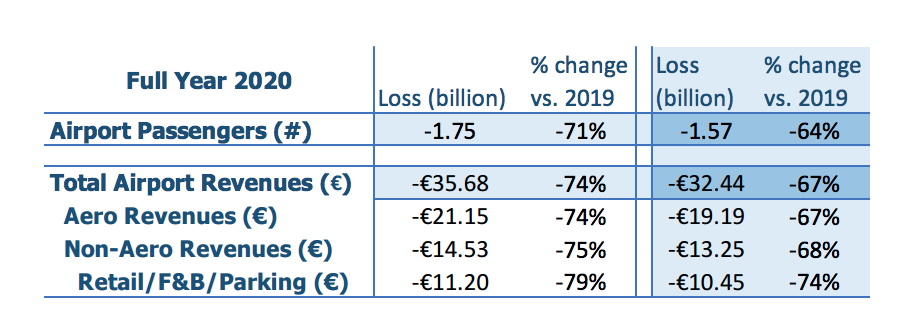

EUROPE. Non-aeronautical revenues at Europe’s airports will fall by an estimated -68% year-on-year in 2020, or €13.25 billion, according to the latest data from Airports Council International (ACI) Europe. Within this, said the organisation, retail, F&B and parking revenues would decline by -74% or €10.45 billion.

The figures emerged as ACI Europe forecast a -64% fall in traffic for 2020 compared to 2019, alongside a -67% slide in overall airport revenues (-€32.44 billion).

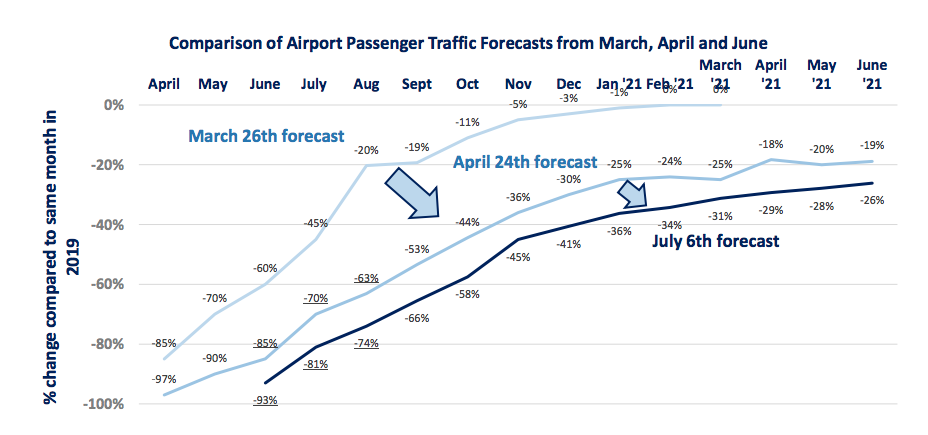

It also said that passenger traffic at Europe’s airports will only make a full recovery in 2024, not 2023 as previously predicted.

ACI Europe reported regional airport traffic figures for June, with passenger volumes falling by -93% year-on-year to 16.8 million. This was a marginal improvement on the -98% decline in May.

The improvement over the preceding month reflects the progressive lifting of travel restrictions within the EU and Schengen area. As a result, the European airport network saw daily passenger volumes increasing nearly threefold from 267,000 passengers on 1 June to 757,000 passengers on 30 June – still a long way from last year’s daily average of 8 million in the same month.

ACI Europe Director General Olivier Jankovec said: “The recovery in passenger traffic is proceeding at a slower pace than we had hoped for. This was the case in June, and initial data for July also indicates we’re likely to recover only 19% of last year’s traffic rather than the 30% we had forecast. This is down to the still incomplete lifting of travel restrictions within the EU/Schengen area and the UK, as well as the permanence of travel bans for most other countries.

“The fact that EU and Schengen states have not yet managed to effectively coordinate and align over their travel policies does not help, as it is not conducive to restoring confidence in travel and tourism in the middle of the peak Summer season.”

ACI Europe also warned that current recovery patterns come with significant “diseconomies of scale” for airports.

It noted that with reinstated flights generally achieving low load factors, passenger volumes are trailing behind flight numbers. It noted: “This is particularly impacting airports, as their operating costs are driven by aircraft movements while the bulk (76%) of their revenues comes from passengers (through passenger charges for the use of their facilities and a wide range of passenger-driven commercial revenues – in particular retail). This means that the current recovery pattern disproportionately increases costs relative to revenues.

Jankovec commented: “The financial situation of airports is not significantly improving – with some even making more losses now compared to their situation prior to the restart.

Considering that the peak Summer season normally accounts for a large share of annual revenues and the fact that temporary unemployment schemes are coming to an end in many EU States – not to mention fierce airline pressure on airport charges – liquidity will remain a concern through the Winter. Many airports, especially smaller regional airports, will need financial relief. This requires looking beyond the current EC Temporary Framework on State aid which is ending next December.”