AUSTRALASIA. Auckland International Airport Limited (Auckland Airport) has just announced (Monday 11 January local time) that it has agreed to purchase from Westpac Bank a 24.55% stake in North Queensland Airports (NQA), the operator of Cairns and Mackay airports in Queensland, Australia for A$132.8 million/NZ$166 million (US$122.9 million).

Auckland Airport Chairman Tony Frankham said: “This is a significant milestone for Auckland Airport and for our strategy to grow beyond our core business in Auckland.

“This proposed acquisition opens up exciting new opportunities to strengthen and grow air services connections with Cairns as a stepping stone between New Zealand and the high-growth tourism markets of Asia, and enables us to leverage our world-class expertise in the large scale movement of people and goods to grow shareholder value.”

Cairns Airport is Australia’s seventh busiest airport, with approximately 3.7 million passengers in the year to 30 June 2009 (compared with Auckland Airport’s 13.0 million passengers in the same period).

|

“New Zealand has underperformed against Australia in gaining a share of Asian tourism, so we have decided to take a position in the Australian market in an effort to get better connected “ |

Simon Moutter CEO Auckland Airport |

It is the closest international airport to Asia on Australia’s eastern seaboard and is the gateway to Tropical North Queensland, an internationally renowned tourism region boasting two World Heritage listed attractions; the Great Barrier Reef and the Wet Tropics Rainforests.

Mackay Airport is an important regional domestic airport with nearly 1 million passengers in the year to 30 June 2009. The airport is the main airport servicing the Bowen Basin, an important region for natural resources, which contains one of the largest deposits of coal in the world. Mackay Airport also benefits from its close proximity to the Whitsunday resort islands.

Auckland Airport CEO Simon Moutter said: “Since indicating in March 2009 that we would pursue opportunistic but carefully selected step-outs, we’ve looked at a range of opportunities to drive synergies and volume for our core business at Auckland.

“We also recognise that our most important value driver is growth in international passenger volumes. We believe that Asian tourism markets offer the greatest opportunity for volume growth and that one of the keys to growing Asian traffic is improved air services connections.

“Driving more travel demand out of Asia will be crucial to the future growth of both Auckland Airport and the New Zealand tourism sector.

“New Zealand has underperformed against Australia in gaining a share of Asian tourism, so we have decided to take a position in the Australian market in an effort to get better connected and lift our market share. While our primary focus remains direct Asian connections with Auckland, an important stepping-stone is to strengthen connections with other strategically located airports.”

“Cairns Airport fits the bill in terms of its location, scale, focus on Asian tourism, and market diversification opportunities. Mackay offers additional diversified exposure to the booming Australian resources sector.”

“This is very much a case of the right deal at the right time. We’ve monitored this situation closely over the last year since privatisation by the Queensland Government, and we’ve now been able to take advantage of a rare opportunity to enter the Australian airport market alongside key partners (Infrastructure Investment Fund, advised by JP Morgan Asset Management; and The Infrastructure Fund, managed by Hastings Funds Management, the largest airports funds manager in Australia).”

|

NQA Chairman Jason Zibarras welcomed Auckland Airport as a proposed new shareholder and said his Board of Directors was looking forward to forging a new alliance.

“As an airport operator investing in NQA, Auckland Airport will bring additional expertise. Their proposed investment is a welcome mark of confidence in the outlook for Cairns and Mackay,” Zibarras said.

Auckland Airport said it believes the proposed deal to be strongly value accretive, offering an equity return on investment in the “mid teens percentages”. It will initially be financed from existing debt facilities. Subsequently, the funding strategy is likely to involve a mixture of debt and equity consistent with Auckland Airport’s current capital structure.

The proposed purchase, which is due to be settled on 13 January, is conditional on NQA obtaining the consent of its financiers to the proposed transaction prior to that date.

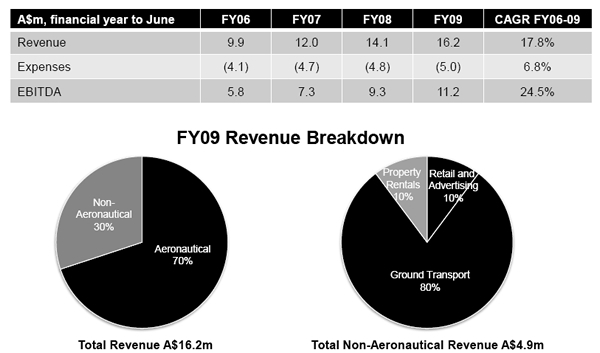

Cairns Historical Financials

|

Mackay Historical Financials

|

Auckland Airport would become the only airport operator shareholder in NQA. Its shareholding arrangements would enable it to exercise strategic and operational influence and drive benefits from joint air-services development and operational expertise sharing across all three airports.

Moutter added, “Cairns has been underperforming due to the decline in some key markets such as Japan. However we believe it is poised for a strong rebound, driven by improving tourism demand, recently announced new air services, new Federal Government initiatives to encourage foreign airlines to fly to and beyond regional international airports such as Cairns, and more than A$45 million of committed government tourism support.”

MORE STORIES ON AUCKLAND INTERNATIONAL AIRPORT