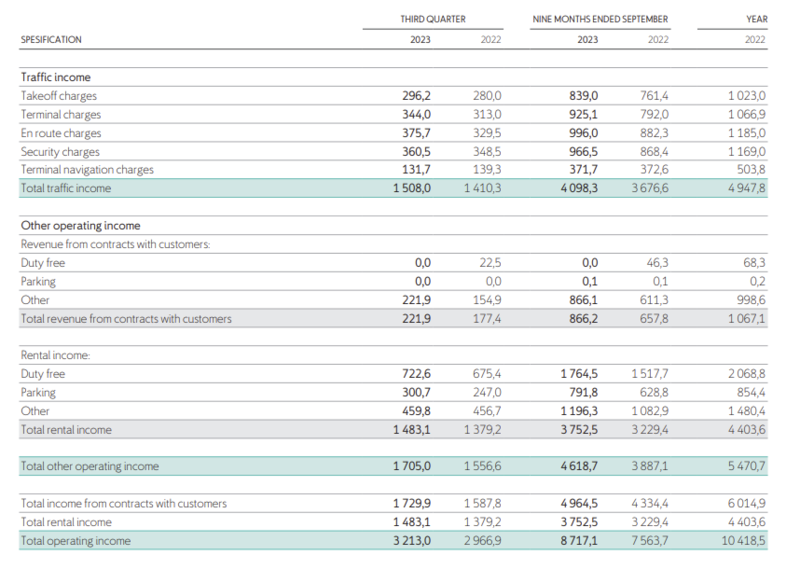

NORWAY. Duty free income outpaced traffic growth for national airport authority Avinor in the first nine months ended 30 September, rising +16.3% year-on-year to NOK1,764.5 million (US$163.6 million).

Growth slowed in the key Q3 period to a +7% increase over the same period last year to NOK722.6 million (US$67 million).

In announcing the results, Avinor noted the impact of January’s slashing of the inbound tobacco allowance. As reported, the Norwegian government halved the tobacco allowance for returning residents from 1 January. The former allowance was 200 cigarettes, 250g of other tobacco products and 200 sheets of cigarette paper.

In November 2022, Avinor projected the change would result in an NOK270 million (US$27 million) annual loss of income.

Tobacco previously accounted for around 20% of arrivals duty free sales at Norway’s airports. It is not only a critical category in its own right but a key footfall driver into the stores. At Oslo, the largest and most profitable of Norway’s airports, arrivals shopping represents around 50% of all duty free retail income.

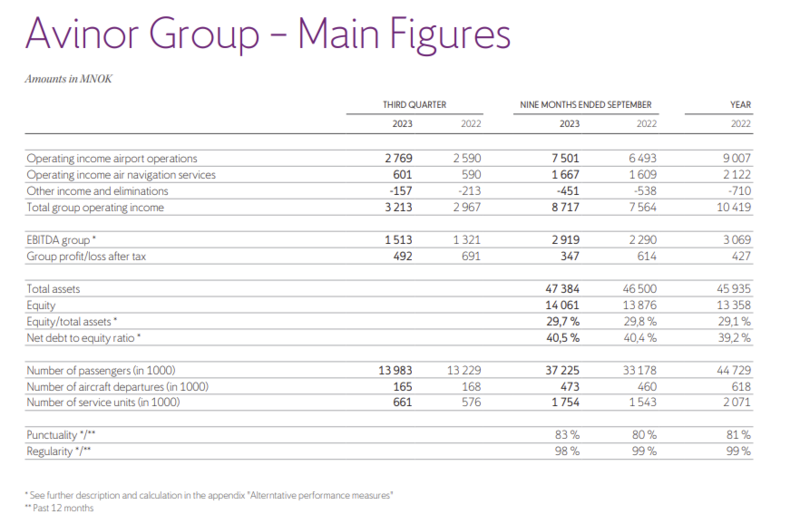

Operating revenues for the first nine months rose +15.2% year-on-year to NOK8,717 million (US$808.4 million), of which commercial revenues accounted for 57.3%.

Operating revenues for the first nine months rose +15.2% year-on-year to NOK8,717 million (US$808.4 million), of which commercial revenues accounted for 57.3%.

“This indicates a weaker revenue development than previously assumed performance, while a cost base that does not vary with revenues to the same extent, as well as underregulated airport taxes, changed framework conditions in the form of the elimination of duty free quotas [the tobacco allowance -Ed], and the addition of new tasks and associated costs also have a negative impact,” Avinor commented.

“To retain sustainable financial framework conditions, Avinor has thus signalled the need for a real increase in fees.”

A total of 37.2 million passengers travelled through Avinor’s airports during the nine months, up +12.2% year-on-year. Traffic for the period was -10.1% lower than in the same period in pre-pandemic 2019. For Q3 passenger traffic rose +5.7% year-on-year.

EBITDA for the nine months rose +27.4% to NOK2,919 million with an EBITDA margin of 33.5% compared to 30.3% last year.

“The Ministry of Transport and Communications stipulates that the basic structure of the company shall remain, but that the financial framework conditions must be strengthened. Avinor appreciates that. At the same time, we expect the financial situation to be strained for the next few years, also with the measures now outlined by the owner,” said CEO Abraham Foss.

“Traffic remains at lower levels than before the pandemic, and forecasts of future traffic growth indicate that recovery will take longer than previously anticipated,” Foss said.

“In addition, there has been a significant real decline in airport taxes, which account for 50% of Avinor’s revenues, since 2019.” ✈