The brand value of tobacco companies rose over the last year, despite strict regulations on selling this product category in many markets around the world.

Research from valuation and strategy consultancy Brand Finance found over 80% of the tobacco companies it tracked experienced growth in brand value even though multiple restrictions have been imposed on where consumers can buy and use cigarettes.

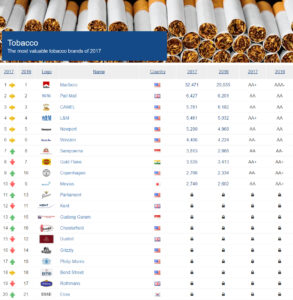

Marlboro was judged to have the greatest brand value (US$32.4 billion) and Brand Finance said this was a record high for any company operating in the sector. Pall Mall (US$6.43 billion), Camel (US$5.78 billion), L&M (US$5.48 billion), Newport (US$5.29 billion) and Winston ($4.41 billion) were ranked the next highest in an unchanged top six from last year.

“Marlboro’s success is by no means an isolated case, with the brand values of major names such as Pall Mall, L&M, Newport and Winston all growing this year and the likes of Parliament, Sampoerna and Chesterfield enjoying double digit growth.”

Brands are first evaluated to determine their power based on factors such as marketing investment, familiarity, loyalty, staff satisfaction and corporate reputation, before they are issued with a letter grade up to AAA+.

The strength of a brand is used to determine what proportion of a business’s revenue is contributed by the brand, which Brand Finance said is “projected into perpetuity to determine value”.

The research noted a tobacco usage decline in Western regions but said it was offset by growth in other parts of the world such as China, Indonesia and Africa where regulation remained weaker.

Marlboro’s extension into the e-cigarettes sector when many other tobacco brands were slow to extend their ranges into this burgeoning area was highlighted as evidence of the US company’s market power.

The increase in brand value has come despite what Brand Finance described as “an accelerating tide of regulation” sweeping over the industry.

Most Organisation for Economic Co-operation and Development members – and many other markets – follow strict tobacco guidelines, but the consultancy warned the threat of plain packaging could put the very existence of tobacco firms’ brands at risk.

“Despite the well-founded health concerns and mounting regulation, the value of these brands for their owners and investors remains robust.”

It said, in its strictest form, plain packaging will prevent companies from differentiating themselves which could result in tobacco products becoming a commodity hit by subsequent price and quality reductions.

Australia became the first country to ban logos on cigarette packaging in 2012 and has reported a drop in smoking rates in the years since, while other nations – notably Canada – are working on plans to introduce similar measures to reduce tobacco usage.

“Despite the well-founded health concerns and mounting regulation, the value of these brands for their owners and investors remains robust,” explained Haigh.

“The day when the value of tobacco brands goes up in smoke is a long way off.”

Brand Finance – The World’s Leading Independent Branded Business Valuation and Strategy Consultancy

T: +44 (0)20 7839 9400

E: enquiries@brandfinance.com

www.brandfinance.com