INTERNATIONAL. Bain & Company recently released its 20th annual Luxury Study, which underlines the resurgence in the global luxury market in 2021 after a contraction in 2020. The study also reinforced previous projections that China and Chinese consumers will become the dominant force in global luxury by 2025 (see below).

Produced in partnership with Fondazione Altagamma, the trade association of Italian luxury goods manufacturers, the report (titled ‘From Surging Recovery to Elegant Advance: The Evolving Future of Luxury’) estimated that the market for luxury goods and experiences grew by +13% to +15% in 2021 to €1.14 trillion. This was still -9% to -11% below 2019 levels. The study tracks nine segments led by luxury cars, personal luxury goods, and luxury hospitality, which together account for 80% of the total market.

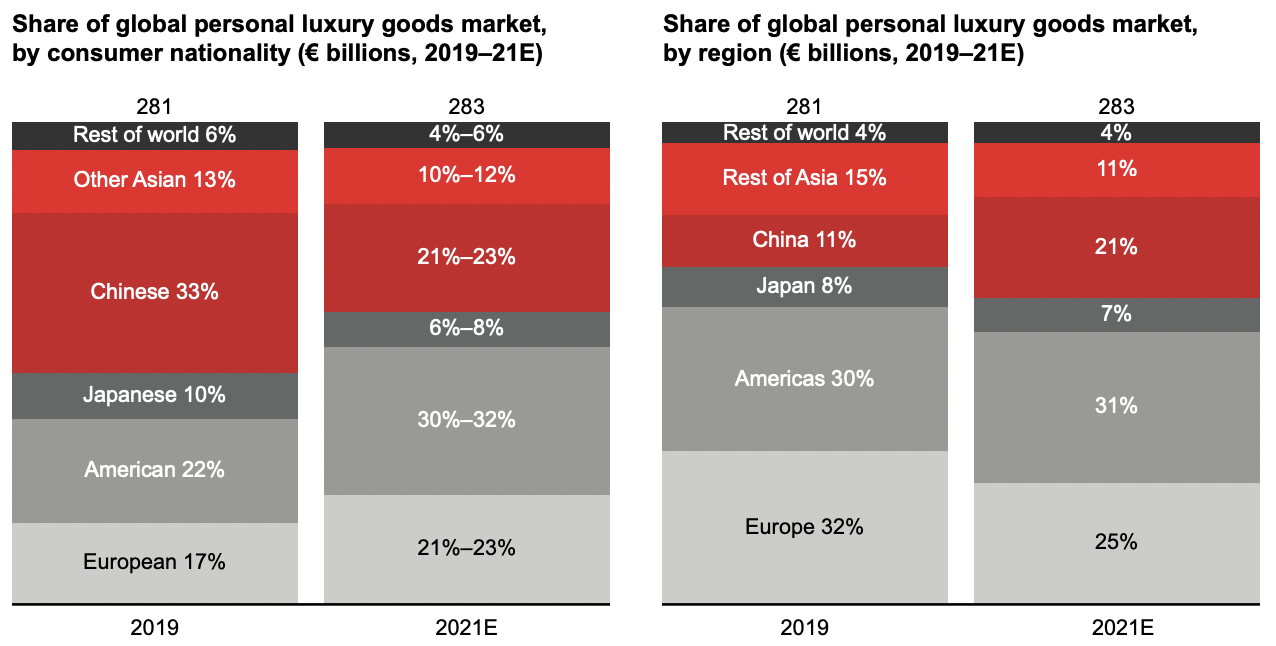

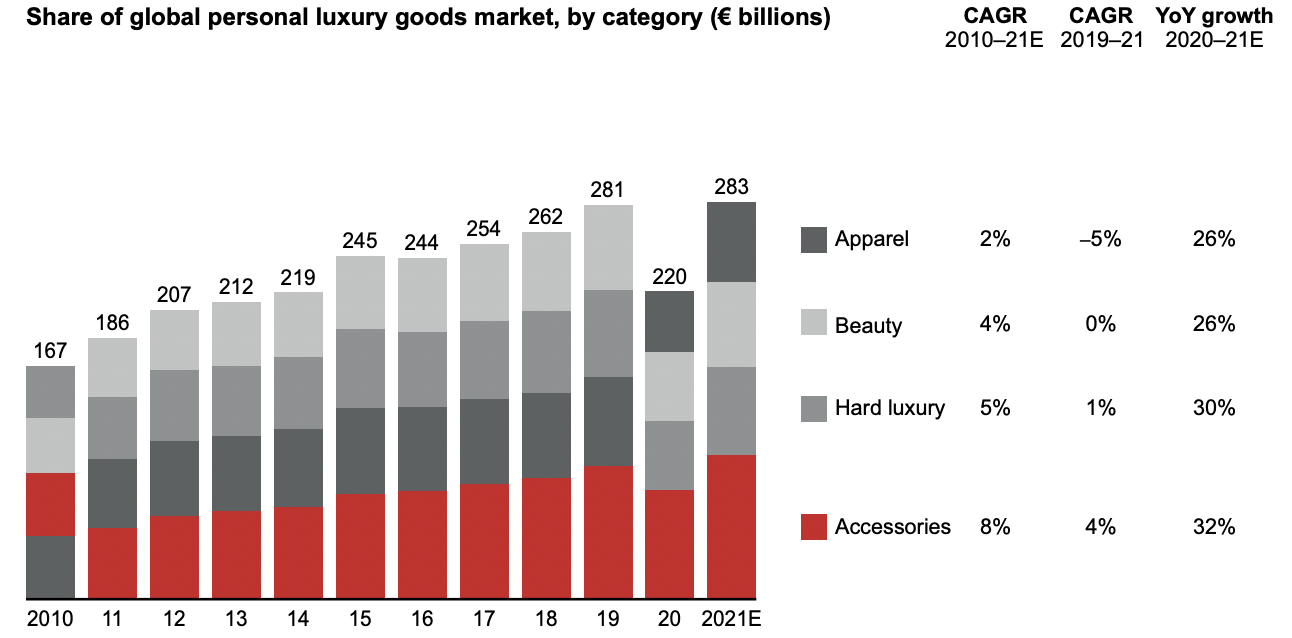

Within this, personal luxury goods sales are estimated to have risen by around +29% last year to €283 billion, said Bain & Company, amid a V-shaped recovery from a year earlier. Importantly, this also represents a +1% gain compared to 2019.

Bain & Company commented: “The revived personal luxury goods market has been powered by the dynamism of local consumption, particularly in China and the US, which now form a dual engine for the sector. Regional shifts were indeed marked by the persistent rebalancing of where luxury purchases are made. Purchases made locally have grown by 50%–60% since 2019, and tourist purchases have declined 80%–90% vs. 2019.”

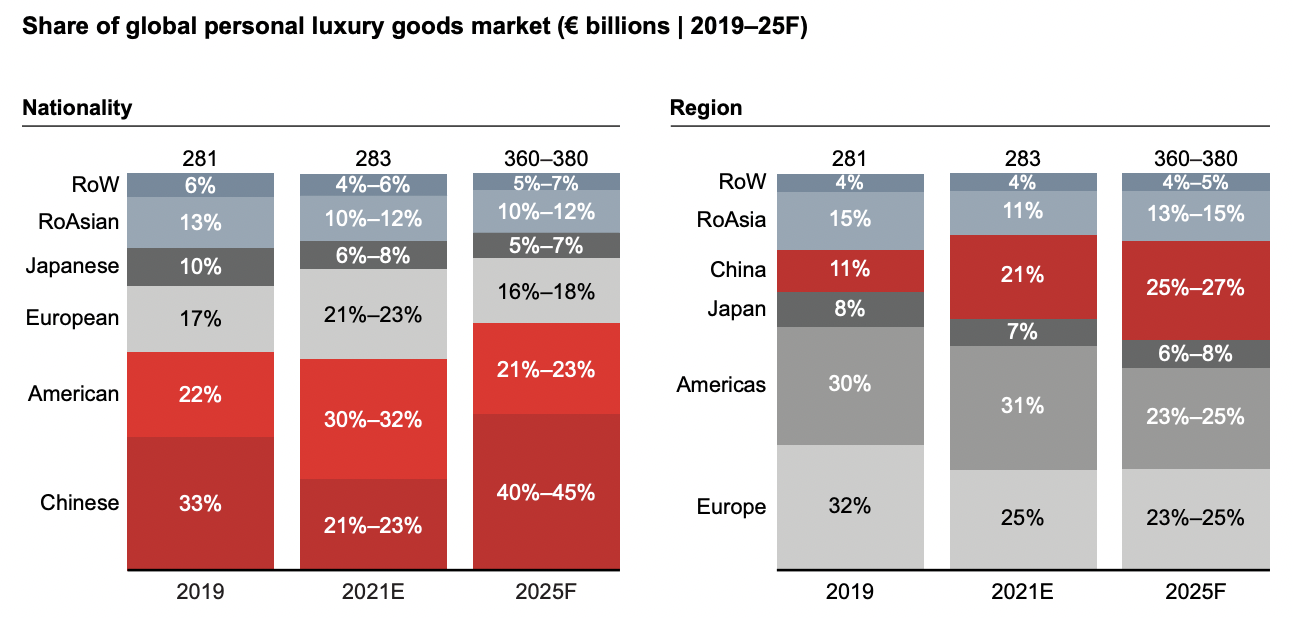

Mainland China experienced what Bain termed “remarkable momentum”, with the market size nearly doubling since 2019, due to the repatriation of Chinese purchases from overseas during the pandemic.

China’s share of the global market has almost doubled in two years, it said, to around 21% in 2021. “We anticipate that the corresponding dip in the overall global spending by Chinese consumers will be reversed in the second half of 2022 or the first half of 2023 as tourist flows normalise.”

Japan is expected to be back to pre-pandemic levels by 2023 and Europe by 2024. The rest of Asia is estimated to have returned to growth in 2021, rising by +19% at current exchange rates to reach €32 billion.

Bain & Company said: “The performance of Hong Kong remained weak, while Taiwan and Macau faced more mixed results. South Korea regained its 2019 levels due to the repatriation of local customers’ spending, which more than compensated for the lack of tourism. Southeast Asia, meanwhile, continued to suffer from the dearth of tourists.”

The Americas posted “solid growth”, with a “new map of luxury” fast emerging in the US with the increased importance of secondary cities and suburban areas, said the study. The Americas account for €89 billion in annual sales (31% of the global market), while sales in Mainland China amount to €60 billion (21% of the global market), though China is set to become the largest market by 2025.

In the Middle East, Dubai and Saudi Arabia led growth. Europe, Japan, and the rest of Asia only partially recovered during 2021 and have still not reached pre-Covid levels. Their comeback, noted Bain & Company, is “inherently linked to the resumption of global travel, particularly of tourism out of China”.

Changing channels

Luxury goods sales in the online channel nearly doubled in the past two years and the second-hand market thrived, noted Bain & Company.

Brands continued to increase control over their distribution in 2021, with a rise of directly operated channels, it stated. The retail channel now accounts for almost half the market (an estimated 49% in 2021) and is poised to overtake the wholesale channel.

Overall, online and monobrand stores were the key channels for recovery in 2021 and should lead growth in the medium term. “After a +50% jump from 2019 to 2020, online continued to power on, thanks to accelerated adoption during Covid-19. Websites devoted to a single brand gained ground on other types of online platforms and now make up 40% of the online segment, up from 30% in 2019,” said Bain & Company.

The analyst estimated that the secondhand luxury market soared to €33 billion in 2021, driven by surging demand and an increasingly competitive offer.

Category split

All personal luxury goods categories except apparel are back to their 2019 levels, said the report.

At category level, shoes, accessories, and jewellery were the “star performers” during the pandemic. “Their success—sales for all three should exceed 2019 levels in 2021—reflects the contradictory currents of the pandemic, in which some consumers embraced a new informality while others rediscovered logo-led style or turned to the most exclusive and sparkling incarnations of hard luxury.”

According to Bain’s forecasts, sales in the luxury shoe market grew by +11% compared with 2019 to reach €23 billion, thanks to a switch to casual footwear. Accessories remained the largest personal luxury goods category in 2021 and grew by +8%, relative to 2019, to reach €62 billion.

Jewellery reached €22 billion, up +7% from 2019, as the appeal of branded luxury continued to grow in traditionally non-core markets. Unisex jewels became popular, and the online channel played a key role for entry-level-priced goods and custom pieces.

Watches and beauty grew back to their 2019 levels, said the report. The luxury watch market regained its record €40 billion valuation, reflecting solid demand for “über-luxury” and iconic pieces, as well as genderless watches. Beauty recovered to €60 billion, just -1% below its 2019 levels. Skincare was boosted by a trend for self pampering in the pandemic, said Bain & Company, although the weak performance of travel retail has constrained beauty’s acceleration worldwide, it argued.

The apparel category grew in 2021, but not sufficiently to close the gap with 2019. “The desire for comfort was a theme again, but big-occasion dressing is making a comeback, giving womenswear more of a spark than menswear. As in accessories, logos are back in fashion.”

Over the last 20 years, the leading brands have grown both their share of the market and their scale advantage over other players, said the report, though it added that a place for “rising stars” in the industry remains.

Small brands, many of which are newcomers, currently make up 2% of the market but are growing twice as fast as the broader industry.

Outlook for luxury and key trends

After two years of turbulence, Bain & Company said that the luxury goods industry is coming out of the crisis “with more strength, resilience, and agility than before”. Profitability has already recovered to pre-Covid levels: it forecast that a typical brand’s earnings before interest and taxes margin nearly doubled in 2021 to 21%, up from 12% in 2020.

The study said: “The prompt 2021 rebound suggests that growth will be healthy for the personal luxury goods market in the medium term. We expect the sales recovery to continue over the next four years, with the personal luxury goods market reverting to annual growth rates between 6% and 8% until 2025.

“We anticipate that four growth trends will profoundly reshape the luxury market by 2025. First, Chinese consumers are set to become the dominant nationality for luxury, growing to represent between 40% to 45% of global purchases.

“Second, mainland China is on a path to overcome the Americas and Europe to become the biggest luxury market globally. Third, online is set to become the leading channel for luxury purchases. Fourth, younger cohorts (Generations Y and Z) should become more demographically dominant in luxury, representing 70% of global purchases.”

Bain & Company also commented: “The crisis marks a turning point for luxury as we knew it. The expanding universe of luxury customers expects more from brands than before. Well beyond product considerations, they seek personalisation and alignment with their values, a strong voice on social issues, and real action and responsibility when it comes to sustainability.

“Luxury brands will continue to redefine themselves over the next 20 years by expanding their historical mission beyond creativity and excellence, generating economic growth in a networked economy, contributing to cultural development, and fostering social progress. New keywords and phrases—such as metaverse, personalisation at scale, and tech stack—will come to the fore as the industry grows and evolves.”

About the Bain Luxury Goods Worldwide Market Study

Bain & Company analyses the market and financial performance of more than 280 leading luxury goods companies and brands for Fondazione Altagamma. This database, known as the Luxury Goods Worldwide Market Observatory, has become a leading source in the international luxury goods industry. Bain has published its annual findings in the Luxury Goods Worldwide Market Study since 2000. The study’s lead author is Claudia D’Arpizio, a Bain partner in Milan. Fondazione Altagamma is led by Matteo Lunelli, who was named Chairman in 2020.

Click here to access the full report.