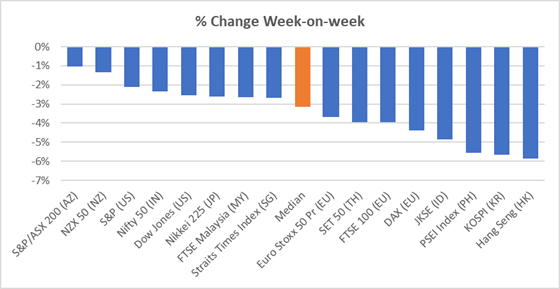

Last week global investors continued to react negatively to news of the coronavirus spread. Among benchmark indexes closely followed by the Moodie Davitt Business Intelligence Unit, the biggest fallers between 24 and 31 January were the Hang Seng Index (Hong Kong), down -5.9%, KOSPI Index (Korea) -5.7% and PSEI Index (Philippines) -5.5%.

Global stock markets have shown high volatility since 20 January, when confirmed cases of the coronavirus jumped. Global equity markets have plunged with investors paring back their investments in search of safe haven assets such as gold, the Japanese Yen and the US Dollar.

Since 17 January, the Shanghai Stock Exchange Index and Hong Kong’s Hang Seng Index have been worst hit by the coronavirus. China and Hong Kong were impacted most by SARS and memories of the negative economic fall-out remains fresh in the minds of investors who are comparing the latest outbreak to events in 2003.

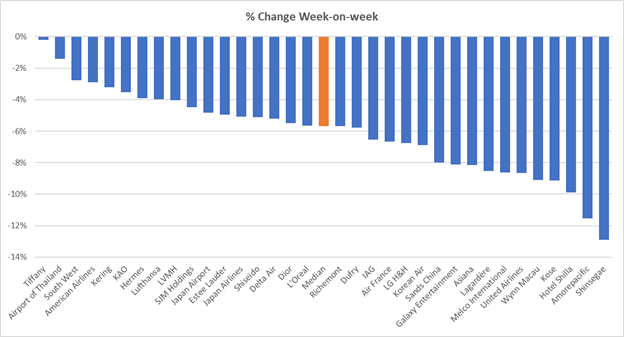

The hardest hit individual shares monitored by the Moodie Davitt Business Intelligence Unit on a week-on-week basis (to 31 January) were Korean stocks Shinsegae (-12.9%), Amorepacific (-11.5%) and Hotel Shilla (-9.9%), all heavily reliant on duty free business with Chinese customers.

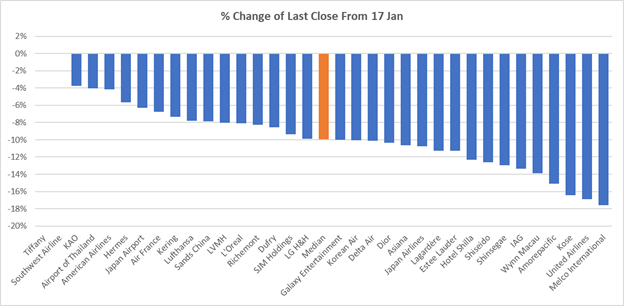

Individual stock prices monitored from 17 January showed the biggest coronavirus impact at Hong Kong-based gaming & leisure holding company Melco International (-17.6%), major American airline holding company United Airline Group (-16.9%) and Japanese cosmetics manufacturer Kose (-16.4%).

NOTE: Given the serious implications of the coronavirus outbreak for the aviation, tourism and travel retail sectors, The Moodie Davitt Report is running live updates from around the world.Click here for the latest.