SOUTH KOREA. In late December Incheon International Airport Corporation (IIAC) issued the long-awaited Request for Proposals (RFP) for the duty free retail concessions at Terminals 1 and 2 at the country’s main gateway.

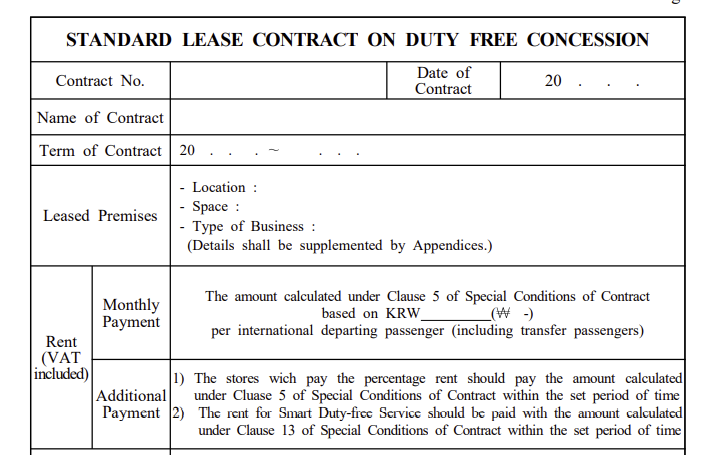

The multiple contracts grouped within seven packages will each run for ten years with no extensions. Opening dates are set for 1 July 2023, unless an incumbent’s contract expiry means a different start-up timing. In a key change to the previous contract model, concessionaires will pay a monthly rent calculated by multiplying the number of monthly passengers by rent per passenger to IIAC.

Here we present comment and analysis on historically what ranked as the world’s most important single airport retail tender but amid radically changed conditions is now a much more complex proposition.

The Incheon International Airport Corporation view

IIAC says that the revamped tender will strengthen operational stability and business feasibility by integrating seven business licences and adding mobile shopping.

This bid is being conducted “under more uncertain circumstances than ever”, admitted IIAC, quoting factors such as the COVID-19 pandemic; the phase 4 airport construction work; the merger of national airlines (Korean Air and Asiana Airlines); airline relocation issues; a “deteriorating” duty free business environment and institutional changes.

Accordingly, the corporation said it had focused on “relieving the uncertainty of duty free operators participating in the bidding”.

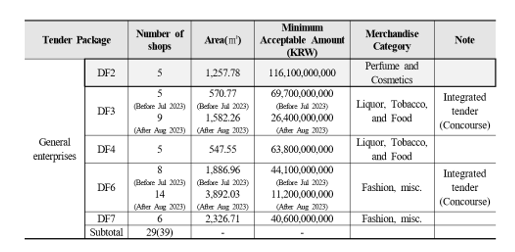

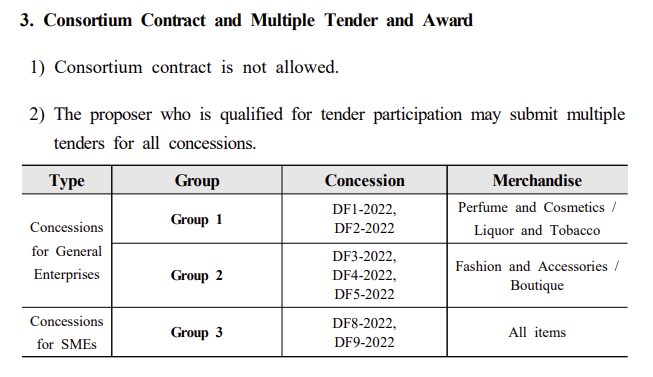

IIAC said that by offering seven business licences (five general licences covering 63 stores, and 20,842sq m of space) and two small and medium-sized (SME) licences (14 stores, 3,280sq m) it has addressed that uncertainty.

The Corporation also noted that in some cases it has consolidated perfumes & cosmetics operations – which it noted are being undermined by competition from other channels – with liquor and tobacco (see DF2-22 and DF2-2022 below) to help retailers. It has also boosted opportunities in the growing fashion & accessories and luxury sectors.

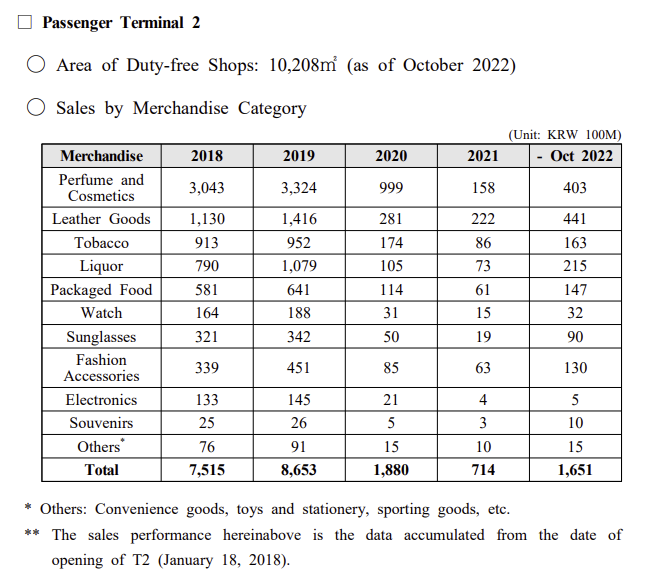

“Inefficient” stores in the Concourse and Terminal 1 have been reduced while store space in the valuable T2 has been expanded by +32.1% to 13,484sq m.

Crucially, all contracts have been extended to ten years (without an extension option) to increase operational stability from the previous default five years + optional five years formula. “It is expected that these stable long-term contracts will minimise the inconvenience of airport users due to any operational vacuum,” IIAC commented.

The rental system (see below), which has been maintained since the opening of Incheon International Airport in March 20o1 in the form of a fixed minimum guaranteed amount, is changed to a ‘rent per passenger’ formula.

This calculates the rent by multiplying the number of airport passengers by the unit price per passenger proposed by the business operator. IIAC says it can be adjusted immediately in situations where the number of passengers fluctuates rapidly (such as with COVID-19), “greatly relieving business operators’ concerns about operational uncertainty”.

Additionally, and, considering the “sluggish” conditions in the duty free business, the mandatory facility investment, which previously had to be implemented twice during the contract tenure, is reduced to just once.

Digital drive, ‘Smart Duty Free Service’

IIAC is also promoting the development of what it called “unique” duty free stores to provide an enhanced customer experience.

The Corporation pledges to provide a higher level of shopping experience by embracing the latest shopping trends using smart technology, biometric-based payment services, and creating experiential stores using new IT technologies.

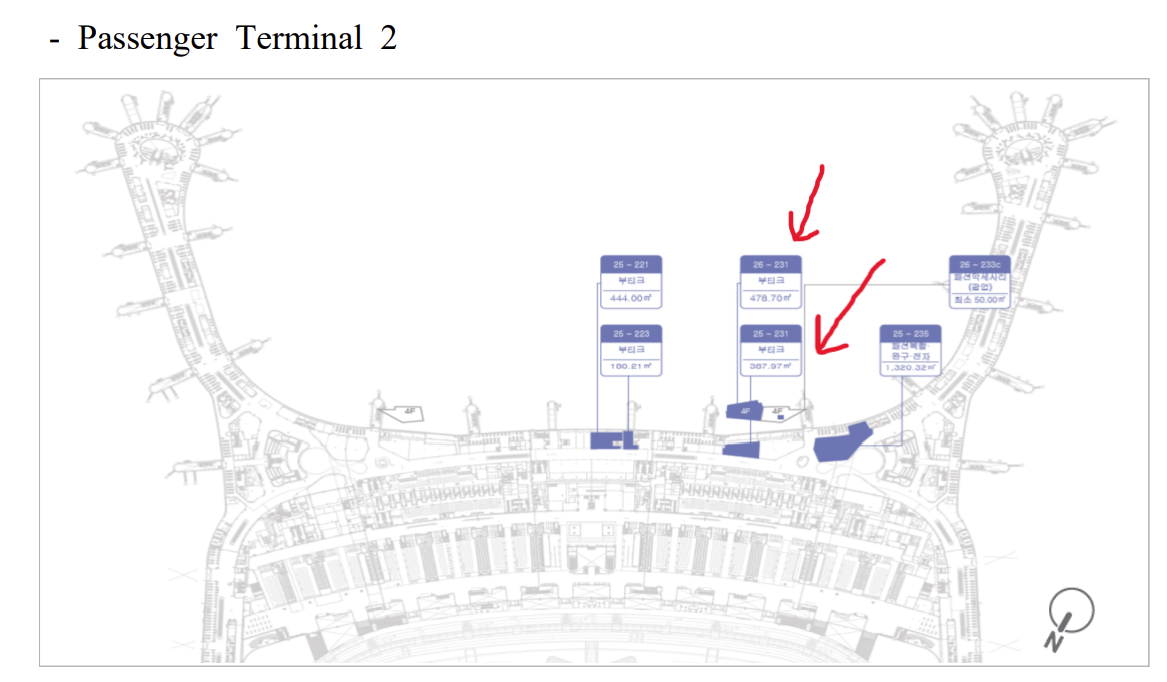

In addition, Incheon Airport’s first duplex duty free stores will be introduced in the east and west departure halls, the core areas of Terminal 2. IIAC said it plans to provide a new duty free shopping experience for airport users by attracting internationally renowned luxury brands that connect the 3rd and 4th floors through the duplex formula.

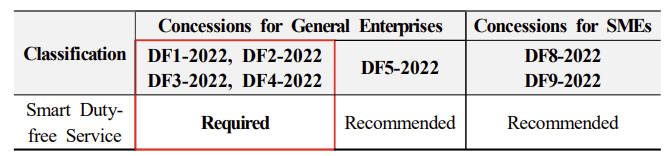

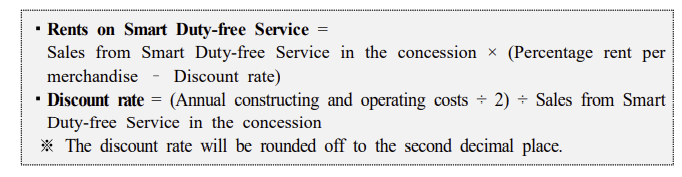

In addition, the ‘Smart Duty Free Service’ will be introduced, allowing passengers to purchase duty free products from airport shops anytime from pre-travel at their homes to shortly before boarding the plane. Shoppers can conveniently pick goods up at stores rather than traditional Incheon International Airport pick-up points.

IIAC believes the Smart Duty Free Service will provide passengers with a more convenient shopping experience by alleviating purchasing time constraints – a limitation, it claims, of existing downtown and online duty free shops.

IIAC believes the Smart Duty Free Service will provide passengers with a more convenient shopping experience by alleviating purchasing time constraints – a limitation, it claims, of existing downtown and online duty free shops.

Incheon International Airport Corporation CEO Kim Gyeong-wook said, “As the number of daily passengers at Incheon Airport recently exceeded 120,000 and China – an overseas country that accounts for the largest portion of airport duty free shop sales, completely lifted COVID-19 quarantine measures, airport operations are rapidly normalising.

“Considering the current situation, we plan to promote bidding quickly to avoid customer inconvenience,” he said. “By successfully conducting this bidding in the post-COVID-19 era, we will regain our competitiveness as the world’s No. 1 airport duty free shop.”

Industry reaction (all sources quoted below requested anonymity)

1.

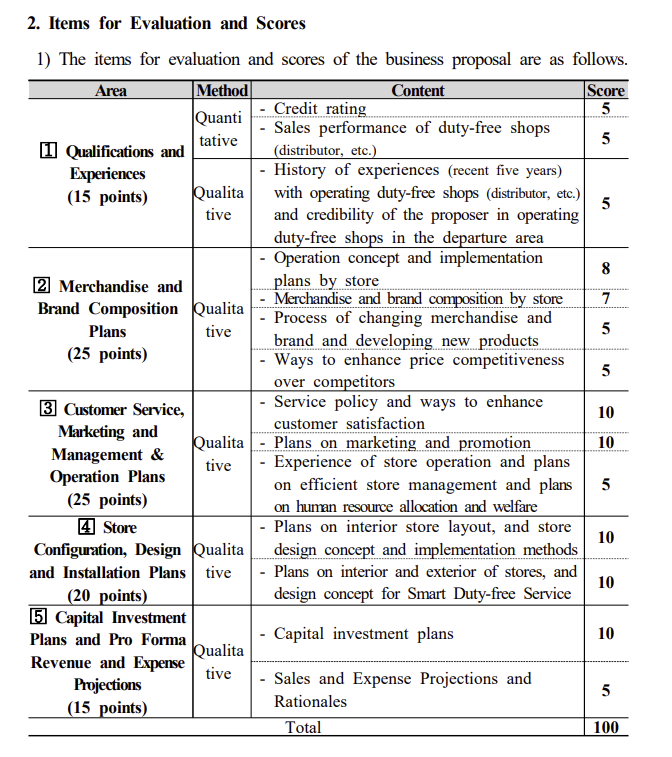

Applauding the longer, ten-year contracts, one seasoned travel retail executive noted that the investment required for the duplex stores based on the same tender conditions as other luxury spaces makes the economics difficult.

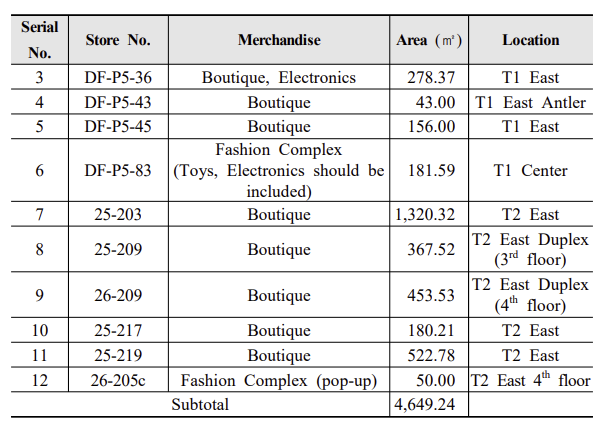

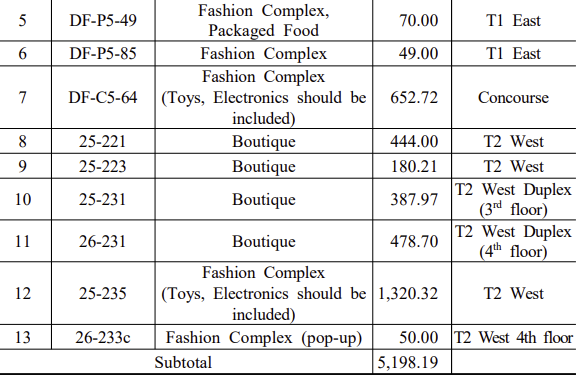

Though noting the attractive total duplex space of some 821sq m in T2 East and 867sq in T2 West, he said that many luxury brands would likely prefer the single level opportunities, particularly the large 522.78sq m 25-219 (East) boutique and 25-221 (West) with 444sq m {Note: the sizable 1,320.32sq m 25-203 T2 store shown as ‘boutique’ includes toys, electronics and packaged food.}

“The capital investment will be quite high and the second floor space is tricky due to [passengers carrying] luggage so I am not sure this works on the same conditions as other stores,” he said. The Hong Kong International Airport icon store [duplex] tenders enjoyed separate conditions from other luxury concessions with a longer term (seven years vs five), and much lower minimum monthly guarantee and minimum percentage rents, the source noted.

“In the best-case scenario, the second floor is half as productive as the first and in the more likely case 30%. Based on the same commercial conditions, that doesn’t really fly. The difference is two to three times the capital investment [for a duplex store].

“Capex huge, staffing higher, and commercial conditions the same,” he concluded. “Probably 60% of the capex and 75% of staffing needed {in single-level boutiques} for 80-90% of the sales potential {of the duplex}.”

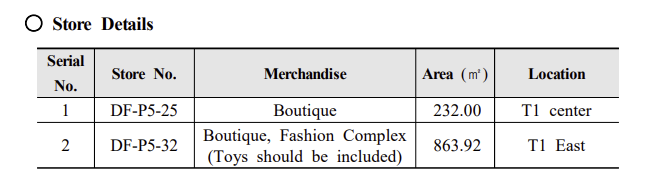

DF3-2022 Concession (Fashion, Accessories and Boutiques)

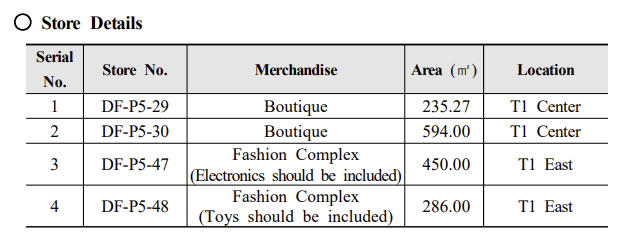

DF4-2022 Concession (Fashion, Accessories, and Boutiques)

2.

“The ten-year term is good but the starting date of 1/7/23 is tight given the complexity,” said another veteran travel executive with experience of multiple tenders. “There are 77 outlets in total – albeit broken into packages and terminals and categories.”

The source believed Incheon is a high operating cost environment. “Lots of smaller stores and lots of replication means higher labour to sales cost,” he said. “Also, there are lots of additional storage/office spaces that you need to rent.

“The sales per sq m are -20-30% less than you might find in a typical duty free operation but this is probably due to the amount of duplication and the inclusion of fashion boutiques.”

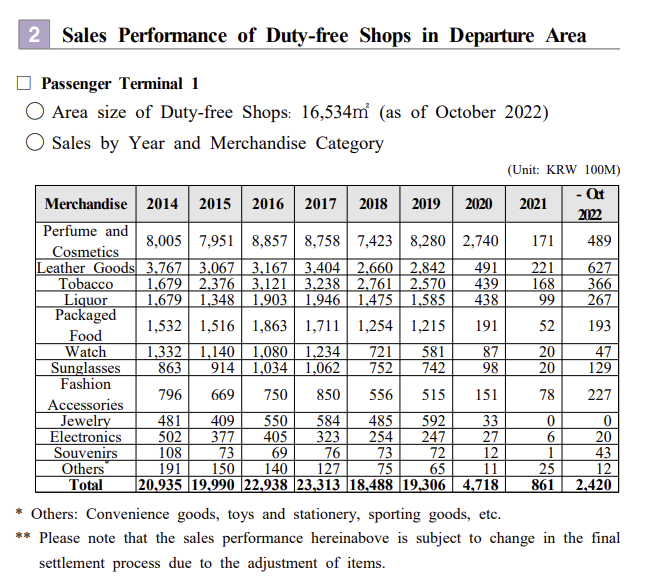

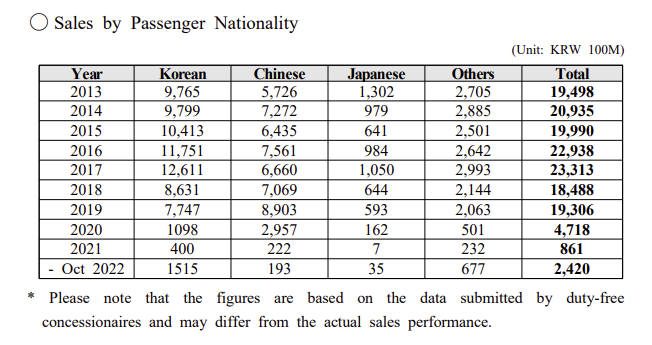

Commenting on the rent per passenger formula, he noted, “This looks like it manages downside pax risk, but it comes with a big risk in the sales by nationality mix {see tables below}– given that one nationality (Chinese) accounts for 42% of all sales but only 19% of all pax.

“This means the PSR is much higher for PRC pax than others. An adverse change in the mix could be very material to rent as a percentage of sales. The remedy of course is a rent per pax by nationality. This is how Sydney Airport, for example, dealt with the PRC pax mix risk.”

3.

Another prominent industry figure questioned whether there was any real chance of a foreign bidder winning one of the contracts.

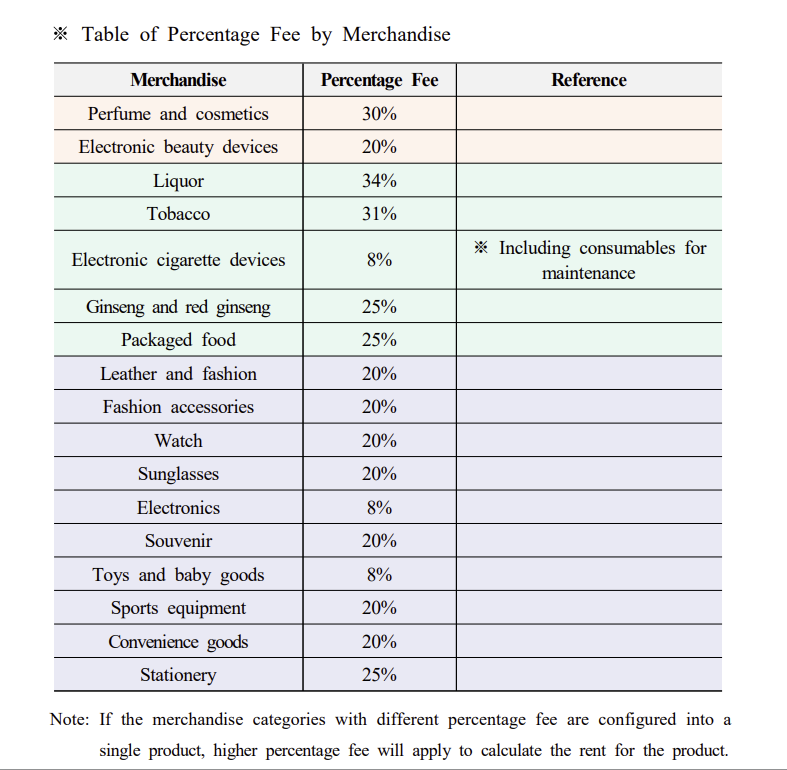

He also noted that the percentage fee by merchandise category shows 34% for all liquor, not just spirits, which will penalise wine sales.

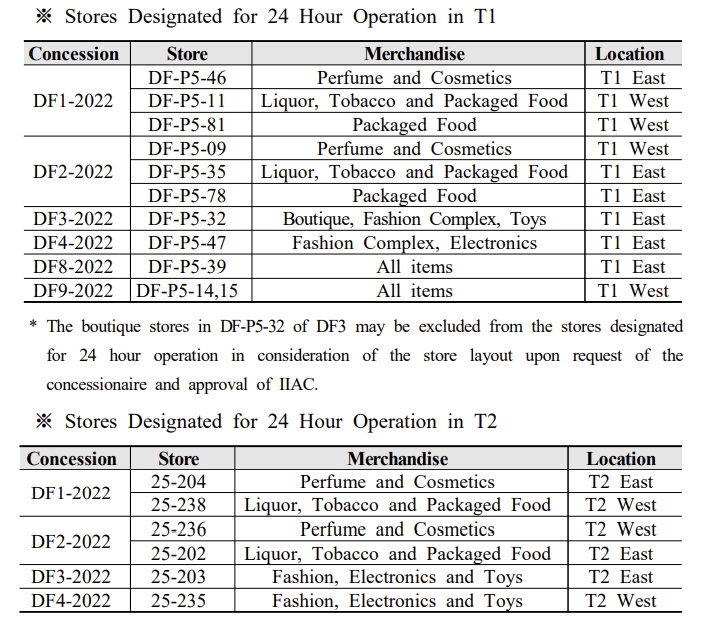

The source noted that all but two of the concession groups require the store to be open 24/7 (see below). He also thought clarification on the fees payable for items sold online and collected in-store was needed, noting along with other observers that more details were needed over the Smart Duty Free Service.

4.

An experienced Korean travel retail executive also applauded the long-term nature of the contracts but described the timeline to final bids as “very tight”.

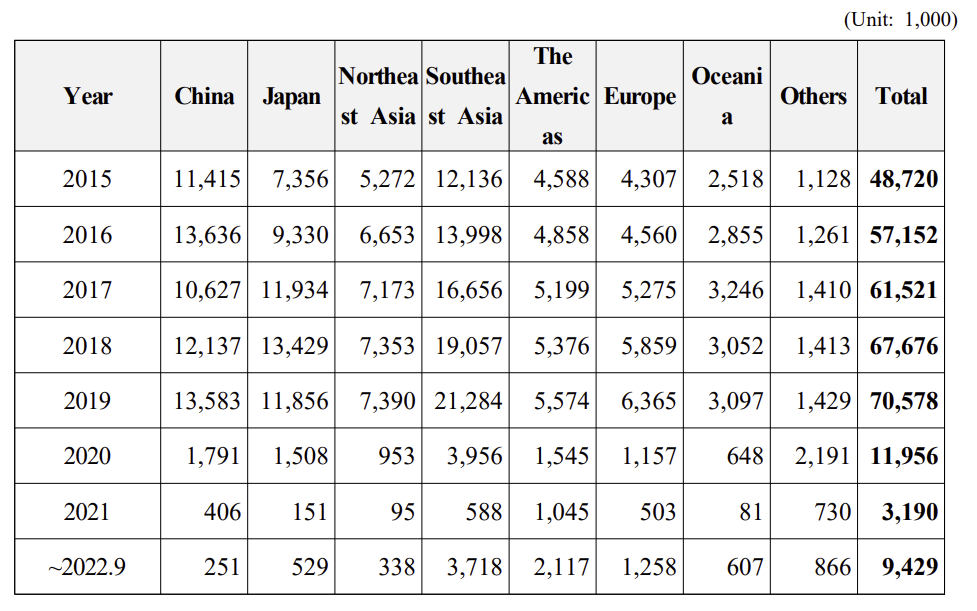

“The ten-year term is very attractive but Incheon is not as commercially attractive as before,” he cautioned. “The government expects 2 million Chinese will visit Korea next year while 6 million visited in 2019. Also, Incheon’s position as a prominent leading hub airport linking Asia to the world has deteriorated due to the competitors’ expansion and development.

“The worst thing is that during the pandemic Korean duty free retailers have supplied duty free products to China through the daigou channel in quantities that are too big and at prices that are too low. Chinese do not need to buy luxury items in Korean duty free offline anymore.”

He also noted the exit by Louis Vuitton and other luxury houses from Korean downtown duty free stores and pondered whether some brands might be sufficiently motivated by the airport opportunity.

Asked for his view on that, one international brand executive told The Moodie Davitt Report, “The airport still offers good potential but the economics [as per the tender] don’t appear to be there.”

Financial and business proposals

5.

A fellow Korean travel retail expert said the two combined P&C/Liquor & Tobacco packages are likely to attract most attention, far more than the fashion and boutique-focused packages.

He also felt the MAG per pax would prove problematic because any increase in passenger numbers may actually coincide with a spend per passenger decline.

On Smart Duty Free Service, he cautioned that the larger Korean duty free retailers will prefer to sell the same items at their downtown shops rather than through the airport site to avoid additional rent costs.

“According to the airport’s plan, the passengers will need to make orders by mobile and pick up from the airport shop,” he added. “If they need to visit the airport shop anyway, why do they have to order online? They can just directly pick up and pay.”

THE MOODIE VIEW

THE MOODIE VIEW

Undoubtedly some of the queries and concerns raised above will be addressed by the various bidders and IIAC in discussions over coming weeks. The prospective concessionaires will be doing some hard thinking and rigorous calculations during the short timeline before their offers must be tabled.

Historically, the Incheon International Airport tender was viewed as one of the most attractive opportunities in the travel retail industry by dint of its size (along with Dubai Duty Free at Dubai International Airport, always number one or two single airport duty free location over recent years) and enviable passenger profile (Koreans, Chinese and Japanese dominated).

But the pandemic has made the ‘sell’ of the airport retail opportunity much more difficult for IIAC, as evidenced by the multiple failure to attract bidders for the T1 tender (now combined with T2) through the pandemic-ravaged 2021.

Given the commercial trauma of the 2020 to mid-2022 period all Korean travel retailers have been through, this tender represents a particularly delicate blend of opportunity and risk. The latter is accentuated by prevailing uncertainty regarding the lingering pandemic; the timing and speed of the return of Chinese travellers; and concerns over the Korean and global economic climate.

As a result, caution bordering sometimes on reluctance, even disinterest, was bound to be a common reaction among bidders if IIAC had adopted a traditional minimum guarantee formula.

To its credit, the Corporation has attempted to address such concerns and added in the critical allure of long-term contracts.

What will those ten years bring? Will we see more volatility medically, economically and politically? More positively, will the imminent return of Chinese outbound travel spark a period of intense revenge spending to mirror the surge in outbound travel?

IIAC has attempted to remove as much uncertainty as it can in terms of the tender model. It will be fascinating to see how Korean retailers (and possibly their international counterparts) assess the risk/reward balance implicit in any tender but especially in one issued towards the end (we hope) of the most severe and sustained crisis in travel retail history. ✈

Note: The Moodie Davitt Report is the industry’s most popular channel for launching commercial proposals and for publishing the results. If you wish to promote an Expression of Interest, Request for Proposals or full tender process for any sector of airport or other travel-related infrastructure revenues, simply e-mail Martin Moodie at Martin@MoodieDavittReport.com.

We have a variety of options that will ensure you reach the widest, most high-quality concessionaire/retailer/operator base in the industry – globally and immediately.

The Moodie Davitt Report is the only international business media to cover all airport or other travel-related consumer services, revenue-generating and otherwise. Our reporting includes duty free and other retail, food & beverage, property, passenger lounges, art and culture, hotels, car parking, medical facilities, the Internet, advertising and related revenue streams.

Please send relevant material, including images, to Martin Moodie at Martin@MoodieDavittReport.com for instant, quality global coverage.