AUSTRALIA/NEW ZEALAND. Ivo Favotto, a Sydney-based executive and company owner who has worked for all three stakeholders in the Trinity chain, considers the early-stage recovery of travel and the gradual reopening of airport commercial activities in Australia and New Zealand. While the two countries have handled the COVID-19 crisis efficiently, the recovery will be slow and uneven, he cautions.

AUSTRALIA/NEW ZEALAND. Ivo Favotto, a Sydney-based executive and company owner who has worked for all three stakeholders in the Trinity chain, considers the early-stage recovery of travel and the gradual reopening of airport commercial activities in Australia and New Zealand. While the two countries have handled the COVID-19 crisis efficiently, the recovery will be slow and uneven, he cautions.

‘Winter is coming:’ For anyone who sat through the eight seasons of the award-winning TV series Game of Thrones (ending in 2019), the motto of House Stark will resonate strongly.

For the travel retail industry, Winter really did come in the form of the COVID-19 pandemic that swept the world in the first quarter of 2020 and that still rages today. In travel retail, while it didn’t bring an army of the dead, it did bring about the near death of passenger traffic, the lifeblood of our channel.

In a snapshot analysis, The Mercurius Group – led by Senior Consultant Diane Owens – assessed the impact of COVID-19 on travel retail in Australia and New Zealand on 27 April. It covered 778 shops and restaurants across 27 airports with more than 500,000 passengers a year (19 in Australia and eight in New Zealand). We found that just 8.5% of travel retail outlets were open across duty free, speciality, F&B and services.

The team has now repeated the previous month’s analysis (for 27 May) to determine if and by how much things had changed.

And while things are improving – across the same 778 outlets and 27 airports, 18% of travel outlets are now open – the results are still sobering for the industry.

This modest recovery in outlet openings follows the early stages of economic and societal reopening across New Zealand and some states of Australia, which has allowed some domestic travel to start again. International borders remain tightly shut in both countries.

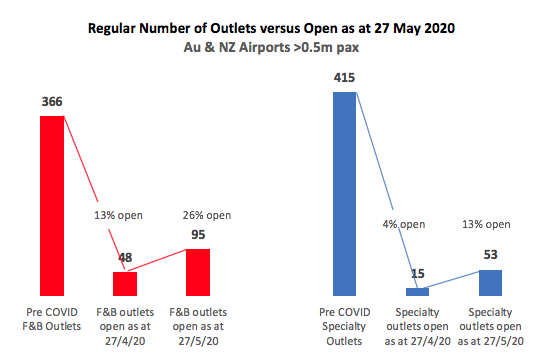

The results of the May analysis show that in F&B, 95 sites were open, representing 26% of pre COVID-19 levels. These were predominately cafés and fast food outlets that are better able to operate in restrictive COVID-19 operating environments.

The next wave of openings, as passenger numbers grow and each jurisdiction loosens operating constraints, should enable a wider range of food categories to open.

For speciality retail, the analysis showed that in May, stores were starting to emerge from hibernation, with 53 sites open, more than triple the 15 we counted in April, but still only 12% of pre-COVID-19 levels.

The first wave of openings in this sector will come in travel essentials stores (news, books, convenience and pharmacy) as one would expect. How quickly other more discretionary categories (duty free, beauty, fashion and gifting) follow remains to be seen. Here, it not just the sheer volume of passengers that is important but the mix of passengers and their spending power: both Australia and New Zealand are heading for economic recession.

While different rules for opening and managing health concerns across jurisdictions is challenging, both F&B and speciality operators are showing their resilience by quickly adapting.

One element to watch amid the reopening is the variance between Australia and New Zealand. New Zealand, which had the more restrictive lockdown controls followed by a more rapid easing, has seen a quicker rebound in commercial activity at airports.

In the April study, all travel in New Zealand was effectively stalled (excepting the occasional repatriation flight) and hence only three locations were open, all at Auckland Airport. In May however, the analysis showed a total of 44 sites open, representing 33% of food outlets and 19% of speciality outlets. This compared to just 23% and 11% respectively in Australia.

With neither travel retailers nor airports in the position to burn cash by opening outlets too early (i.e. before they can cover their cash operating costs), complex conversations are happening in both countries. These concern which outlets can open when as traffic levels recover to ensure that operators can trade on a cash-positive basis (forgetting profitability for the time-being) and not cannibalise from each other.

The next phase of store reopenings will be strongly driven by the reopening of borders between Australian states and the international borders in both Australia and New Zealand.

The timing of reopening of borders between states in Australia to facilitate travel is especially bewildering. Some, notably Queensland, which is normally heavily reliant on both domestic and international tourism, steadfastly refuse to open up despite rising numbers of insolvencies in tourism-related sectors.

Other states have loosened their restrictions with domestic travel set to ramp up in July. But it appears that it would not take much of a ‘second wave’ of COVID-19 infections for skittish state governments to reimpose restrictions.

The opening of international borders is another matter entirely. There has been much talk about the creation of a ‘travel bubble’ between New Zealand and Australia (or at least with some states in Australia). This has been promoted heavily by airports, airlines and tourism industry operators on both sides of the Tasman Sea. But the New Zealand and Australian governments seem more reluctant.

Australian Tourism Minister Simon Birmingham has said that Australia’s borders will likely remain closed for the remainder of 2020, which if it happens will have a devastating impact on the region’s already suffering duty free retailers. With the New Zealand government seemingly conservative on health versus economy considerations, and with a national election coming up before year end, the prospects of an early trans-Tasman travel bubble appear to be weakening.

Not wanting a good crisis go to waste, the Australian Duty Free Association is lobbying the government to align Australian duty free limits on liquor to New Zealand’s generous allowances. It is a strong, bold move but may carry risk too given the recent history in both countries of reducing duty free tobacco allowances and recent rumblings in some political circles about reducing duty free alcohol allowances.

At a more structural level, the gradual return of traffic reignites the debate about how expensive airport real estate can be economically managed with lower passenger numbers – with integrated domestic and international terminals increasingly on the agenda for many airports.

Remember that many Australian airports still suffer from legacy terminal developments that had separate buildings for domestic and international passengers, sometimes on opposite sides of the airport (as in Perth and Sydney). Moving to integrated terminals as some airports have done more recently (Adelaide for example) is an option many are now examining.

However, fully optimising duty free and retail in integrated terminals also requires some regulatory/legislative around screening of purchases and Customs requirements, similar to the changes that the EU went through in 1999 post intra-EU duty free abolition. More than ever it is critical that all interested parties are joined at the hip to ensure that the industry’s messaging has clarity and weight with political powers for which travel retail may not be a priority. The Mercurius Group is currently working with a number of airports and other industry stakeholders to envision this next evolution of the industry.

Let us not forget that behind these stories of recovery there are casualties, and that the longer COVID-19 impairs traffic, the greater the casualties will become. It is beholden on the travel retail Trinity – airports, retailers and brands – to ensure that all parties come out the other side of this crisis. Flexibility and innovation will be the key to survival.

While Winter did come (and it was long and dark), the first signs of Spring are emerging in Australian and New Zealand travel retail. Let’s hope it is not a false Spring, that more restrictions will ease and that at least some traffic will return to our airports. I make this statement more with bright eyed optimism than with conviction. But hope is critical to recovery, so here’s hoping.

*About Ivo Favotto

Ivo Favotto has a long and distinguished record in the airport and travel retail sectors. A trained economist, he entered the airports/infrastructure sector with Australia’s Federal Airports Corporation in 1992 as GM – Planning & Economics.

He later built a highly successful international airports/infrastructure consulting practice, working with three firms – Bach Consulting, Arthur Andersen and URS Corp – and advising many of the world’s leading airports, governments and investors in the areas of retail planning, master planning and privatisation/transaction support.

In 1998 he established the market-leading Airport Retail Study, selling it to Moodie International so he could join The Nuance Group (now owned by Dufry) as Executive Vice President – Strategy & Business Development in Zürich. He later returned to his native Australia as Director – Sydney Airport before being named Executive General Manager of Duty Free & Luxury, Pacific for Lagardère Travel Retail.

Favotto has now formed The Mercurius Group, a Sydney-based consultancy focused on industry research, consultancy and benchmarking studies.

Favotto has now formed The Mercurius Group, a Sydney-based consultancy focused on industry research, consultancy and benchmarking studies.

Contact: Tel: +61 423 564 057; E-mail: ifavotto@themercuriusgroup.com; Website: www.themercuriusgroup.com