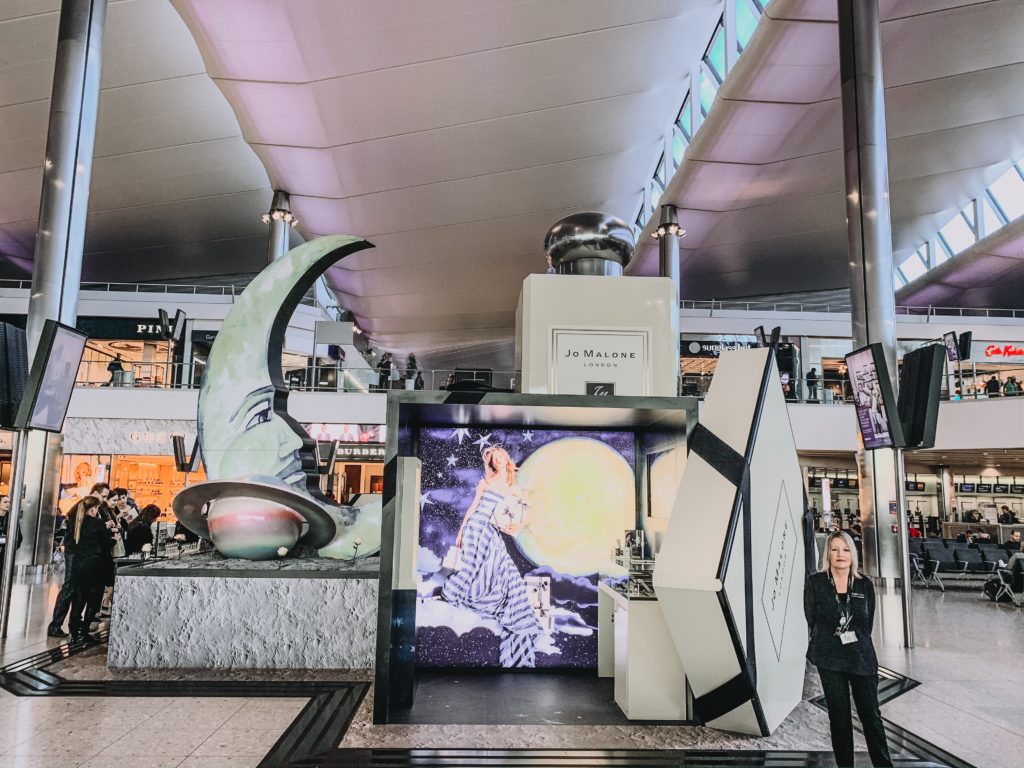

Key travel retail take-outs: • Estée Lauder delivered double-digit growth in travel retail and triple-digit growth online, driven by consumer demand for high loyalty hero franchises, including Advanced Night Repair, Perfectionist, Re-Nutriv, Micro Essence and Revitalizing Supreme+. • Double-digit growth from La Mer was also driven by Asia Pacific, with significant strength in Mainland China, and by travel retail given strong growth in hero products, including The Treatment Lotion and relaunches of The Regenerating Serum and The Eye Concentrate. • Net sales from Le Labo rose mid-single digits with growth in nearly all regions and strong double-digit growth in Asia Pacific and travel retail despite the decline in travel retail net sales in the second half of the fiscal year. • Net sales from the company’s global travel retail business grew during the fiscal year as the adverse impacts from COVID-19 were more than offset by strong growth from July through February. Net sales growth primarily reflected strength from Estée Lauder and La Mer, due to the continued success of certain hero franchises, such as Estée Lauder’s Advanced Night Repair and La Mer’s The Treatment Lotion, Crème de la Mer and The Eye Concentrate. |

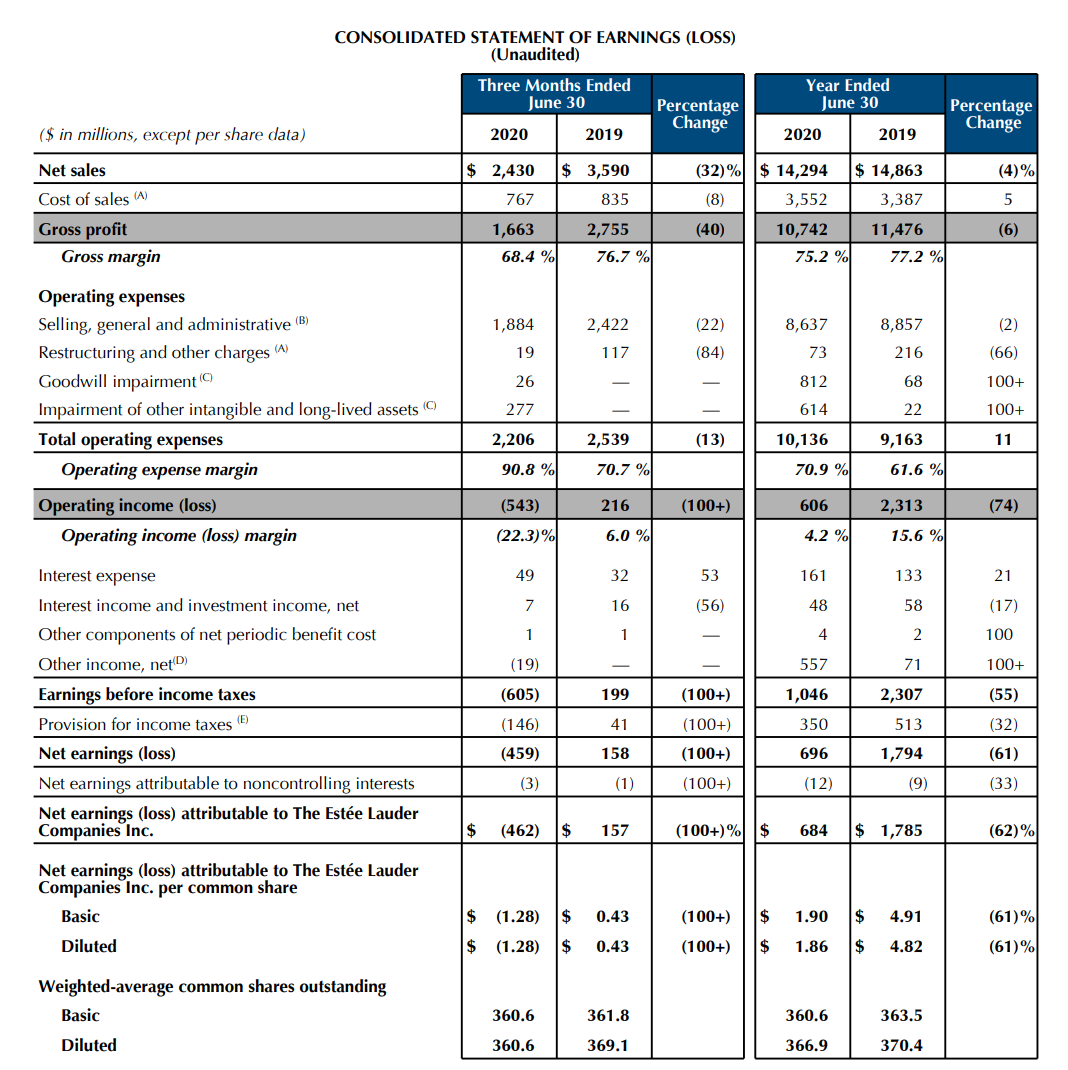

The Estée Lauder Companies Inc today reported a -4% decline year-on-year in net sales to US$14.29 billion for its fiscal year ended 30 June. Excluding the impact of currency translation, net sales decreased -3%.

Net sales from the company’s global travel retail business grew during the fiscal year as the adverse impacts from COVID-19 were more than offset by strong growth from July 2019 through February 2020. Net sales growth primarily reflected strength from Estée Lauder and La Mer, due to the continued success of certain hero franchises, such as Estée Lauder’s Advanced Night Repair and La Mer’s The Treatment Lotion, Crème de la Mer and The Eye Concentrate.

The net sales decline was driven by retail store closures as a result of the global spread of COVID-19 that was partially offset by the “tremendous” acceleration online. Net sales from the group’s acquisition of Have&Be Co (Dr. Jart+) contributed approximately 1 percentage point of growth to reported net sales.

The company reported net earnings of US$0.68 billion, down sharply on US$1.79 billion last year. Diluted net earnings per common share were US$1.86, compared with US$4.82. Excluding the negative impact of currency translation, adjusted diluted earnings per common share decreased -22% to US$4.16.

President and Chief Executive Officer Fabrizio Freda said, “Fiscal 2020 was a year without parallel, as we delivered record sales and exceptionally strong adjusted EPS growth in our first half and navigated with agility through an unprecedented pandemic in our second half.

“The second half also marked a period of profound pain as tragic events in the United States highlighted the systemic racial injustice that has plagued our society for far too long. In this challenging year, our multiple engines of growth strategy proved highly effective.

“The Estée Lauder brand grew double-digits for the third consecutive year. Asia/Pacific was strong with organic sales growth in Mainland China and several other markets driving prestige beauty share gains, our skin are category grew and was further boosted by the acquisition of Dr. Jart+, and our online channel surged. We quickly pivoted to capture consumption online during COVID-19 as retail stores around the world temporarily closed.”

Freda added: “In this new fiscal year, we remain focused on the safety and wellbeing of our employees and consumers. Our sense of urgency to act on our recently announced racial equity commitments is strong. We enter fiscal 2021 with cautious optimism, given the vibrancy of our skincare portfolio, acceleration in Asia/Pacific, momentum online globally, and robust innovation pipeline, which includes the exciting launch this month of Estée Lauder’s new Advanced Night Repair. We expect sales trends to improve sequentially each quarter.

“Our strategic priorities for fiscal 2021 rightly balance investment in these engines with cost discipline amid the ongoing pandemic. Through the post-COVID Business Acceleration Program announced today, we are better aligning our brick-and-mortar footprint to improve productivity and invest for growth. We are well-positioned to drive growth as the market dynamics support it, yet remain equally mindful of the effects of COVID-19 on consumers, the retail sector and economics, in general, as well as geopolitical uncertainty.”

Travel retail impacted by closed borders & government restrictions

Commenting on the company’s key travel retail sector, the company said, “Air travel has been largely curtailed globally due to both government restrictions and the sentiment around health concerns, which adversely impacted, and continues to impact, consumer traffic in most travel retail locations.”

More positively, it added: “During the second half of fiscal 2020, online sales growth accelerated in every region as the company and its retailers activated numerous digital capabilities and strategies to capture consumer demand online.

“Net sales in Mainland China, where restrictions were lifted first, grew strong double digits year-over-year during the fourth quarter of fiscal 2020, and net sales in Korea, excluding the impact of Dr. Jart+, also returned to growth in the quarter.”

Job losses

COVID-19 and its wide-ranging impacts have also influenced consumer preferences and practices due to the closures of offices, retail stores and other businesses and the significant decline in social gatherings, the company noted.

The demand for skincare and haircare products has been more resilient than the demand for makeup and fragrance. Within skincare, the demand for products in hero franchises has remained strong, driving double-digit growth at the Estée Lauder brand during the fourth quarter of fiscal 2020.

In connection with the group’s post-COVID Business Acceleration Program, the company estimates a net reduction in the range of approximately 1,500 to 2,000 positions globally, primarily point of sale employees and related support staff in the areas that were the most disrupted. That represents about 3% of its current workforce, including temporary and part-time employees.

This reduction takes into account the elimination of some positions, retraining and redeployment of certain employees, and investment in new positions in key areas such as online. The company also estimates the closure of between 10-15% of its freestanding stores globally, as well as certain less productive department store counters.