INTERNATIONAL.Welcome to the second edition of The Moodie Davitt SPEND Index, a new platform that tracks the effects of currency fluctuations across key travelling nationalities and destinations – a key driver of travel retail spending.

The value of the domestic home currency against other denominations abroad carries serious weight when it comes to consumers’ decisions whether to travel, where to go and, of course, if, how and where they shop.

Our second edition (click here for the launch edition) adds the Thai Baht (THB), the Singapore Dollar (SGD) and the New Zealand Dollar (NZD), bringing the SPEND Index basket to 15 currencies.

The nationalities that enjoy an increased spending power (‘Winners’), based on the evolution of their domestic currency over the past 12 months versus a basket of 14 other currencies, are listed below.

A Spend Index <100 indicates that the spending power of this nationality has improved over the past year due to a stronger currency. Likewise, a Spend Index >100 indicates that a denoted spending power ohas weakened due to a frailer home currency.

The nationalities that have benefited the most over the past year are those from the Eurozone, the UK, Thailand, China and, more marginally, Singapore, South Korea, Switzerland and Japan. Currency values and rates of exchange on 31 March 2018 have been compared to those valid on 31 March 2017.

With a SPEND Index at 90.18 for the Eurozone, a basket of products that cost EUR100.00 on 31 March 2017 now only costs EUR90.18 on average (all countries and destinations), a saving of -9.8%.

The SPEND Index also explores the relationship between Nationality & Destination pairs. Destinations are given as countries rather than cities.

Travellers from any of the 19 Eurozone countries going to Brazil now pay -16.8% less (SPEND Index = 83.15) on their duty free purchases than one year ago (Rank No. 1 above). This is not due to any significant duty free retail price decreases in Brazil, but entirely driven by the weakening of the Brazilian Real and strengthening of the Euro over the past 12 months.

Travellers from the Eurozone area are well off in many additional countries of destination, including India (-13.6% saving as compared to one year ago /SPEND Index 86.43 / Rank No. 4 above), the US (-13.2% saving / SPEND Index 86.80 / Rank No. 5 above), Australia (-12.7% saving), Canada (-10.4% saving) and Russia (-14.3% saving / SPEND Index 85.68 / Rank No. 2 above).

The strengthened Euro and the weakened Russian Ruble will certainly help to boost bookings and travel to Russia for this June’s FIFA World Cup, and therefore also the duty free and travel retail business in this country. If exchange rates hold, Eurozone visitors to Russia will make a nice saving of nearly -15% as compared to one year ago. Notably, UK football fans (and others) will see significant savings of -11.7% (Spend Index 88.3 / Rank No. 9 in the table above) when visiting Russia this summer.

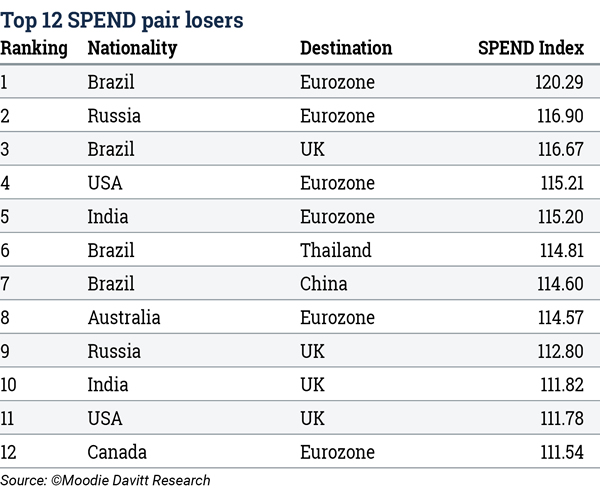

Below is an analysis of nationalities and currencies that have suffered over the past 12 months.

The nationalities that have lost in terms of their spending power are:

The above seven countries, and outbound travellers from these countries, have all seen their currency weaken effectively over the past year. Focusing on the Brazilians, with a SPEND Index at 109.91, a basket of products that cost BRL100.00 on 31 March 2017 now costs BRL109.91 on average (all destinations), a significant increase of +9.9%.

In the table above, the Eurozone is listed as an ‘expensive’ destination no less than six times, i.e. for six different nationalities. Compared to one year ago, travellers from these six countries visiting the Eurozone now must pay more in the duty free and travel retail shops. They are from Brazil (+20.3%), Russia (+16.9%), the USA (+15.2%), India (+15.2%), Australia (+14.6%) and Canada (+11.5%).

Using the adjective ‘strong’ in relation to the current strength of the Euro might not be entirely correct. Currency experts and other insiders suggest that the Euro today is indeed fairly and appropriately valued, reflecting its true value against other currencies.

The fact remains, however, that over the past year up to 31 March 2018, no major currency can match the appreciation of the Euro, which has advanced +11.1% on average against the other 14 currencies in the Moodie Davitt Currency Room basket.

How the current strength of the Euro hurts European duty free and travel retailers twofold

Pro primo: The current valuation of the Euro discourages Eurozone travellers from shopping in their own duty free and travel retail shops, upon departure or arrival. Instead, in order to reap some of the benefits of their strengthened currency, they tend to shop upon arrival or departure at their international destination.

Pro secondo: The table above lists six nationalities that certainly will find duty free and travel retail prices in the Eurozone area to be ‘expensive’, at least when compared to the prices of a year ago. All due to the weakening of their respective home currency and the appreciation of the Euro.

The latest data from the European Travel Retail Council (ETRC) reveals that in 2017, the sales per passenger parameter at European airports dropped a significant -4.1% on average. In 2017 the growth in European airport duty free and travel retail sales came to +4.1% (in Euros) but could not match the growth in European air passenger travel at +8.5% [Source: Airports Council International]. Thus, the pace of growth in duty free and travel retail sales is less than half of the growth in passenger travel.

Some results as reported by respective companies: Germany’s Fraport Group claims that its 2017 drop in net retail revenue per passenger of -3.4% is explained by the depreciation of various currencies against the Euro which impacted spending.

Amsterdam Airport Schiphol owner Royal Schiphol Group saw a fall in retail per passenger spending last year. Average retail spending per departing passenger in the post-security shops fell -2.2%. France’s Groupe ADP reported that in 2017 its retail spend per passenger held relatively steady at +0.4%. For Spain’s AENA, average revenue per passenger was up +2.7% compared to 2016.

The Moodie Davitt SPEND Index analysis embraces in total 210 Nationality & Country of Destination pairs as well as 15 averages for nationalities (= 225 value indicators). It will continue to monitor the consequences and possible impacts of currency fluctuations on duty free and travel retail trade in the months ahead.