CHINA. The duty free market in China is set to double by 2025 in the wake of burgeoning ecommerce activity and the rapid growth of Hainan Island’s offshore duty free business, according to Morgan Stanley Research.

In a detailed note dedicated to prospects for China Duty Free Group parent company China International Travel Service (CITS), Morgan Stanley Research said: “The COVID-19 outbreak has triggered an evolution in China’s duty free market, with ecommerce the newest initiative. Together with Hainan and the mainland downtown [duty free] development, we think this market will double by 2025 in our prudent base case scenario.”

While noting that deregulation of China’s duty free market will bring increased competition for CDFG (from both local and international players), Morgan Stanley Research concludes that CITS (which is being renamed as China Tourism Group Duty Free) will maintain its dominant position with minimal market share loss. “We see CITS as the key beneficiary of China’s duty free evolution,” the report observes.

CITS, together with its (newly) 51%-controlled Hainan Duty-Free Company, has a monopoly on the Hainan duty free market currently. However, local and global players are seeking to penetrate the market, the report noted. Among local players, Caissa Tourism Group appears most active after striking a joint venture partnership with Sanya’s government recently.

That competition will come both from established enterprises such as CNSC; long-established Beijing-based department store operator Wangfujing Group (which has just won a duty free retail licence); and international retailers including Dufry. Global travel retail giant Dufry is understood to have signed a partnership agreement with real estate giant Evergrande Group on 13 April for a duty free city on Ocean Flower Island [Dufry declined to comment when contacted by The Moodie Davitt Report about this agreement].

Ocean Flower Island is an extraordinarily ambitious project, involving the creation of an artificial archipelago off the north coast of Danzhou, Hainan. It is due to open later this year and is expected to welcome ten million visitors annually.

Speeding up growth

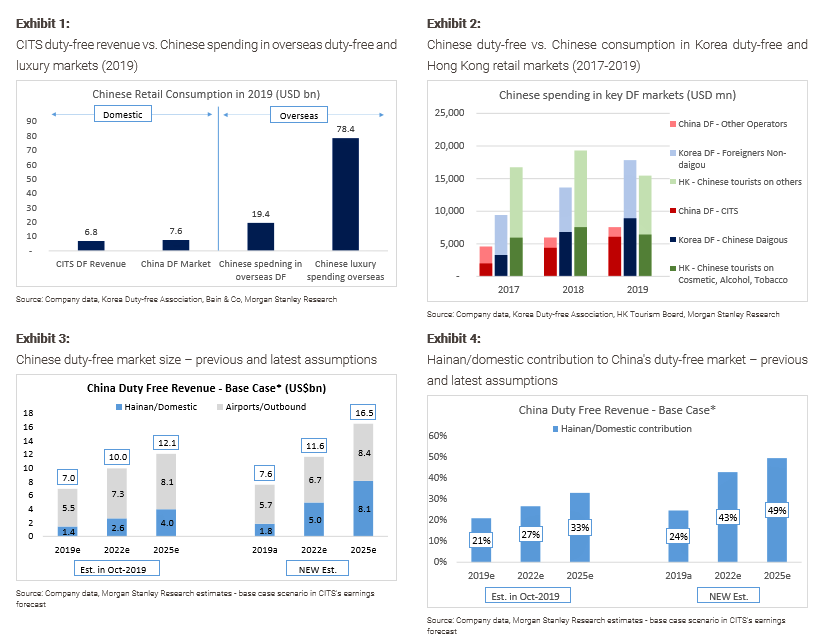

“New initiatives – online, Hainan free trade zone, and Mainland downtown – should speed up the [sales growth] process,” said Morgan Stanley. “In 2019, Chinese consumers contributed one-third of global duty free sales (US$27 billion of US$82 billion), but China’s duty free market was just 9% of the global share (US$7.6 billion).

“We expect China’s duty free market to more than double to US$16.5 billion by 2025, with the Hainan contribution to grow from 24% in 2019 to 50% in 2025e. We see upside risk if the government relaxes restrictions faster. Before COVID-19, we had expected a 10% CAGR in market size, to US$12 billion by 2025e, with 33% coming from Hainan.”

Morgan Stanley believes there will be three key drivers of growth, as follows:

1. Online duty free: This sector was ramped up following the COVID-19 outbreak and contributed 50% of CITS’s revenue in May, up sharply from under 10% in January. Consumers can purchase online with home delivery after they return from travelling to Hainan. This channel will be sustainable even after COVID-19, as operating costs are lower than in airport stores, Morgan Stanley said. This supports attractive product pricing that is 30%+ lower than official prices.

2. Hainan free trade zone: The development roadmap announced on June 1, 2020, proposed raising the Hainan duty free purchase limit from RMB30,000 per annum to RMB100K per annum, and widening the duty free product category mix by 2025 [at the latest -Ed]. Morgan Stanley believes that CITS can defend its leading position.

3. Mainland downtown duty free: The NDRC said recently that this channel would be developed, although an exact development timeline has not been given.

We will bring you further analysis on Hainan and more detail from the Morgan Stanley Research report soon. Click here for a special report by Ruslan Tulenov, Supervisor at Hainan Provincial Bureau of International Economic Development on the free trade port development.