Japanese beauty giant Shiseido’s travel retail net sales fell -3.7% year-on-year on a like-for-like basis to ¥38.6 billion (US$279 million) for its first quarter ended 31 March. The result was driven by retailer inventory adjustments in Asia, mainly in the key South Korean market (also see The Estée Lauder Companies results).

The company said, “In the travel retail business… tourist traffic resumed with the mitigation of impact from COVID-19, and we saw strong growth particularly in Europe and Japan. In Asia, Hainan Island in China continued to grow in consumer purchases through the enhancement of brand and consumer experience at the storefront.

“However, net sales as a whole were lower year-on-year due to the significant impact of retailer inventory adjustments, especially in South Korea.

“As a result, net sales were ¥38.6 billion, up +3.8% year-on-year on a reported basis, down -8.3% year-on-year on an FX-neutral basis, or down -3.7% year-on-year on a like-for-like basis excluding foreign exchange and business transfer impacts. Core operating profit declined by ¥0.6 billion year-on-year to ¥7.5 billion, primarily due to lower margins from a decline in sales.”

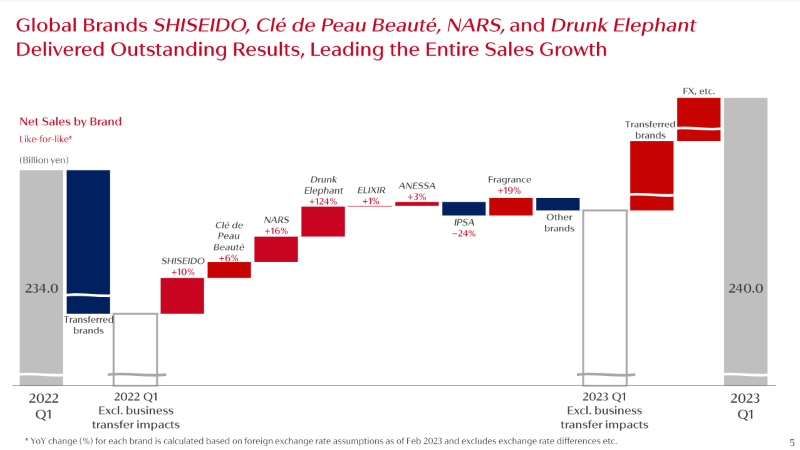

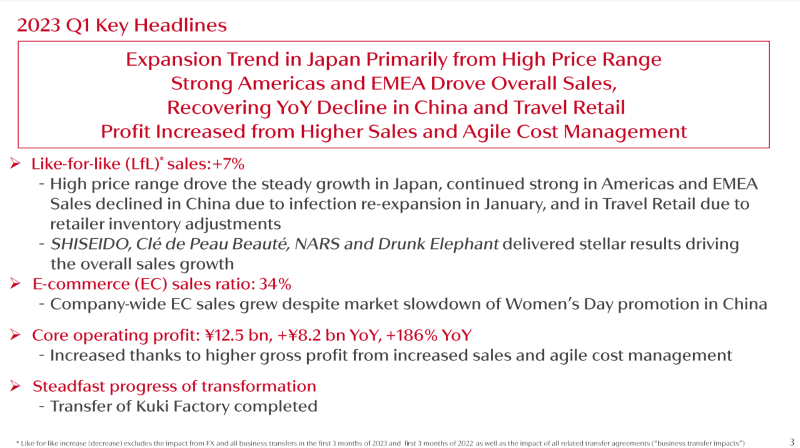

Overall, the group registered net sales of ¥240 billion (US$1.78 billion) in Q1, a year-on-year increase of +2.6% on reported figures (down -3.6% on an FX-neutral basis and up +6.6% like-for-like excluding the impact of FX and business transfers).

Net sales on a like-for-like basis decreased year-on-year in the key China business, which was affected by COVID infection cases in January, and the travel retail issues mentioned above.

The company noted: “Conversely, we achieved steadfast growth year on year in the Japan business through enhancing the launch of new products capturing the market recovery, and also achieved strong growth in the Americas, EMEA, and Asia Pacific businesses.”

Core operating profit increased by ¥8.2 billion year-on-year to ¥12.5 billion, thanks to higher sales and continued agile cost management.

The company said: “In the first three months of the fiscal year 2023, while uncertainty continued such as the prolonged conflict in Ukraine and rising prices, as a whole, the transition to post-pandemic new normal and the normalisation of economic activities progressed and personal consumption showed signs of improvement.”

The strong performance was led by core brands, Shiseido, Clé de Peau Beauté, NARS and Drunk Elephant.

Across all geographic markets, the Americas delivered stellar results, with sales up +30% (like-for-like) to ¥26 billion (US$193 million), thanks to the high demand for key brands Nars and Drunk Elephant.

EMEA also contributed strongly, registering net sales of ¥27.8 billion (US$208 million), a +22.1% increase.

Sales in Asia Pacific rose +15.7% to ¥15.4 billion (US$114 million).

The launch of new products in the skincare and makeup categories in Japan drove the company’s home market performance. Net sales were ¥61.7 billion (US$446 million), up +8.4%.

In China, net sales fell -3.9% to ¥53.2 billion (US$385 million), reflecting the rise in COVID-19 infections after the government eased its previously stringent COVID policy. The company’s launch of marketing activities in February and March led to strong growth for the Shiseido and Clé de Peau Beauté brands. Offline sales also grew for the first time in six quarters.

Strengthening its commitment to Hainan, Shiseido showcased its powerful portfolio of 11 brands at the China International Consumer Products Expo under the theme ‘Awaken Your Inner Beauty.’ It featured new launches, limited-edition and travel retail-exclusive releases and highlighted the company’s sustainability and DE&I initiatives. ✈