INTERNATIONAL. The scale of air passenger traffic recovery hinges greatly on the “known unknowns” facing the COVID-19 hit world, according to Airports International Council (ACI) World Vice President Economics Patrick Lucas. He was speaking at a Duty Free World Council seminar on Wednesday titled 2021 – The Year of Recovery?.

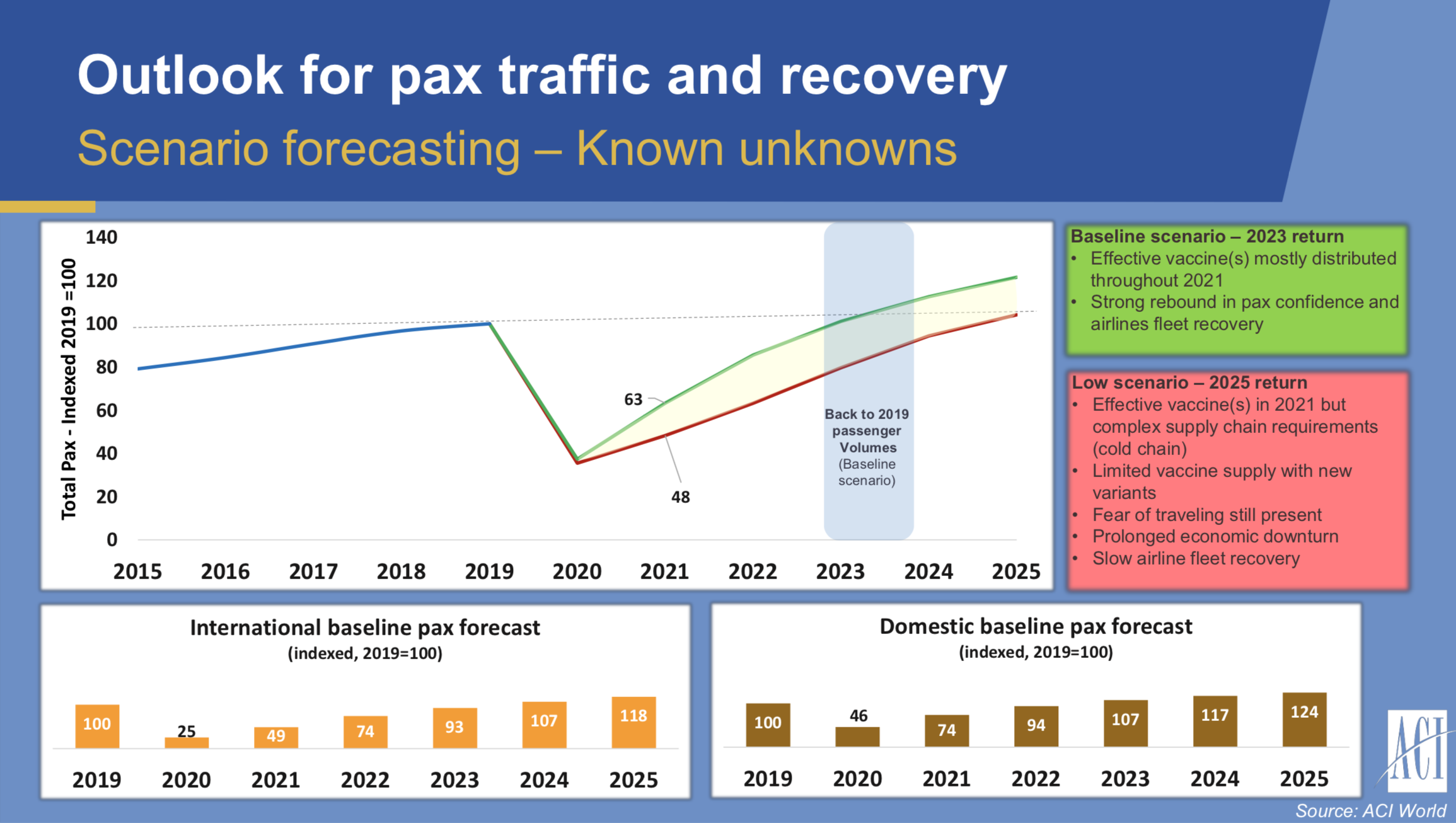

ACI forecasts a recovery to 2019 passenger levels by the end of 2023 or into 2024, but Lucas warned that this target could stretch into 2025 for the key European and North American markets. (Click here for our earlier story on ACI forecasts.)

The global airports association also predicts that air traffic should rebound to over 50% of 2019 levels by the end of 2021, up to a maximum of 65% in its most optimistic scenario.

All of the above, as Lucas noted, is dependent on the continuing spread and containment of the coronavirus pandemic, the imposition of travel restrictions by world governments and the speed of COVID-19 vaccine roll-outs over the course of 2021.

As a result, Lucas declared that making forecasts for air traffic recovery have “some degree of randomness making it a challenge for predictions”.

He pointed to solid international guidance material and recommendations from an array of international organisations to aid air traffic recovery, including ACI and the International Air Transport Association (IATA), working together. But, he noted, “governments continue to react and act unilaterally for the most part”.

“Reinvigorating the sector by building up passenger confidence has become paramount” – ACI World Vice President Economics Patrick Lucas

Lucas said recovery for the sector requires governments to introduce a consistent testing process to promote travel. He said: “We need to move away from restrictive quarantine measures with a coordinated and risk-based approach, which combines both testing and vaccinations as the way forward.”

Addressing the question of whether 2021 could see a meaningful recovery in air passenger traffic, Lucas said he expects a notable improvement on 2020, and that “the darkest days are behind us”, with the steepest traffic declines having already been witnessed.

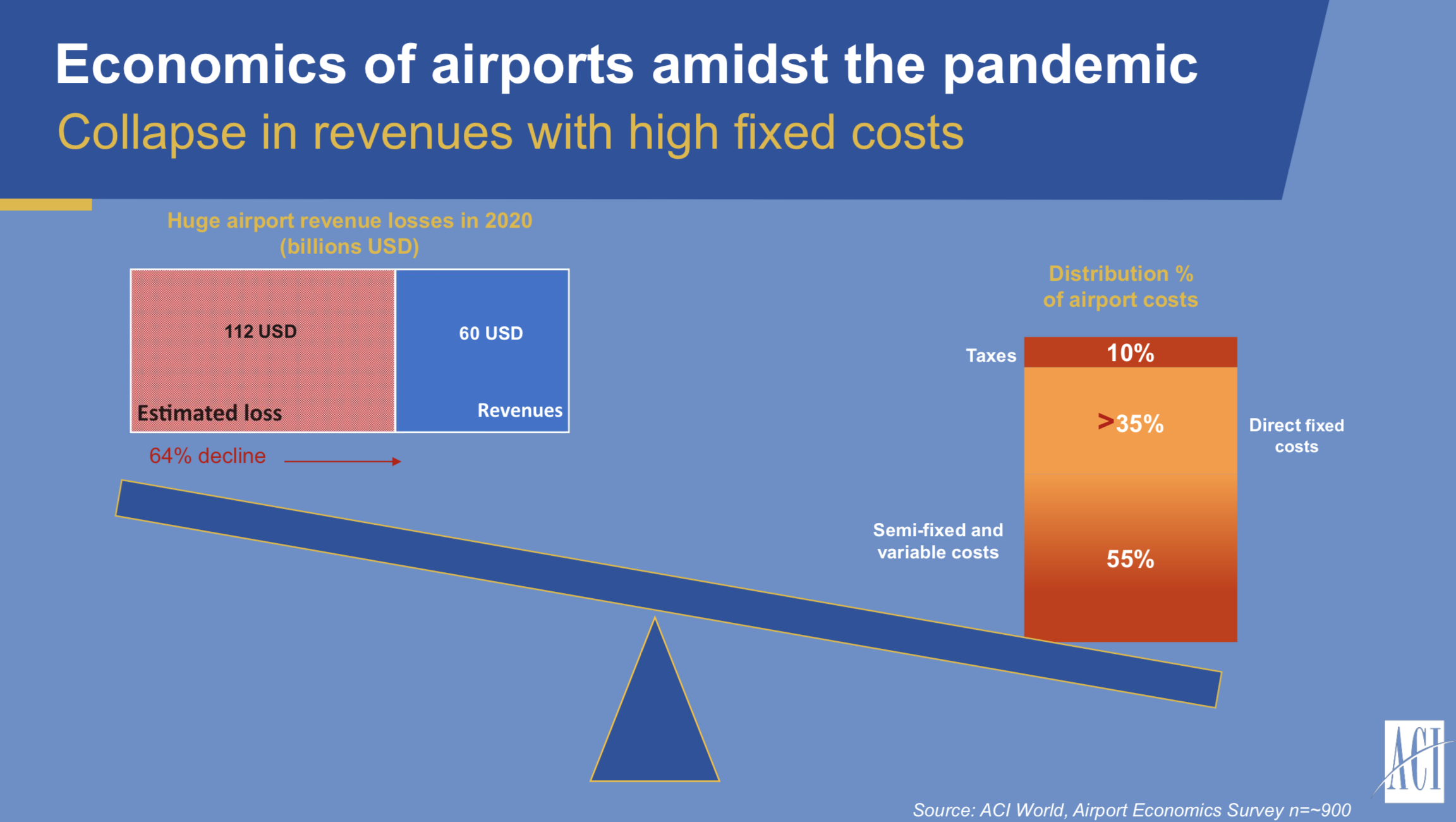

Lucas, speaking from Montreal, reported that global air passenger traffic was down by -63% across 2020, with an estimated six billion passengers removed from the projected baseline set down before the start of the year. According to ACI figures, this translated into estimated losses of US$112 billion in the airport industry.

Putting that figure into perspective, he calculated that this translates to the world’s 85 busiest air travel hubs having their revenues wiped out for the year.

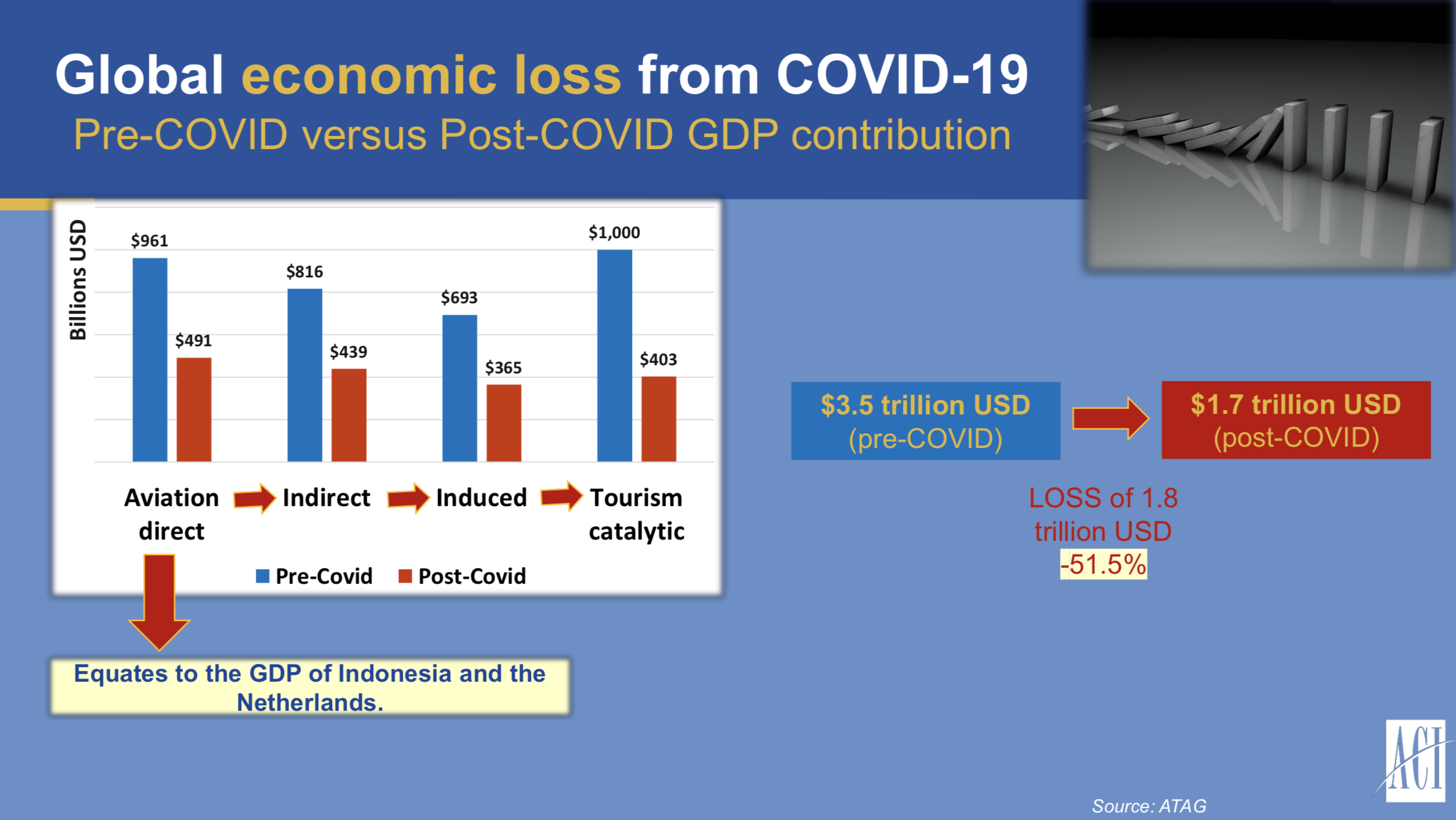

He also highlighted the knock-on financial effects to the wider travel business – including hotels, restaurants and retail – noting that 57% of global tourists would arrive by air in a typical year. Lucas said this translates into a US$1.8 trillion drop in GDP for 2020 which would usually be supported by aviation, adding: “This is due to a slow recovery impacting the catalytic benefits of aviation-supported tourism, but also a reduction in investment by airports, airlines and other parts of the sector.”

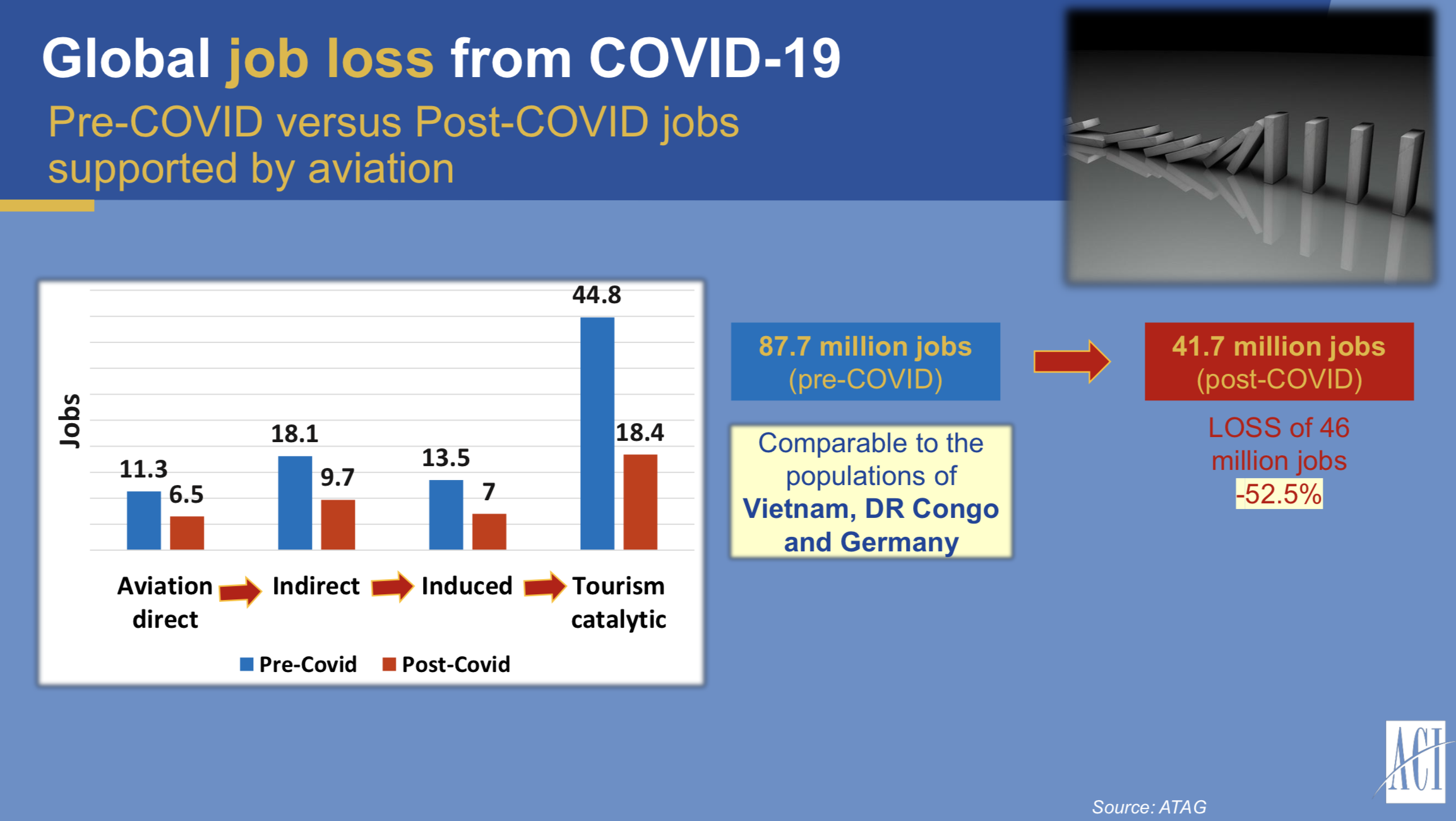

Looking at employment factors, Lucas also warned that, according to ACI’s calculations, 4.8 million direct aviation-related jobs could be lost once government wage support schemes conclude. Of all the sectors within this ecosystem, the largest decline – up to -55% – will be felt by those working on airport sites including duty free, retail, car rental, airport administration and other services, Lucas observed.

Looking ahead to the prospects of recovery for 2021, Lucas said the main ingredients to support air travel demand will relate to consumer confidence, namely the “fear factor” to travel, vaccine roll-outs and the alleviation of travel restrictions. “Reinvigorating the sector by building up passenger confidence has become paramount,” he said, noting that as of 31 January only Israel had achieved a high vaccine penetration rate.

Continuing on the vaccine theme, he added: “Another quasi known unknown is related to the vaccine divide between those who want to take it versus those who are reluctant to take it. And there is a rising divide that also exists between advanced economies versus developing economies in terms of who gets into the queue first, for the vaccines. All of these factors contribute to the timing and velocity of the industry recovery.”

On the subject of consumer confidence, Lucas cited an Autumn 2020 ACI survey of 4,100 travellers across the world, who had travelled by air in 2019. More than three quarters of respondents (76%) mentioned that they will not travel if they need to quarantine. This proportion becomes significantly higher among vacation travellers, at 85%.

Addressing supply side factors, he said the airline industry has “literally physically shrunk”. He said that large airlines which have retired four-engine passenger wide-body aircraft such as Airbus A348/A380 and Boeing 747 will not replace them in many cases, given the current state of the market. A combination of this, and other, supply side factors, Lucas noted, will contribute to a predicted decline of -38% in scheduled seat capacity for the first quarter of 2021 (OAG figures).

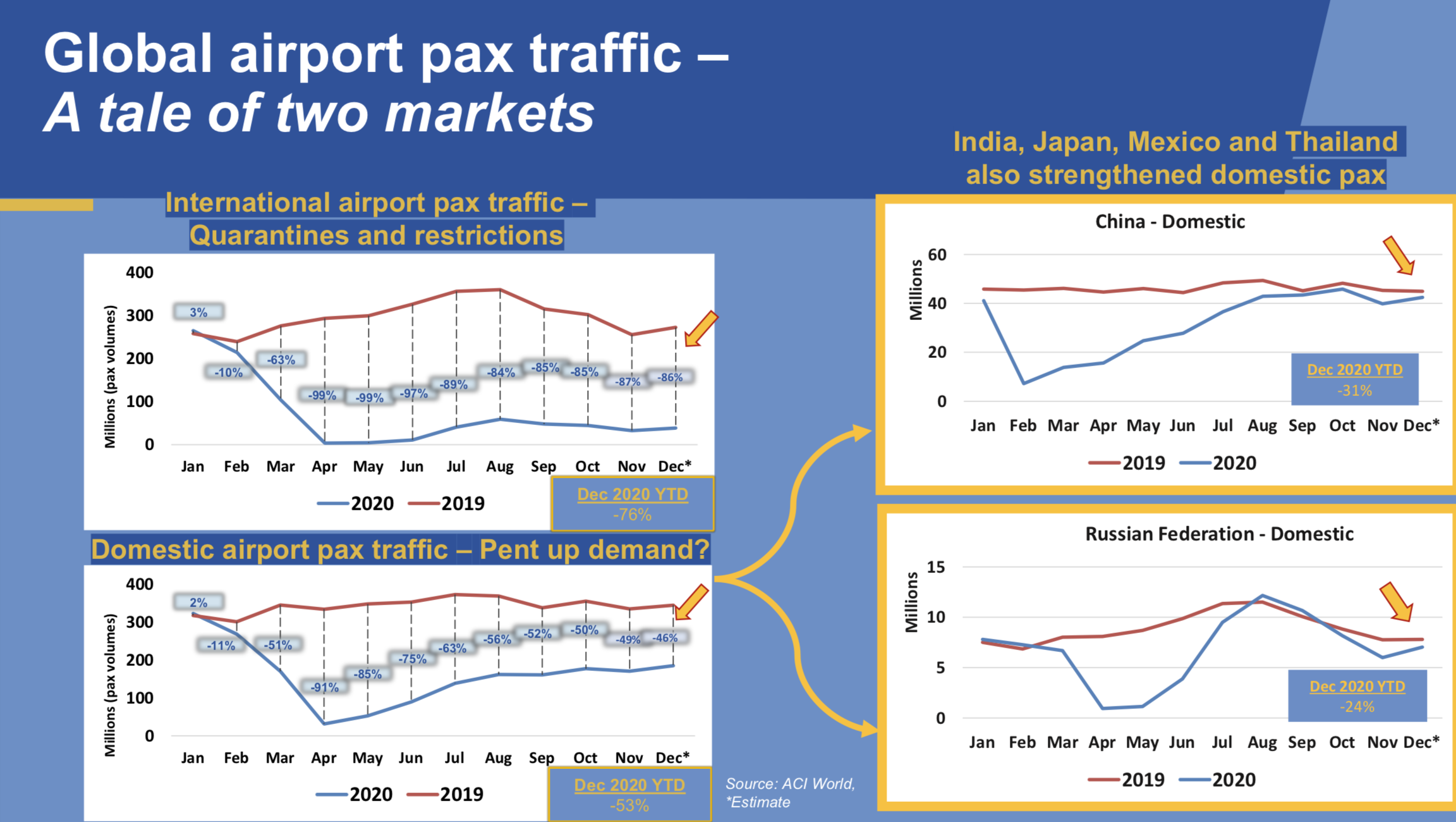

On a more positive note, Lucas said that domestic air travel – down by -46% in December 2020 – is showing some positive signs with the major markets of China and Russia “just about” recovered. Other big domestic markets such as the US, India, Japan, Mexico and Thailand, he noted, are also now accelerating their recoveries.

International passenger traffic (down -86% in December 2020), however, will recover much more slowly, Lucas predicted. He added: “Tighter international restrictions have recently been put in place in some major markets, so we will see the biggest uptick as a result of pent up demand on the vaccine rollout in H2.”

Looking at the overall picture, Lucas said that ACI expects traffic levels – “guided by the strength of some major domestic markets” – to be somewhere above 50% of 2019 levels this year, up to a maximum of 65% in the most optimistic scenario, as noted above.

Considering the longer-term air traffic recovery picture, and assuming that the bulk of vaccines will be rolled out in 2021, traffic is expected to get back to 2019 levels by the end of 2023 according to ACI’s predictions. However, negative factors relating to COVID-19 (such as new variants) and the timing of vaccine roll-outs could push that recovery well into 2024, Lucas said, and in the case of the more mature air passenger markets of Europe and the US, even into 2025.

Considering the traffic picture even further ahead, Lucas stated that he believes the long-term fundamentals of air travel market growth remain, with 80% of the world’s population residing in emerging markets and developing economies.

Lucas concluded: “I want to remind us all that, despite the crisis, despite the human atrocity that has come with this, we’ve also seen the introduction of different opportunities to innovate, bringing the passenger centre stage and we are going forward with a potentially unified or consolidated business model based on technological solutions.”

“Some kind of digital system is urgently needed to cope with the future upswing in passenger volumes” – Duty Free World Council President Sarah Branquinho

Also contributing to the webinar were senior representatives from regional duty free and travel retail associations, who gave updates on advocacy efforts and COVID-19 travel restrictions across the world.

They included Duty Free World Council President Sarah Branquinho, European Travel Retail Confederation Secretary General Julie Lassaigne, ASUTIL Secretary General José Luis Donagaray, APTRA Executive Director Christina Oliver, MEADFA Vice President Sherif Toulan, Frontier Duty Free Association Executive Director Barbara Barrett and IAADFS Chairman René Riedi. The session was moderated by TFWA Managing Director John Rimmer.

Branquinho had opened the webinar by highlighting the potential of IATA’s digital Travel Pass solution in reducing the “extraordinarily long time” air passengers are currently facing at check-in with documentation required including fit to fly certificates, proof of nationality, proof of residence and in some cases proof of valid emergency reason to travel.

This has a negative knock-on effect on the amount of time travelling consumers have to shop in airport retail. Branquinho said: “Some kind of digital system is urgently needed to cope with the future upswing in passenger volumes.”

She added: “Looking to the future, IATA envisages an extension of this technology to enable seamless travel, with digital facial recognition at each stage of the journey. This will be a bigger hurdle as governments and citizens will be concerned to protect personal data.

“But for our industry, the concern is that replacing boarding passes by digital facial recognition may leave us with challenges on fulfilling our agreements with our customs authorities and could also have an impact on passengers’ perception of speed of travel through airports, reducing dwell time.”

Branquinho also said that she and her DFWC colleagues have recently reminded IATA that duty and tax free retail are an integral part of the total aviation business model and that safeguards need to be built in “to protect our ability to make those sales”.

She continued: “It is something we’ll be working on with IATA and that we all need to remember when discussing a digital future with our airport and airline partners.”

Meanwhile, in their updates, Donagaray and Riedi encouraged attendance at the forthcoming virtual Summit of the Americas, which is being staged by IAADFS and ASUTIL in partnership with The Moodie Davitt Report (5-9 April).

Riedi said: “The exhibition is an excellent opportunity for people from the travel retail industry to contact virtually their counterparts. It has an educational element which will be very important as we look towards recovery. There is a very impressive line-up of speakers covering quite a list of topics.”

More detail on the event appears below. Click here for our latest story on the Knowledge Hub (conference) line-up.

The Summit of the Americas – A Virtual Experience

Click on the video above for an explanation of how the virtual Summit of the Americas event works for exhibitors and visitors

To learn more about this opportunity, please download the 2021 Virtual Summit Information Briefing. For virtual stand reservations or media, please contact Irene Revilla at Irene@MoodieDavittReport.com.

You can access the event’s web site here.

For general questions about participation in the Virtual Summit, please contact Steven Antolick for further assistance.