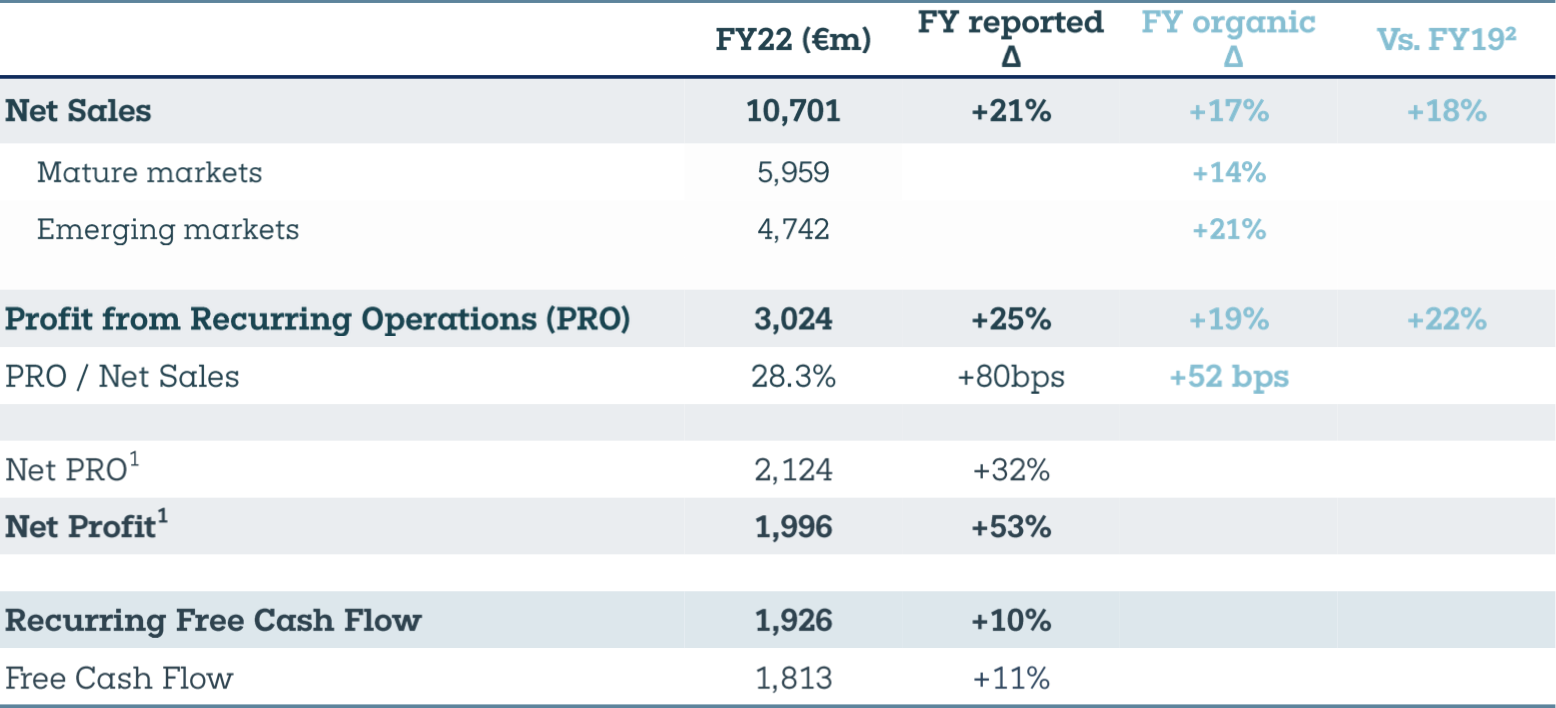

Leading drinks group Pernod Ricard today reported results for the 12 months to 30 July, with sales climbing by +21% year-on-year (+17% in organic terms) to €10,701 million.

The group reported a +48% leap in travel retail sales, led by a rebound in the Americas and Europe in particular. The company said it had achieved strong market share gains in the channels compared to pre-COVID. Crucially, travel retail profit is expected to return to pre-crisis levels by FY23.

The company also highlighted recovery in the on-trade and resilience in the off-trade as factors positively influencing its performance.

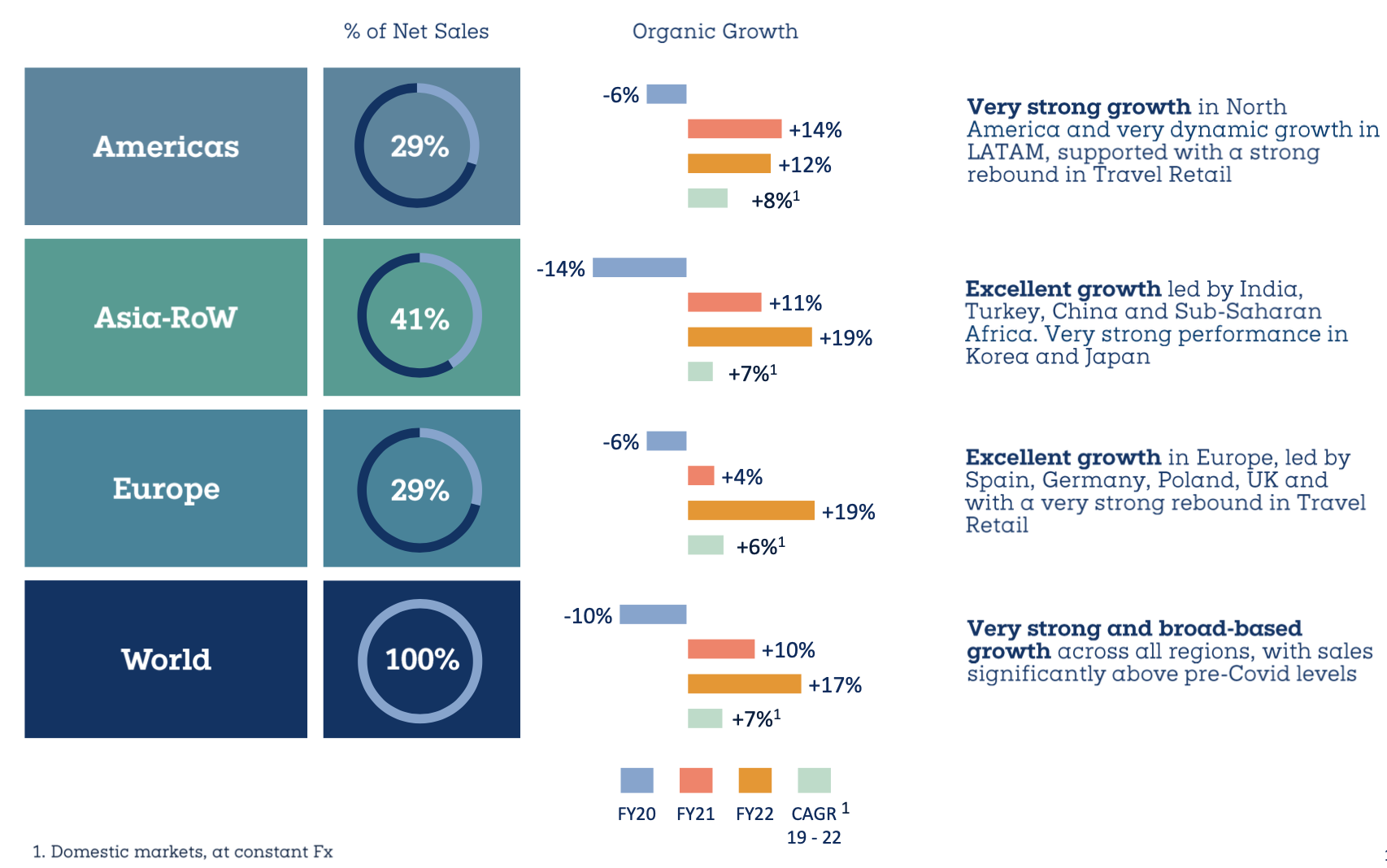

Sales in all regions grew double digits:

- Americas: +12%, with strong growth in North America and very dynamic growth in LATAM, supported with a “strong rebound” in travel retail

- Asia-RoW: +19%, led by India, Turkey, China and Sub-Saharan Africa. The group reported a strong performance in Korea and Japan

- Europe: +19%, “excellent growth” in Europe, led by Spain, Germany, Poland, UK and with a “very strong rebound” in travel retail.

Among Pernod Ricard’s ‘must win’ national markets, India sales grew by +26%, USA +8% and China +5% year-on-year.

All spirits categories delivered double-digit growth:

- Strategic International Brands: +18%, led by Jameson, Chivas Regal, Ballantine’s, Absolut and Martell

- Strategic Local Brands: +18%, led by Seagram’s Indian whiskies, Kahlua, Olmeca and Seagram’s Gin

- Specialty Brands: +24%, continued rapid development led by American whiskies, gins and agave brands. Specialty Brands doubled their weight in sales versus FY19

- Strategic Wines: -4%, soft performance in particular due to New Zealand lower harvest.

Pernod Ricard noted that 76% of sales were generated from categories that were premium (over €15 per bottle) or above, underlining the relevance of its focus on premiumisation as a long-term trend.

Pernod Ricard noted that 76% of sales were generated from categories that were premium (over €15 per bottle) or above, underlining the relevance of its focus on premiumisation as a long-term trend.

Profit from recurring operations reached €3,024 million, a rise of +25% in reported terms (+19% organic). Net profit climbed by +53% year-on-year to €1,996 million.

Chairman and Chief Executive Officer Alexandre Ricard said: “Three words summarise Pernod Ricard’s excellent performance in FY22: record, balanced and sustainable.

“FY22 was a record year in many respects. Our sales broke the symbolic milestone of €10 billion with our fastest growth rate in over 30 years, delivering a record €3 billion profit from recurring operations at a record operating margin of 28.3%.

“FY22’s performance was also very well balanced. Growth was driven by all regions, categories, price points and channels, with a comparable contribution from both mature and emerging markets. Most importantly, our performance was sustainable thanks to the real progress we’ve made on delivering our strategic roadmap ‘Good Times from a Good Place’.”