ASIA PACIFIC. Ships in Asia will call at more destinations this year according to a new report from cruise industry trade association Cruise Lines International Association (CLIA) – but there will be fewer passengers onboard.

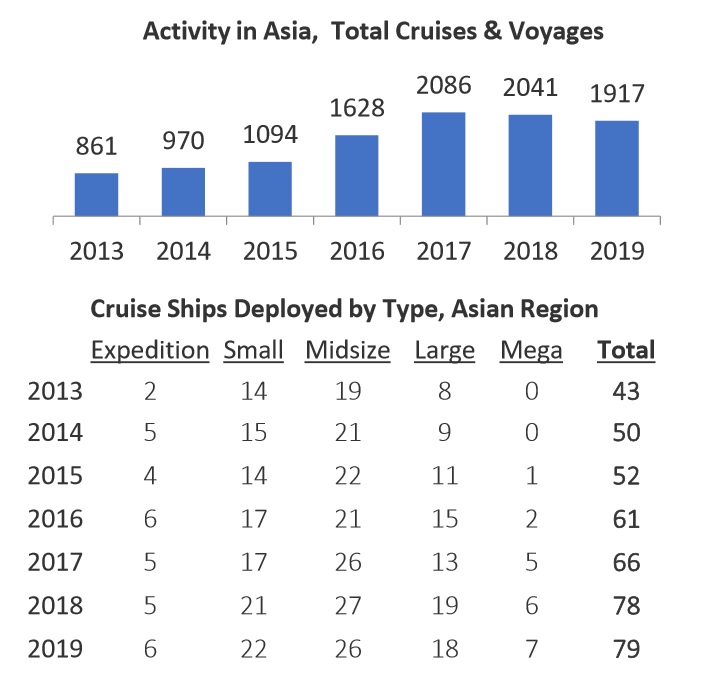

CLIA’s 2019 Asia Deployment and Capacity Report shows that cruise destinations in the region will rise to 306, an increase of 18 compared to 2018, with roughly the same number of ships deployed: 79 this year versus 78 in 2018.

However, passenger numbers will fall by -5.7% year-on-year to 4.02 million from 2018’s 4.26 million, based on planned itineraries. This is lower than both 2018 and 2017, and comes after several years of rapid expansion.

Also, not since 2016 have sailings in Asia dropped below the 2,000 mark: to an expected 1,917, after peaking at 2,086 in 2017.

The news will disappoint players in travel retail. Both cruise lines and shopping concessionaires have created Asian-targeted store environments to cater to expected demand. For example, MSC Cruises and Starboard Cruise Services respectively have developed new spaces onboard MSC Bellissima and Costa Cruises’ Costa Venezia.

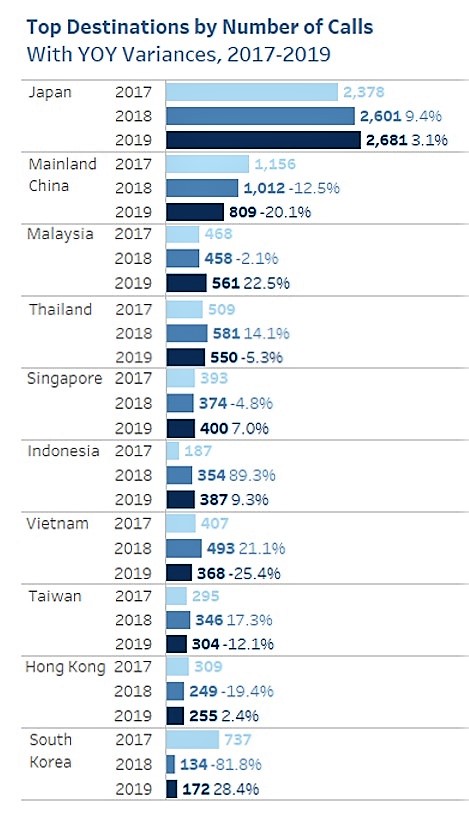

They will have to be patient went it comes to traffic, particularly from China-heavy destinations. Commenting on the passenger contraction, CLIA said: “The decline was mainly due to the reduction of short-cruise itinerary options from Mainland China.” In fact, the Mainland Chinese market has been decreasing since 2017 in terms of number of calls (see chart).

CLIA looks ahead for positives

While the traffic numbers are falling, CLIA emphasised some positives including new dedicated ships for the market as well as better port facilities.

CLIA Australasia & Asia Managing Director Joel Katz said: “The popularity of cruising in Asia is expected to grow as cruise lines deploy new, larger vessels that have been purpose-built for Asian consumers. The coming generation of ships will replace older vessels and, when coupled with new cruise infrastructure in several Asian destinations, they are expected to fuel strong interest among travellers. The result is likely to be a return to growth for cruising in Asia after a slight decline this year.”

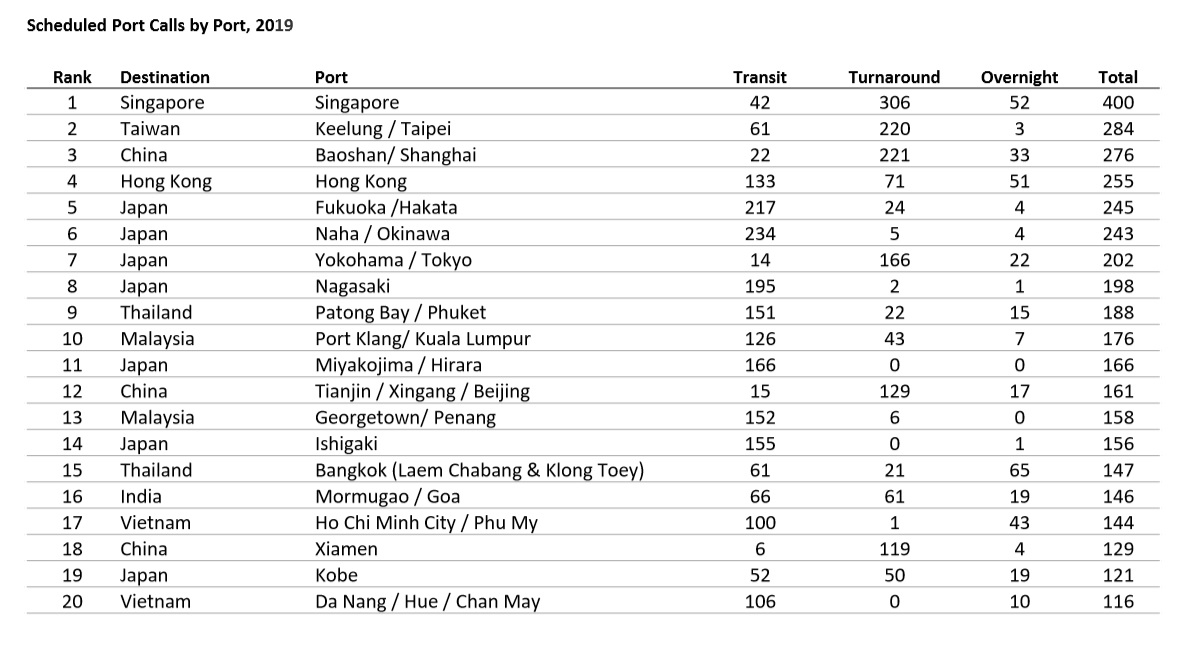

While total port calls to Asia will remain relatively flat this year at 7,154, a few destinations will see good growth. By size of market they include Malaysia (+22.5%), Singapore (+7.0%), Indonesia (+9.3%) and South Korea (+28.4%).

To access the full CLIA 2019 Asia Deployment and Capacity report, click here.