Since January when the COVID-19 crisis began, The Moodie Davitt Report has provided a daily update of the latest case and death tolls globally and from the key travel retail markets of China and South Korea. Today we evaluate the latest numbers through some comparitive analysis from six months ago, early into what would become a nightmare period for our industry.

The comparison is instructive in evaluating how different countries have been affected – and how they have responded – since. The numbers also help paint a picture of where the best prospects for travel retail recovery lie.

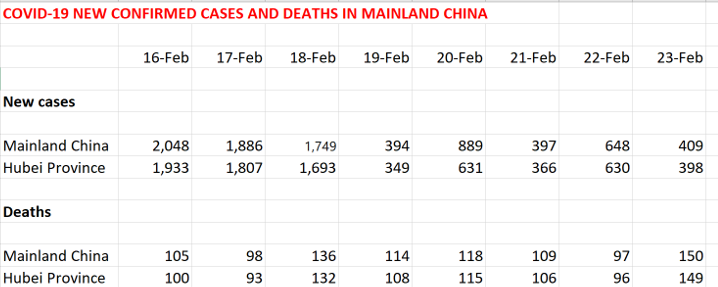

On 23 February, China recorded 409 new daily infections, 398 of them in the coronavirus epicentre of Hubei province. That day there were 150 deaths nationwide, all but one in Hubei. But those figures, though high, were already a sharp improvement on those of a week earlier (see table). Swift action by the authorities, a total lockdown of the Hubei capital of Wuhan, and a great sense of civic responsibility ever since have driven a remarkable turnaround across not just the Mainland but all of Greater China.

When new waves have emerged, such as those in Beijing, the Xinjiang Uygur autonomous region and Hong Kong, they have been dealt with swiftly (the situation in Hong Kong, which saw a worrying spike over recent weeks, continues to improve rapidly). Look at today’s numbers (below) reported by The National Health Commission of the People’s Republic of China. No locally transmitted cases across the Mainland for six days running. No cases in the Xinjiang Uygur autonomous region (there were 112 as recently as 30 July and the authorities were deeply concerned) and just 26 in Hong Kong. The Mainland authorities claim there has not been a COVID-19 death in four months.

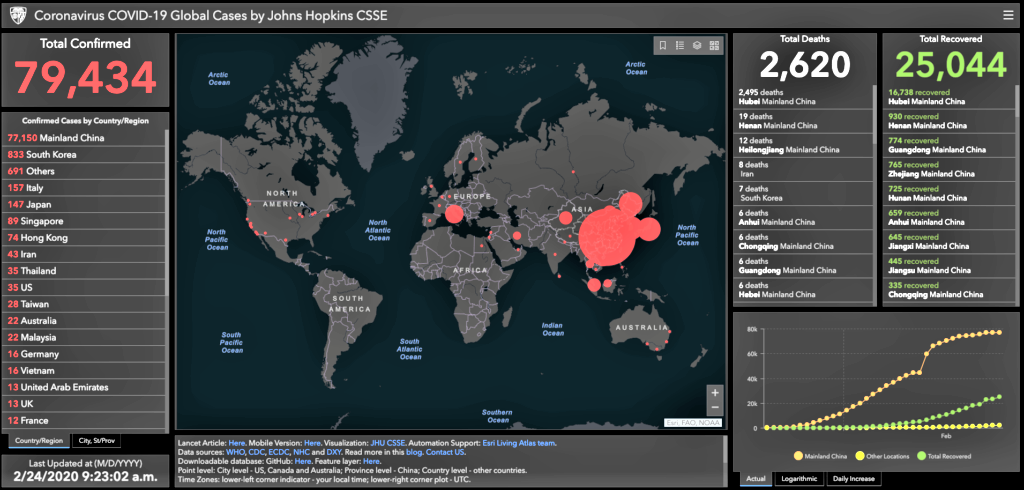

Now look at similar comparisons from Johns Hopkins University in the US, which tracked the pandemic from early on. Our screengrab from 24 February shows that there had been 79,434 cases globally, of which 77,150 were in China with South Korea the next-worst affected nation. Italy was starting to be of concern with 157 cases. The US had posted just 35 cases and the UK just 13.

Roll on six awful months. The figures reveal a tale that few western politicians or media have told. The US now ranks number one in total case numbers and deaths with counts of 5,668,245 and 176,362, respectively. The UK ranks fifth in the death toll with 41,509 and 13th in total infections with 326,595 (a position made to look moderately better by the recent surge in cases across Central and South America, India, Russia and South Africa).

China, in vivid contrast, now ranks a lowly 33rd in case numbers (89,654) and 27th in deaths (4,711), despite a population of 1.4 billion. South Korea comes in at 75th and 76th places, respectively, with 17,399 infections and 309 deaths.

These are important statistics from both a medical and also travel retail perspective. From relatively early on in this crisis it seemed likely that Chinese domestic travel would be one of the first sectors to recover, a factor of crucial industry importance given the existence of offshore duty free in Hainan province. And so it has proved, with a combination of enhanced allowances and categories, ecommerce and other business/consumer-friendly policies driving an extraordinary revival of the offshore business – currently travel retail’s only global hotspot of scale.

So where else do we look for pockets of growth in the relative near term? Given the importance of Chinese shoppers to travel retail, we should focus on where any outbound visitors will want to travel, where they will be allowed to travel, and (importantly in the longer term) where they will be welcomed.

Last week the Singaporean government announced that for travellers from Macao and Mainland China the SHN (stay at home notice) will be shortened from 14 to seven days, effective 1 September. They will also be allowed to serve their SHN at their place of residence, and undergo a COVID-19 test at the end of (rather than during) their SHN. Critically, Singapore also announced the unilateral opening of its borders to travellers from Brunei and New Zealand, both of which have managed the pandemic with impressive effectiveness.

While Singapore is still battling to eradicate its latest wave (it reported 87 new cases today, taking its total to 56,353), it seems likely to be among the earliest countries to benefit from greater Chinese outbound travel. Geographically, South Korea and Japan would be expected to join that group but both countries are witnessing worrying new waves.

New Zealand with its enviable performance throughout this pandemic could join that list, though its combination of geographic isolation and a government determination to keep the virus outside national shores means that any travel bubble with China is likely to be some way off.

Thailand and Vietnam, both hugely popular with Chinese travellers, will certainly be prime candidates for any early revival. Thailand has recorded an extraordinarily low 3,395 COVID-19 cases since the crisis began in January and just 58 deaths. But its government is taking an understandably ultra-cautious approach to opening its borders with most foreign nationals not allowed to enter the country until 31 August. What happens then will be critical to the fortunes of travel retail stakeholders through the balance of the annus horribilis that is 2020.

And Vietnam? Like New Zealand and Thailand it had enjoyed a remarkably low infection rate until a recent surge. Even so, as of today Vietnam had confirmed just 1,014 cases of COVID-19 with 27 deaths. Since 22 March, the country’s borders have been closed to foreign travellers. Only Vietnamese nationals, foreigners on diplomatic or official business, and highly skilled workers are allowed to enter the country. Will the combination of both countries’ low infection rates and the sheer economic importance of allowing Chinese visitors into the country change that on a ‘bubble’ basis?

The Special Administrative Regions (SAR) of Macau and Hong Kong, Malaysia (9,267 cases) and Cambodia (just 273) are the other best prospects for increased Chinese travel outside the Mainland. The Macau authorities have controlled the virus effectively (only 46 cases, all cured), prompting the authorities to this month resume issuing visas under the Individual Visit Scheme (IVS), which has led to an imminent spike in visitor numbers. With the IVS scheme likely to be widened China-wide, travel retailers in the SAR are cautiously optimistic of a late-year flourish to brighten a difficult year.

With many countries in Europe experiencing new waves (and the worry of a winter spike ahead); the US in turmoil; and much of Central and South America (Uruguay a notable exception) reeling, it’s clear that with the likely phased exceptions of certain Middle East, transit-driven locations such as the UAE and Qatar, travel retail’s best bets for near- and mid-term recovery lie intra-Asia.