INTERNATIONAL. The Moodie Davitt Report is proud to unveil our new SPEND INDEX, an exclusive innovation which tracks the effects of currency fluctuations across key travelling nationalities and destinations – a key driver of travel retail spending.

The value of the domestic home currency against other denominations abroad carries a significant weight when it comes to consumers’ decisions whether to travel, where to go and, of course, if, how and where they shop.

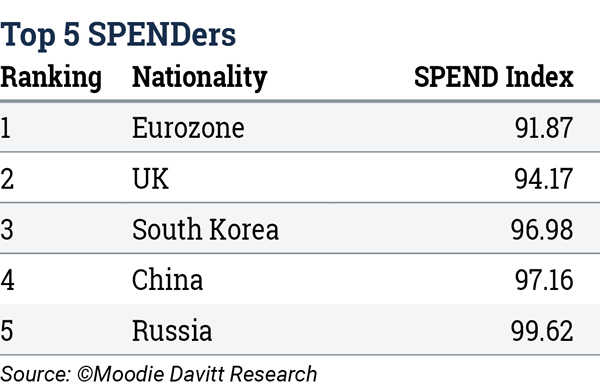

The table below (‘Winners’) lists the nationalities that enjoy an increased spending power based on the evolution of their domestic currency over the past 12 months versus a basket of 11 x other currencies.

A Spend Index <100 indicates that the spending power of this nationality has improved over the past year due to a stronger currency. Likewise, a Spend Index >100 indicates that the spending power of this nationality has weakened due to a weaker home currency.

A Spend Index <100 indicates that the spending power of this nationality has improved over the past year due to a stronger currency. Likewise, a Spend Index >100 indicates that the spending power of this nationality has weakened due to a weaker home currency.

The nationalities to have benefited the most over the past year are those from the Eurozone area, the UK, South Korea, China and Russia. Currency values and rates of exchange on 31 January 2018 have been compared to those on 31 January 2017.

With a SPEND Index at 91.87 for the Eurozone area, a basket of products that cost €100.00 on 31 January 2017 now only costs €91.87 on average (all destinations), a saving of 8.1%.

More interestingly, it’s possible to study the SPEND Index between Nationality & Destination pairs.

Travellers from any of the 19 x Eurozone countries going to Rio de Janeiro or any other Brazilian city now pay 14.1% less (SPEND Index = 85.99) for their duty free purchases than one year ago (Rank 1 above). This is not due to any sudden or significant duty free retail price decreases in Brazil, but entirely due to the weakening of the Brazilian Real and strengthening of the Euro over the past 12 months.

Travellers from any of the 19 x Eurozone countries going to Rio de Janeiro or any other Brazilian city now pay 14.1% less (SPEND Index = 85.99) for their duty free purchases than one year ago (Rank 1 above). This is not due to any sudden or significant duty free retail price decreases in Brazil, but entirely due to the weakening of the Brazilian Real and strengthening of the Euro over the past 12 months.

In New York, Chinese travellers (Rank 7 above) now buy – due to the strengthening of the Chinese Yuan Renminbi and the weakening of the US Dollar – duty free products at an 8.6% discount (SPEND Index = 91.40) compared to one year ago. Outbound travellers from South Korea (Rank 9 above) can now shop at an 8.3% (SPEND Index = 91.67) discount at Sydney Airport or at any other Australian duty free shop.

Some changes in the spending of nationalities, countries and locations may, at least in part, be explained by fluctuations in the currency pairs. At the recently completed Rio Carnival 2018, did the organisers, Dufry (operating the duty free shops in Brazil) and other traders note an increase in the spending of Eurozone visitors (Rank 1 above), or UK travellers (Rank 3 above) or even Chinese (Rank 6 above) and South Korean (Rank 10 above) visitors? Has Heinemann Australia recently noted a greater influx and/or spending of South Korean visitors (Rank 9 above)?

Many conclusions may be drawn from this analysis. Over the past 12 months no currency can match the appreciation of the Euro, which has advanced +9.0% on average against the other 11 x currencies in Moodie’s Currency Basket. We will examine some consequences of this significant development and its impact in future columns.

Do outbound travellers from the Eurozone countries (France, Germany, Italy, etc.) headed for a destination outside the Eurozone spend their money on shopping in any Eurozone country upon airport departure (or arrival) – where they economically and technically see no ‘extra’ savings despite their strengthened currency (the Euro)?

No, according to trade sources, they prefer to spend when abroad, i.e. when they are out of the Eurozone countries in order to “get their monies’ worth”. So, to Eurozone travel retailers, the strengthened Euro doesn’t benefit spending: firstly, the situation does not encourage Eurozone travellers to shop in their own Eurozone territory and, secondly, the ‘expensive’ Euro discourages foreign nationalities from shopping in a Eurozone country.

This in addition to the fact, of course, that duty free to intra-EU travellers has not existed in the Eurozone countries since July 1999.

Of interest is also the study and analysis of nationalities and currencies that have suffered over the past 12 months.

The nationalities that have lost in terms of their spending power are:

The above six countries, and outbound travellers from these countries, have all seen their currency weaken effectively, meaning that today their currencies are less worth than one year ago.

The above six countries, and outbound travellers from these countries, have all seen their currency weaken effectively, meaning that today their currencies are less worth than one year ago.

The two countries/nationalities that stand out are Brazil and the US. With a SPEND Index at 108.32, a basket of products that cost BRL100.00 on 31 January 2017 now costs BRL108.32 on average (all destinations), an increase of +8.3%.

Any duty free and travel retail shop relying on, benefiting from or seeing the Brazilians (e.g. the shops at Paris Charles de Gaulle and Orly airports – see table above, Nationality & Destination pairs), or say travellers from the US, as important customers should pay attention. The currencies of these two countries, in terms of spending power, have weakened by -8.3% (BRL) and -7.2% (USD) respectively on average over the past year.

Any duty free and travel retail shop relying on, benefiting from or seeing the Brazilians (e.g. the shops at Paris Charles de Gaulle and Orly airports – see table above, Nationality & Destination pairs), or say travellers from the US, as important customers should pay attention. The currencies of these two countries, in terms of spending power, have weakened by -8.3% (BRL) and -7.2% (USD) respectively on average over the past year.

At the travel retail shops at Paris’ two international airports (or at the international airports of, say, Lyon, Marseille or Nice) the Brazilians now pay +16.3% (SPEND Index 116.28) more compared to one year ago. Similarly, Americans arriving from the US are charged +15.1% (Spend Index 115.14) more than a year ago.

The SPEND Index analysis embraces 132 x Nationality & Destination Pairs as well as 12 x averages for nationalities (= 144 x value indicators).

The volatility in currency markets has always played a prominent role in the duty free and travel retail business. Like any cross-border retail business, currency fluctuations are an ongoing set of risks for travel retailers and suppliers. Such fluctuations often distort pricing arrangements as well as impacting travel destination choices and shopping habits among travellers, including their propensity to shop at a particular location at a particular time.

The monthly Moodie Davitt SPEND Index will continue to monitor the consequences and impacts of currency fluctuations on travel retail in the months ahead, always with a 12-month perspective.