CHINA. TFWA’s third China’s Century conference, held in partnership with APTRA, closed in Guangzhou yesterday, having attracted a record 412 visitors.

The conference was highlighted by strong, contrasting addresses from CDFG President Charles Chen and DFS Chairman & CEO Philippe Schaus on day one and an insightful presentation into Chinese entrepreneurship on day two by business consultant and author Dr Edward Tse (below).

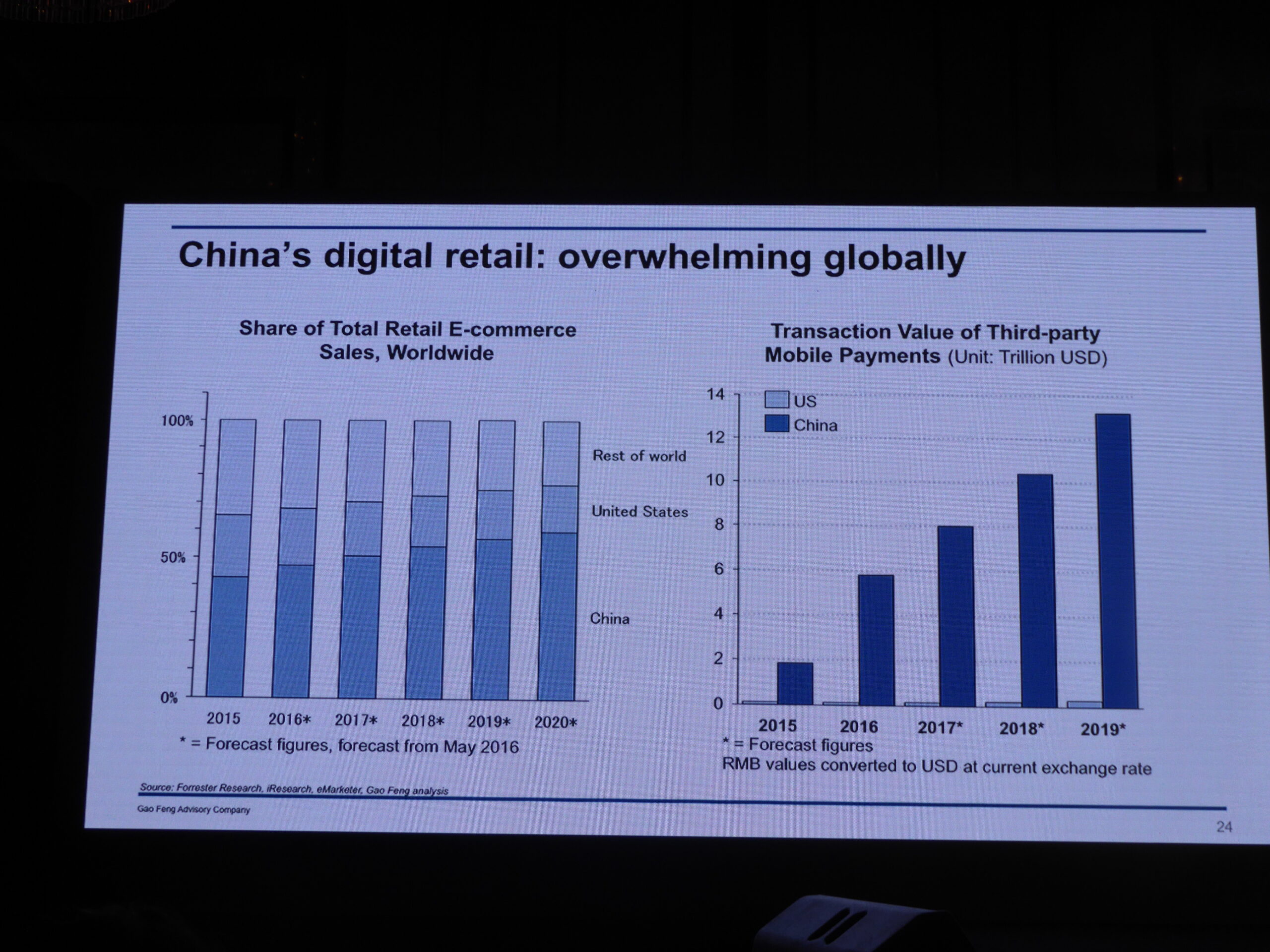

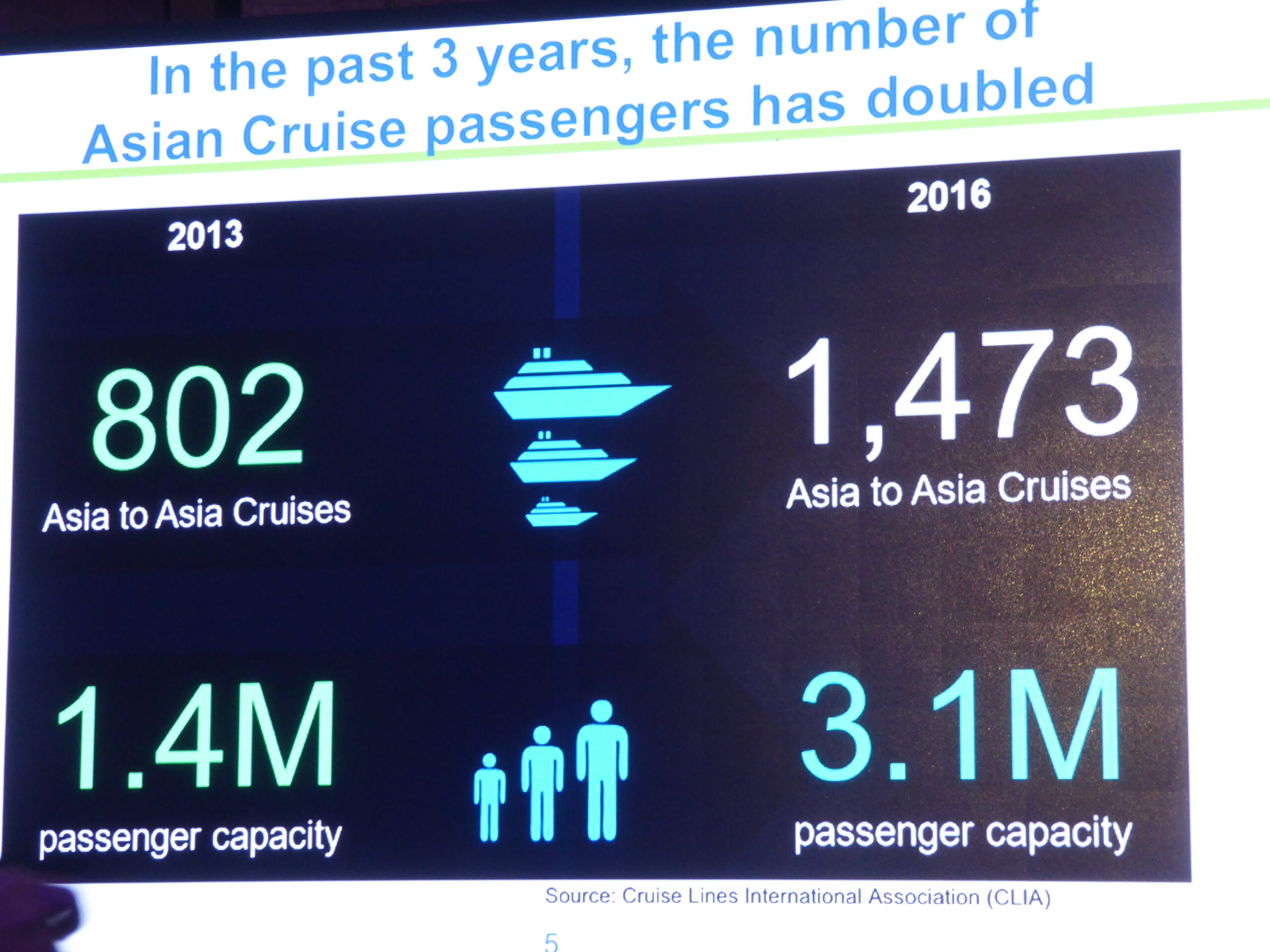

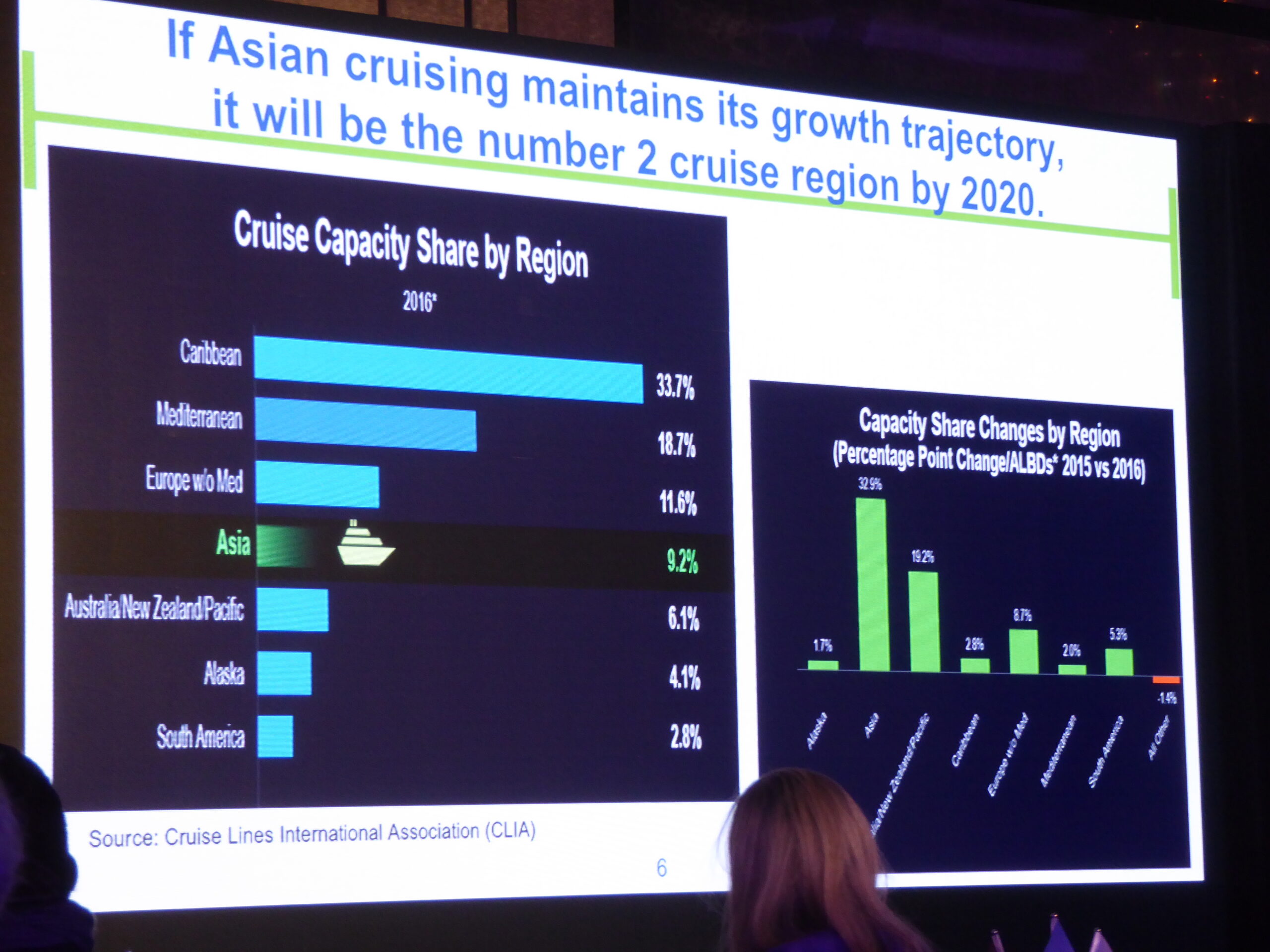

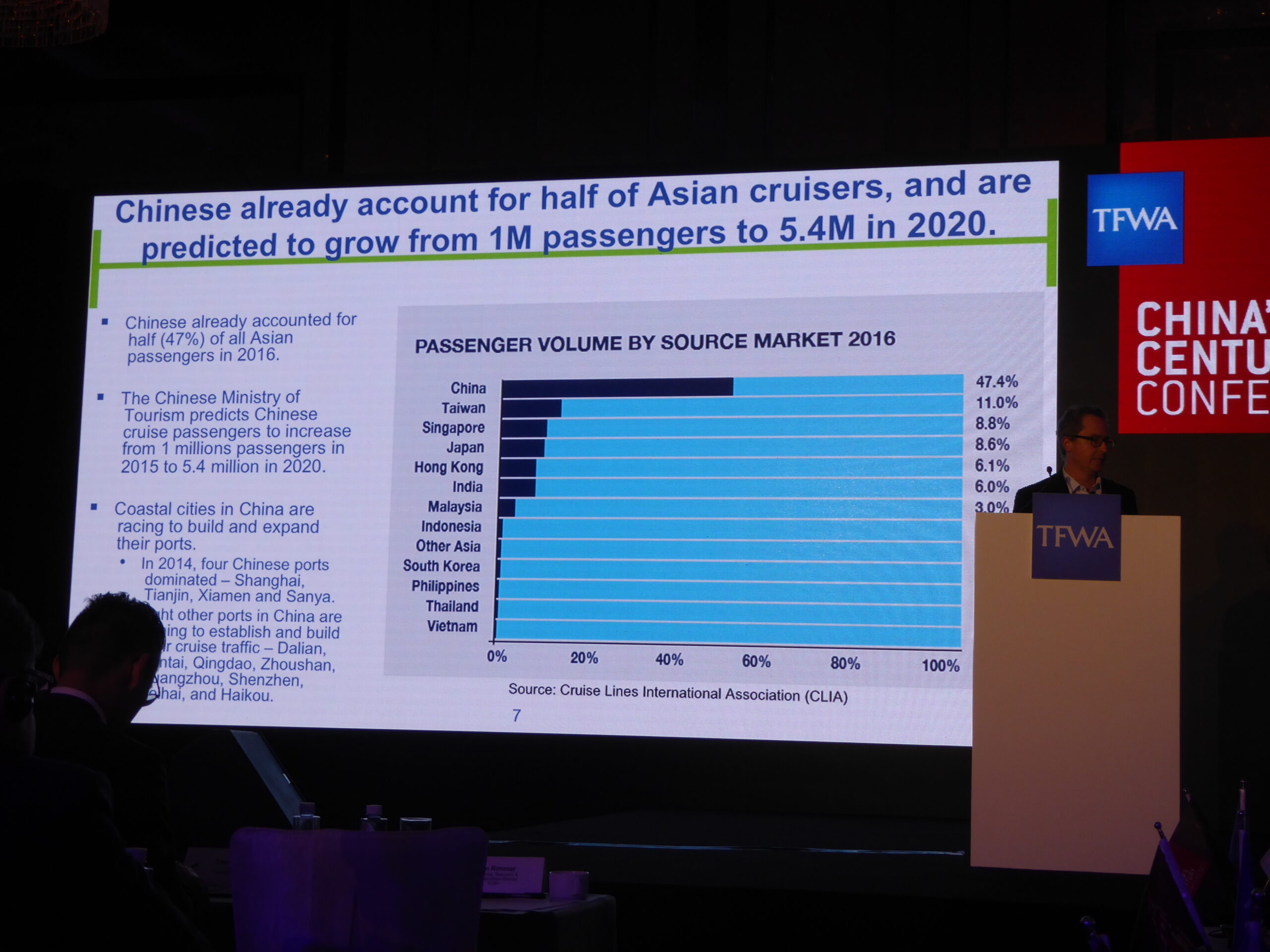

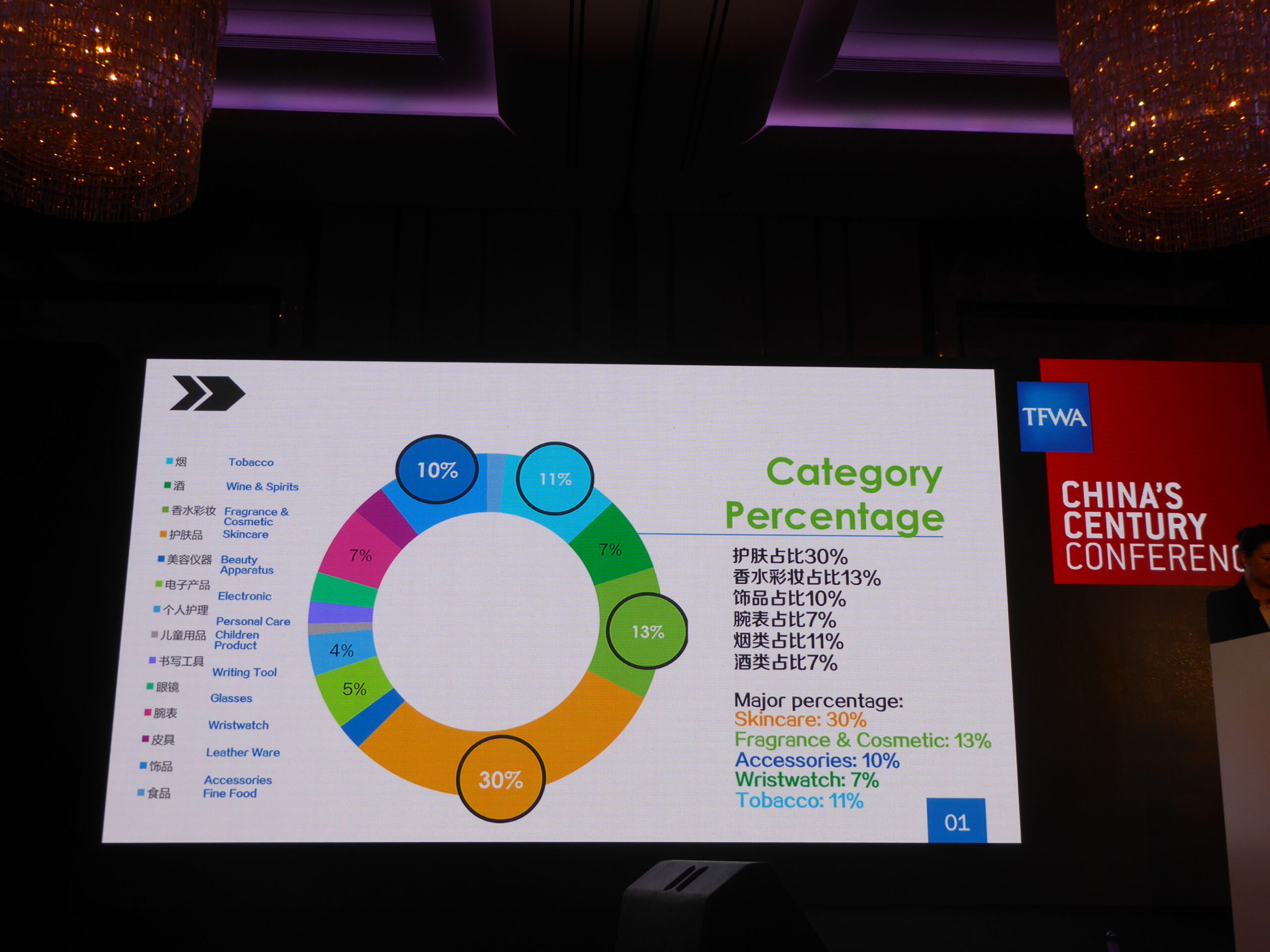

Several prevailing themes echoed throughout many of the speeches, notably the dual opportunity and threat of e-commerce, the vast potential of the cruise retail sector and the rapid development of China’s tourism and aviation sectors.

But perhaps the residing take-out was an observation made by Fortune Character Institute Dean Tina Zhou, who spoke of how we should approach the Chinese market at home and abroad not as separate entities but as a single “Chinese consumers’ market. “This will replace the geographical concept of the China market,” Dr Zhou told delegates.

Dr Zhou also unveiled what she described as the world’s first products display & online reservation platform for luxury boutiques, called YAOK. Fortune Character has a database of over 3 million Chinese high-net-worth-individuals (HNWIs), which YAOK is targeting by providing a luxury products shopping service abroad.

By the end of 2017, Yaok plans to expand its business to 18 countries, providing luxury shopping reservations worldwide, and serve over 500,000 HNWIs. The service has just been trialled successfully with several major luxury brands abroad.

We’ll bring you an exclusive interview with Dr Zhou and a profile of YAOK soon.

King Power Group (Hong Kong) Managing Director Travel Retail Sunil Tuli questioned the sustainability of the airport retail model in a candid address.

“In simple terms, more travellers add more of a percentage to the expected Minimum Annual Guarantees we give. Then when we experience a lower spend overall per passenger,as felt in the Chinese travel retail market more recently, this creates an unsustainable situation.”

“We are aware of the challenges that airports face, but equally our landlords should understand the challenges in our roles as operators working with our brand partners and suppliers,” he commented. “Airport infrastructures are expanding in order meet the rise in traffic and passenger growth, as travel becomes more widely available. The result of this rise in travel and the opening of more routes has seen a reduction in the costs of flights which, along with lower fuel prices, is good news for the airline travel industry. It does, however, cause additional problems for retail operators. In simple terms, more travellers add more of a percentage to the expected Minimum Annual Guarantees we give.

“Then when we experience a lower spend overall per passenger as felt in the Chinese travel retail market more recently, this creates an unsustainable situation. We know historically that sales have been and are continuing to decrease but that passenger numbers are increasing and this situation can only adversely affect meeting the cost of airport rents.

“We have to study closely why the Chinese consumer is no longer spending as much. I’ve already referred to the economy and the emergence of e-commerce but we have also seen a slow down in the region affected by all manner of reasons, resulting in consumers buying more and more within the Chinese domestic market. The market has been saturated and that because of this Chinese spend – from Dubai to Paris to Macau to Hong Kong – has all slowed down.

“Time is often something we don’t have with the concession periods on offer. Losses can hit at great speed when there are economic downturns, natural disasters or regional unrest.”

“In addition, penetration and conversion still remains relatively low in comparison to the expected footfall based on passenger numbers. And yet footfall is often the determining factor of rents and guarantees in airports, regardless of historical and current sales figures. As an operator, we also expect to experience the additional challenges that arise due to currency fluctuations and exchange rates, which can in turn have immediate negative impact.

“If we look at what has happened over the last seven years where the Chinese spend was initially increasing year on year, many concession contracts have been and are still based on similar sales and revenue projections. And yet the sales have been in decline and spending has slowed right down. The main problem is that when sales drop like this, as a retailer one cannot simply proportionally cut costs. This kind of financial management takes time. And time is often something we don’t have with the concession periods on offer. Losses can hit at great speed when there are economic downturns, natural disasters or regional unrest. We’ve all seen before that travel retail is particularly vulnerable to such fluctuations and sudden events.

“The business mindset in this industry needs to embrace the general acceptance that the rules of the game have, I believe, completely changed.”

“So, while it’s all very well setting MAGs and making financial promises to our landlords, the short -erm contracts on offer reflect risk aversion and reluctance overall. I believe we still need to apportion more risk and reward for all stakeholders in travel retail because of this, and find fair ways of doing so. The ‘auction’ nature of our open tender system still exists and this usually results in unrealistic bidding. Importantly, this works to the detriment of consumers as well as all stakeholders in the travel retail business.”

He concluded: “The business mindset in this industry needs to embrace the general acceptance that the rules of the game have, I believe, completely changed. We all need to accept this – operators, landlords and brands alike, and work together to reset the model. This kind of acceptance can only lead us to make the changes we need to; changes that show we can react and adapt to the outside pressures and challenges such as heavy price competition, availability, accessibility and the magnitude of online shopping and e-commerce.” [We’ll bring you the full Tuli speech in the May issue of The Moodie Davitt Report Print Edition].

Comment: After their superb first China’s Century conference in Beijing in 2013, TFWA and APTRA have always had a tough act to live up to. While not touching the same heights here, the event still provided a useful focus on a ‘home and away’ market that will underpin the fortunes of many airports, brands and concessionaires for years to come.

Possibly a shorter format, finishing at lunch on day two, would address the impression of information overload, while based on our own conference-organising experience forged over many years, we would suggest three-person rather than four-member panels in the interests of substance, time-keeping and focus.

As always the joint moderation of Trevor Lai and John Rimmer was a pleasure to watch and listen to and the networking, staging and logistics were in line with TFWA’s traditional excellence.