INTERNATIONAL. The Moodie Davitt Report Senior Retail and Commercial Analyst Min Yong Jung investigates the impact of the coronavirus outbreak on travel companies across the world.

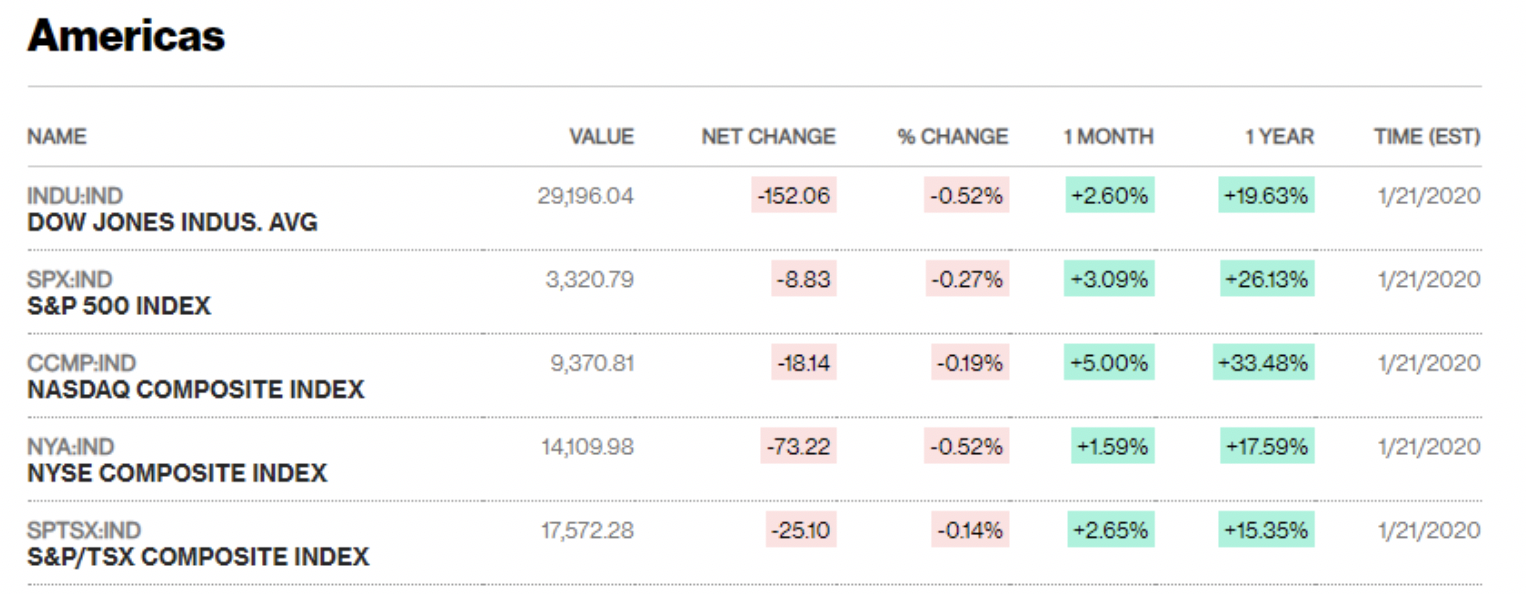

Key indexes for the US economy pulled back on Tuesday afternoon after the US Centers for Disease Control & Prevention confirmed the country’s first case of the coronavirus that originated in Wuhan.

The Dow Jones Industrial Average (-0.5%) and S&P 500 (-0.3%) were both down on the day before, with the share price of travel, retail and luxury companies dropping amid concerns the virus could spread faster than first anticipated. Airline stocks closed in the red, epitomised by American Airlines (-4.2%) and Southwest Airlines (-2.7%), as did shares of casino and hotel companies Wynn Resorts (-6%) and Las Vegas Sands (-5%).

The US markets followed in the footsteps of Asian markets that recorded heavy losses across the board in Tuesday’s trade. Benchmark indexes in Shanghai, Tokyo, Hong Kong and South Korea all retreated following the Chinese government’s announcement of additional fatalities, a sudden jump in new cases and cases of infections being transmitted from person to person.

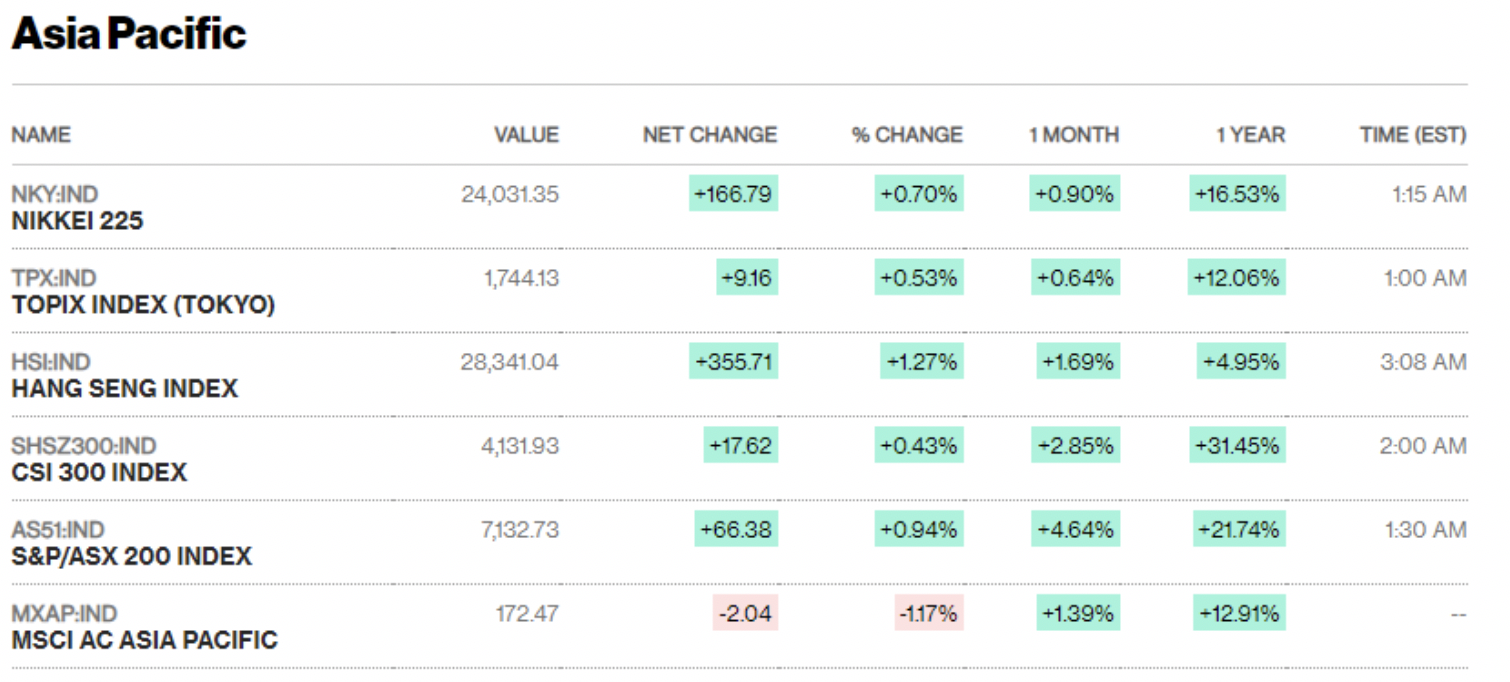

Hong Kong’s Hang Seng Index closed down -2.8% in its biggest one-day drop this year, while China’s Shanghai Stock Exchange Composite Index dropped -1.4%.

Asian markets recovered from some of their losses in trading today (22 January). Korea’s KOSPI was up +1.2%, Hong Kong’s Hang Seng Index rose +1.1%, Japan’s NIKKEI 225 increased +0.7% and China’s Shanghai Stock Exchange Composite Index was up +0.3%.

Despite Asian stocks recouping some of their losses today, investor sentiment is strikingly different this week compared to the positive tone set from last week’s US-China Phase 1 deal agreement signing. UBS Global Wealth Management CIO Mark Haefele had remarked that “the benefits of a phase one trade deal should accrue more to Asia and China” in a note to investors suggesting emerging-market equities are set to outperform this year.

The Chinese Yuan, which strengthened with the signing of the trade agreement, fell to its lowest in over a week and was down -0.6%. Currencies linked to Chinese trade were also weak as risk appetite waned: the Australian Dollar was down -0.2% and the Korean Won down -0.6%. Risk-averse currencies such as the Japanese Yen and the Swiss Franc gained, the Japanese Yen increased by +0.2% and the Swiss Franc was up slightly by +0.1%.

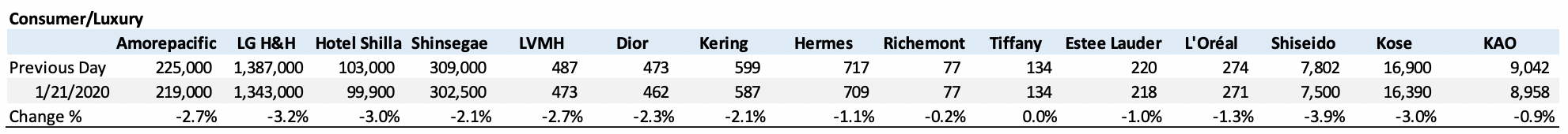

The share price of companies engaged in tourism were widely affected globally, and most underperformed their respective benchmarks. Among major consumer and luxury brand owners, Shiseido saw the largest decline for the day (-4.3%).

Among Airline stocks, Japan Airport and United Continental were worst affected on 21 January with declines of -4.5% and -4.4% respectively.

The new coronavirus and rapid spread are a key concern that is weighing on the stock market. An increase in travel volume and distance by Chinese nationals for the Lunar New Year is a concern. During the SARS outbreak of 2003, the virus spread into Vietnam and Canada in the month following Chinese New Year.

However, a look at the share price of key benchmarks during SARS shows a limited impact on the stock markets as a result of global outbreaks. The Hang Seng Index was at an average of 9,182 when media reports of infections were widespread in February 2003, but closed at 9,657 (up +5.2% compared to February 2003) on 23 June 2003 when the WHO removed Hong Kong from its list of affected areas.

Considering the multiplicity of competing factors affecting the stock market, isolating an impact of a single event on the stock market is difficult. This can make it hard to use the stock market as an indicator for the financial impact of global events.

NOTE: Given the serious implications of the coronavirus outbreak for the aviation, tourism and travel retail sectors, The Moodie Davitt Report is running live updates from around the world. Click here for the latest.