Leading drinks group Brown-Forman this week reported strong sales growth for the fiscal year ended 30 April, with a rebound in travel retail performance among the highlights.

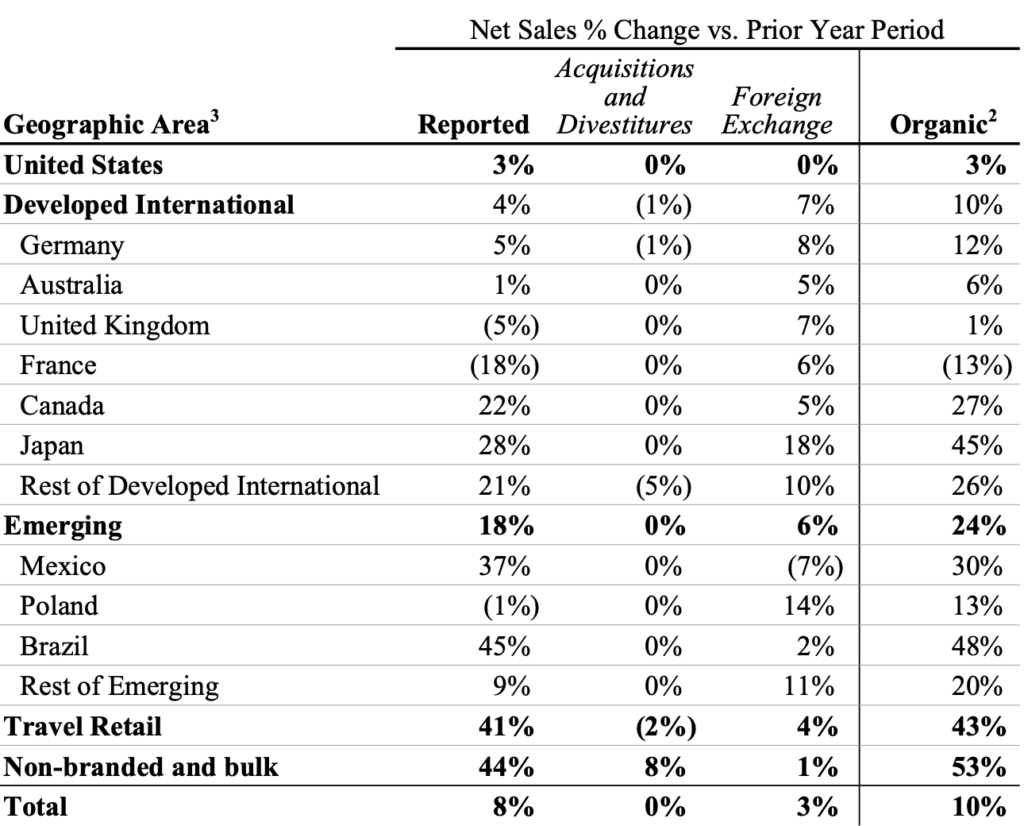

For the full year, reported net sales increased by +8% to US$4.2 billion (+10% on an organic basis). Reported operating income decreased -6% to US$1.1 billion (+8% organic) in fiscal 2023 reflecting lower gross margin, higher non-cash impairment charges (largely related to the Finlandia brand name), and higher operating expenses, including certain post-closing expenses in connection with the acquisitions of Diplomático and Gin Mare. Diluted earnings per share decreased -7% to US$1.63.

The travel retail channel sustained strong growth with a reported net sales increase of +41% (+43% organic) driven by higher volumes across much of the portfolio, led by Jack Daniel’s Tennessee Whiskey, as travel rebounded.

Brown-Forman President and Chief Executive Officer Lawson Whiting said: “In fiscal 2023,Brown-Forman continued its tradition of delivering strong organic top and bottom line growth. We were able to build on last year’s double-digit organic net sales growth by continuing the premiumisation of our portfolio, investing boldly in our brands, building new strategic relationships, developing and supporting our talented people, and honouring our values.”

Across all channels, portfolio growth was led by a +26% leap in Woodford Reserve net sales (+27% organic) and +3% net sales growth in Jack Daniel’s (+8% organic).

The Jack Daniel’s family of brands’ reported net sales growth of 4% (+9% organic), led by Jack Daniel’s Tennessee Whiskey in international markets and the travel retail channel.

Higher pricing and an estimated net increase in distributor inventories in certain emerging and developed international markets positively impacted reported net sales. Jack Daniel’s RTD/RTP grew reported net sales 11% (+16% organic) driven by the introduction of the Jack Daniel’s & Coca-Cola RTD. In addition, reported net sales also benefited from innovation with the launch of Jack Daniel’s Bonded Tennessee Whiskey.

Premium bourbons, propelled by strong double-digit net sales growth from Woodford Reserve and Old Forester, delivered +23% reported net sales growth (+24% organic) driven by stronger consumer demand in the US.

Reported net sales for the tequila portfolio increased +10% (+10% organic) with el Jimador and Herradura both delivering double-digit reported net sales growth. el Jimador grew reported net sales 13% (+14% organic) with broad-based growth across all geographic clusters, led by emerging markets and the US.

Herradura increased reported net sales growth of +11% (+10% organic) driven by higher prices and volumes in Mexico and volume growth in the US, partially due to an estimated net increase in distributor inventories.

Looking ahead, the company said it expects organic net sales growth in the +5% to +7% range in 2024, as well as organic operating income growth in the +6% to +8% range.

*Click here for a recent interview with Brown-Forman Vice President and Managing Director Global Travel Retail David Rodiek and Marketing Director Global Travel Retail Stéphane Morizet about innovation, an expanded portfolio and market opportunities. ✈