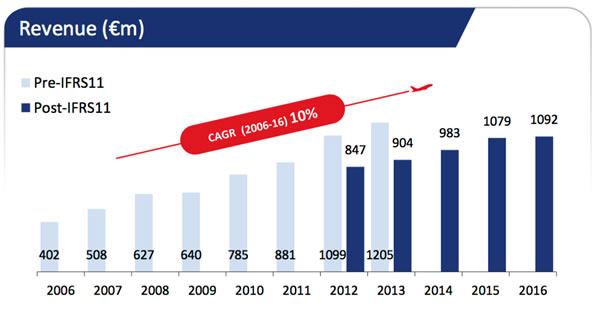

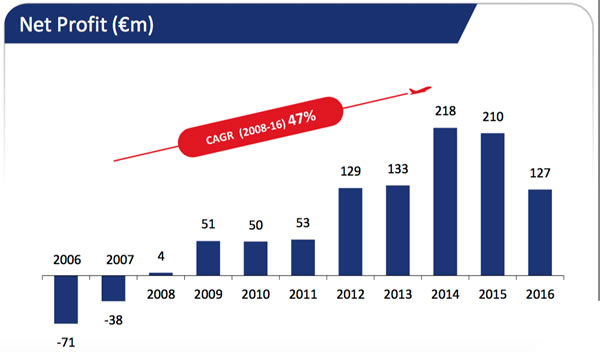

TURKEY. TAV Airports posted a +1% year-on-year rise in revenues to €1,092.3 million in 2016. But profits fell sharply (-39%) to €127.1 million. TAV blamed this mainly on higher management concession fees at its Turkish airports, caused by the strength of the Euro (in which its fees are set).

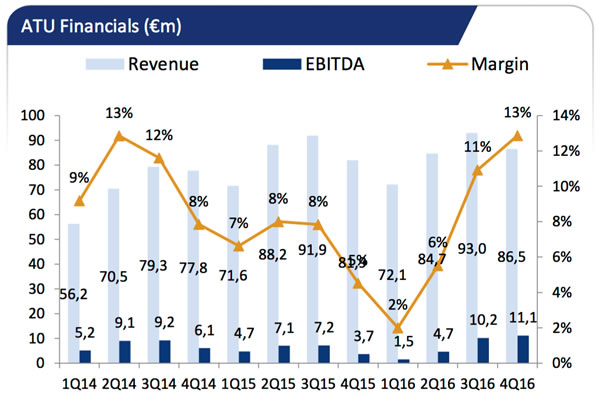

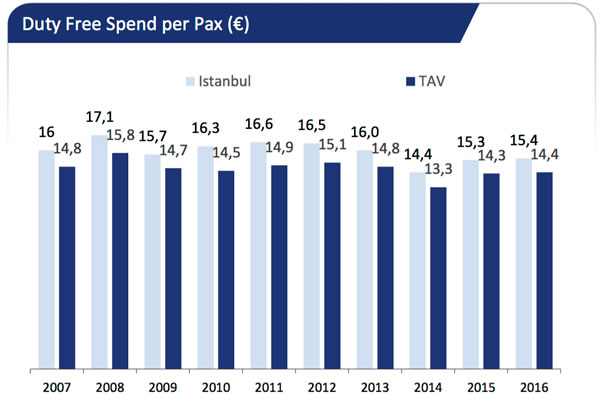

TAV’s duty free business (through its 50% stake in ATÜ Duty Free) posted a +1% revenue increase to €336.4 million, while EBITDA climbed by +21% to €27.4 million. Spend per passenger was flat at Istanbul Atatürk, the largest location, at €15.40, while across the TAV group the figure was also steady at €14.40.

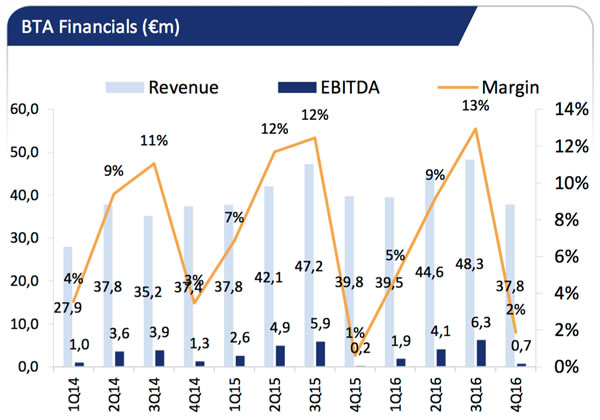

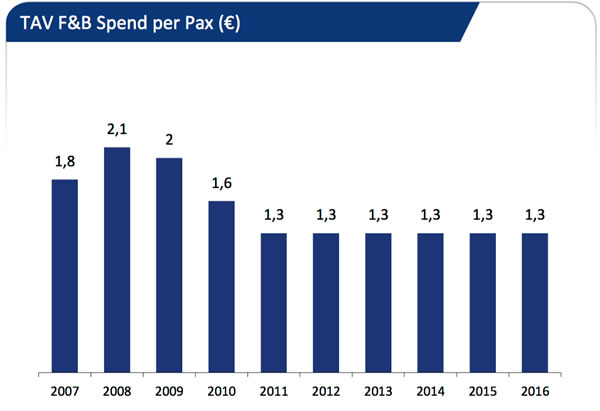

Food & beverage spend per passenger (through TAV majority-owned division BTA) was also flat at €1.30 in 2016. BTA revenue rose by +2% to €170.2 million.

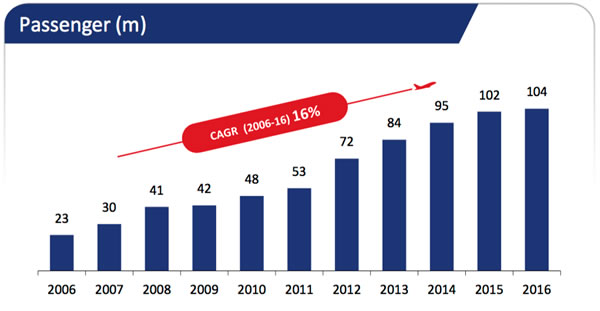

TAV’s 14-airport network handled 104.4 million passengers in the year, a rise of +2%. Within this, international traffic climbed by +1% to 58.5 million.

The key location, Istanbul Atatürk, posted a -2% decline in traffic to 61 million, with international volumes down by -2% to 41 million. Crucially, international O&D traffic slumped by -16% due to fears over terror attacks in the city. Against this, transfer traffic climbed by +18%, driven by Turkish Airlines’ expanding global network.

TAV Airports Holding President and CEO Sani Şener said: “2016 was a challenging year for the aviation sector, both in Turkey and abroad. Security-related concerns had a negative impact on the aviation industry. And yet TAV achieved an increase in the number of passengers served by +2% compared to 2015, thanks to its stable portfolio. Our consolidated revenue [rose] +1% compared to 2015; mainly thanks to other operating incomes, particularly contributed by newly created businesses.”

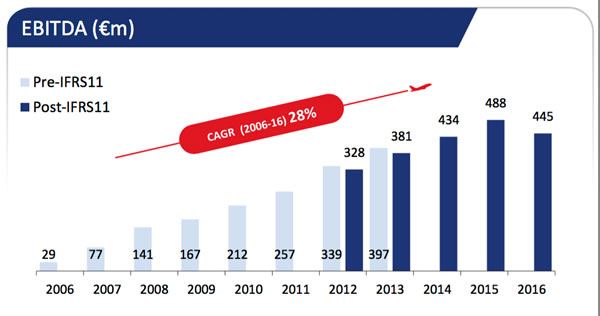

EBITDAR declined by -4% to €597.2 million, mainly due to a large volume of what TAV termed “low margin businesses and projects”, as well as change in the passenger composition at Istanbul Atatürk Airport.

The company noted: “The decrease in our net profit compared to 2015 was a result of the increase in leasing amounts paid to the state due to the increase in Euro. All in all, the decrease was also caused by the increased depreciation and leasing amounts, mainly stemming from Milas Bodrum International Terminal, and conversion of the deferred tax asset of TAV Tunisia.”

In 2017, TAV said it expects an increase of +4% to +5% in passenger traffic, flat revenue & EBITDAR and a significant increase in net profit.

In 2016, TAV began work on the construction of a new terminal at Tbilisi Airport in Georgia. Soon TAV plans to complete the acquisition of 16.67% of the shares in Saudi Oger, TAV’s concession partner at Medinah Airport. The other key development of 2016 was the invitation to a TAV-led consortium by the Cuban state for exclusive talks to operate Havana Jose Marti and San Antonio de los Banos airports.